Abstract Capitalizing a Cure takes readers into the struggle over a medical breakthrough to investigate the power of finance over business, biomedicine, and public health. When curative treatments for hepatitis C launched in 2013, sticker shock over their prices intensified the global debate over access to new medicines. Weaving historical research with insights from political […]

Continue ReadingDi Muzio, ‘Capitalism, Money and Inequality in the World’

Abstract There is little doubt that, in the last hundred years or so, progress has been made in lifting more people out of extreme poverty. Yet, considerable economic inequalities both within and between nations persists and, as recent work has shown, if the rate of return on capital surpasses the rate of growth, inherited wealth […]

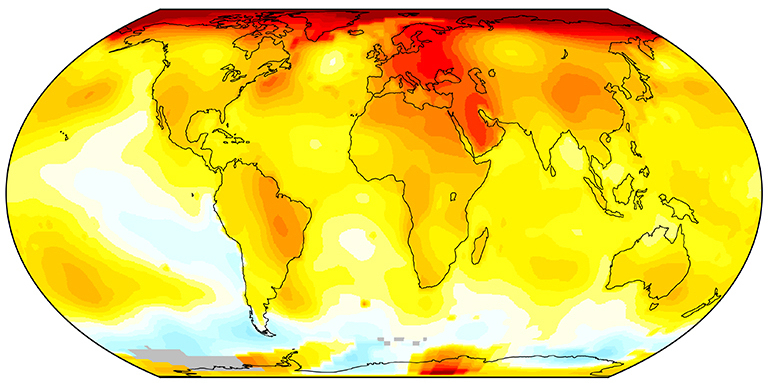

Continue ReadingBaines & Hager, ‘From Passive Owners to Planet Savers? Asset Managers, Carbon Majors and the Limits of Sustainable Finance’

Abstract This article examines the role of the Big Three asset management firms — BlackRock, Vanguard and State Street — in corporate environmental governance. Specifically, it charts the Big Three’s relationships with the public–owned Carbon Majors: a small group of fossil fuels, cement and mining companies responsible for the bulk of industrial greenhouse gas emissions. […]

Continue ReadingHoward et al., ‘Protein Industry Convergence and Its Implications for Resilient and Equitable Food Systems’

Abstract Recent years have seen the convergence of industries that focus on higher protein foods, such as meat processing firms expanding into plant-based substitutes and/or cellular meat production, and fisheries firms expanding into aquaculture. A driving force behind these changes is dominant firms seeking to increase their power relative to close competitors, including by extending […]

Continue ReadingBichler & Nitzan, ‘Unbridgeable: why political economists cannot accept capital as power’

Abstract The theory of capital as power (CasP) is radically different from conventional political economy. In the conventional view, mainstream as well as heterodox, capital is seen a ‘real’ economic entity engaged in the production of goods and services, and capitalism is thought of as a mode of production and consumption. Finance in this approach […]

