Remaking Our Economies with Wartime Analogies, Part 3

July 27, 2021

Originally published at dtcochrane.com

DT Cochrane

In Part 2, I looked at the shifts in U.S. household consumption that occurred during WWII. While aggregate consumption increased alongside massive government intervention, the qualitative mix of that consumption changed in some drastic ways. This analysis was intended to augment the analogy made by J.W. Mason and Mike Konczal between WWII and the prospects for a government-led post-pandemic economic boom. In this post, I will move the analogy from the U.S. to the U.K.

For several reasons, the U.K. is a better analog for our current situation.

While economies are recovering from the pandemic, the climate crisis continues to unfold, not mention other serious ecological issues, including dramatic declines in insect populations, the proliferation of ocean ‘dead zones’, soil degradation, and destruction of peat lands. Each of these crises is exacerbated by the climate crisis.

Our ecological dire straits are much more like living adjacent to a war zone that occasionally spills over onto us than it is like living across the ocean from one.

U.S. and U.K. Economies During WWII

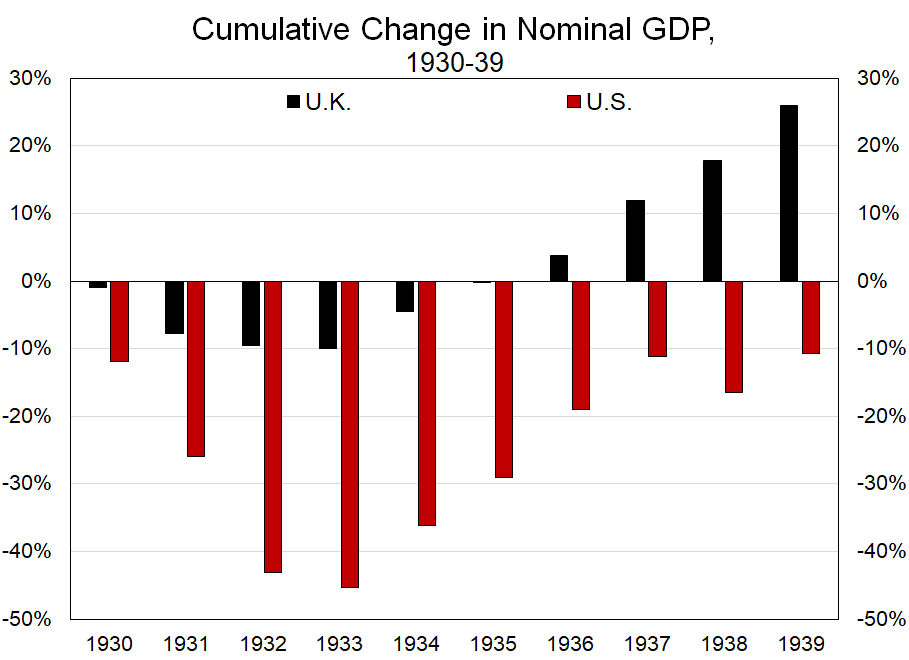

The economic trajectories of the WWII allies were dramatically different before the war. Although both countries had significant economic downturns in the early 1930s, the decline of the U.K. was much smaller and shorter, as seen in the figure below.

Each set of bars is the cumulative change in nominal GDP beginning in 1929. By 1933, U.S. GDP was almost 50 percent below 1929. In the U.K. the decline was about 10 percent. While the U.S. began to recover in 1934, it has not returned to its pre-Great Depression level of GDP by 1939. Meanwhile, the U.K. had almost fully recovered by 1935. In 1939, GDP was more than 25 percent higher than 1929.

With the onset of the war, both countries saw sizeable increases in GDP. As mentioned in Part 2, it took the war for the U.S. to actually complete its recovery from the Great Depression. In 1940, U.S. nominal GDP remained two percent below 1929, although it had grown ten percent from 1939. By 1941, U.S. GDP had more than recovered and was 24 percent above 1929.

The U.K.’s GDP continued to outpace the U.S. during the early years of the war (see the next figure). This was entirely driven by government. By 1941, U.K. nominal household consumption was 12 percent above 1939, while for the U.S. it was 21 percent higher. Then, in 1942, U.S. GDP growth overtook the U.K. as its consumer expenditure continued to grow more and government expenditure jumped dramatically.

