Wal-Mart’s Power Trajectory A Contribution to the Political Economy of the Firm JOSEPH BAINES March 2014 Abstract This article offers a power theory of value analysis of Wal-Mart’s contested expansion in the retail business. More specifically, it draws on, and develops, some aspects of the capital as power framework so as to provide the first […]

Continue ReadingCapital as Power and Freelance Creative Work 1

Frederick H. Pitts Rhythms of Risk and Responsibility in Freelance Creative Work This series of blogs applies Nitzan and Bichler’s theory of capital as power to the empirical concern of freelance work in the creative industries. It reports some findings from a research project I conducted earlier this year. The research was part of a […]

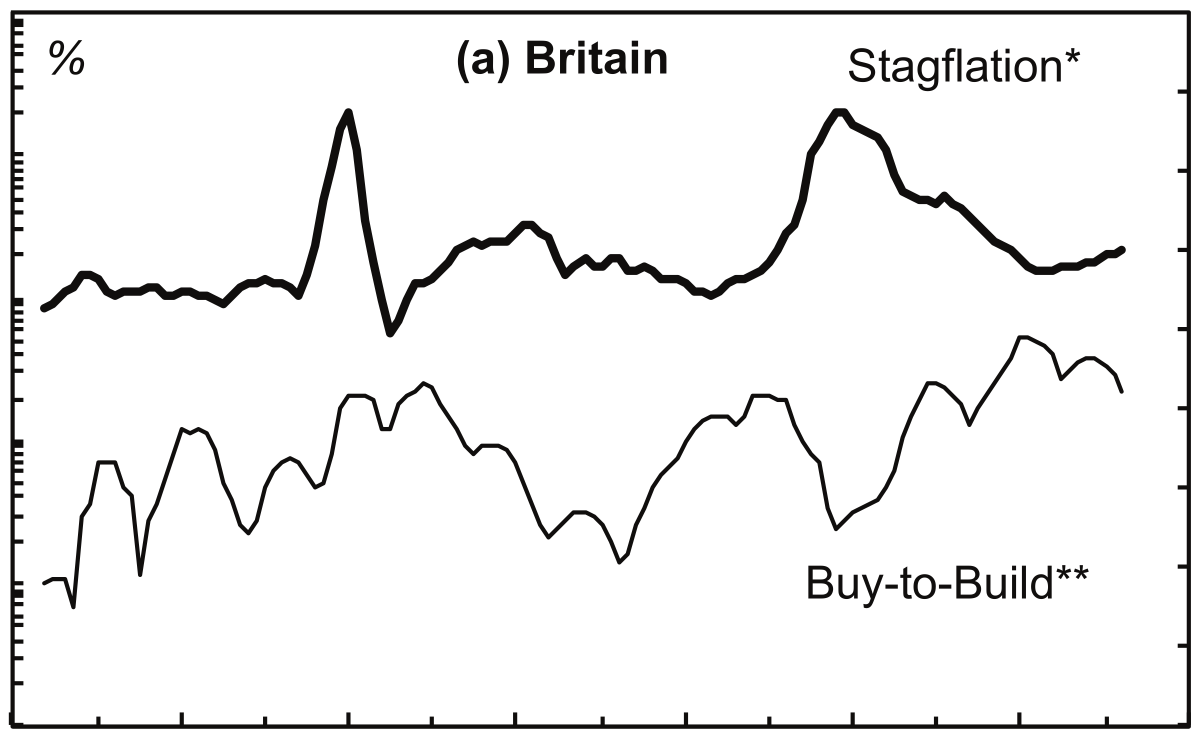

Continue ReadingFrancis, Bichler & Nitzan, ‘The Buy-to-Build Indicator: An Exchange’

Abstract The first part of the exchange is a short article by Joe Francis. The article provides new long-term estimates and an assessment of the buy-to-build indicator for the United States and Britain, going back to the end of the 19th century. The second part offers commentary by Shimshon Bichler and Jonathan Nitzan. Citation The […]

Continue ReadingSpeculation vs Hedging: A False Dichotomy?

