How elite hobbies let billionaires pay no tax

May 29, 2023

Originally published at pluralistic.net

Reproduced under a Creative Commons Attribution 4.0 license

Cory Doctorow

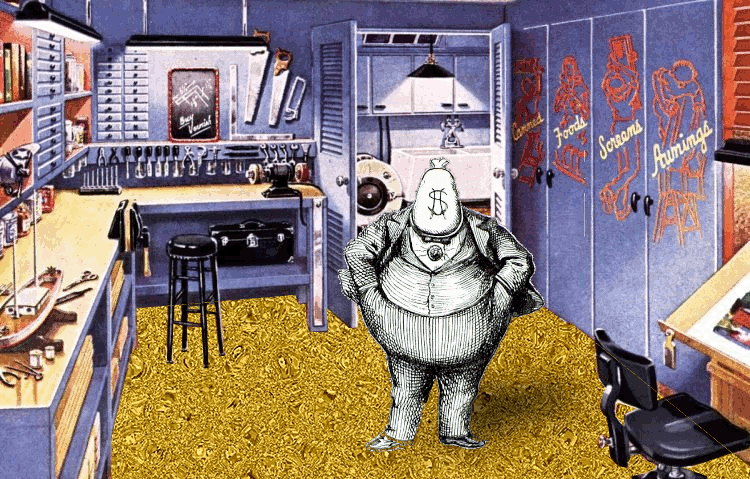

When you hear that a billionaire has bought a horse or a newspaper or a sports team, you might think it’s just dilletantish dabbling by a member of the parasite class with nothing better to do with their time – a way to make the idle rich slightly more vigorous.

But as Propublica documents in the latest installment of its IRS Leaks reporting – drawing on never-seen tax filings of the ultra-rich – hobbies are a way to pile up gigantic tax write-offs that can be applied to passive income (money you earn for doing nothing). What’s more, though there are limits to the way that hobby-related expenses can be deducted from your tax-bill, the super-rich routinely flout those limits and the underfunded IRS lets them get away with it.

https://www.propublica.org/article/when-youre-a-billionaire-your-hobbies-can-slash-your-tax-bill

If anyone is going to get dinged for aggressively taking deductions from their leisure activities, it’ll be a middle-class person who can’t afford the kind of high-powered consultants, lawyers and accountants that can tie the IRS up in expensive knots it can’t afford.

The tax code is stacked in favor of elite hobbies. Most of the time, a hobby has to turn a profit in 3 out of 5 years to count as a business and supply deductions. But if your hobby is horse-racing, you only have to turn a profit in 2 out of 7 years.

But the wealthy flout even this modest stricture: tobacco billionaire Brad Kelley and Cambell’s Soup billionaire Charlotte Weber both took millions of dollars in horse-losses for 16 or more consecutive years without an IRS investigation.

No surprise, really: the nine criteria the IRS uses to sort side-hustles from hobbies are subjective and easy to argue against. How can the IRS prove that you’re not experiencing undue “personal pleasure or recreation” from your hobby? Even the more objective criteria, like “the expertise of the taxpayer or his or her advisers” can be bought for (billionaire) chump-change. In the case of the horsey set, there’s a whole industry of consultants, breeders, etc who will provide cover to satisfy that test.

Technically, you have to spend at least ten hours a week on a hobby for it to constitute a business. Theoretically, the largest number of hobbies a billionaire can claim business losses against is four or five – not more than six or seven. But by grouping multiple hobbies together under a single “holding company,” the super-rich can duck even this hard limit.

Billionaire Patrick Soon-Shiong is America’s 89th richest person. He has a “cancer moonshot” business, he buys newspapers like the LA Times and San Diego Union-Tribune, he says he’s making a covid vaccine. He has a health care infomatics company, a car battery company, a bioplastics company. He’s got a water purification company, a production soundstage, and an electric scooter company.

Many of these businesses lose money. Soon-Shiong claims he’s personally spending at least 10 hours a week on each of them, which lets him take personal tax deductions on their losses. All told, that’s added up to $887m in deductions he’s taken against his major source of income – capital gains from his existing wealth. He’s got another $400m off losses saved up he can write off against any future gains, too.

If you or I invest in a portfolio of high-risk businesses, our deductions are capped at $3k/year. You have to be a billionaire like Soon-Shiong to reap hundreds of millions of dollars in deductions for essentially the same activity.

Propublica’s reporting – by Paul Kiel, Jesse Eisinger and Jeff Ernsthausen – identifies plenty of other super-rich hobbyists who mostly or entirely escape tax through their hobbies.

- Tobacco billionaire Brad Kelley: $189m in writeoffs for his horses

-

Soup heiress Charlotte Weber: $173m in writeoffs for her horses

-

Hedge fund billionaire Seth Klarman: $138m in writeoffs for his horses

-

Reebok founder Paul Fireman: $9.3m in writeoffs for his horses, $22m in writeoffs for a “ranch” (Fireman made $360m from 2008-17, and paid $0 in federal tax)

-

Beanie Babies founder Ty Warner: $219m in writeoffs for money-losing prestige resorts (Warner made $363m from 2004-16 and paid $0 in federal tax)

-

Uniphase billionaire Kevin Kalkhoven: $264m in writeoffs for money-losing racecars, planes and an auto-parts company (Warner made $264m from 2005-2018 and paid $422k in federal tax)

I’m a science fiction writer. I earn a good living from writing about weird stuff, and I take some weird deductions, because the kind of research I do for each book is often strange, and sometimes I have to talk about that at length with my accountant to make sure I’m on the right side of the law. But never, in my wildest dreams, have I contemplated the kind of aggressive – even fraudulent – claims these ultra-wealthy people routinely use.

After all, the IRS does have the resources to drag people like you and me into tax-audit hell. When everyday hobbyists who overclaim on their taxes get taken to court by the IRS, the taxman usually wins. The parts of the tax-code that deal with hobbies, and the enforcement mechanisms for them, are tailor-made for billionaire tax-evasion – not for a fair deal for everyday people with a side-gig.