During the war years, government expenditure became a much larger portion of both countries’ GDP, as seen in the next figure.

Although it is universally known among economists that government spending is a part of GDP, they generally neglect that fact when advocating for increased GDP as evidence of increased well-being. Belief in ‘crowding out’, which I discussed in Part 1, could be a reason why. Or, perhaps ‘crowding out’ offers a convenient theoretical justification for an ideological opposition to government.

Currently available data does not have values for U.K. government investment during the war years. Aggregate investment in “fixed capital formation” is available. However, comparisons between the U.S. and the U.K. suggest there may be accounting differences that affect the distribution of values between expenditure and investment. For the figure below, I imputed a value for U.K. government spending on assets using the U.S. government’s relative share of total investment in non-residential assets. Before and after the war, the government share of total investment was similar for the U.K. and the U.S., even if the investment share of GDP was quite different.

In the figure below, the full height of the black/gray bars is U.K. government spending on both consumption expenditures and investment, as a share of GDP. The investment segment is in gray. The red/pink bars are U.S. government spending. The pink segment is the spending categorized as investment. If there are accounting differences, then the two categories are not as meaningful as the total amount.

In 1940, total U.K. government spending was already more than 40 percent of GDP. For 1942 until 1944, it was over 50 percent. Because the U.S. did not enter the war until 1941, the level of government spending as a share of GDP actually fell slightly in 1940. Nominal government spending increased, but because GDP increased more, the share fell.

U.S. government spending never broke the 50 percent mark, although it came close. Obviously, the U.K. and U.S. governments comprised so much economic activity because of the all-out war effort. Both governments were commanding enormous amounts of material and labour to equip and conduct the war.

U.S. national accounts have data on defence spending. In 1939, U.S. defence spending was $1.7 billion. In 1944, it was $97 billion! In 1941, the U.S. spent $15 billion on defence, which was more than the total amount spent from 1929 to 1939.

So, both the U.K. and the U.S. had growing economies, as measured by nominal GDP, with a substantial portion of that growth in the form of increased government spending. Importantly, that spending becomes some people’s income. The economist J.M. Keynes recognized this fiscal reality—a fact ignored, denied, or misunderstood by most of our prominent contemporary economists—and saw in it both opportunity and risk. The spending offered an opportunity to reduce inequality. The risk was that the money spent to fund the war effort could lead to destructive inflation, especially of goods needed to conduct the war.

Keynes offered his solution in a short pamphlet titled How to Pay for the War. He called for a mixture of taxes and forced saving, which would draw money out of circulation. I will discuss Keynes’ solution and its applicability to our present situation in the conclusion to this third, and final, part. However, for now it suffices to say that the U.S. and the U.K. were affected very differently by the war, not least in the domain of household consumption. These differences are important if we are going to look back at WWII as an analogy for dealing with the post-pandemic recovery in the context of the climate crisis.

U.K. Household Consumption

The inspiration for this series of posts was a pair of articles; one written by Peter Coy, the other by J.W. Mason and Mike Konczal. The latter made the point that price-adjusted U.S. household consumption rose throughout WWII, even as the U.S. government spent heavily. This inspired Coy to check the fact and determine that Mason and Konczal were correct. However, the situation was markedly different in the U.K.

Consumption by U.K. households fell every year for the first four years of the war. Although it increased in 1944 and 1945, it would not fully recover until 1946. As we will see below, even in 1946 many categories of household consumption remained well below their pre-war levels.

Unlike the U.S. economy, the U.K. economy was unable to provide simultaneously more goods and services tohouseholds and the war effort.

Changes in U.K. Household Consumption

Unfortunately, the detail available in U.S. national accounting is not available for the U.K. And the disaggregate categories are not the same as the U.S. data. That means I cannot directly compare shifts in household purchases of durable goods, non-durable goods, and services. Nonetheless, the disaggregated data highlights some important qualitative shifts in household consumption that accompanied the aggregate decline.

‘Essential’ Goods

First, the data shows that the war required a decline in several categories of goods that we can consider ‘essential’: fuel & lighting, food, and clothing.

Food consumption fell by 21 percent. It is worth noting that in 1943 almost 20 percent of the working-age population was in the armed forces. That means a significant portion of food consumption would have shifted from a household expense to a government expense.

