The rotten culture of the rich

January 7, 2022

Originally published at pluralistic.net

Cory Doctorow

In his 2019 book Dignity, Chris Arnade left his Wall Street job and traveled America, talking to poor, marginalized people, mostly at McDonald’s restaurants.

Now, in a new essay for American Compass, Arnade delves into the “rotten culture of the rich.”

https://americancompass.org/what-about-the-rotten-culture-of-the-rich/

Arnade starts with observations about how rich people talk about poor people: “we talk too much about policy and not enough about culture” – meaning that poor people’s fecklessness, lack of self control and pleasure seeking results in poverty.

But the wealthy are loathe to examine their own culture, especially that of the “iconoclastic men who felt held back by outdated social norms from pursuing their individual pleasure” who went on to run hedge funds and private equity firms.

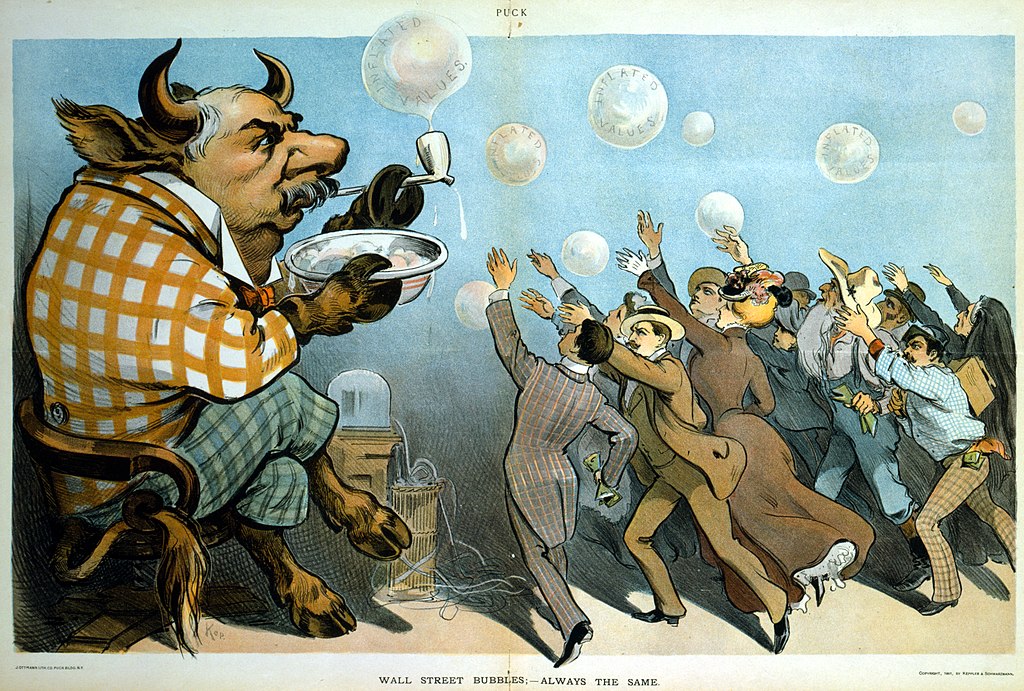

These are the people who gave us “junk bonds, leveraged buyouts, distressed debt, and other complex financial products whose goal is intentionally unclear,” all of it “making obscene amounts of money with little regard to how or the impact to society overall.”

It comes down to this: “Why isn’t it considered bad behavior to sit in front of a wall of screens filled with flashing numbers making bets on those numbers?”

And this: “Why isn’t it considered bad behavior to find a mid-sized company, load it up with debt, strip it of its valuable assets, and send jobs overseas to the country with the lowest labor cost and least environmental regulations.”

These are just the visible manifestations of the sick culture, though: Finance’s purpose is to “help the powerful bend rules and regulation…The more complex and devious your financial product, the more celebrated you are on Wall Street.”

Or as the Trashfuture podcast folks put it recently, fintech exists solely to create unregulated banks.

https://trashfuturepodcast.podbean.com/e/greensill-2-green-harder/

The wealthy have elaborate justifications for their selfishness, grounded in turgid Ayn Rand novels and deliberately impenetrable economics jargon, all to handwave away the indefensible business of “getting rich by being clever, without regard to the larger impact.”

The cultural mores of Wall Street are: “cleverness trumps hard work”; and “disregard for the rules trumps playing it straight.”

Wall Street’s message is “Why diligently work your way up the corporate ladder when you can smooth-talk enough people into lending you enough money to take over the corporation, fire the board, leverage it up with debt, and then dismantle it while pocketing a few billion.”

Arnade refers us to American Compass’s Coin-Flip Capitalism project, which quantifies the extent to which high-flying venture capitalists, hedge fund managers, and private equity looters underperform a coin-toss when it comes to picking winners.

https://americancompass.org/essays/coin-flip-capitalism-a-primer/

This project includes a Returns Counter that “aggregates returns data from multiple sources to create a simple metric—a ‘Returns Counter Average’ that can be directly compared against public market benchmarks.”

https://americancompass.org/projects/coin-flip-capitalism/returns-counter/