The Review of Capital as Power (RECASP) announces an annual essay prize on the subject of capital as power. The best paper will receive a prize of $2000. A prize of $500 will be awarded to the second best contribution, while a $300 prize will be given to the third best article. Submitted articles should […]

Continue Reading'Is the Power of Mass Culture Profitable?', Public Lecture by James McMahon

This presentation will examine how and why political economic theories of mass culture have accumulated, but not settled, methodological issues about the meaning of value and the nature of productivity. Labour is certainly an important factor to any comprehensive study of capitalist mass culture, but it is our assumptions about economic productivity and not the […]

Continue Reading'From Colonialism to Climate Change: The Power to Externalize', Public Lecture by D.T. Cochrane

The history of capitalism is a history of externalization. While benefits were tallied, costs were routinely excluded from accounts. In this presentation I examine the history of externalization as a power process. A history of brutality and destruction marketed as innovation and efficiency, externalization has been the shadowy counterpart to accumulation. From colonialism to climate […]

Continue Reading'A Power Theory of Personal Income Distribution', Public Lecture by Blair Fix

Due in no small part to the work of Thomas Piketty, the empirical study of income inequality has flourished in the last decade. But this plethora of new data has not led to a corresponding theoretical revolution. Why? The problem, I believe, is an unwillingness to question and test the basic assumptions on which current […]

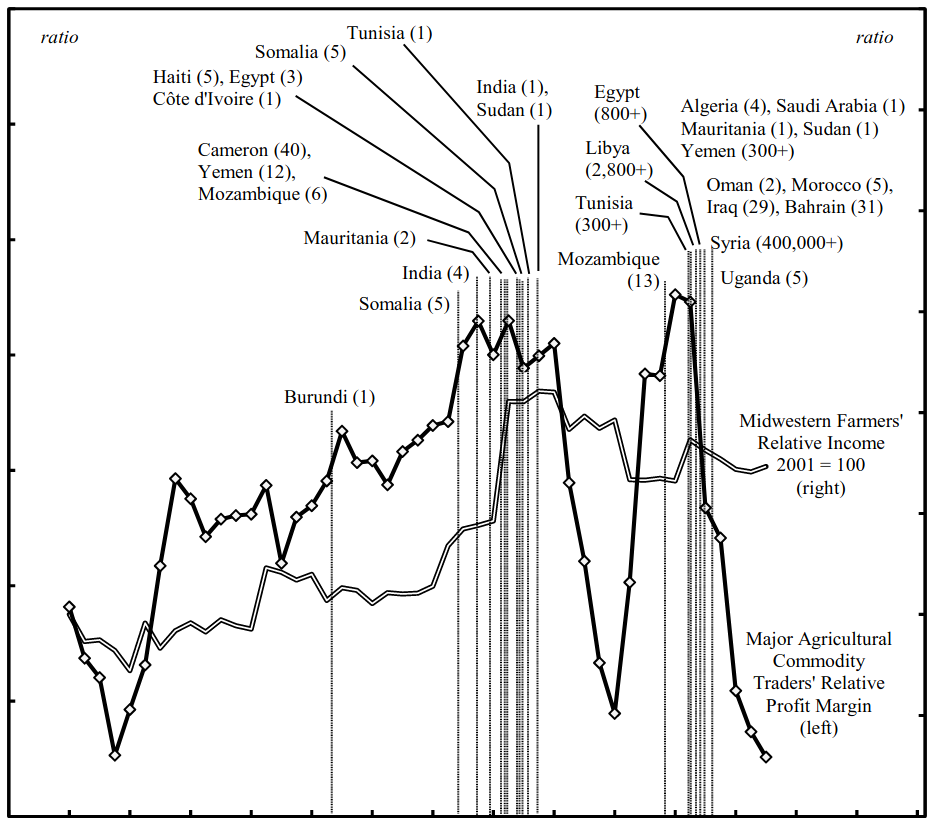

Continue ReadingBaines, ‘Accumulating through Food Crisis? Farmers, Commodity Traders and the Distributional Politics of Food Crisis’

Abstract This paper considers the domestic and international ramifications of financialization and grain price instability in the US agri-food sector. It finds that during the recent period of high and volatile prices, the average income of large-scale farms reached the earnings threshold of the top percentile of US households, and agricultural commodity traders markedly outperformed […]

Continue ReadingCapital as Power Essay Prize, 2016

First Prize $2000 Second Prize $500 Third Prize $300 The Review of Capital as Power (RECASP) announces an annual essay prize on the subject of capital as power. The best paper will receive a prize of $2000. A prize of $500 will be awarded to the second best contribution, while a $300 prize will be […]

Continue ReadingCall for Papers for a Special Issue of the RECASP: 'Broadening the Vista'

Click here for the official call. Submissions deadline: December 31st, 2016 Submission guidelines: http://www.recasp.com/contact Contact: Tim Di Muzio, University of Wollongong, Australia (tdimuzio@uow.edu.au) Alternative location: http://bnarchives.yorku.ca/488/

Continue Reading2016 CasP Conference on ‘Capital as Power: Broadening the Vista’