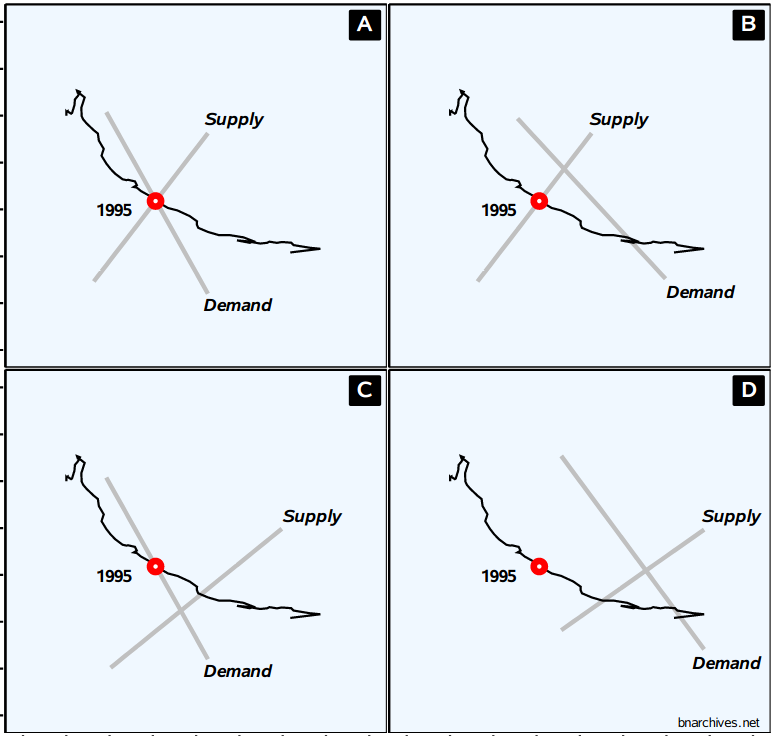

Continue Reading2021/03: Bichler and Nitzan, ‘The 1-2-3 Toolbox of Mainstream Economics: Promising Everything, Delivering Nothing’

Abstract We write this essay for both lay readers and scientists, though mainstream economists are welcome to enjoy it too. Our subject is the basic toolbox of mainstream economics. The most important tools in this box are demand, supply and equilibrium. All mainstream economists – as well as many heterodox ones – use these tools, […]

Continue ReadingLucas, ‘Risking the earth, parts 1 and 2’

Abstract This two-part paper details the arguments and evidence that have been marshalled by both climate scientists and social scientists to critique the current procedures and methodologies deployed by the Intergovernmental Panel on Climate Change (IPCC) and the United Nations Framework Convention on Climate Change (UNFCCC) to represent the risks of anthropogenic forcing and a […]

Continue ReadingBaines & Hager, ‘Commodity Traders in a Storm: Financialization, Corporate Power and Ecological Crisis’

Abstract Commodity trading firms occupy a central position in global supply chains and their activities have been associated with financial instability, social upheaval and manifold forms of ecological devastation. This paper examines these companies in the context of debates regarding corporate financialization. We find that since the 2003–2011 commodity boom, trading firms have become less […]

Continue ReadingMcMahon, ‘Selling Hollywood to China’

Abstract From the 1980s to the present, Hollywood’s major distributors have been able to redistribute U.S. theatrical attendance to the advantage of their biggest blockbusters and franchises. At the global scale and during the same period, Hollywood has been leveraging U.S. foreign power to break ground in countries that have historically protected and supported their […]

Continue ReadingBaines & Hager, ‘The Great Debt Divergence and its Implications for the Covid-19 Crisis: Mapping Corporate Leverage as Power’

Abstract The COVID-19 pandemic has amplified longstanding concerns about mounting levels of corporate debt in the United States. This article places the current conjuncture in its historical context, analysing corporate indebtedness against the backdrop of increasing corporate concentration. Theorising leverage as a form of power, we find that the leverage of large non-financial firms increased […]

