Home › Forum › Political Economy › CasP Q+A for new readers

- This topic has 8 replies, 6 voices, and was last updated January 18, 2022 at 9:37 am by jmc.

-

CreatorTopic

-

May 31, 2021 at 12:26 pm #245728

Our editorial email recently received a nice email from someone that is new to the capital-as-power approach. Emails like this can be shocking, but in a good way. From time to time, we need to be reminded that interested participants might be hesitant to join more high-level discussion, especially if one does not have a background in political economy or is still confused about key definitions.

Please use this space to ask the “simplest” of questions. Nothing is off limits, because what are we doing if key ideas cannot be understood clearly?

Also, anyone can respond. There is no monopoly on interpretation and many can contribute definitions or claims.

- This topic was modified 4 years, 8 months ago by jmc.

-

CreatorTopic

-

AuthorReplies

-

-

May 31, 2021 at 12:28 pm #245729

Thanks, David, for the email!

What is the main thesis of the book [Nitzan and Bichler, Capital as Power (2009)]?

Are you trying to show that

1_ The capitalist regime will one day be overthrown as “the masses” become enlightened? (If so, hopefully something better than the communism of the Soviet Union will replace it.)

2_ The capitalist regime should one day be overthrown ?

3_ “The capitalists” will continue to grow in power until they own — and control — everything. And there is nothing that “we, the people” can do to prevent this.

Any help you can give me to understand your book would be appreciated.

PS. I am also having trouble understanding the term “capitalization”. Do you mean by this term just the “total value” in a corporation (as in the market capitalization of Microsoft is US$ 50 billion).

-

May 31, 2021 at 12:53 pm #245731

I find that Creorder does not provide a political mandate as much as it provides a framework for better understanding capital and the processes by which capital shapes society.

Much of Bichler and Nitzan’s work is indebted to Marx and his studies of capital, but I think the one of the impressions one is left with after reading Creorder the entrenchment of capital in everything, down to our ways of thinking. I find Creorder to be a study of how we can better understand capital and its effects on society, not necessarily a way of promoting any societal alternative or way we can lose our chains as Marx would say. However, one take away would be that understanding capital is one step towards effectively opposing it, should one wish to do so.

-

May 31, 2021 at 5:10 pm #245735

Thanks, David, for the email!

What is the main thesis of the book [Nitzan and Bichler, Capital as Power (2009)]? Are you trying to show that

1_ The capitalist regime will one day be overthrown as “the masses” become enlightened? (If so, hopefully something better than the communism of the Soviet Union will replace it.)

2_ The capitalist regime should one day be overthrown ?

3_ “The capitalists” will continue to grow in power until they own — and control — everything. And there is nothing that “we, the people” can do to prevent this. Any help you can give me to understand your book would be appreciated. US$ 50 billion).

I would argue “none of the above.” The primary insight of the book is “Capitalism is a mode of power,” and the book uses this insight to present a new framework for thinking about and understanding Capitalism. The book offers no predictions, recommendations or judgments about Capitalism itself.

In context, I understand “mode of power” to refer to a “political” (loosely defined) system that creates and enforces social order. Historically, such systems were merely referred to as a “state,” as Aristotle did. Unlike prior modes of power (and especially states), however, capitalists wield their power covertly and indirectly through the assertion of legal rights such as private property, not overtly and directly through violence as the rulers of a state do, and capitalists do so by encouraging constant social change instead of by enforcing a static social order.

PS. I am also having trouble understanding the term “capitalization”. Do you mean by this term just the “total value” in a corporation (as in the market capitalization of Microsoft is US$ 50 billion).

The Capitalist Mode of Power includes a glossary of terms and defines capitalization as follows:

“Capitalization . Capitalization is the discounting to present value of risk-adjusted expected future income. For listed corporations, capitalization –which is often called market value – is calculated by multiplying the price of one share by the number of outstanding shares. For example, if Facebook has 2.17 billion shares outstanding and one share is currently trading at US$24, then the company is currently capitalized at US$52 billion. But capitalization is also the dominant mathematical ritual of capitalist societies. Anything that generates an income stream can theoretically be capitalized and, in that sense, is part of capital.”

