By Cassandra Jeffery1 and M. V. Ramana2 The “largest bribery, money-laundering scheme ever perpetrated against the people and the state of Ohio” came to light during an unexpected press conference in July 2020 in Columbus. Speaking haltingly and carefully, US Attorney for the Southern District of Ohio David DeVillers announced “the arrest of Larry Householder, […]

Continue Reading2021/02: Fix, ‘Living the good life in a non-growth world: Investigating the role of hierarchy’

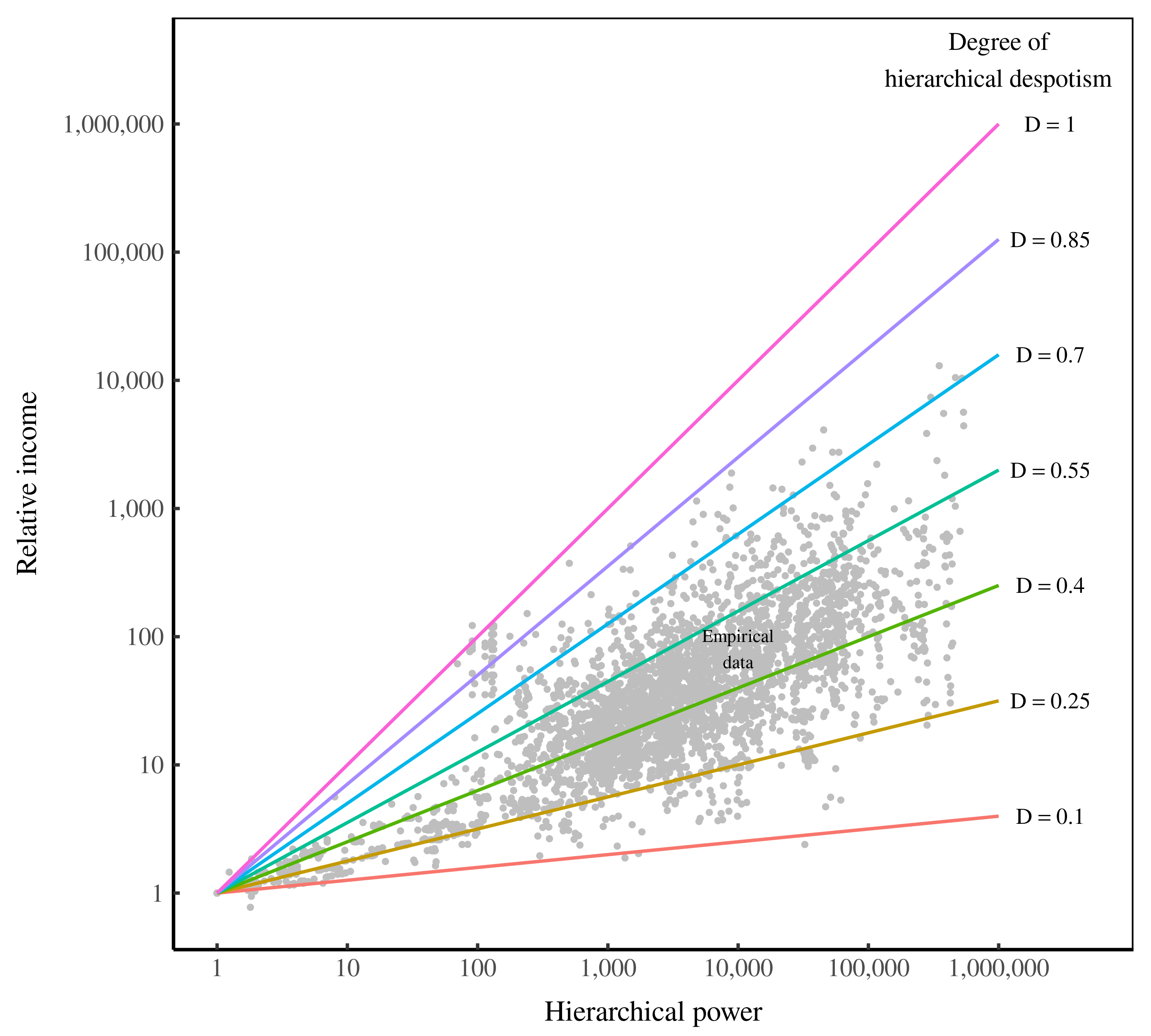

Abstract Humanity’s most pressing need is to learn how to live within our planet’s boundaries — something that likely means doing without economic growth. How, then, can we create a non-growth society that is both just and equitable? I attempt to address this question by looking at an aspect of sustainability (and equity) that is […]

Continue Reading2021/01: Mouré, ‘Soft-wars: The Differential Trajectories of Google and Microsoft – a Capital as Power Analysis’

