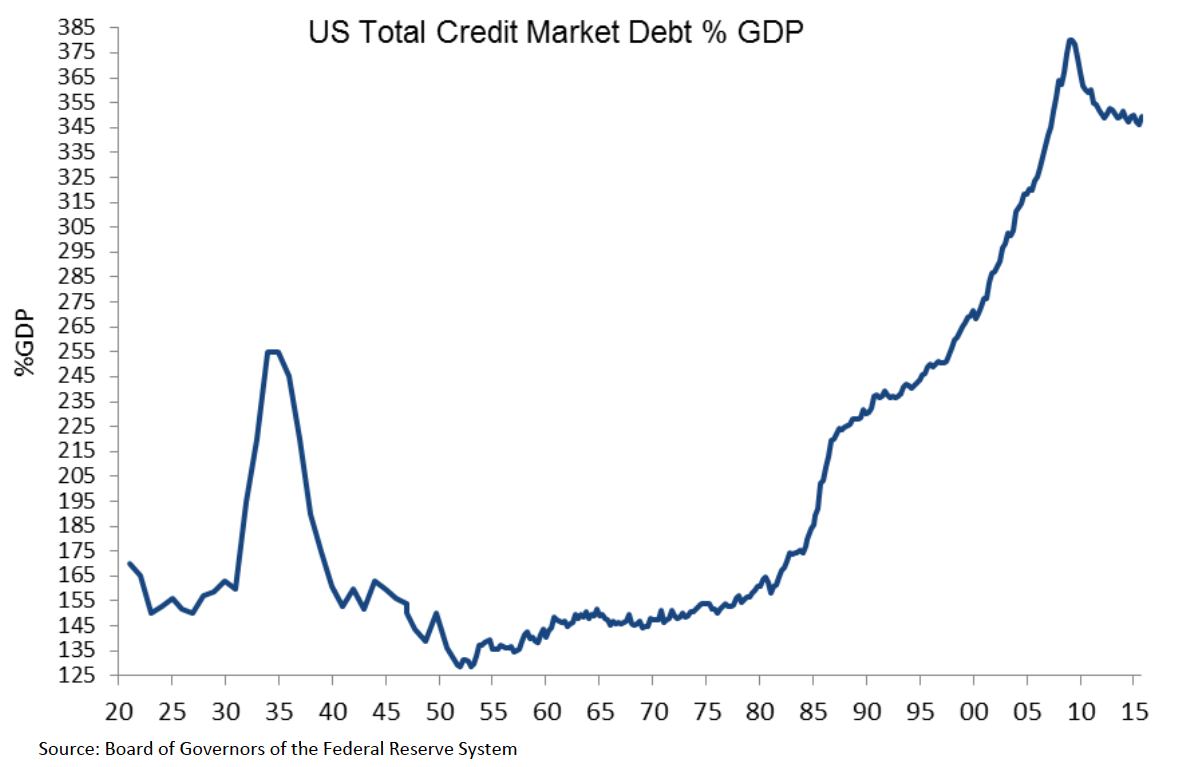

Nice chart. Here is my simplistic guess at what has happened since the 80s.

They became correlated because they both became driven by the same underlying ‘credit/leverage driven accumulation mechanism’ which took over in the 80s. The growth of credit – simply put, Wall Street was unleashed and found ‘innovative’ ways of creating new claims on things (for which there was great demand). And accommodative policy – the Fed (knowingly or unknowingly) did their best to make sure these claims were ‘made whole’, through ensuring access to liquidity. The losses are ‘deferred’, but it more seems like they are actually transferred – as they manifest in increasing inequality. The 0.01% are those who are able to accumulate the most claims while times are good, and make sure those claims are made whole.

As for OPs original question. This quote comes to mind:

“I guess the trouble was that we didn’t have any self-admitted proletarians. Everyone was a temporarily embarrassed capitalist.’ – America & Americans, 1966

Commonly quoted as:

“Socialism never took root in America because the poor see themselves not as an exploited proletariat, but as temporarily embarrassed millionaires.”