- This topic has 4 replies, 2 voices, and was last updated February 21, 2024 at 10:20 pm by .

-

Topic

-

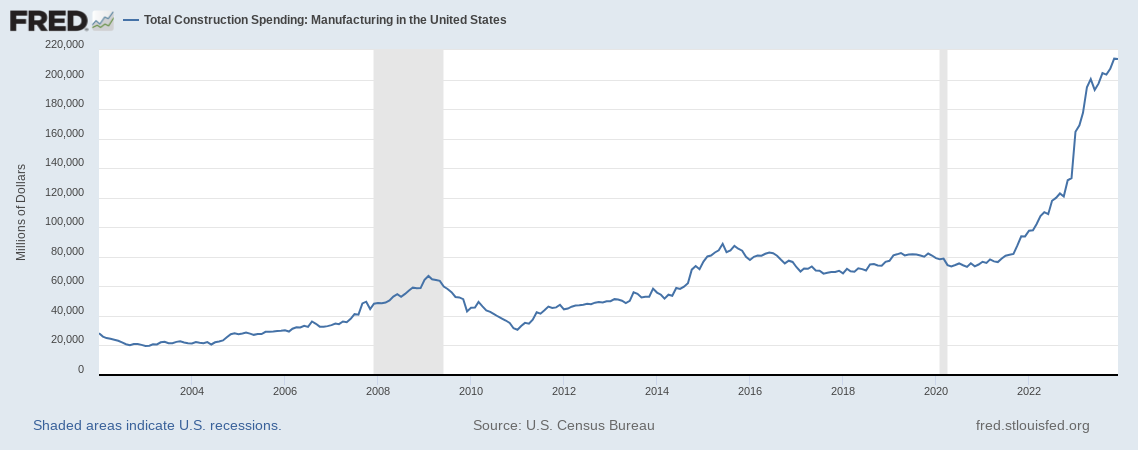

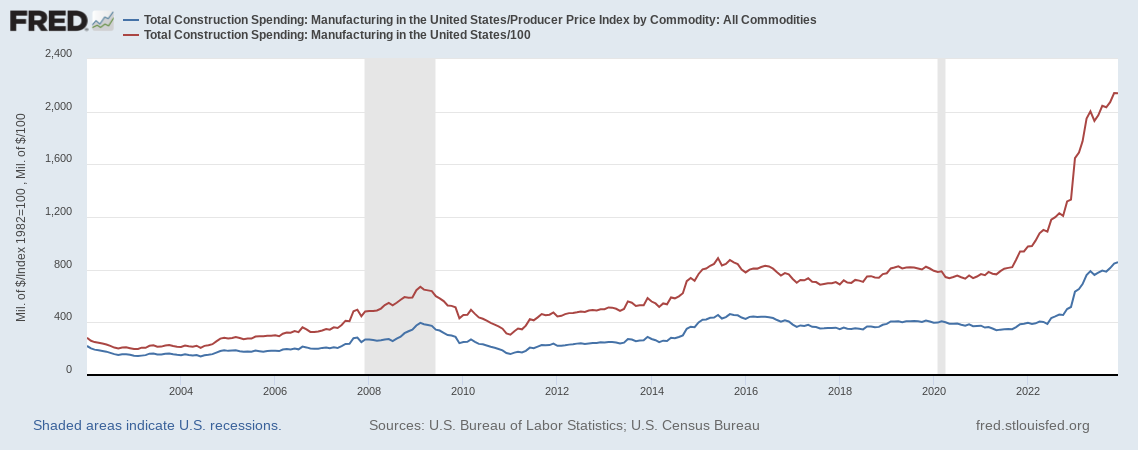

Does it look like the global economy is moving into a new breadth cycle, or at least in some advanced core countries (the UK being an exception) and adjacent periphery partners? CapEx is mostly rising across the board since the pandemic leveled off, and the quantities of the spending are the highest levels seen in a decade. US ‘non-financial’ corporations have spiked capex spending (https://fred.stlouisfed.org/graph/fredgraph.png?g=1g3uz) alongside the entire corporate sector, and globally the 2,000 largest ‘non-financials’ spent $3.7 trillion on capex in 2021. Dominant capital too (S&P 500 as a proxy) is undertaking large capex plans with 9 quarters straight of capex gains so far and are projected to push $900 billion into capex, with capex spending exceeding buyback spending pace (https://www.bloomberg.com/news/articles/2023-08-03/earnings-season-2q-s-p-500-companies-cut-buybacks-capital-spending-rises). CapEx growth also is rising throughout all regions of the world with the strongest growth in Latin America in 2021 (https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/global-corporate-capex-poised-for-biggest-surge-since-2007-s-p-forecasts-65739086). US average employment growth in the business sector as a whole (I don’t have the time-series to calculate the differential rate of employment growth) has been strong even after the rebound from the COVID unemployment spike, with the average growth rate being 3.45% month-over-month between August 2021 (around the time US unemployment ‘normalized’ from the pandemic rise) and today. Contrast that with the 1.63% average over the post-GR ‘secular stagnation’ period (https://fred.stlouisfed.org/series/PAYEMS). Greenfield investment into manufacturing capacity has also spiked in the US to its highest levels in the past 22 years, with construction spending into manufacturing establishments rising to $213 billion in the last month of 2023 (https://fred.stlouisfed.org/series/TLMFGCONS#0). This is in contrast to the time just before the pandemic, where US corporate executives were announcing that they would not be pushing money into capex or M&A, focusing instead on buybacks and dividends (https://www.bloomberg.com/news/articles/2020-02-14/u-s-firms-put-shareholder-payments-top-capex-last-ubs-survey). These trends are projected by leading banks to continue through the next few years, with the “Bank of America estimat [ing] that manufacturing capital expenditure will reach USD 850bn in 2025, up 60% from the 2019 pre pandemic peak of USD 532bn” (https://www.ubs.com/us/en/wealth-management/insights/market-news/article.1592074.html). This is even in the context of the highest interest rates in years as the US Fed tries to take on the capitalist hobby of boosting unemployment to slow industrial pace (‘inflation targeting’) through the credit channel. While these rates are certainly holding back some greenfield investment growth, with some disappointing stories of green energy projects being held back by high rates, commentators and the experts have announced that the US achieved a ‘soft landing’ with Fed high-rate policy not tanking the domestic economy into recession (and usually then the rest of the world).

Maybe the reasons for this wave of external breadth are the new range of industrial policies undertaken by various governments across the globe that open new territory for investment into decarbonization and ‘reshoring’, etc coupled with new corporate confidence in future demand growth. Employment growth and capex have slowed recently, maybe as a result of aggregate profit margins sliding (https://fred.stlouisfed.org/graph/fredgraph.png?g=1g3Wj), which might encourage further slowing of hirings and scrapping capex plans. This breadth cycle (as B&N have predicted) might not last very long, as it might lead to industry becoming ‘inordinately productive’ and capitalized power declining. US historical trends see the profit share of Gross Value Added (GVA) and ‘capital stock’ value relative to GVA move tightly inversely (https://research.chicagobooth.edu/stigler/research/-/media/8ee68ec563aa4c70aa94897ee04f68b6) and if this trend continues, this new boom might fizzle out into depth in the coming years. I wonder what anyone else thinks about these trends and there potential future paths from a CasP perspective?

- You must be logged in to reply to this topic.