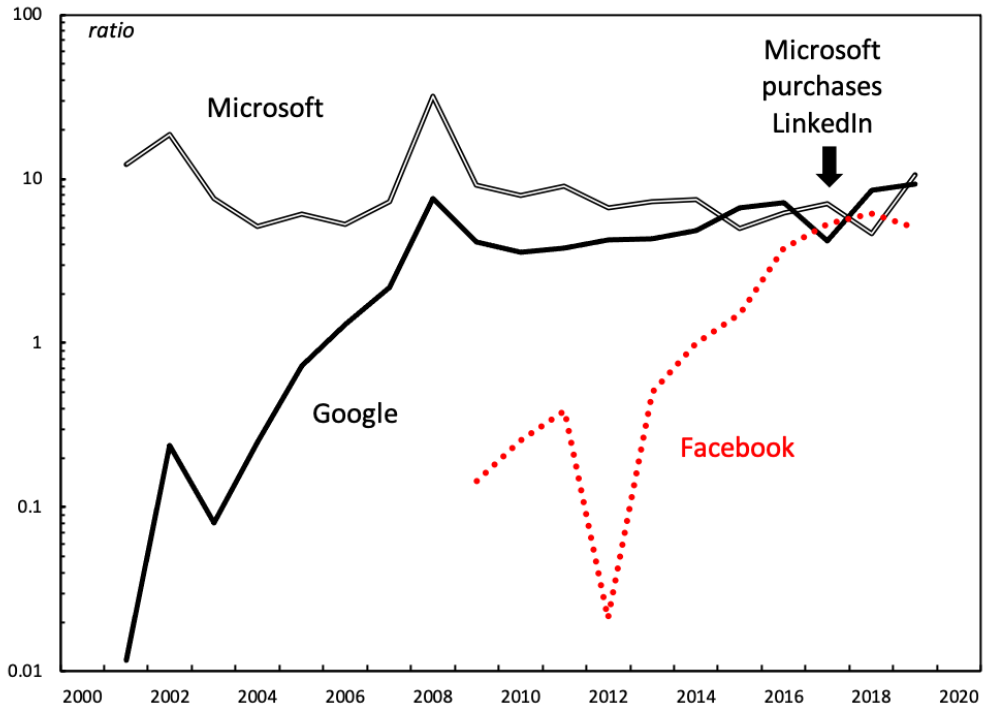

Abstract According to the capital as power framework, pecuniary earnings, or profits, are a symbolic representation of the struggle for power between different capitalist groups. In this struggle, capitalists measure their own power differentially – that is, relative to other capitalist entities. The focus on differential power, expressed in differential earnings, leads firms to try […]

Continue ReadingLucas, ‘Risking the earth, parts 1 and 2’

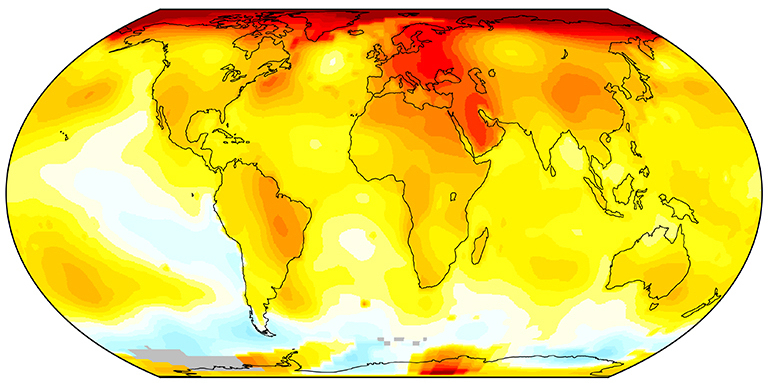

Abstract This two-part paper details the arguments and evidence that have been marshalled by both climate scientists and social scientists to critique the current procedures and methodologies deployed by the Intergovernmental Panel on Climate Change (IPCC) and the United Nations Framework Convention on Climate Change (UNFCCC) to represent the risks of anthropogenic forcing and a […]

Continue ReadingBaines & Hager, ‘Commodity Traders in a Storm: Financialization, Corporate Power and Ecological Crisis’

Abstract Commodity trading firms occupy a central position in global supply chains and their activities have been associated with financial instability, social upheaval and manifold forms of ecological devastation. This paper examines these companies in the context of debates regarding corporate financialization. We find that since the 2003–2011 commodity boom, trading firms have become less […]

Continue ReadingGameStop Capitalism: Wall Street vs. The Reddit Rally (Part 1)

Tim Di Muzio1 PDF version available here The phrase, ‘there’s a sucker born every minute’ is typically attributed to the American showman, P.T. Barnum and was made infamous since the mid-19th century by gamblers, hucksters and confidence artists (con men). On Wall Street, the ‘sucker’ is supposed to be the ‘dumb money’ retail traders who […]

Continue ReadingEconomic Growth Theory … Bah Humbug!

Originally published on Economics from the Top Down Blair Fix I’ve written a lot on this blog about the absurdity of marginal productivity theory. But I haven’t said much about the other pillar of mainstream economics: neoclassical growth theory. Today I’ll break that silence. Neoclassical growth theory is a textbook example of Murphy’s law. Everything […]

Continue Reading