Big money, nuclear subsidies, and systemic corruption

February 12, 2021

By Cassandra Jeffery1 and M. V. Ramana2

The “largest bribery, money-laundering scheme ever perpetrated against the people and the state of Ohio” came to light during an unexpected press conference in July 2020 in Columbus. Speaking haltingly and carefully, US Attorney for the Southern District of Ohio David DeVillers announced “the arrest of Larry Householder, Speaker of the House of the state of Ohio and four other defendants for racketeering. The conspiracy was to pass and maintain a $1.5 billion bailout in return for $61 million in dark money.”

Unravelling an intricate web of alleged illegal activities used to launder money, DeVillers broke down the complicated modus operandi of “Company A.” With a gentle smile on his face, he said, “everyone in this room knows who Company A is, but I will not be mentioning the name of Company A because of our regulations and rules. They have not, and no one from that company has as of yet, been charged”.

Company A is FirstEnergy Solutions, a fact most Ohians had been aware of long before the July 2020 press conference. FirstEnergy, now called Energy Harbour, is one of Ohio’s largest utility corporations. For years, the firm lobbied to get a subsidy to continue operating its unprofitable nuclear plants and maintain its revenue flow. When lobbying efforts failed to produce subsidies, it resorted to bribery to gain legislative support for House Bill 6, 2019 legislation that forces state consumers to pay into something called “the Ohio Clean Air Fund.” The green language is a smoke screen for the real purpose: to siphon nearly $150 million annually to FirstEnergy to keep its Perry and Davis-Besse nuclear power plants and two coal-fired power plants operating, while simultaneously gutting Ohio’s renewable energy standards. Also gone were the state’s energy efficiency programs, which had saved consumers and corporations millions of dollars. When citizens tried to organize a referendum to repeal the bill, FirstEnergy indulged in various dirty tactics to thwart this democratic opposition.

Ohio is not alone in its nuclear energy corruption. Also in July 2020, Commonwealth Edison (ComEd), a subsidiary of Exelon, was charged with bribery to “Public Official A” in Illinois. Though not named, the filing makes it clear that “Public Official A” is Illinois House Speaker Michael Madigan, who has denied wrongdoing. ComEd has agreed to pay a $200 million fine to resolve this case. Exelon also finds itself at the centre of another ongoing investigation by the United States Securities and Exchange Commission. The focus of the investigation is reportedly Anne Pramaggiore, a former Exelon CEO who stepped down from the company and from his post chair of the Federal Reserve Bank of Chicago. As in Ohio, the corruption charges relate to lobbying for state subsidies and special treatment of nuclear power plants.

Three other states—New Jersey, Connecticut, and New York—have implemented similar subsidies (although, to date, no allegations of wrongdoing related to them have been made public). Changes in the economics of electricity markets are threatening the profitability of nuclear power plants, a shifting reality driving a demand for these financial bailouts. As the New Jersey-based energy company Public Service Enterprise Group (PSEG) explained in October 2020, across the nation “nuclear plants continue to struggle economically to survive. Since 2018, three nuclear plants have closed in the eastern US, all for economic reasons, and the impact has had a ripple effect.”

Changing economics of electricity generation. These “economic reasons” have to do with an ongoing massive transformation of the energy sector. Over the last decade, the cost of renewables like solar and wind have dropped substantially; these renewables can generate electricity at much lower costs than fossil fuels and, especially, nuclear power. In the United States, unsubsidized wind power costs fell by 71 percent between 2009 and 2020, whereas unsubsidized utility scale solar energy costs declined by 90 percent during the same period. Nuclear energy costs increased by 33 percent between 2009 and 2020. The International Energy Agency has dubbed solar energy “the new king of electricity” and foresees it dominating future deployment in the electricity sector for decades.

The major beneficiaries of the subsidies for nuclear plants are large corporations: PSEG in New Jersey and Dominion in Connecticut, besides Exelon and FirstEnergy. These, and other electrical utility companies in the United States, have historically invested primarily in nuclear reactors and fossil fuel plants. Thanks to the changing economics of electricity, these companies are finding it harder to maintain their profits while operating the older power plants that are now more expensive as sources of electricity.

These companies and various associated organizations have engaged in extensive lobbying and large-scale propaganda campaigns to get governments pass legislation that makes consumers pay more for the electricity they use. In that sense, what has resulted would be better described as corporate welfare than as subsidies. The subsidies have improved these companies’ financial situation, which in turn contributes to their clout in state and national policy making and their ability to fund advocacy efforts—and even to pay politicians tidy sums of money. The larger significance of the political power these large utilities have amassed is their ability to block transition to a fully renewable and more environmentally sustainable energy system.

