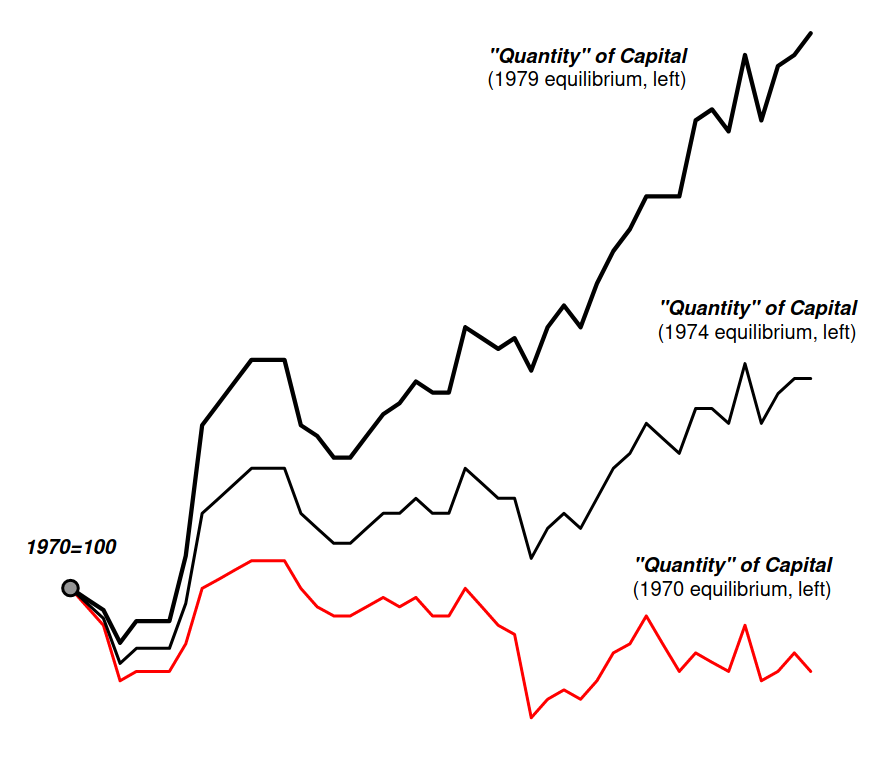

Abstract What do economists mean when they talk about “capital accumulation”? Surprisingly, the answer to this question is anything but clear, and it seems the most unclear in times of turmoil. Consider the “financial crisis” of the late 2000s. The very term already attests to the presumed nature and causes of the crisis, which most […]

Continue ReadingDi Muzio, ‘Carbon Capitalism: Energy, Social Reproduction and World Order’

Abstract Modern civilization and the social reproduction of capitalism are bound inextricably with fossil fuel consumption. But as carbon energy resources become scarcer, what implications will this have for energy-intensive modes of life? Can renewable energy sustain high levels of accumulation? Or will we witness the end of existing capitalist economies? This book provides an […]

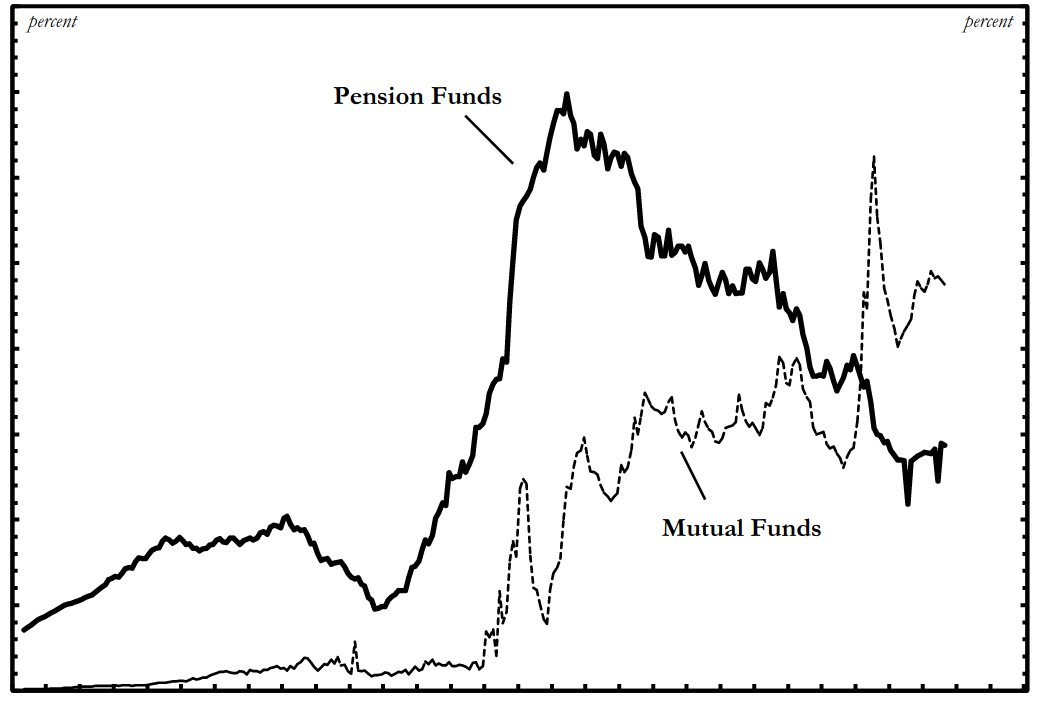

Continue ReadingHager, ‘Corporate Ownership of the Public Debt’

Abstract In various writings Karl Marx made references to an ‘aristocracy of finance’ in Western Europe and the United States that dominated ownership of the public debt. Drawing on original research, this article offers the first comprehensive analysis of public debt ownership within the US corporate sector. The research shows that over the past three […]

Continue ReadingFix, ‘Putting Power Back Into Growth Theory’

Abstract Neoclassical growth theory assumes that economic growth is an atomistic process in which changes in distribution play no role. Unfortunately, when this assumption is tested against real-world evidence, it is systematically violated. This paper argues that a reality-based growth theory must reject neoclassical principles in favour of a power-centered approach. Building on Nitzan and […]

Continue ReadingMalik, ‘The Ontology of Finance: Price, Power, and the Arkhéderivative’

Abstract In what promises to be a significant contribution to political economy, Malik seeks to combine the philosophical understanding of the nature and logic of the derivatives market with an analysis of the entirely novel, structurally-specific mode of capitalist power it expresses. This ambitious ‘ontology of finance’ supplements Ayache’s understanding of the fundamental logic of […]

Continue ReadingBichler & Nitzan, ‘The Scientist and the Church’

Abstract The Scientist and the Church is a wide-ranging biography of research, showcasing Bichler and Nitzan’s attempts to break through the stifling dogmas of the academic church and chart a new scientific cosmology of capitalism. Central to the authors’ work is the notion that capital is not a productive economic category but capitalized power, and […]

Continue ReadingBaines, ‘Fuel, Feed and the Corporate Restructuring of the Food Regime’

Abstract The agrofuel boom has brought about some of the most significant transformations in the world food system in recent decades. A rich and diverse body of agrarian political economy research has emerged that elucidates the conflicts and redistributional shifts engendered by these transformations. However, less attention has been given to differences within agri-food capital. […]

Continue ReadingBrennan, ‘Ascent of Giants: NAFTA, Corporate Power and the Growing Income Gap’

Abstract There is growing awareness in Canada of how unequal society is becoming. It is probably most obvious in the gap between the compensation of Canada’s highest paid corporate executives and the average worker. The political pressure to do something to close this gap, for example by increasing taxes at the top of the income […]

Continue Reading