Additionally, we know about the ‘Victory Gardens‘, which produced food for consumption but was excluded from the national accounts. This points at a standard criticism of GDP: it only includes most activities once they are monetized, which excludes a lot of activities that are nonetheless valuable. The classic example is the exclusion of housework, which is heavily performed by women. If a stay-at-home mother cares for her children and cleans her home, it contributes nothing to the national accounts. However, if she goes back to work, and hires a nanny and house cleaner to perform those tasks, that expense is added to GDP.

The reduction of fuel & light likely meant, on the one hand, more discomfort due to cooler homes in winter, and more inconvenience from reduced lighting. On the other hand, it also meant more diligent conservation, which can offer its own rewards. Anyone who has We cannot assume that a reduction in household purchases automatically means deprivation.

Similarly, the reduced spending on clothing likely brought disappointment to many. Those who enjoy wearing the latest fashions undoubtedly had to forego that luxury. However, it also meant people got more use out of their clothing by wearing it for longer. Additionally, as with food, a large portion of the population were provided a portion of their clothing by the government.

The two figure above—aggregate consumption and consumption of ‘essentials’—both overstate how much consumption by the U.K. population actually declined. At the same time, figures of aggregate U.S. household consumption understate how much consumption by the U.S. population actually increased. A similar portion of the U.S. working age population ended up in the armed forces during WWII, although, as noted in Part 2, “food furnished to employees (including military)” is a subcategory of household consumption in U.S. national accounts.

Other Goods & Services

In the U.K. data, five categories of goods are combined into a single annual value during the war years. It includes several types of goods that saw declines in the U.S., such as furniture. The aggregated category saw a 44 percent decline. Vehicle purchases dropped to nothing in 1943 and 1944. Expenditures on vehicle operations declined by 78 percent. A broad category of ‘other services’ fell by nine percent.

In fact, other than housing, which had a minor increase, only two categories of U.K. household consumption expenditure increased between 1939 and 1943: tobacco and public travel & communication.

These two categories correspond to some highlighted in my analysis of shifts in U.S. household consumption during the war. I discussed how increased consumption is not necessarily a sign that people are better off. Tobacco is the perfect example. While smoking can be an enjoyable activity, it is also physically harmful and addictive. Also, consumption is exacerbated by stress. In actual pounds, tobacco expenditure rose as high as 8.9 percent of total household expenditures during the war.

However, the increase in public travel & communication was mostly a good thing. People were connecting with friends and family more. It is likely a healthier way to manage stress. This greater connection was part-and-parcel of the social cohesion and solidarity that those who lived through the war described as a highlight among all the stress and terror.