The glossary also defines “mode of power” differently than I do (my definition explicitly equates “mode of power” with politics and “mode of production” with economics, thus refuting the duality of economics v. politics; capitalism is both systems in one):

“Mode of power . The specific architecture of power that creates and recreates a given hierarchical, class society. The notion of a mode of power differs from that of a mode of production: whereas the latter emphasizes production and labour as central to understanding society, the former prioritizes the role of organized power.”

-

June 26, 2021 at 9:57 am #245832

Thanks for the reply.

You say ¨Unlike prior modes of power (and especially states), however, capitalists wield their power covertly and indirectly through the assertion of legal rights such as private property, not overtly and directly through violence as the rulers of a state do, and capitalists do so by encouraging constant social change instead of by enforcing a static social order.¨

Are you suggesting that some (possibly most or all) of the political unrest — e.g., Democrat versus Republican, BLM, Antifa, Boycott Israel (BDS), etc — in the United States is being fomented by wealthy capitalists?

How can capitalists exert power by encouraging civil unrest / social change ? What do capitalists have to gain from an unstable United States? Can you give one or more examples of this exercise of control?

— CamelGuy

-

June 26, 2021 at 1:28 pm #245833

Thanks for the reply. You say ¨Unlike prior modes of power (and especially states), however, capitalists wield their power covertly and indirectly through the assertion of legal rights such as private property, not overtly and directly through violence as the rulers of a state do, and capitalists do so by encouraging constant social change instead of by enforcing a static social order.¨ Are you suggesting that some (possibly most or all) of the political unrest — e.g., Democrat versus Republican, BLM, Antifa, Boycott Israel (BDS), etc — in the United States is being fomented by wealthy capitalists? How can capitalists exert power by encouraging civil unrest / social change ? What do capitalists have to gain from an unstable United States? Can you give one or more examples of this exercise of control? — CamelGuy

No, I was not trying to suggest that dominant capital are trying to foment civil unrest, although nobody can rule out that possibility. After all, there is a recent history of right-wing astroturfing in the U.S. (see the Koch-bankrolled “Tea Party”) as well as Fox News and the alt-right media, which are owned or funded by right-wing billionaires and keep their audiences in a constant state of fear and agitation. Antifa is more of a label than an organization, BLM arose organically in response to the extra-judicial killing of people of color, and BDS or some form of it has been around since before I was in college in the 1980s. Nevertheless, each of these recently has been elevated into a bogey man by right-wing media, even though BLM appears to be the only organization that has a substantial power base and is growing.

What I was originally attempting to express was B&N’s concept of a “state of capital,” which they pose as much as a question as anything else. The owner of private property has a right to invoke the state to eject trespassers making the property right itself a threat of violence. The owners of a corporation enjoy a form of sovereign immunity, i.e., limited liability, that human actors in the market do not. The state’s legal delegation of privileges (property ownership) and immunities (e.g., the corporate form, safe harbors, etc.) to dominant capital transfers power from the public sphere to the private sphere, creating a domain of state power controlled by capital.

Turning to your question “what do capitalists have to gain from an unstable United States?” Some of them, like Koch industries and the oil industry have everything to gain because they face losing much of what they have because of proposed climate change legislation. Instability means maintaining the status quo, thus ensuring their differential accumulation.

We really should not think of capitalists as a monolith. In CasP, there is “dominant capital” and there are all the other capitalists, which themselves should be further divided into groups based on common interests. Currently, I’d argue that dominant capital in the U.S. is finance, but the oil industry was a very important part of that coalition not too long ago and remains very powerful. George Monbiot once suggested that Brexit was caused by a civil war between English capitalists.

