Abstract One of the most important and recurring debates in the field of International Political Economy and international affairs are the links between capitalism, fossil fuel energy and climate change. In these debates, the origins of our current climate emergency are rooted in how Britain became the first country to become reliant on mass production […]

Continue ReadingBichler & Nitzan, ‘The Mismatch Thesis. Fiction and Reality in the Accumulation of Capital’

Abstract Political economists, both mainstream and Marxist, find it difficult to reconcile the «real» and «financial» appearances of capital. The conventional view is that «real» capital is an objective productive entity; that «finance» merely reflects this reality; and that, unfortunately, the reflection is often inaccurate, causing the two to «mismatch». This convention, we argue, is […]

Continue ReadingAnderson, ‘From Operation Warp Speed to TRIPS. Vaccines as Assets’

Abstract This chapter examines the political economy of biopharmaceutical innovation, focusing primarily on vaccines in the Covid-19 pandemic. This analysis aims to make visible the deep entanglements that entrench an extractive and dysfunctional innovation ecosystem, calcifying inequities in global access to essential medicines. The chapter argues that the current inequities in vaccine access are not […]

Continue ReadingDi Liberto, ‘Differential Harm: Patterns of Uneven Destruction’

Abstract This essay opposes the idea that contemporary critical events like pandemics, global warming, environmental deterioration, et cetera, are to be considered as affecting humanity in a uniform way. Instead of seeing these phenomena like abstract universal threats, I propose to look at them through the lens of my concept of differential harm. By drawing […]

Continue ReadingSuaste Cherizola, ‘Estudiar el precio, olvidar el valor. Una alternativa al pensamiento económico tradicional’

Abstract Este artículo intenta sentar las bases para una comprensión de los precios radicalmente diferente a como los entiende el pensamiento económico tradicional. Tras revisar algunos aspectos relevantes de la crítica a la teoría del dinero como mercancía, se muestra que el pensamiento tradicional es incapaz de captar las propiedades irreductibles de los precios y […]

