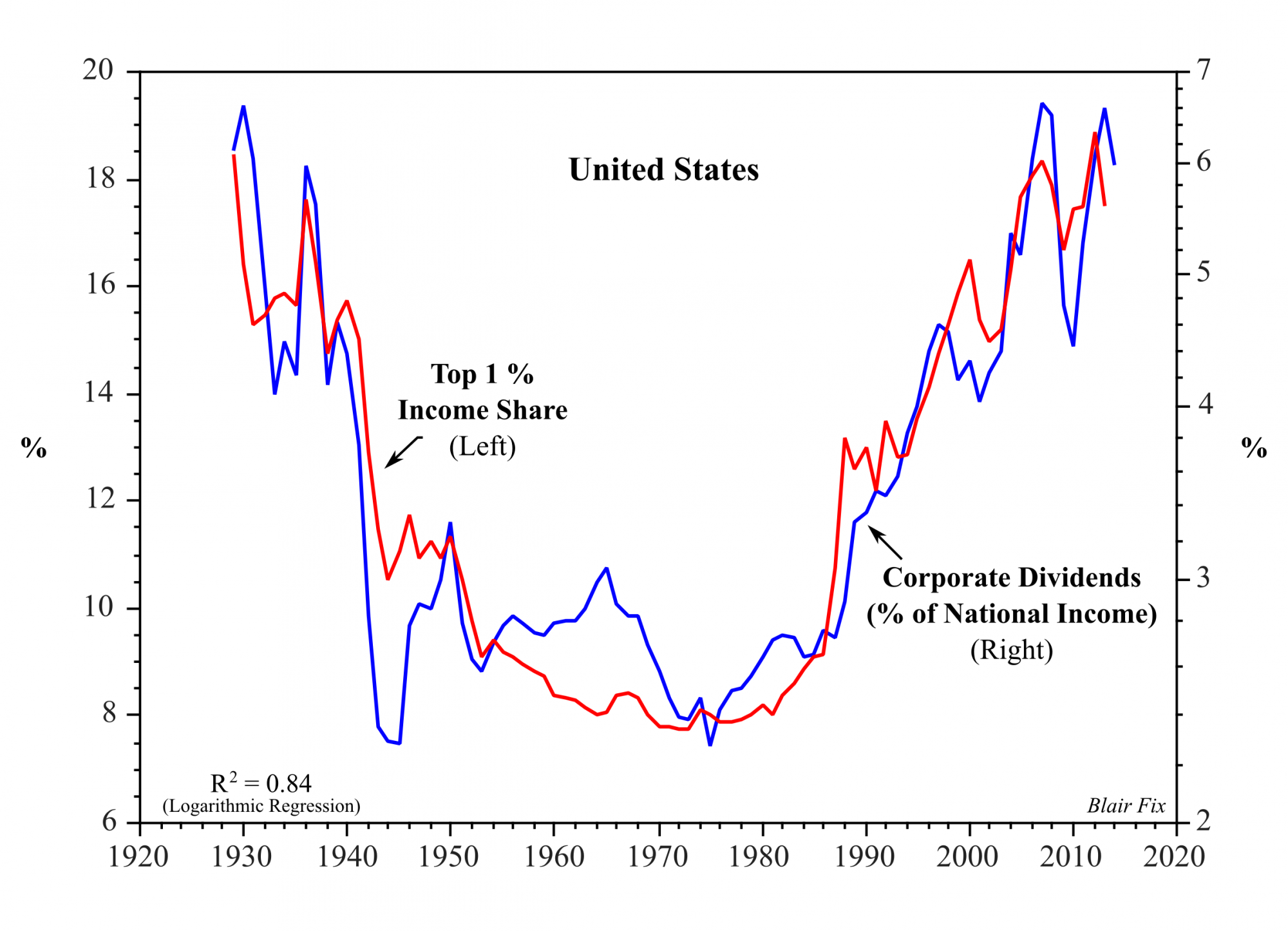

Jonathan Nitzan Blair Fix, a PhD student in the Faculty of Environmental Studies at York University in Toronto, points to some important limitations of income inequality data. In a recent posting on capitalaspower.com, Fix shows that, in the case of the U.S., the Top 1% income share correlates not with the share of capitalists in […]

Continue Reading