Broadly speaking, there are two dominant forms of capitalist enterprise. The first could be described as housetrained capitalism. It seeks an accommodation with the administrative state, and benefits from stability, predictability and the regulations that exclude dirtier and rougher competitors. It can coexist with a tame and feeble form of democracy.

The second could be described as warlord capitalism. This sees all restraints on accumulation – including taxes, regulations and the public ownership of essential services – as illegitimate. Nothing should be allowed to stand in the way of profit-making. Its justifying ideology was formulated by Friedrich Hayek in The Constitution of Liberty and by Ayn Rand in Atlas Shrugged. These books sweep away social complexity and other people’s interests. They fetishise something they call “liberty”, which turns out to mean total freedom for plutocrats, at society’s expense.

-

November 8, 2021 at 1:38 pm #247131

[merged to keep this thread centralized. Original title: “What Does It Mean That Capital Exists as Finance, and Only As Finance?” – jmc]

The full quote is “In fact, in the real world the quantum of capital exists as finance, and only as finance.” Nitzan and Bichler (2009), Capital as Power: A Study of Order and Creorder, p. 7.

I understand the above-quoted statement serves as a rejection of the assertion by mainstream and Marxist economists that capital includes material items such as manufacturing equipment and other so-called “capital assets.” This aspect of the statement is discussed at length in Chapter 5 of the book.

Personally, I also take the quote quite literally to mean that “capital” exists only as tallies in accounting records of financial institutions, and these tallies are indicia of wealth owed to the account holder by the institution that maintains the accounting records (e.g., banks and stock brokerages). Of course, all accounting records record capital transactions, even those of a non-financial business, but as a practical matter all “capital” in developed countries “accumulates” as tallies of accounts held in financial institutions.

My interpretation may be idiosyncratic, but an understanding of the inherent hierarchy of capitalism flows quite easily from it.

Does anybody else understand the statement differently? Was the statement meant to convey other ideas? Am I missing something? Thanks.

–Scot

-

November 8, 2021 at 6:56 pm #247141

Personally, I also take the quote quite literally to mean that “capital” exists only as tallies in accounting records of financial institutions, and these tallies are indicia of wealth owed to the account holder by the institution that maintains the accounting records (e.g., banks and stock brokerages). Of course, all accounting records record capital transactions, even those of a non-financial business, but as a practical matter all “capital” in developed countries “accumulates” as tallies of accounts held in financial institutions.

Scot,

Our claim that “the quantum of capital exists as finance, and only as finance” can be clarified by breaking it into two parts.

(1) Capital is finance. For capitalists, “capital” are record of ownership (stocks, bonds, real-estate claims, etc.) whose quantity is their forward-looking pecuniary capitalization, and forward-looking capitalization is a financial quantum: its magnitude is risk-adjusted expected future earnings discounted by the normal rate of return.