Joseph Baines How do we make sense of the role of different participants in futures markets? According to the conventional wisdom, market participants can be put into two different categories: hedgers and speculators. Hedgers, such as farmers and other commercial entities, assume positions in the futures market that are equal and opposite to their positions […]

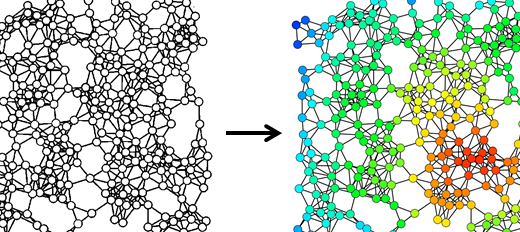

Continue ReadingComplexity Science and Political-Economy: Post 1 – Networks

Shai Gorsky This series of posts will explore some contemporary fields in “complexity science”. They summarize experiences from the Santa-Fe Institute Complex Systems Summer School 2014, with the hope of suggesting to readers useful research tools for political-economy. Please feel free to contact the author if you are interested in discussing or utilizing any of […]

Continue ReadingThe Brawl on Bay Street

DT Cochrane The world of traders has largely been outside political economic analysis. With financial values treated as ‘fictitious’ representations of real values, trading is, at best, a distortion. The actual individuals who perform this role, and supporting roles in the realm of financial intermediation, are given no consideration. From the perspective of CasP, on […]

Continue ReadingPublic vs Private Interests in Cancer Research

DT Cochrane Harvard Medical School researchers Michelle Holmes and Wendy Chen wrote an op-ed in the New York Times about research they published in 2010 that found aspirin may be an effective treatment for breast cancer patients. The op-ed was not just calling attention to these results. Rather, it was a complaint that the research […]

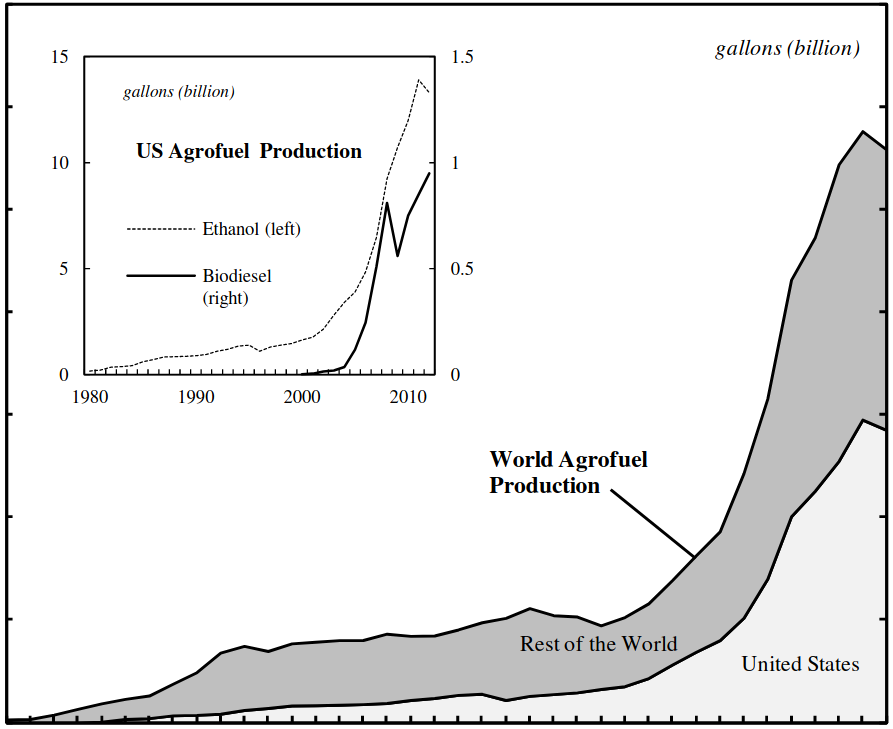

Continue ReadingNo. 2014/03: Baines, ‘The Ethanol Boom and the Restructuring of the Food Regime’

Abstract The agrofuel boom has brought about some of the most significant transformations in the world food system in recent decades. A rich and diverse body of agrarian political economy research has emerged that elucidates the conflicts and redistributional shifts engendered by these transformations. However, hitherto this point, less attention has been given to differences […]

Continue ReadingCentral banking and the governance of the price architecture

Jeremy Green With the Bank of England signalling an impending interest rate rise, monetary policy has returned to centre stage. Since 2008 we have lived through a period of extremely unorthodox monetary policy characterised by unprecedentedly low interest rates. This era of ‘cheap money’ may now be about to end and a return to ‘normality’ […]

Continue ReadingThe Business of FIFA and Our Love of Football

James McMahon John Oliver, a former correspondent for The Daily Show with Jon Stewart, now has his own HBO show. Like what he did on The Daily Show, Oliver’s Last Week Tonight brings irreverence and wit to politics, business and other news of the day. Recently, he did a funny and sarcastic piece on FIFA, […]

Continue ReadingA Price for Everything

DT Cochrane What is a tree worth? Is this a question you’ve ever pondered? Does it seem like an odd question? Perhaps it seems like an inappropriate question? How could someone possibly attach a financial quantity to a tree? Don’t trees transcend monetary values? Trees are more the things of poetry than finance, aren’t they? […]

Continue ReadingBichler & Nitzan, ‘How Capitalists Learned to Stop Worrying and Love the Crisis’