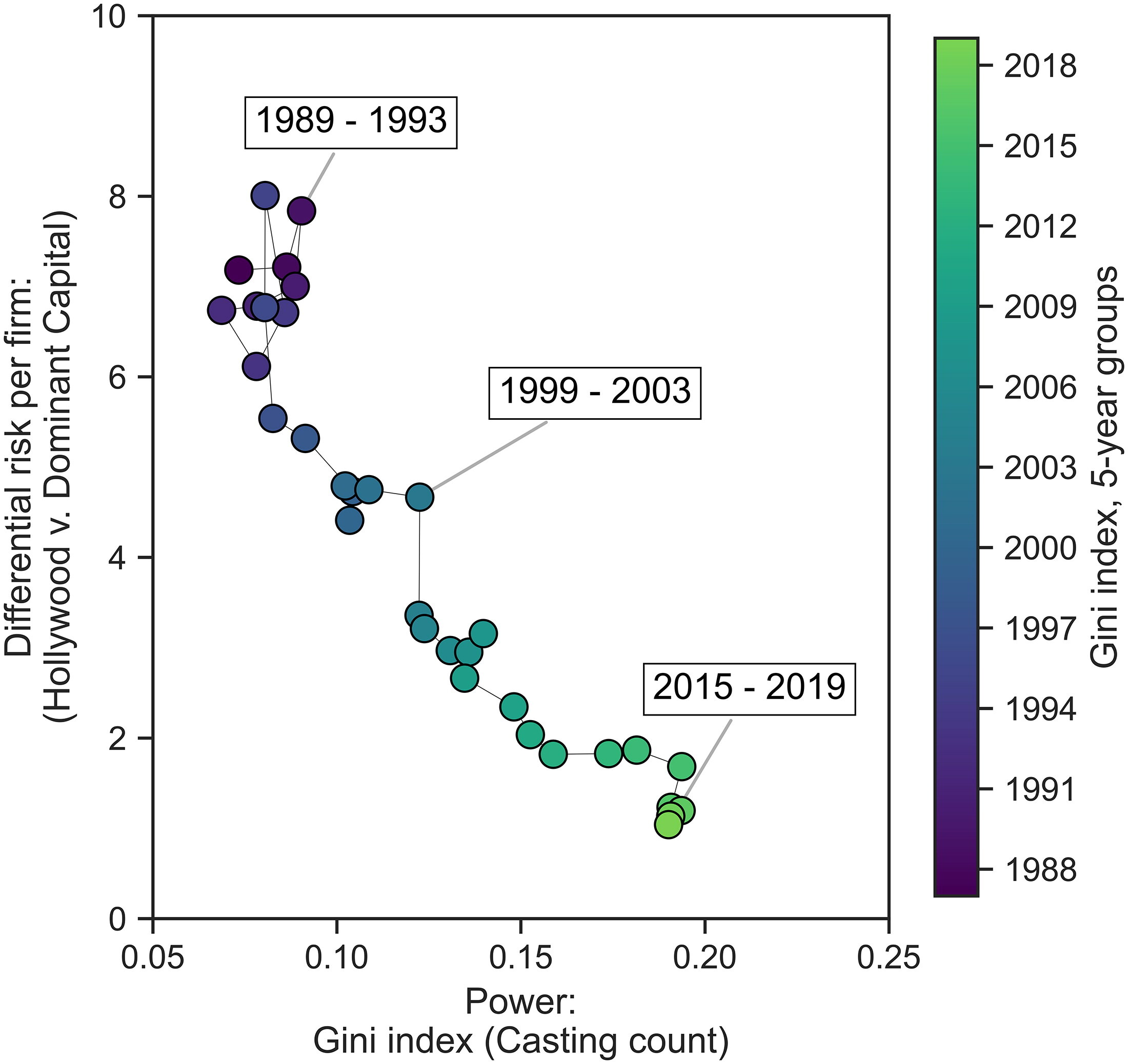

Continue ReadingMcMahon, ‘Star Power and Risk: A Political Economic Study of Casting Trends in Hollywood’

Abstract This paper builds an empirical and theoretical model to analyze how the financial goal of risk reduction changed the insides of Hollywood’s star system. For the moviegoer looking at Hollywood cinema from the outside, the function of the star system has remained the same since the 1920s: to have recognizable actors attract large audiences […]

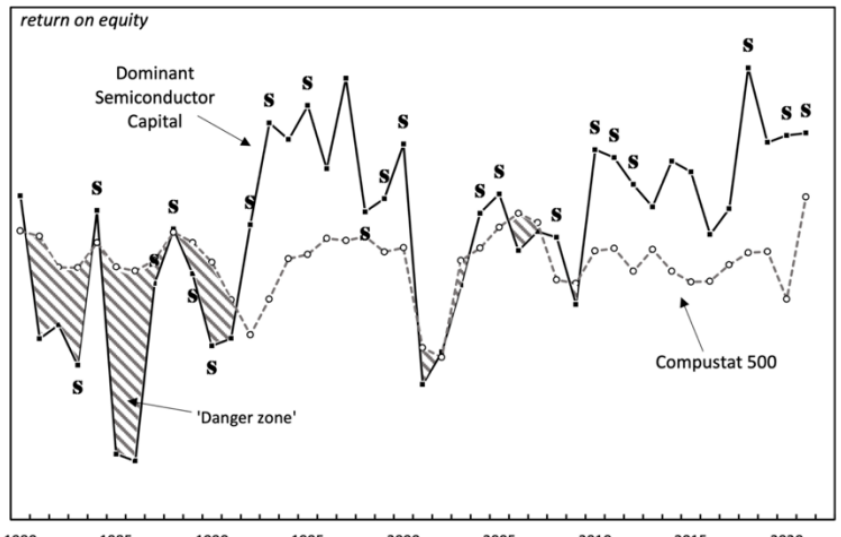

Continue ReadingMouré, ‘Technological Change and Strategic Sabotage: A Capital as Power Analysis of the US Semiconductor Business’

