Why are not-for-profit hospitals in the US so much more profitable than for-profit hospitals?

May 19, 2023

Christopher Mouré and Shai Gorsky

When it comes to social institutions, not-for-profit organizations (NFPs) allegedly strike a balance between the private and public realm. While privately owned and operated, not-for-profits are distinguished by their ostensibly public purpose – in eschewing private profits, they claim to make the pursuit of some social benefit their primary objective.

However, not all not-for-profits are equal. While most make little or no revenue, let alone net income, some NFPs collect billions in revenue and hundreds of millions in net income.1

Nowhere is this inequality more evident than in the US hospital sector, where NFP hospitals are the preponderant organizational form. According to the American Hospital Association, in 2020 there were 1,228 FP hospitals, 951 public hospitals, and 2,960 NFP hospitals – 50% more than for-profits (FP) and public combined2. However, only a select few hospitals (FP and NFP) collect a lion’s share of the profits.

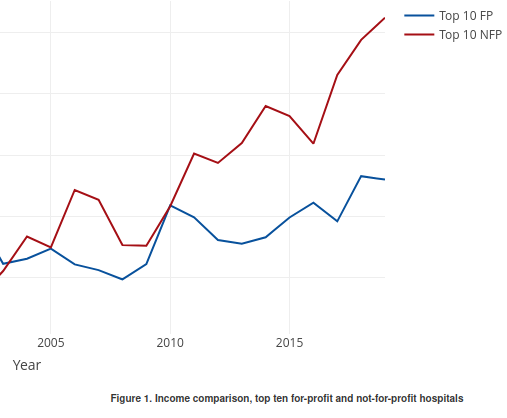

Surprisingly, since the mid-2000s, the largest NFP hospitals in the US have become significantly more ‘profitable’ than their FP counterparts. In 2019, the 10 largest NFP hospitals (by net income) collected $1.05 billion in net income on average, whereas the ten largest FP hospitals “only” collected an average of $520 million.

Source: COMPUSTAT (FP) and IRS 990 forms via the NCCS data archive (NFP)

In general, our research engages with the capital-as-power political economy approach, which argues that FP firms are power-oriented — meaning that firms seek to differentially accumulate social power against other firms and against the populace. They tend to deploy two core strategies, above-average merger and acquisition activity (‘breadth’) and above-average markup (amount of revenue over costs, ‘depth’) that result–when successful–in greater relative organized social power. The key implication of this approach is that much of the behaviour of FPs is socially negative: mergers and acquisitions augment the power of organizations without increasing the social product, while increasing markup redistributes wealth from others to the consolidated firm.

To return to our initial public/private distinction, we might say that while ‘private’ FPs tend to be power-oriented, NFPs are supposed to be ‘public-oriented’. These two orientations tend to be opposed, because power is a relation of domination (i.e., power over others), whereas a public orientation is one of submission to or in service of the will of the public.

In this research note, we examine whether or not the biggest NFPs behave like the biggest FPs. That is, we try to understand whether or not the biggest NFPs engage in differential breadth and depth strategies of accumulation, and whether or not this activity is linked to their actual level of relative profitability, a key proxy for social power. In our mind, there’s no socially beneficial reason for an NFP to buy hospitals at a rate faster than other NFPs (let alone faster than large FP hospitals), or charge double the markup. Both of these behaviours are socially negative, are contrary to the ‘public-orientation’ of NFPs and their existence suggests that these organizations too are ‘power-oriented.’

Source: COMPUSTAT (FP) and IRS 990 forms via the NCCS data archive (NFP)

Figure 2 shows that dominant NFP hospitals have consistently charged higher markups that their FP counterparts, although the distance between the two has shrunk. The fact that the relative markup of NFP hospitals compared to FP hospitals has been falling, while their relative income has been increasing, may suggest that NFP hospitals are differentially accumulating through corporate consolidation. The differential pace of the volume of NFP mergers and acquisitions in Figure 3 confirms this.

Source: Centers for Medicare and Medicaid Services, Hospital Change of Ownership files

Figure 3 presents a tally of the number of different kinds of change of ownership that occurred in the hospital sector between 2016-2022. Overall, NFP firms have been significantly more active in buying firms than FP hospitals, though it should be taken into account that the total number of NFPs is greater than that FP hospitals.

There is evidence that large hospital firms are pursuing differential accumulation. Strikingly, in the last twenty years NFP hospitals seem to be doing so more successfully than FP Hospitals. This evidence calls into question the notion that all NFPs are by definition ‘public-oriented’, i.e., pursue social benefit as their highest priority.

This preliminary research note is a first step toward answering larger questions about the potentially changing role of NFPs in the capitalist order. Are some NFPs power-oriented in the same way as FPs, or do they operate under a different logic? Are NFPs a charity that merely mitigates, or stabilizes the for-profit destructive power-oriented business tactics? How has the role of NFP changed over the years?

Finally, then, we wonder if we can analyze capitalist healthcare in a useful manner beyond the standard, but potentially limited current notions of ‘private’ and ‘public’ ownership of social institutions.