Abstract Do capitalists really want a recovery? Can they afford it? On the face of it, the question sounds silly: of course capitalists want a recovery; how else can they prosper? According to the textbooks, both mainstream and heterodox, capital accumulation and economic growth are two sides of the same process. Accumulation generates growth and […]

Continue ReadingThe Weekly Sabotage: Week 7

Tim Di Muzio The Privatization of Money: The Greatest Sabotage in Human History? Part II Last time we found out that modern money is created when commercial banks make loans to people and businesses. They are not loaning out other people’s money at all, but effectively creating it by entering numbers into a computer. Between […]

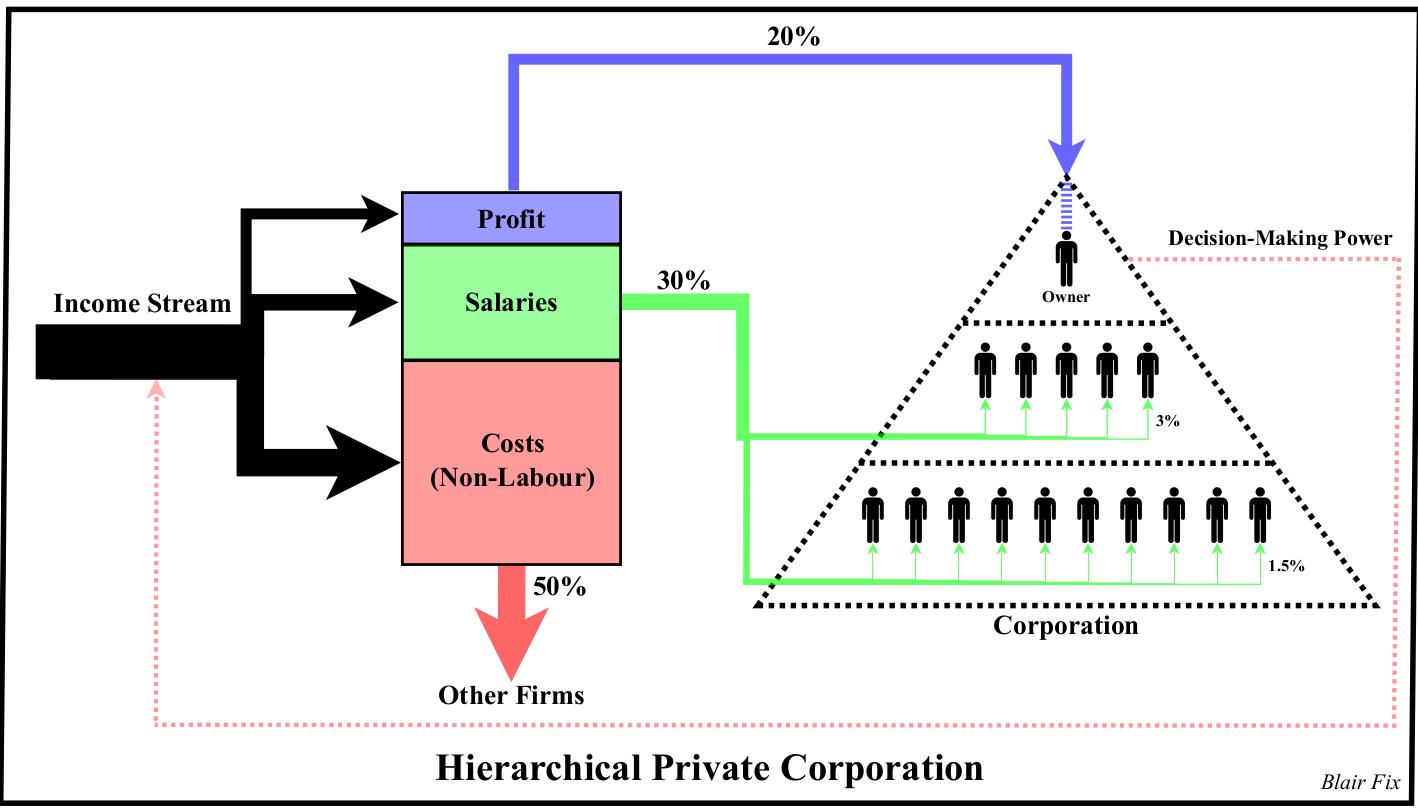

Continue ReadingNo. 2014/02: Fix, ‘Rethinking Profit: How Redistribution Drives Growth’

Abstract Using a combination of heterodox economics and biophysical analysis, this paper investigates the relationship between economic distribution and the growth of material throughput. Empirical results show that the growth of “useful work” correlates with redistribution towards profit. Furthermore, increases in energy consumption are correlated with increases in the largest corporations’ share of total employment. […]