Abstract Rapid technological change is often touted as a fundamental reality of capitalist societies. It is also presented as concrete evidence for the supposed progressive improvement of material well-being that characterises the capitalist system of social order. Since its emergence in the mid-20th century, semiconductor technology in many ways exemplifies this view. Yet the rapid […]

Continue ReadingPietryka, ‘Kapitał, by rządzić, musi sabotować postęp’

Abstract Od głodu i biedy po zwykłe marnotrawstwo i nawracające fale przeróżnych kryzysów – to nie niepożądane skutki uboczne kapitalizmu, ale przejawy sabotażu. Bo nic nie utrwala władzy kapitału skuteczniej niż istnienie szerokiej rzeszy ludzi, którzy ani na chwilę nie mogą przestać pracować, by przeżyć. Capital, in order to rule, must sabotage progress From hunger […]

Continue ReadingRoy, ‘Capitalizing a Cure: How Finance Controls the Price and Value of Medicines’

Abstract Capitalizing a Cure takes readers into the struggle over a medical breakthrough to investigate the power of finance over business, biomedicine, and public health. When curative treatments for hepatitis C launched in 2013, sticker shock over their prices intensified the global debate over access to new medicines. Weaving historical research with insights from political […]

Continue ReadingDi Muzio, ‘Capitalism, Money and Inequality in the World’

Abstract There is little doubt that, in the last hundred years or so, progress has been made in lifting more people out of extreme poverty. Yet, considerable economic inequalities both within and between nations persists and, as recent work has shown, if the rate of return on capital surpasses the rate of growth, inherited wealth […]

Continue ReadingBichler & Nitzan, ‘ההון ושברו (Capital and its Crisis)’

Abstract הקפיטליזם שולט בעולם. דיונים סוערים מתנהלים בין המלומדים הממסדיים לבין “הביקורתיים” על טיבו של הקפיטליזם הגלובלי. הבעיה היא שטיבו של המוסד המרכזי בקפיטליזם — ההון — אינו ידוע. לאחר יותר ממאתיים שנה של התפתחות קפיטליסטית נמרצת לא קיימת תיאוריית הון הגיונית אמפירית — לא במדע הכלכלה, לא בכלכלה הפוליטית המרקסיסטית ולא במדעי החברה בכלל, […]