Post-war Household Consumption

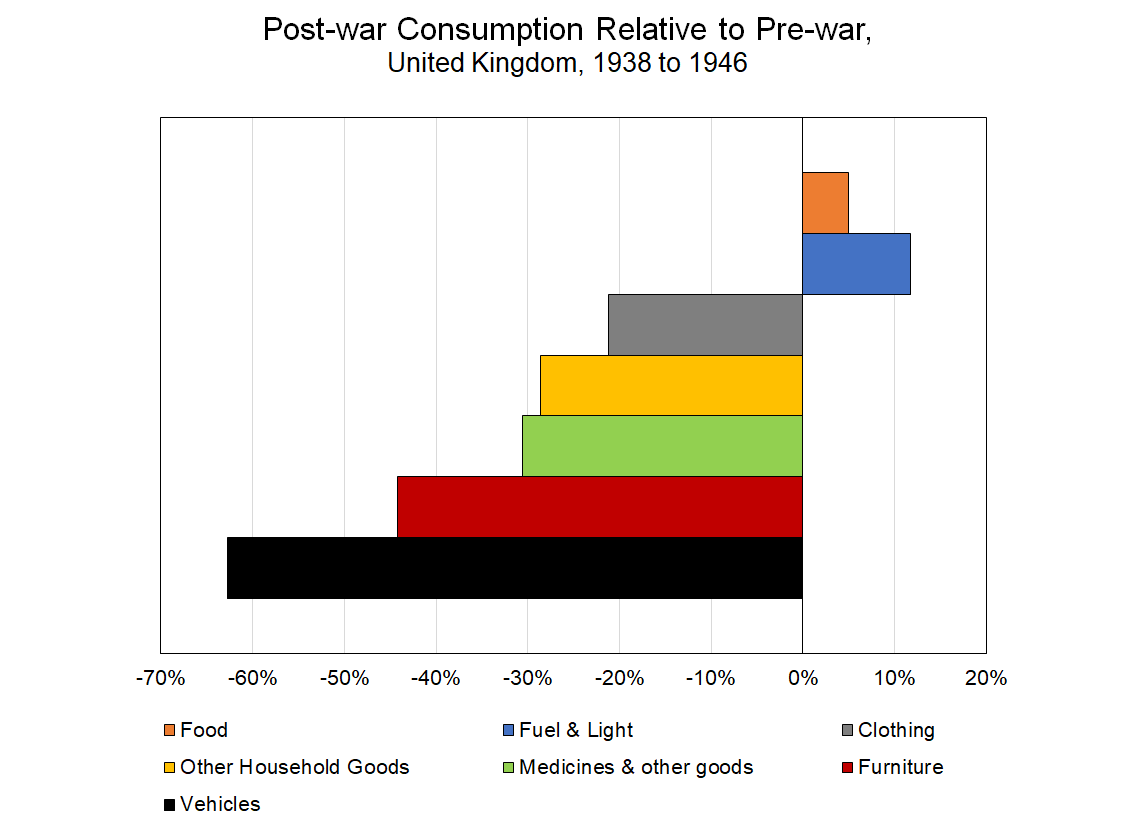

By 1946, aggregate U.K. household price-adjusted purchases exceeded the pre-war level. However, several categories of goods remained much lower. For the following, I am comparing 1946 to 1938. That allows me to compare some of the categories that were combined during the war years. It also accounts for the fact that some categories of consumption had already declined by 1939.

First, it is worth noting that a comparison with 1938 shows that the purchase of books, which is not reported for the war years, was 46 percent higher in 1946 (not shown). Perhaps this is due to a dramatic recovery from wartime decline. Paper use was restricted during the war. However, U.K. consumers may have paralleled U.S. consumers, who bought more books during the war, as seen in Part 2.

The categories that were higher in 1946 than 1938, apart from tobacco, public travel & communications, and books, included food and fuel & light. However, clothing remained 21 percent below 1938. All the categories that might be considered ‘durable goods’ remained well below pre-war levels. Household purchases of vehicles would not achieve pre-war levels until the early 1950s. The same was true of furniture and household appliances.

Conclusion

The sacrifice of U.K. households during wartime is the less surprising outcome compared to the increased household consumption in the U.S. The latter might hold out a promise that we can recover from the pandemic and confront the climate crisis and not sacrifice our well-being. However, we also need to be prepared to give up some things. The mix of things we purchase is going to change.

Consumption?

We need to acknowledge that an aggregate measure of household consumption is an extremely problematic indicator of well-being, for many reasons. First, there is the issue of distribution. All measures examined in this analysis were for consumption by the entire population. If consumption at the top of the income/wealth hierarchy grows by more than it falls at the bottom, then aggregate consumption would increase.

Second, increased consumption of certain goods and services does not necessarily mean we are actually better off. If we are consuming more of certain ‘bads’ in order to manage stress or other disorders, that is hardly evidence we are better off. Additionally, if households are increasing their spending on goods and services that would be more effectively, efficiently, and fairly distributed via public institutions, that is not necessarily evidence of improved well-being.

Third, the concept of ‘consumption’ is itself problematic, as David Graeber, among others, has written. The issue was touched on above, in a different context: government consumption vs. investment. As mentioned, the U.S. and U.K. data seems to differ in terms of how government purchases were classified as either ‘consumption’ or ‘investment’. The dividing line is hardly clear-cut.

We never think of household purchases as an investment unless it is for a business, at which point the buyer ceases to be considered a household, although even this categorical distinction is not as clear-cut at the margins. Household purchases, sometimes labelled “final consumption expenditures” because they are considered the endpoint of our economy, do not become assets that generate income. Yet, as Graeber notes, much of what we buy is not actually ‘consumed’.

When a teenager buys a guitar and begins to learn to play, that is more an investment than consumption. This is obviously true if the teenager goes on to become a paid musician. However, it is also true if it just contributes to building the skills of a lifelong hobby that is never monetized. While the concept of durable goods somewhat compensates, using the term ‘consumption’ to describe the relationship between the household and those goods is misleading.