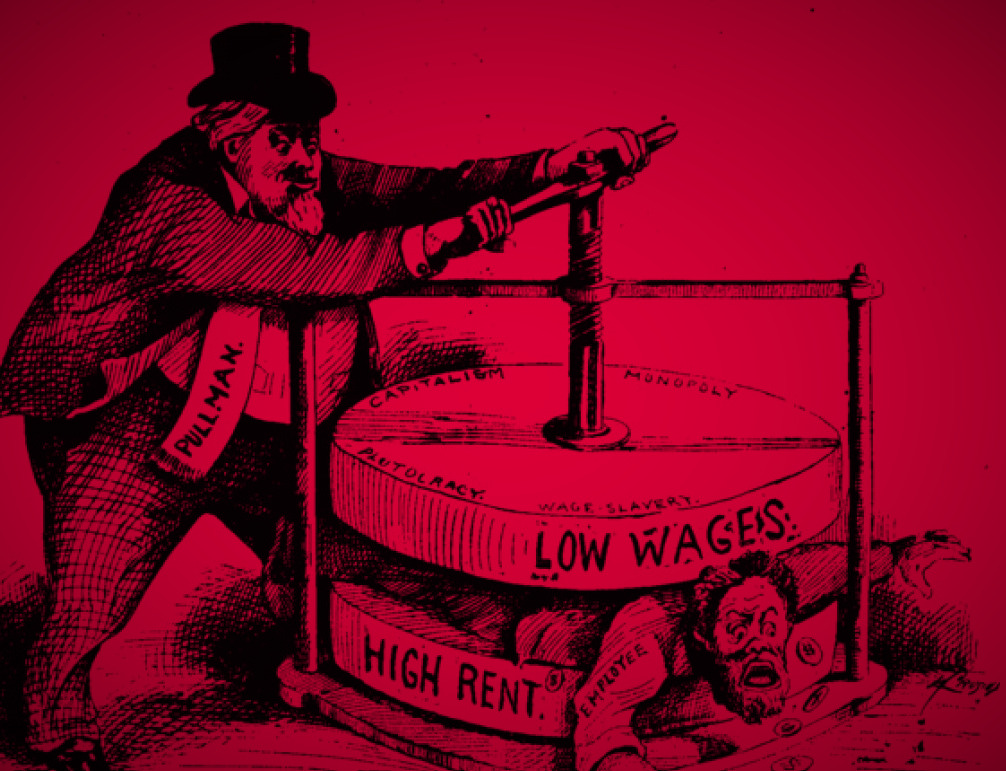

Continue ReadingMonaghan & Cochrane, ‘Fight to Win! Tools for Confronting Capital’

Abstract Anarchists have generally rejected the idea that there is or ought to be a pure or inherently revolutionary strategy or tactic. In this chapter we make use of the capital-as-power theory of value and capital in a way that informs and supports the ad hoc perspective on struggle and fighting to win. Our primary […]

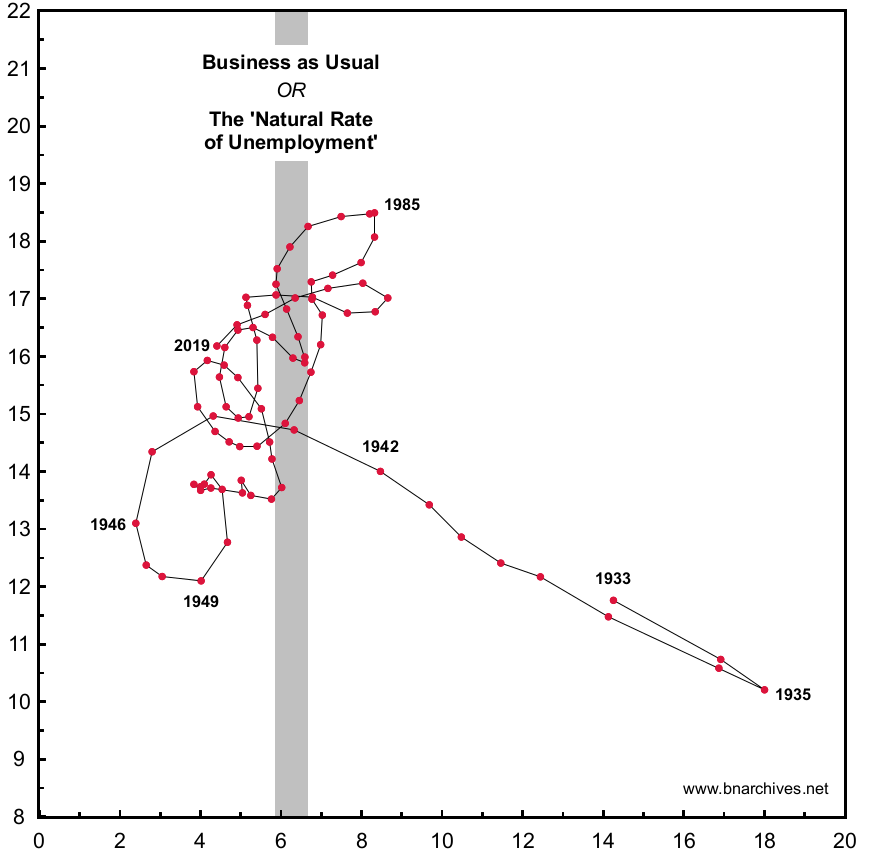

Continue Reading2020/06: Bichler & Nitzan, ‘The Limits of Capitalized Power. A 2020 U.S. Update’