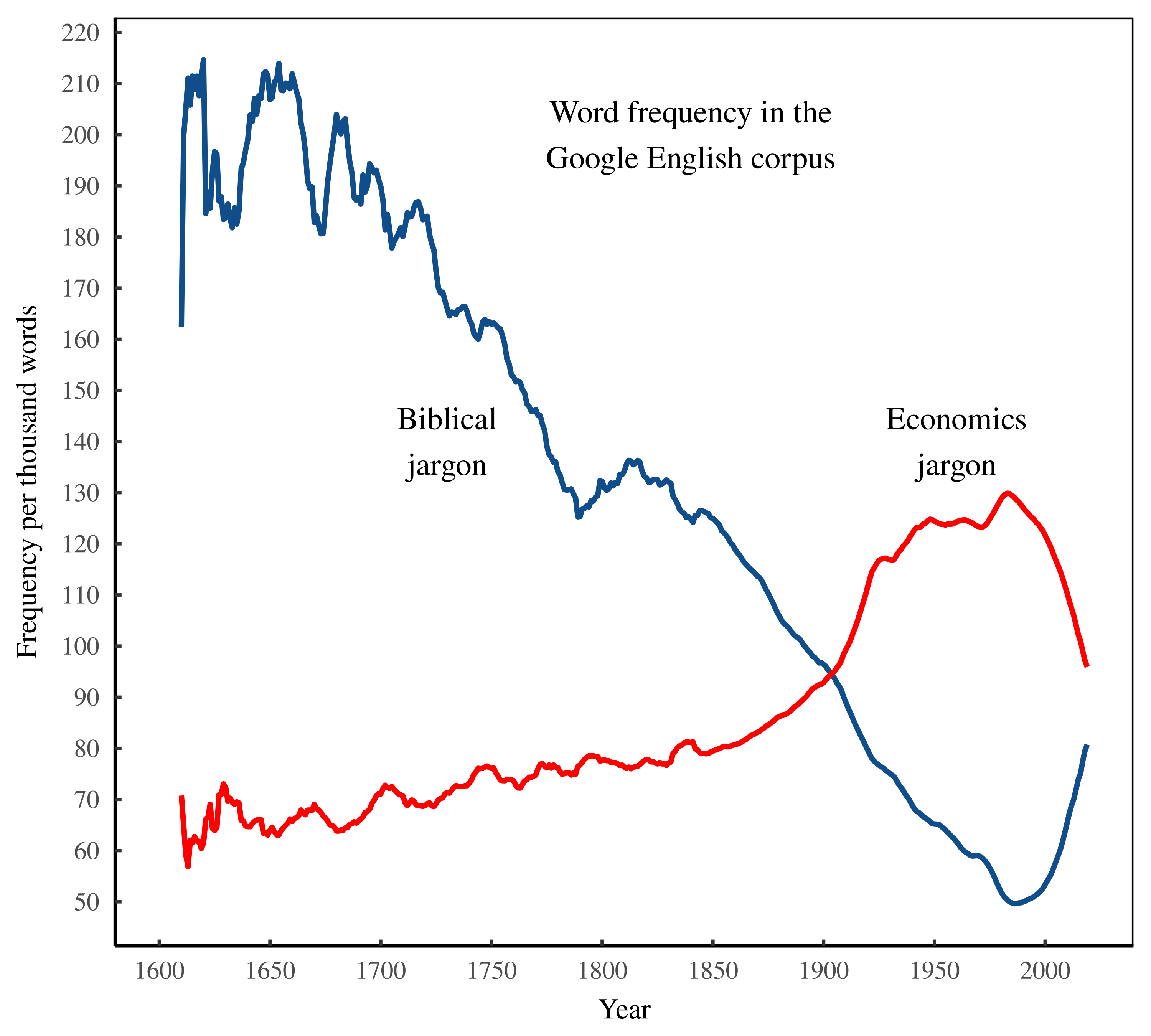

Continue ReadingFix, ‘Have We Passed Peak Capitalism?’

Abstract This paper uses word frequency to track the rise and potential peak of capitalist ideology. Using a sample of mainstream economics textbooks as my corpus of capitalist thinking, I isolate the jargon of these books and then track its frequency over time in the Google English corpus. I also measure the popularity of feudal […]

Continue ReadingBichler & Nitzan, ‘Book Review: Steve Keen (2021) The New Economics: A Manifesto’

Abstract Steve Keen’s book, The New Economics: A Manifesto (2021), offers a new path for economics, and for good reason. In his view, neoclassicism, the paradigm that rules modern-day economics, has become a serious menace: “I regard Neoclassical economics as not merely a bad methodology for economic analysis, but as an existential threat to the […]

Continue ReadingDi Muzio & Dow, ‘Covid-19 and the Global Political Economy. Crises in the 21st Century’

Abstract Covid-19 and the Global Political Economy investigates and explores how far and in what ways the Covid-19 pandemic is challenging, restructuring, and perhaps remaking aspects of the global political economy. Since the 1970s, neoliberal capitalism has been the guiding principle of global development: fiscal discipline, privatisations, deregulation, the liberalisation of trade and investment regimes, […]

Continue ReadingMcMahon, ‘Why Scorsese is Right About Corporate Power’

Abstract In the March 2021 issue of Harper’s, Scorsese wrote an essay to pay tribute to Federico Fellini, the Italian director who directed such great films as La Strada, 8 1/2, La Dolce Vita, Nights of Cabiria and Satyricon. Scorsese writing on Fellini is definitely newsworthy for cinephiles who want to know about Fellini’s beginnings […]

Continue ReadingMcMahon, ‘The Political Economy of Hollywood’

Abstract In Hollywood, the goals of art and business are entangled. Directors, writers, actors, and idealistic producers aspire to make the best films possible. These aspirations often interact with the dominant firms that control Hollywood film distribution. This control of distribution is crucial as it enables the firms and other large businesses involved, such as […]

Continue ReadingFix, ‘Das Ritual der Kapitalisierung (The Ritual of Capitalization)’