Finally, focus on increased ‘consumption’ means that more purchases of ‘goods’ is axiomatically better, even if these increases are due to faster obsolescence or break-down. As our household objects become more complicated, we lose our ability to repair them, either ourselves or through the service of a local repairperson. The sellers of these goods have little interest in making them more durable or more easily repaired. Quite the opposite.

Much of the obsolecense of durable household goods diverts resources from sytems of production into waste sinks. Increased ‘consumption’ of durable goods is likely making us worse-off in the long-run.

Constrained Planning and Plenty

Mason and Konczal analogy is important and useful to combat mounting calls for austerity. But there is an extended debate to be had about how we use our resources. The post-pandemic recovery offers an opportunity to begin doing what needs to be done to manage our multiple ecological crises.

Government spent heavily during the pandemic to support economies and households when other sources of income disappeared. Taxes did not rise to match that spending, so the amount of money in the economy increased. Many of our usual spending outlets, such as restaurants and entertainment, were greatly reduced. This led to record household savings rates in many countries.

It also has economists anticipating a major boom in household spending as pandemic restrictions are lifted. While it is a hopeful sign in terms of creating jobs, it is worrisome in terms of the potential ecological impact. What are we going to ‘consume’? How disposable will those things be?

The pandemic is a reminder of the need for government to participate in economic management during times of crisis. It was a lesson learned intensively during WWII. Yet, almost everyone in government, as well as media, is ignoring the lesson as we stumble along, trying to do as little as possible to deal with the climate crisis.

Keynes recognized that spending on WWII would add money to the economy, but that this was a mixed blessing. While it would ensure continued income for workers, increased spending power meant they would compete for resources needed to fight the war. We face a similar problem now, even if our leaders have failed to recognize the necessity to spend huge. Just as Keynes recommended, we will likely need a combination of taxes and forced savings.

We need material budgeting, as was done during WWII. What materials are available? What is needed for a just transition? What is left over? We cannot expect markets and prices to achieve a sustainable outcome.

The qualitative mix of goods and services will change, as it did in the U.S. and the U.K. during WWII. Our absolute consumption of material goods will likely also decline. At the very least, just as fighting the war was prioritized when distributing resources, achieving a just transition must be prioritized. However, this need not mean absolute deprivation. We need to plan our economies within the material constraints of the Earth, but th

At the very least, we can likely have more leisure time. We can also have more public provision. Even in our sacrifices, we can find pleasure, knowing that we are doing so as part of ensuring a just, sustainable future for humanity. Key to appreciation of sacrifice is that it be shared. That is why Keynes thought the economic management needed to fight WWII offered an opportunity to reduce inequality. We should grab the same opportunity that exists now.

After WWII, many economies had significant, sustained booms. Unfortunately, those booms had ecological consequences, many of which we are only acknowledging now. Further, many of those ecological consequences were borne by marginalized communities, especially Indigenous peoples who were displaced by extraction. We cannot have the same sort of boom following a just transition.

We will need continued management of many resources and that management must include the people most affected by extraction and disposal. However, that does not mean we cannot have richer, more satisfying lives, with plenty of consumptive opportunities within those constraints. While our material resources have opportunity costs—using rare earth minerals for an MRI machine means those minerals are not available as inputs to iPhones—they can be combined and recombined with emergent effects that serve ‘consumers’ in vastly different ways. While our resources are constrained, their potential becomings are infinite. We must acknowledge constraints while denying scarcity.

This latter point is part of the anti-scarcity narrative offered by the humanities wing of modern monetary theory. It was also given a fascinating examination by Alex Williams, which I summarized via George Monbiot’s aphorism: private sufficiency, and the luxuries of many publics. Other words we might use for publics are communes or communities or collectives or institutions.

We need to supercede the naive—and destructive—individualism of both mainstream economic theory and American right-wing populist rhetoric. Our lives are lived within many commons. We can acknowledge our intractable interdependence without denying the individual, whose individuality is both output and input of the different publics in which they participate. The Earth is materially fixed. But that materiality can express itself as both a wasteland devoid of life or a thriving cornucopia of ecological and cultural diversity.

Getting from here to there will require much effort, including the sacrifice of things that many of us currently take for granted. Thankfully, we have the resources, expertise, and creative capacity to not only do it, but to do it joyfully.