Financial subsidies. Subsidies take different forms in different states. In New York and Illinois, utility companies are required to purchase a specific amount of zero-emission credits from authorized nuclear generating stations, all of which are owned and operated by Exelon Corporation. Purchasing contracts in both states will be in effect for 10 to 12 years, and utility companies are mandated to tack on the cost to consumer bills. Over in New Jersey, “each electric public utility” is required to purchase “Nuclear Diversity Certificates” from nuclear power plants, with consumers paying for these programs through higher utility bills.

The deal that Dominion Energy struck in Connecticut was different, taking the form of a contract that requires the state’s two electric distribution utilities to purchase about 50 percent of the electricity output of Dominion’s Millstone nuclear generating plant for 10 years. Millstone houses two operational nuclear reactors. In all of these cases, the annual financial benefits to these large corporations run in to the hundreds of millions of dollars.

The modus operandi was developed by multiple stakeholders and publicly released in 2016 in the form of a toolkit by the American Nuclear Society (ANS). Produced by a special committee consisting of senior nuclear officials, the toolkit outlined “a variety of policy pathways to support the current nuclear fleet and prevent early retirement.” The states mentioned above have implemented polices that incorporate one or more of the strategies outlined in the ANS toolkit, including amalgamations of low-carbon portfolio standards and mandated purchase of nuclear energy. The toolkit even went so far as to suggest that state government entities could acquire nuclear power plants or suspend collecting taxes, but these suggestions have not been implemented so far.

Building political support. While the American Nuclear Society led the policy-development charge, the Nuclear Energy Institute (NEI)—the nuclear industry’s lobbying arm—reinforced the advocacy message on the ground. The NEI’s 2017 report outlined specific plans and efforts instituted around the same time as many of these nuclear bailouts were pushed through state legislatures. Substantial resources were funnelled toward lobbying efforts aimed at key political and public actors. NEI’s deliberate intention, as outlined in the 2017 report, was to build political support to “avoid placing additional financial burden on US nuclear plants.”

Large-scale media dissemination, educational campaigns, relationship-building with regulatory bodies, think tanks, and policy institutions, and direct political lobbying are some of the tactics outlined in the report. Not all of the tactics aimed at subsidies; some were aimed at lowering expenses for nuclear companies by finding ways to lessen their environmental obligations. For example, the NEI managed to terminate annual fees charged to nuclear generating plants for hazardous material cleanup, which made taxpayers liable for these costs. The NEI took full credit for this shift: “After targeting the House and Senate Appropriations Committees, NEI successfully prevented reimplementation of a $200 million annual fee placed on the industry.”

The NEI also tried to influence the appointment of officials to oversight bodies, including the Nuclear Regulatory Commission (NRC), declaring that it “shared names of potential candidates with the Trump administration and worked with member companies to urge Congress to communicate with the White House the need to nominate and confirm commissioners.” The NRC is the agency tasked with overseeing safety, and in 2017, the NEI proudly announced that it had “worked with the House Appropriations Committee to again reduce the NRC’s budget.”

The institute took credit for engaging “across the Ohio state government to support enactment of zero-emission nuclear credit legislation,” for convening “meetings with the governor’s staff on the value of nuclear energy,” and for testifying “at legislative hearings on the issue.” Not surprisingly, NEI’s efforts were supported by large cash payments allegedly provided by FirstEnergy.

The power game. Many energy companies are actively involved in local or state-level lobbying. In recent years, Illinois has been a site of intense lobbying by Exelon and its subsidiary, Commonwealth Edison (ComEd), primarily to get more and more subsidies from the state. “At least two dozen former Illinois state lawmakers have lobbied on behalf of ComEd or Exelon since 2000,” according to Illinois Policy, an independent public policy organization. Exelon’s hold on Illinois decision-making has been characterized by David Kraft of the Nuclear Energy Information Service as “nuclear blackmail,” a result of politics that “forced environmentalists wanting to see new legislation pass that would expand renewables, into a reluctant and grudging alliance with Exelon, but on Exelon’s terms.”

The process works as follows. Every so often, Exelon or ComEd would declare that one or more of their nuclear plants are no longer profitable and threaten to shut the plants down within a year. The threats have tended to be successful; lobbyists can argue, with some truth on their side, that a shutdown will lead to job losses and a cut in tax revenue, also leaving Illinois with an energy shortage that may increase reliance on carbon-based sources.