The theory of capital as power (CasP) offers a radical alternative to mainstream and Marxist theories of capitalism. It argues that capital symbolizes and quantifies not utility or labour but organized power writ large, and that capitalism is best understood and challenged not as a mode of consumption and production, but as a mode of […]

Continue Reading'Pseudorational Control and the Magma of Reality' – A Seminar Presentation by Ulf Martin

A seminar presentation by Ulf Martin York University, September 27, 2:30-5:30pm 1 INTRODUCTION. – 2 POWER. From magma ontology to the dual project of modernity. Some etymology. Gestaltungsvermögen. Magma concept (Castoriadis). Magma ontology. The radical imagination of the psychic monad. The social imaginary significations (SIS) of the socio-historical. Gestaltungsvermögen, magma ontology, capital. Autonomy versus Heteronomy. […]

Continue ReadingEconomics and Power: An Historical Perspective – Conference Call for Papers

Italian Association for the History of Economic Thought 14th Conference – Call for Papers; 28-30 April 2016 Università del Salento (Lecce, Italy) The Italian Association for the History of Economic Thought invites historians of economic thought, economic historians, economists and interested scholars to present proposals for papers and/or sessions along the lines listed below, or […]

Continue ReadingVideo of Blair Fix's Presentation – Economic Growth as a Power Process

Is economic growth a miracle of the free market? According to mainstream theory, growth is best ensured through conditions of ‘perfect competition’. However, economic growth is tightly correlated with the concentration of power in the hands of large corporations. Why? The capital as power framework provides potential answers that turn mainstream theory on its head: […]

Continue ReadingVideo of Jonathan Nitzan's Presentation – The CasP Project: Past, Present, Future

Bichler, Shimshon and Nitzan, Jonathan. (2015). Presentation at York University. 20. October. 2015. The study of capital as power began when we were students in the 1980s and has since expanded into a broader project, involving a growing number of researchers and new areas of inquiry. The presentation explores what we have learned so far, […]

Continue ReadingSpeaker Series on Capital as Power (October-November, 2015)

Organized by the Forum on Capital as Power and sponsored by the York Department of Political Science and Graduate Program in Social and Political Thought (open to all, with refreshments) Existing theories of capitalism, mainstream as well as heterodox, view capitalism as a mode of production and consumption. This speaker series interrogates capitalism as a […]

Continue ReadingThe Enduring Power of GE The Enduring Power of GE (Tuesday Nov . 17. 3-5pm)

Abstract or Brief Description General Electric (GE) has demonstrated extraordinary longevity in the upper echelon of U.S. corporations. From 1925 to 2013, the company has never fallen below 10th in the rankings of firms by market capitalization. The only other firm to match this feat is the oil giant ExxonMobil. GE’s durability is remarkable given […]

Continue ReadingBlockbuster Cinema: Hollywood’s Obsession with Low Risk (Tuesday, Nov 3, 3-5pm)

Blockbuster Cinema: Hollywood’s Obsession with Low Risk York University presentation by James McMahon ABSTRACT: Hollywood is obsessed with blockbusters – for 20 years the major studios have been making them, and it appears that blockbuster cinema will be with us for many years to come. This presentation will theoretically and empirically explain how blockbusters, and […]

Continue ReadingCapital as Power: Broadening the Vista – (Conference Postponed to 2016)

(Conference Postponed to 2016) The theory of capital as power (CasP) offers a radical alternative to mainstream and Marxist theories of capitalism. It argues that capital symbolizes and quantifies not utility or labour but organized power writ large, and that capitalism is best understood and challenged not as a mode of consumption and production, but […]

Continue ReadingBaines, ‘Fuel, Feed and the Corporate Restructuring of the Food Regime’

Abstract The agrofuel boom has brought about some of the most significant transformations in the world food system in recent decades. A rich and diverse body of agrarian political economy research has emerged that elucidates the conflicts and redistributional shifts engendered by these transformations. However, less attention has been given to differences within agri-food capital. […]

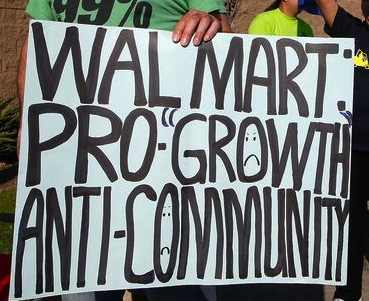

Continue ReadingWal-Mart store count data (by country)

JB 2015 – Wal-Mart store count data

Continue ReadingBaines, ‘Encumbered Behemoth: Wal-Mart, Differential Accumulation and International Retail Restructuring’

Abstract This chapter draws on, and develops, some aspects of the capital as power framework so as to provide the first clear quantitative explication of the company’s power trajectory to date. After rapid growth in the first four decades of its existence, the power of Wal-Mart appears to be flat-lining relative to dominant capital as […]

Continue ReadingSpeculation vs Hedging: A False Dichotomy?

Joseph Baines How do we make sense of the role of different participants in futures markets? According to the conventional wisdom, market participants can be put into two different categories: hedgers and speculators. Hedgers, such as farmers and other commercial entities, assume positions in the futures market that are equal and opposite to their positions […]

Continue Reading