Abstract Wenn man genau hinhört, kann man zuhören, wie Jeff Bezos immer reicher wird. Da ist es schon wieder, dieses Geräusch. Eine weitere Milliarde in Bezos‘ Kassen. Lassen Sie uns diesen Klang des Geldes mit ein paar Zahlen belegen. Seit 2017 ist das Nettovermögen von Bezos um etwa 4 Millionen Dollar pro Stunde gewachsen – […]

Continue ReadingBaines & Hager, ‘From Passive Owners to Planet Savers? Asset Managers, Carbon Majors and the Limits of Sustainable Finance’

Abstract This article examines the role of the Big Three asset management firms — BlackRock, Vanguard and State Street — in corporate environmental governance. Specifically, it charts the Big Three’s relationships with the public–owned Carbon Majors: a small group of fossil fuels, cement and mining companies responsible for the bulk of industrial greenhouse gas emissions. […]

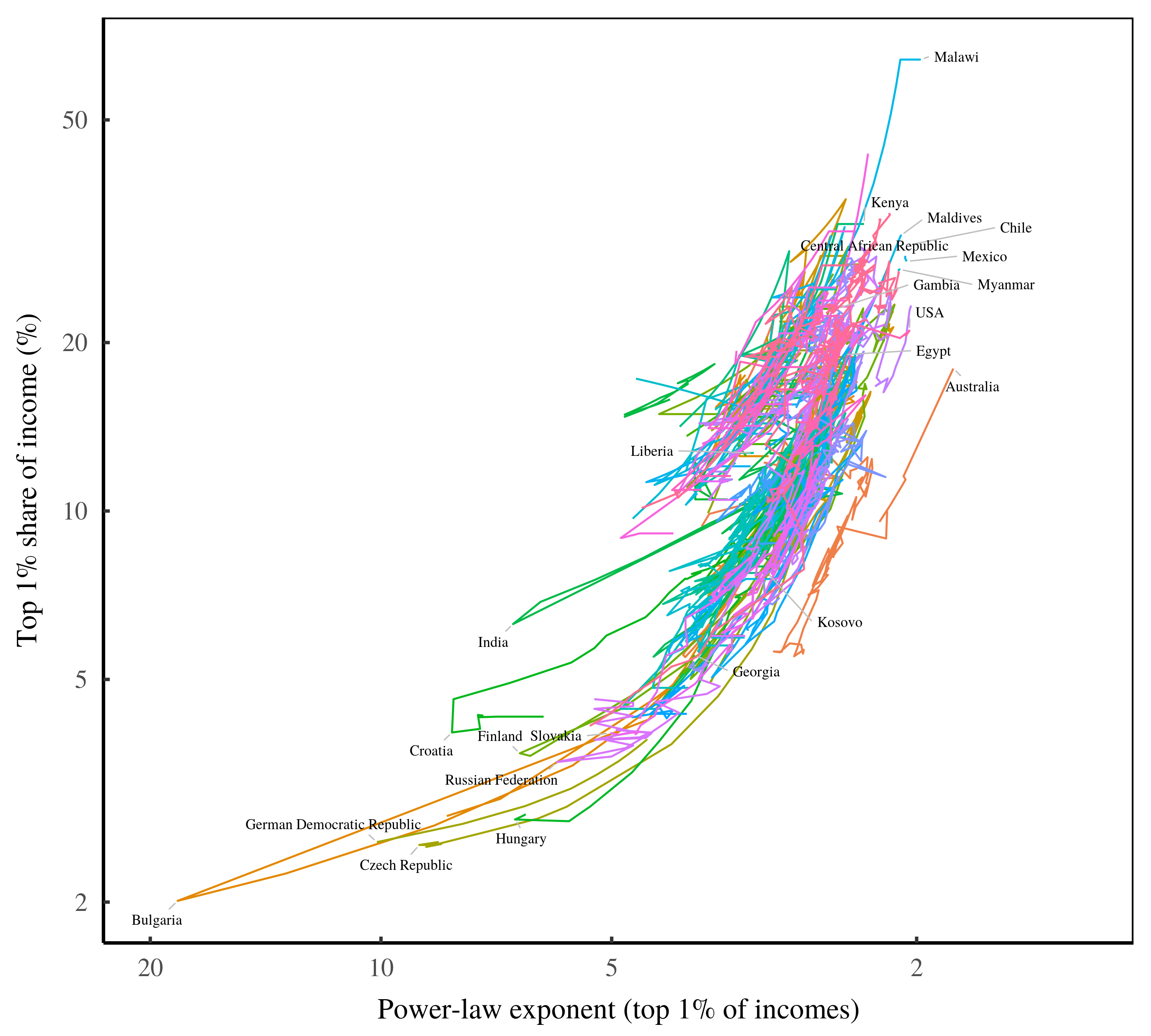

