- This topic has 6 replies, 4 voices, and was last updated November 22, 2020 at 11:46 am by .

-

Topic

-

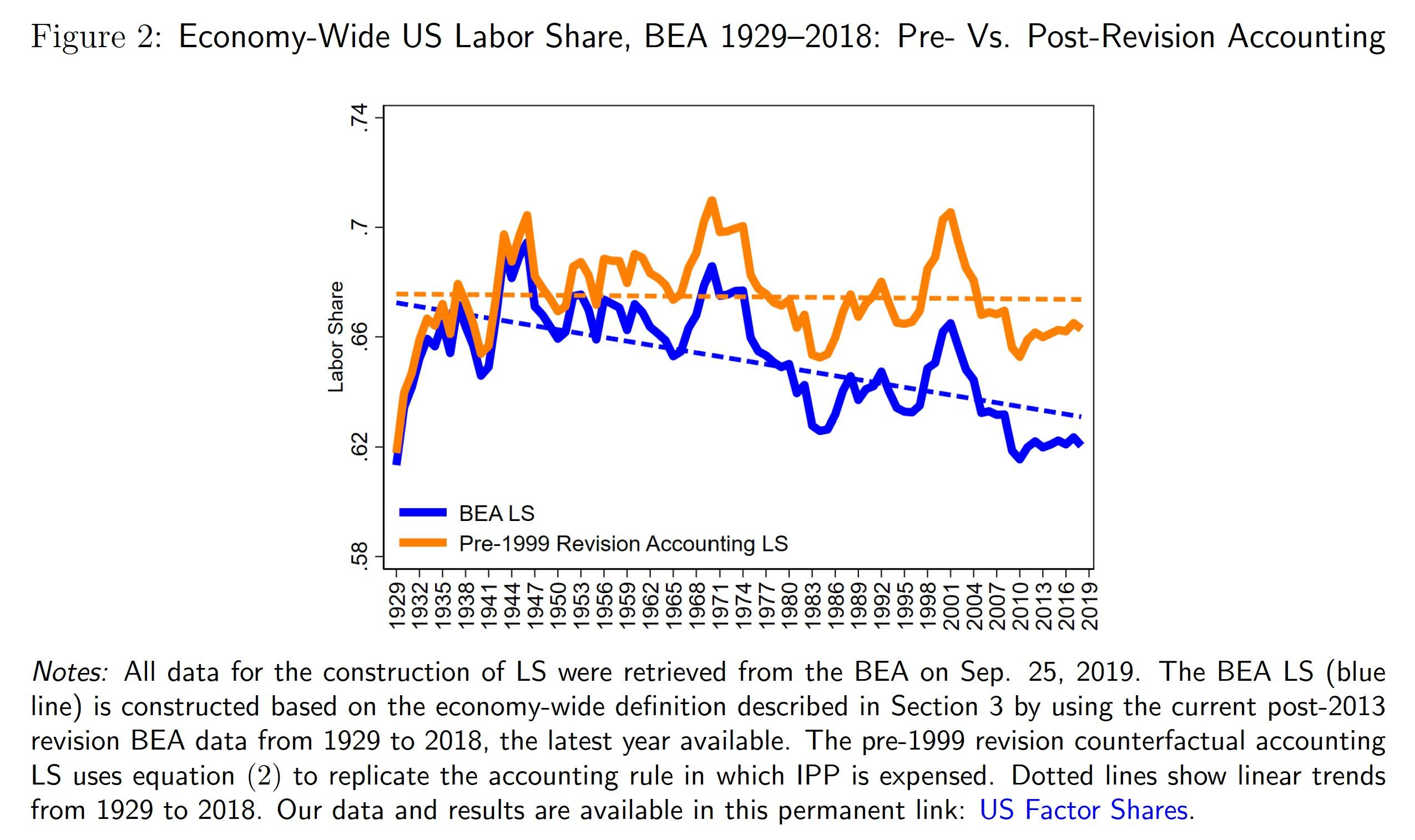

One of the important trends in capitalism, Jonathan Nitzan and Shimshon Bichler observe, is that the capitalist share of income have increased over the last half century. Whether this is the case (or not) may be related to how we define capitalist income.