The same strategy was used successfully in New York, Connecticut, and New Jersey, where state officials described the process in colorful terms like “highway robbery” and “ransom.” The nuclear sector has extensively resorted to this kind of power politics, even using it in regard to nuclear plants that eventually shut down, such as the Vermont Yankee Nuclear Power Station.

Money begets money. The effects of enacting laws that favor nuclear energy firms are clear from the financial status of these corporations. Exelon share prices increased from $34.63 on April 1, 2017 to a high of $50.95 exactly two years later, while Dominion’s stock price grew from $64.19 on May 1, 2018 to $83.70, as of November 6, 2020. Similar increases have been recorded by FirstEnergy and PSEG.

Apart from stock owners, the other major beneficiaries from the utility business are, of course, executives in these companies. CEOs like Dominion’s Thomas Farrell and Exelon’s Christopher Crane are among the highest paid executives in the electrical generation and utility industry.

But the long-term impact of legislation that favors nuclear energy firms involves the great economic and political power that these large utilities possess. To better understand the basis of the economic power of these corporations, we analyzed financial data from electric utilities listed on the New York Stock Exchange (NYSE) between 1970 and 2019 on the standard Compustat database.

The first trend that is evident is one of increasing market concentration. From the 1970s through to the mid-1990s, there were roughly 80 to 85 companies listed in this sector on the NYSE. By 2000, that number had dropped to 56. The reason was a series of mergers and acquisitions through which large companies absorbed smaller companies. For example, Commonweath Edison became part of Unicom in 1994. Unicom and the Philadelphia Electric Company merged in 2000 to form Exelon. Similar mergers and acquisitions have continued, and by 2019 there were only 36 utility companies operating in the United States.

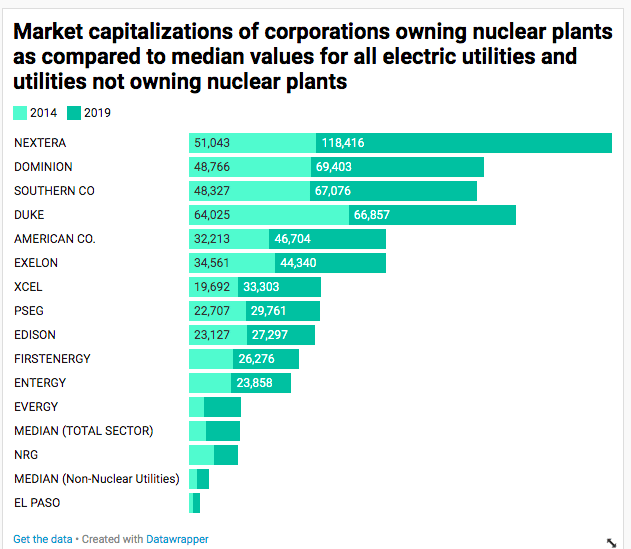

Measured through their market capitalization values, these 36 corporations are not equal. By and large, the corporations with the largest market cap values are the ones that own nuclear plants. Exelon is a good example, owning 17 of the 94 nuclear units that are operating in the United States as of November 2020. In 2019, Exelon’s average market capitalization was $44.3 billion. But Exelon is by no means the largest utility. Nextera Energy ($118 billion), Dominion ($69 billion), Duke ($67 billion), and American Electric ($47 billion) dominate the industry in terms of market capitalization. All of these five companies had a higher market capitalization in 2019 than the largest utility that did not own nuclear plants: Sempra Energy ($44.1 bn).

Over the last six years, when there have been no mergers or acquisitions among these companies, 11 out of the 14 companies that own nuclear assets have consistently held market capitalization values well above the median (based on 36 companies in all). Two of the remaining three hover near the median value, sometimes higher, sometimes lower. (The one remaining utility, El Paso, was recently bought out by JP Morgan, and will no longer be a publicly traded company.) On the whole, companies with nuclear plants have recorded larger market capitalization values than the median of 22 utilities that don’t own nuclear assets.

The legislative means used to take money away from electricity consumers and bail out economically failing nuclear plants owned by these large corporations helps further their market power, as illustrated by Dominion’s value rising from $49.5 billion in 2018 to $69.4 billion in 2019. While it is well known that wealthy corporations have a lot of political power, it seems from these examples that the converse might also be true: The political power enjoyed by these large corporations is at the root of their economic power. Indeed, as political economists Jonathan Nitzan and Shimshon Bichler have argued at length, the standard economic concept of capital symbolizes “organized power writ large,” challenging the conventional division between politics and economics. The various bills passed in state legislatures offer a political assurance to investors that revenues for these utilities are assured for the foreseeable future, which naturally translates into higher stock prices and market capitalizations.