Abstract Until the late 2000s, our work focused primarily on why capitalism should be understood as a mode of power. We argued that capital itself is a form of organized power and researched how capitalists sustain, defend and augment their capitalized power. We called our approach ‘capital as power’ – or CasP, for short. But […]

Continue ReadingKvachev, ‘Unflat Ontology: Essay on the Poverty of Democratic Materialism’

Abstract The paper is dedicated to the problem of flat ontology in philosophy and its relation to the practice in economy. The author argues that flat economy is based on a marginal utility theory of value and presents hierarchical value chains with concentration of power-capital as if they were flat and all the actors involved […]

Continue Reading2020/04: McMahon, ‘Reconsidering Systemic Fear and the Stock Market: A Reply to Baines and Hager’

Abstract A recent New Political Economy article by Baines and Hager (2020) critiqued Shimshon Bichler and Jonathan Nitzan’s capital-as-power (CasP) model of the stock market (Bichler & Nitzan, 2016). Bichler and Nitzan’s model of the stock market seeks to explain how financial crises are tied to the (upper) limits of redistributing income through power. Bichler […]

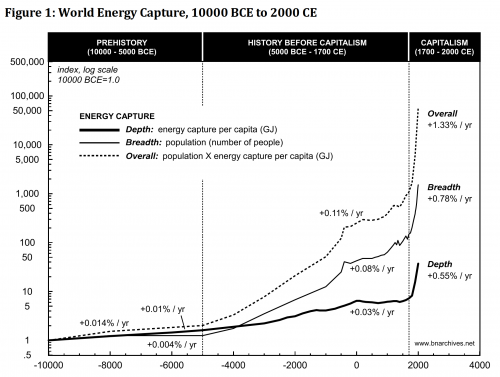

Continue ReadingBichler & Nitzan, ‘Growing through Sabotage: Energizing Hierarchical Power’

Abstract According to the theory of capital as power, capitalism, like any other mode of power, is born through sabotage and lives in chains – and yet everywhere we look we see it grow and expand. What explains this apparent puzzle of ‘growth in the midst of sabotage’? The answer, we argue, begins with the […]

Continue ReadingVideo: Can Capitalists Afford Economic Growth? An Animation

Elvire Thouvenot has produced an animated video that summarizes the key points of Bichler and Nitzan’s 2014 paper “Can Capitalists Afford Recovery? Three Views on Economic Policy in Times of Crisis.” This paper was first printed in Review of Capital as Power. It was reprinted in Philosophers for Change. Watch the video below:

Continue ReadingFix, Nitzan & Bichler, ‘Real GDP: The Flawed Metric at the Heart of Macroeconomics’

Abstract The study of economic growth is central to macroeconomics. More than anything else, macroeconomists are concerned with finding policies that encourage growth. And by ‘growth’, they mean the growth of real GDP. This measure has become so central to macroeconomics that few economists question its validity. Our intention here is to do just that. […]

Continue ReadingBaines & Hager, ‘Financial Crisis, Inequality, and Capitalist Diversity: A Critique of the Capital as Power Model of the Stock Market’

Abstract The relationship between inequality and financial instability has become a thriving topic of research in heterodox political economy. This article offers the first critical engagement with one framework within this wider literature: the Capital as Power (CasP) model of the stock market developed by Shimshon Bichler and Jonathan Nitzan. Specifically, we extend the CasP […]

Continue ReadingMartin, ‘The Autocatalytic Sprawl of Pseudorational Mastery ‘

Abstract Winner of the 2018 RECASP Essay Prize According to Jonathan Nitzan and Shimshon Bichler (2009), capital is not an economic quantity, but a mode of power. Their fundamental thesis could be summarized as follows: capital is power quantified in monetary terms. But what do we do when we quantify? What is the nature of […]

Continue ReadingOn the Power Theory of Capitalism and Differential Accumulation

Ken Zimmerman This piece was originally posted on the Real-World Economics Review Blog here and here. Shimshon Bichler and Jonathan Nitzan are Israeli political economists. Together they’ve created a thought-provoking power theory of capitalism and theory of differential accumulation. The theory is not “pie-in-the-sky,” but is based in their analysis of the political economy of […]

Continue Reading