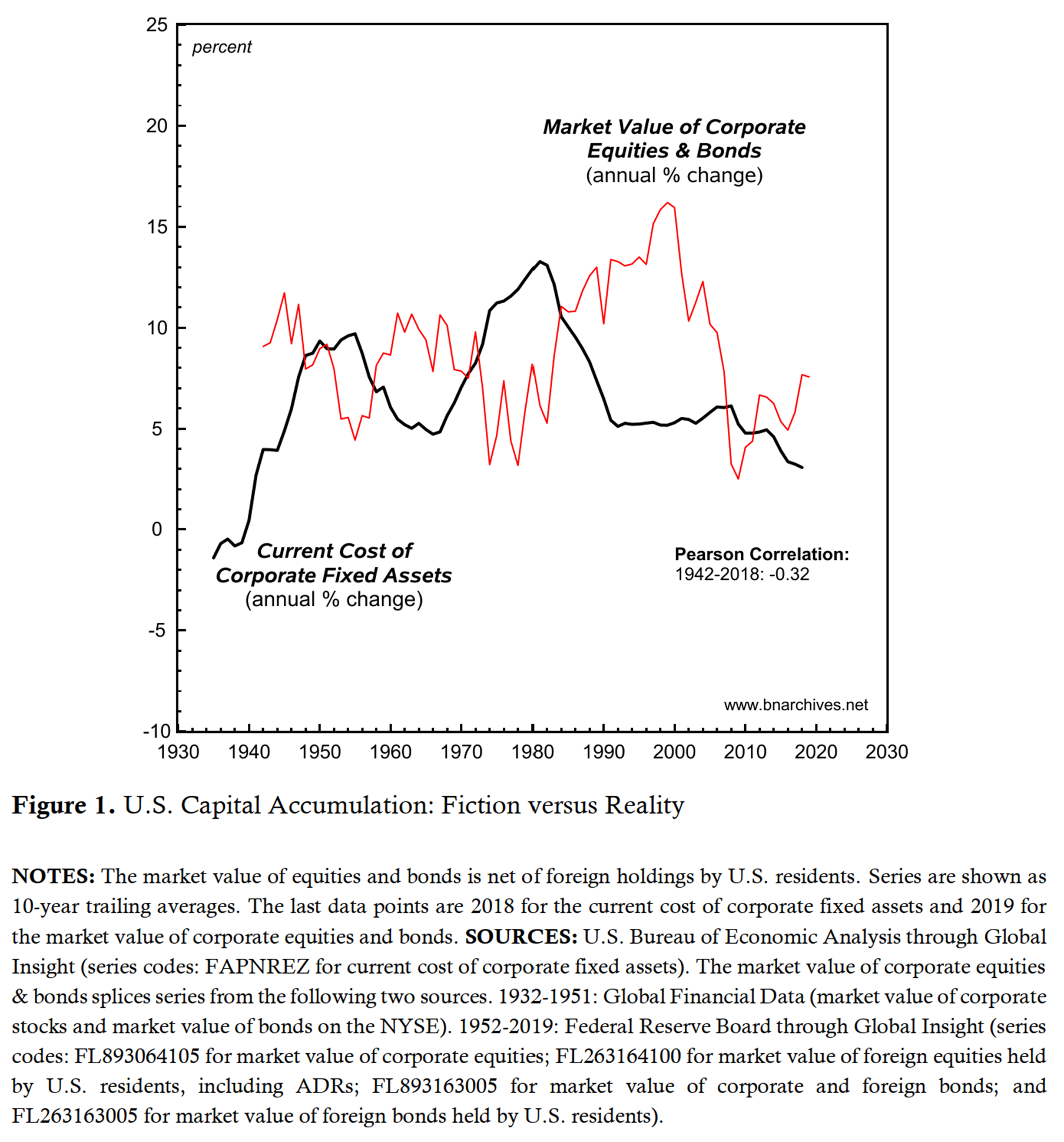

(2) Capital is only finance. The common view that capital=capital goods breaks down because amalgams of heterogeneous capital goods cannot be measured in meaningful ‘real’ units (physical volume, weight, embodied energy, etc., although universal, are not meaningful). Furthermore, even when we measure the money magnitude of capital goods rather than their so-called real magnitude, the movement of this magnitude has little or nothing to do with that of capitalization. In the U.S., the two magnitudes move in opposite directions.

The fact that records of ownership are held by financial institutions is immaterial for these arguments. You could hold them under the mattress and they would still be finance and only finance.

- This reply was modified 4 years, 3 months ago by Jonathan Nitzan.

- This reply was modified 4 years, 3 months ago by Jonathan Nitzan.

- This reply was modified 4 years, 3 months ago by Jonathan Nitzan.

-

-

January 18, 2022 at 9:37 am #247573

The conversation between Scot, Michael and Jonathan has become its own thread, https://capitalaspower.com/casp-forum/topic/casp_finance_only_finance/

- This reply was modified 4 years ago by jmc.

-

-

AuthorReplies

- You must be logged in to reply to this topic.