- This topic has 6 replies, 2 voices, and was last updated October 26, 2022 at 7:44 pm by .

-

Topic

-

I had a useful Twitter exchange about CasP and conventional ‘capital theory’ with John Michael Colón (JMC), editor at Strange Matters and The Point. Here it is (with minor style modifications to my posts).

JMC:

[…] B&N seem like the most coherent “capital theory” of recent years — but a notion of capital as capitalization & capitalization the product of a power relations makes it by definition nondeterministic & contingent, I think, in ways old capital theories wouldn’t have been. Which is to B&N’s credit, but to the detriment of “capital theory” as a project.

JN:

If we take ‘capital theory’ as a general attempt to understand capital, would you argue that the notion of Capital as Power has undermined capital theory?

JMC:

Well, idk tbh — part of this is splitting hairs about terms, which I hate doing. But as I understand it…

… capital theory as articulated in classical, Marxian, and neoclassical econ was the attempt to outline how the nature or composition or current qualities of capital shape the trajectory of the entire economy (prices, profits, interest rates, etc) in some predictable way.

It’s my understanding that part of the upshot of your focus on power — which I’ve always regarded as analogous to what Veblen, Means, and Lee are talking about when they talk about “administration,” e.g. administered prices — is, the things capital theory would explain as…

…being determined mechanically by the macro-qualities of “capital” at a snapshot in time, are actually themselves contingent products of the actions of different sorts of actors under conditions of uncertainty, and therefore the answer is you can’t model it that particular way

Perhaps that interpretation’s incorrect idk. But it’s telling that, besides using the Cambridge capital debate in your demolition of neoclassicalism, y’all don’t really seem to concern yourselves much with “capital theory” as a framing for any of your big concepts it seems to me.

Rather, the picture I get in my head reading CasP is of various sorts of agent pursuing capitalization by one of any number of strategies, usually in a way that attempts to exert control over / access to the fruits of capitalization rituals initiated by others, with specific…

…decisions about the microeconomic particulars being downstream of the capitalization strategies adopted by the particular agents in control of them at any given moment, and therefore contingent and difficult to predict merely from the “structure of capital” at any given moment

Or not difficult, sorry, impossible. Like it’s just the entirely wrong framing. Perhaps I’m reading my own beliefs drawn from Fred Lee into your work though. Not sure. You’re the writers, what do you think?

JN:

Good thread, thank you. There are several differences between CasP and the two other main theories of capital, chiefly neoclassical and Marxist.

The first difference has to do with what we mean by ‘capital’. Existing theories focus on the so-called capital stock – namely, outstanding physical means of production, knowledge and cash with which capitalist pay workers. [Marxists see capital as a dynamic social relation, but they measure it using the capital stock.]

By contrast, CasP sees capital as risk-adjusted expected future earnings discounted to present value.

