Originally published at joefrancis.info Joe Francis Giovanni Federico and Antonio Tena-Junguito (2016) have produced a data set of world trade that includes exports and imports, in both current and constant prices, going back to the early nineteenth century for over 100 countries. It will give all economic historians a mass of easily available long-term time […]

Continue ReadingJeffrey Williamson’s Terms of Trade

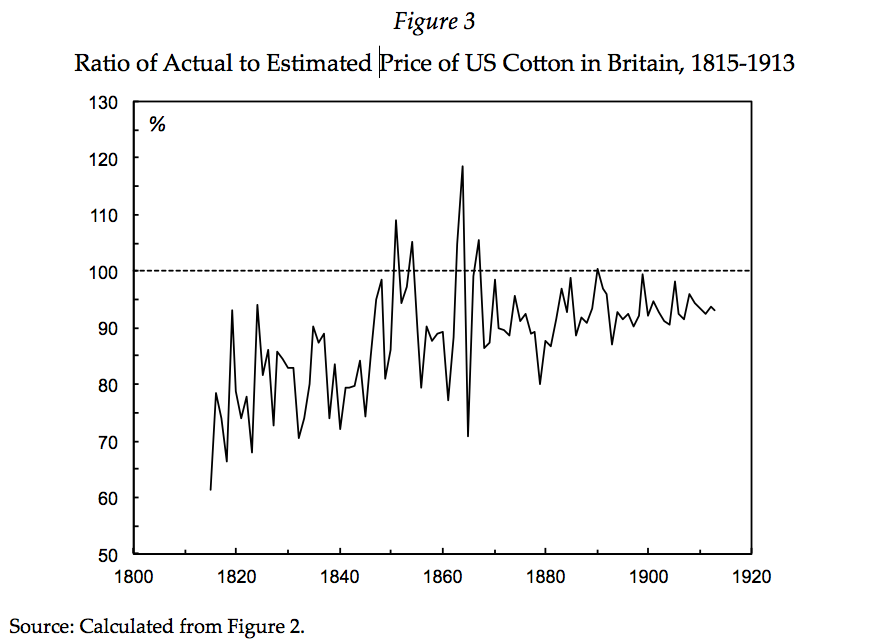

Originally published at joefrancis.info Joe Francis Jeffrey Williamson‘s (2011) book Trade and Poverty: When the Third World Fell Behind is one of the most interesting attempts to explain the ‘great divergence’ between rich and poor countries. It is a shame, then, that it is marred by his use of Mickey Mouse numbers. In simplified terms, Williamson argues that […]

Continue Reading