Home › Forum › Political Economy › Inflation is always and everywhere a redistributional phenomenon › Reply To: Inflation is always and everywhere a redistributional phenomenon

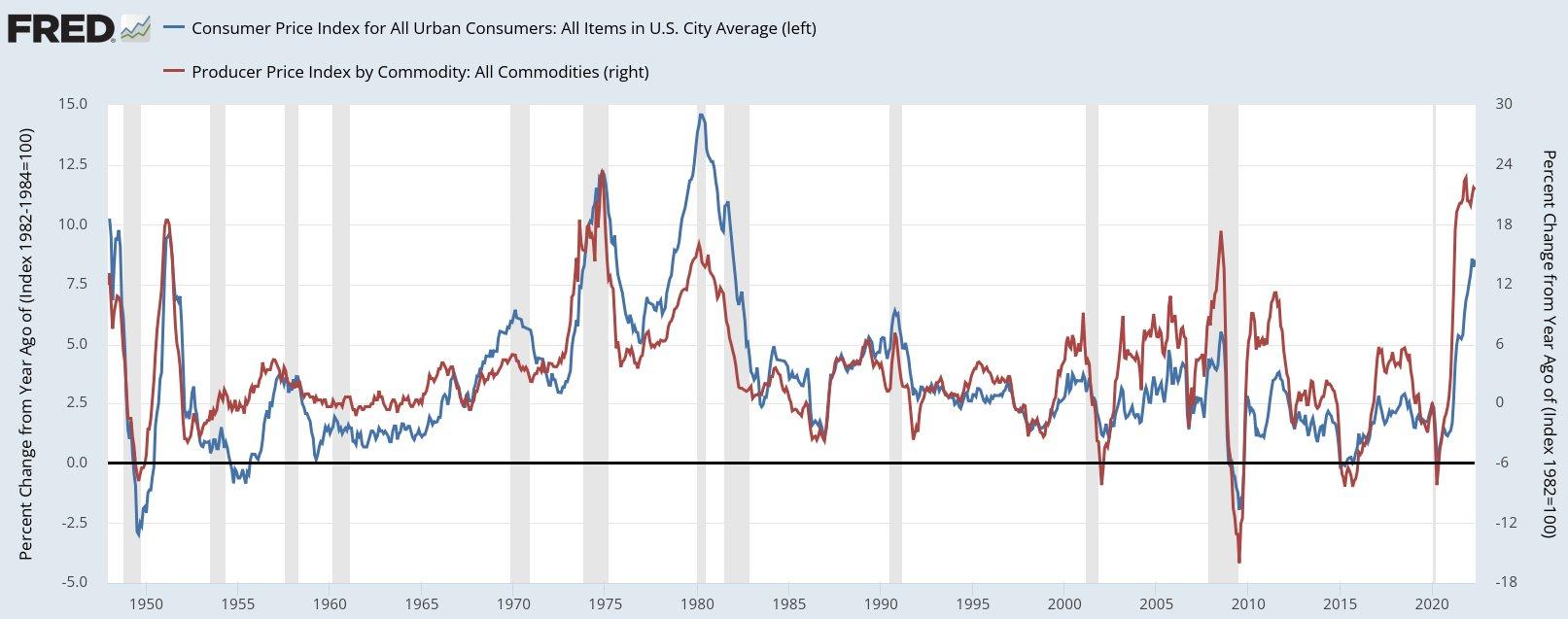

The May 2022 data for the United States, shown in the figure below, suggest that the current bout of inflation may be peaking. The chart contrasts the annual rate of change for consumer prices (left) with that of producer prices (right), and both series indicate that the process may be approaching its upper limits.

The reason for these limits has to do with the re-distributional essence of inflation.

Inflation is an average of individual price changes, and this average hides the most important driver of inflation: the fact that individual prices change and different rates, and that these differences redistribute income and assets.

The next chart contrasts the annual CPI inflation in the United States (red) with the annual rate of change of the purchasing power of wages (blue) — or what economists call the “real wage.” Note how the two series are inversely correlated: when CPI inflation accelerates, the rate of change of “real wages” decelerates, and vice versa.

This negative correlation suggests three things.

1. U.S. wage earners tend to lose from inflation — when inflation rises, U.S. wage increases tend to lag (and, inversely, rise faster when inflation slows). And since, on the upswing, wages rise more slowly than prices, the purchasing power of wage earners suffers.

2. Wage increases do not cause inflation — unless you insist on blaming workers for using wage increases to give capitalists the excuse to raise prices even faster.

3. Redistribution tends to limit the inflationary process — as inflation redistributes income from workers to capitalists, it undermines workers’ income-read-consumption, causing the the profitability of price-setters to gradually wane. Eventually, capitalists lose their price-hike resolve, their tacit coordination fractures, and inflation decelerates.