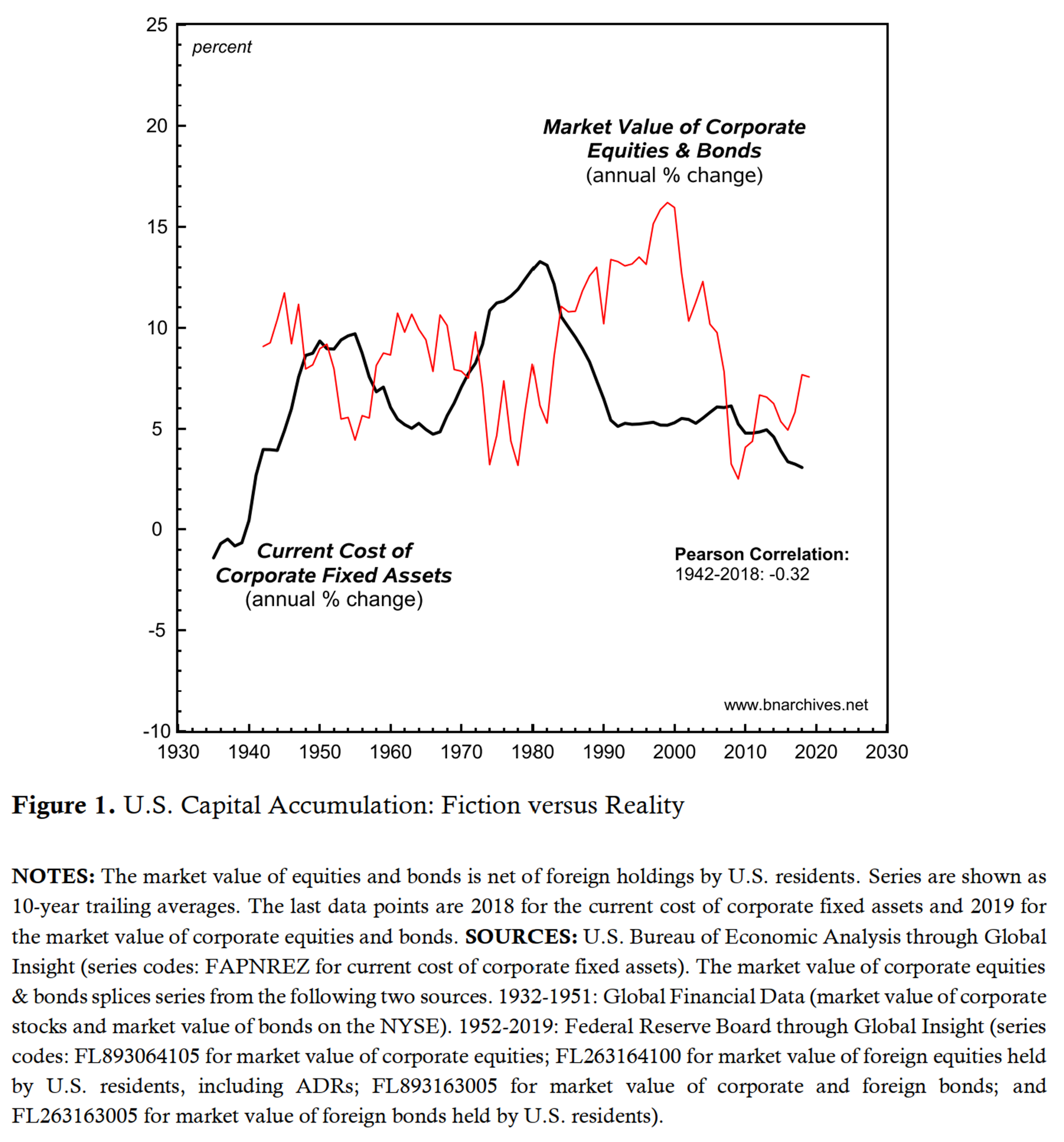

These are very different entities. The former is economic/productive/backward-looking, the latter financial/symbolic/forward-looking. And, not surprisingly, they oscillate inversely (https://bnarchives.yorku.ca/640/).

The inverse relationship between the conventional and CasP views of capital forces us to make a choice: either we stick with the economic/productive/backward-looking view and ignore capitalization, or we ignore the economic/productive/backward view and theorize capitalization.

The reason why CasP focuses on capitalization is twofold. First, the traditional view claims to but in fact cannot measure the so-called ‘real’ magnitude of capital. Second, capitalists are driven not by economic/productive/backward-looking capital, but by capitalization.

And since the two measures (expressed in nominal terms, because the ‘real’ magnitude of capital is impossible to measure) oscillate inversely, we feel our focus is correct and the economists’ isn’t.

And that’s just for starters. Whereas economics is concerned with absolute measures, we focus on differential ones: capitalists, we argue, try not to maximize profit but to ‘beat the average’. So again, our concept and analysis are another level removed from those of economists.

For example, in our work, we show the relationship between Middle East Energy Conflicts and the differential rates of return of the leading oil companies. This relationship does NOT hold for absolute rates of return (https://bnarchives.yorku.ca/432/).

And there is more. Not only do we focus on capitalization rather than the ‘capital stock’, and on differential rather than absolute magnitudes, but our explanations are anchored in power, not production. So CasP theory is three level removed from that of standard ‘capital theory’.

In other words, CasP theorizes capital, but it isn’t the same capital that economists talk about. The validity and robustness of our results are open to debate — but unlike in economics, this debate does not depend on fictitious quanta.

- You must be logged in to reply to this topic.