Continue ReadingFix, ‘Redistributing Income Through Hierarchy’

Abstract Although the determinants of income are complex, the results are surprisingly uniform. To a first approximation, top incomes follow a power-law distribution, and the redistribution of income corresponds to a change in the power-law exponent. Given the messiness of the struggle for resources, why is the outcome so simple? This paper explores the idea […]

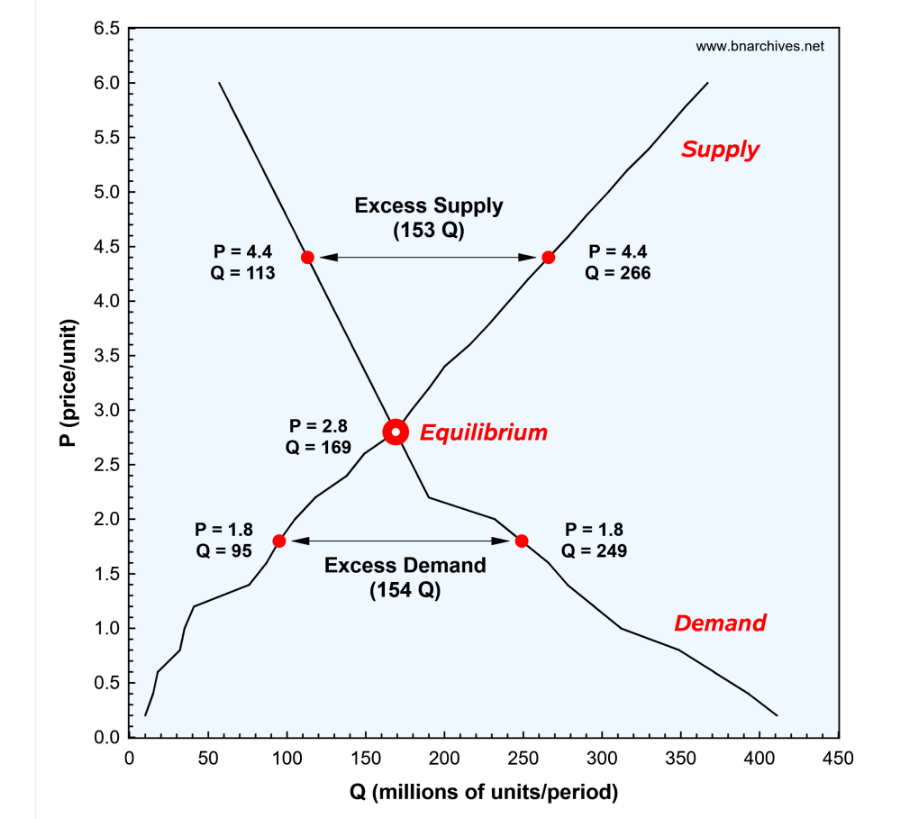

Continue ReadingBichler & Nitzan, ‘The 1-2-3 Toolbox of Mainstream Economics: Promising Everything, Delivering Nothing’

Abstract We write this essay for both lay readers and scientists, though mainstream economists are welcome to enjoy it too. Our subject is the basic toolbox of mainstream economics. The most important tools in this box are demand, supply and equilibrium. All mainstream economists – as well as many heterodox ones – use these tools, […]

Continue Reading