As many CasP researchers are aware, the national accounts rely on a series of often arbitrary accounting decisions. We rely on these statistics for research, but we also use them at our own peril. The national accounts are very much ‘productivist’, meaning they assume that there are different factors of production that contribute productively to the economy.

Back to capitalist income. I want to point CasP researchers to a recent paper that unpacks how the Bureau of Economic Analysis (BEA) accounts for capitalist income. The paper is called “Labor Share Decline andIntellectual Property Products Capital”. (Hat tip to Yigal for pointing out this paper to me.) Read it here:

https://sites.google.com/site/dongyakoh/IPP_USLS_ECMA_resub.pdf?attredirects=0&d=1

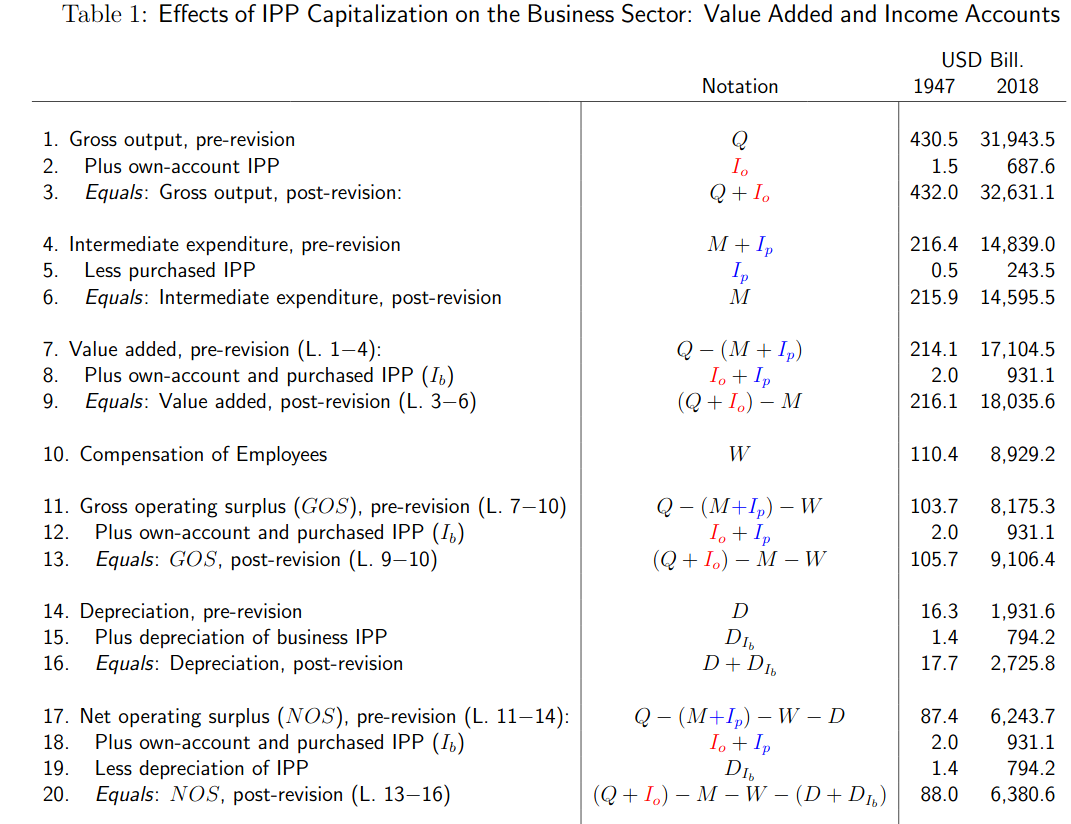

The paper is very much neoclassical, but it identifies an important accounting change. Prior to about 20 years ago, it seems that intellectual property rights expenses were treated as intermediate expense, and were subtracted from value added. Now (if I understand correctly) IPP expenses are added to value added.

Now, as CasP researchers know, intellectual property rights are a hugely important source of capitalist income. So we need to pay attention to the accounting going on.

I haven’t read yet the paper in detail, but it deals with something that is important to CasP. We need to understand the accounting procedures used to create the data we analyze. If we don’t like them, we need to create our own.

I’d be interested to hear your thoughts on this paper.

- You must be logged in to reply to this topic.