Material interests and policy interests. The most common argument used by these companies and those who support nuclear subsidies is the need to fight climate change. There are two problems with this argument. First, it is based on the false idea that nuclear power, if shut down, will necessarily be replaced by fossil fuel plants. A June 2016 decision by Pacific Gas and Electric (PG&E) demonstrates the invalidity of this assumption. PG&E will close the last two nuclear power plants in California (the Diablo Canyon units) by 2024 and 2025, replacing the lost electrical capacity “with a cost-effective, greenhouse gas free portfolio of energy efficiency, renewables and energy storage.” This move to renewables is more cost-effective today than it was in 2016 because of declining costs of renewables and energy storage. As Matthew McKinzie of the Natural Resources Defense Council argued at that time, the decision “shows that given sufficient time to prepare, retiring nuclear capacity can transition smoothly to a mix of energy efficiency measures; clean, renewable resources; and energy storage without any role for fossil fuels – an outcome that can be optimal for the environment, the market, and the reliability of the electric grid.” At a larger scale, Germany has shown that it is possible to retire nuclear plants and reduce emissions at the same time.

The second problem is the assumption that corporations owning nuclear plants are primarily interested in rapidly reducing emissions. Many utilities have large fossil fuel investments— investments that suggest a shutdown won’t be happening anytime soon. This suggestion seems especially true with natural gas plants. Although utilities often describe natural gas as clean (for example, Exelon describes its fleet as powered by “clean burning natural gas”), the climate implications of continued natural gas use are substantial. Exelon, the company with the most nuclear plants in the country, also owns and operates, along with its subsidiaries, 11 oil-fired power plants, five dual-fuel (natural gas and oil-powered) power stations, and 10 natural gas-based power plants throughout North America. In addition to its four nuclear power plants, Dominion owns 17 power plants fueled by natural gas and 14 power plants fueled by coal or oil. The company’s estimate of carbon dioxide emissions from its power plants is around 40 million metric tons in 2018, roughly the same level as in 2012. Likewise, PSEG owns just two nuclear power plants, but the company owns or has a stake in 10 fossil fuel generating plants with one more natural gas powered plant under construction.

With such large stakes in fossil fuel-based power plants, it is clear that these utilities are not about to switch immediately to renewables—or even to nuclear power—and give up on years and years of future profits that they and their shareholders are hoping for. In all of the states that offered nuclear subsidies, and elsewhere, the utilities have tried to hold back the deployment of renewables in more or less obvious ways. US utilities are not alone. Studies show that electric utilities around the world have “hindered the transition of the global electricity sector towards renewables, which has to date mostly relied on non-utility actors (such as independent power producers) for expanding the use of renewables.”

Rather than adapting to the necessity of building up renewables, these utilities resort to tactics that have been used in the past to justify nuclear power plant construction. As former Nuclear Regulatory Commission member Peter Bradford listed at the beginning of the so-called nuclear renaissance, these include “subsidy, tax breaks, licensing shortcuts, guaranteed purchases with risks borne by customers, political muscle, ballyhoo, and pointing to other countries (once the Soviet Union, now China) to indicate that the US is ‘falling behind.’”

Dealing with corruption, legal and illegal. The crimes that people like Larry Householder and Michael Madigan are accused of committing are shameful; they are, however, just examples of the apparent systemic corruption that seems to permeate the nuclear industry.

While the actions taken against these individuals have captured headlines, the picture painted in the media still misses the mark on less egregious, everyday forms of political action. Lobbying by deep-pocketed industries and other efforts to capture regulators are pernicious but often go unremarked, in part because under the rules that govern politics in the United States, such actions are often legal. Addressing these problems with the urgency they require will necessarily involve confronting the economic and political system that privileges profits and capital over people and the environment.

[Reposted from the Bulletin of the Atom Scientists]

-

Cassandra Jeffery holds a Master’s degree in Public Policy and Global Affairs from the University of British Columbia and is the recipient of a Simons Award in Nuclear Disarmament and Global Security for research into the political economy of nuclear energy.↩

-

M.V. Ramana is the Simons Chair in Disarmament, Global and Human Security and Director of the Liu Institute for Global Issues at the School of Public Policy and Global Affairs, University of British Columbia. He is the author of The Power of Promise: Examining Nuclear Energy in India (Penguin Books, 2012) and is a former member of the Bulletin’s Science and Security Board. Ramana is a member of the International Panel on Fissile Materials, the Canadian Pugwash Group, the International Nuclear Risk Assessment Group, and the team that produces the annual World Nuclear Industry Status Report. He is the recipient of a Guggenheim Fellowship and a Leo Szilard Award from the American Physical Society.↩