Continue ReadingNo. 2014/01: McMahon, ‘Capitalist Power, Distribution and the Order of Cinema’

Abstract In this paper, the structure of Hollywood film distribution will be analyzed through the lens of risk. In both its technical and conceptual senses, risk is relevant to the study of Hollywood’s dominant firms. In the interest of lowering risk, the business interests of Hollywood look to predetermine how new films will function in […]

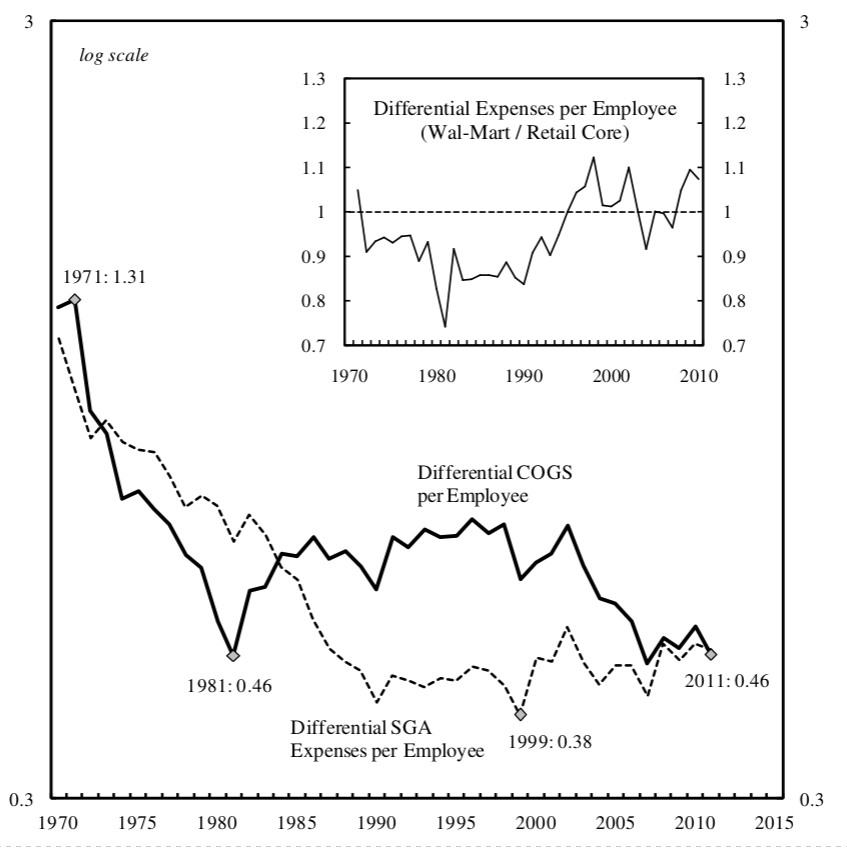

Continue ReadingBaines, ‘Wal-Mart’s Power Trajectory: A Contribution to the Political Economy of the Firm’

Abstract This article offers a power theory of value analysis of Wal-Mart’s contested expansion in the retail business. More specifically, it draws on, and develops, some aspects of the capital as power framework so as to provide the first clear quantitative explication of the company’s power trajectory to date. After rapid growth in the first […]

Continue ReadingThe Weekly Sabotage: Week 6

Tim Di Muzio The Capitalization of Money Creation: The Greatest Sabotage in Human History? Every year in my course on Political Economy in the New Millennium I ask my students to do an exercise. The task is for them to ask three members of their friends or family how money is created. As you can […]

Continue ReadingHow sincere is Mr. Kerry about climate change?

Ilirjan Shehu Speaking to students in Jakarta, Indonesia, US Secretary of State, John Kerry, declared a few days ago that climate change is the world’s “most fearsome” weapon of mass destruction. Likening climate change to terrorism, Kerry stated that “It doesn’t keep us safe if the United States secures its nuclear arsenal while other countries […]

Continue ReadingWhat Should I Read?

James McMahon Over at Heterodox Microeconomics Research Network they have a thorough list of academic publications that are relevant to heterodox theories of capitalism. The list covers the following subjects: History and Methodology of Heterodox Microeconomics Critiques of Mainstream Microeconomics Principles of Heterodox Microeconomic Theory Theory of the Business Enterprise Structure of Production and Costs […]

Continue ReadingUS Department of Justice Increasingly Resorts to “Private” Negotiations

Eric George Since 2012, the U.S Department of Justice has launched a series of private negotiations with Wall Street banks relating to their involvement in the 2008 financial crisis. The DoJ made headlines this November when it struck a record $13b settlement with JP Morgan for allegations of fraud in the sale of mortgage-backed securities. […]

Continue Reading