Baines & Hager, ‘From Passive Owners to Planet Savers? Asset Managers, Carbon Majors and the Limits of Sustainable Finance’

February 4, 2022

Abstract

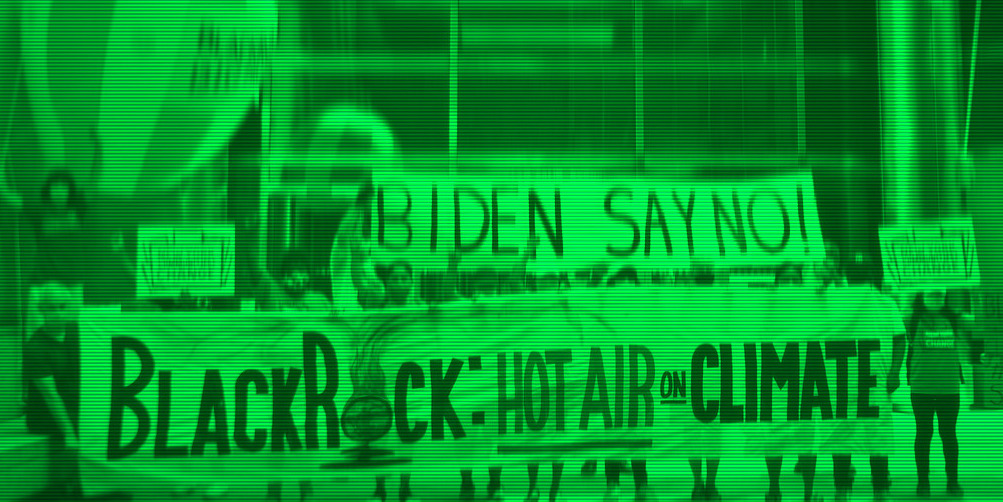

This article examines the role of the Big Three asset management firms — BlackRock, Vanguard and State Street — in corporate environmental governance. Specifically, it charts the Big Three’s relationships with the public–owned Carbon Majors: a small group of fossil fuels, cement and mining companies responsible for the bulk of industrial greenhouse gas emissions. It finds that the Big Three much more often than not oppose rather than support shareholder resolutions aimed at improving environmental governance. Notably, this is even the case with the Big Three’s environmental, social and governance funds. A more fine–gained analysis shows that the combined voting decisions of the Big Three are more likely to lead to the failure than to the success of environmental resolutions and that, whether they succeed or fail, these resolutions tend to be narrow in scope and piecemeal in nature. Based on these findings, the article raises serious doubts about the Big Three’s credentials as environmental stewards.

Citation

From Passive Owners to Planet Savers? Asset Managers, Carbon Majors and the Limits of Sustainable Finance

Baines, Joseph and Hager, Brain Sandy. (2022). CITYPERC Working Paper. No. 2022-04. February. pp. 1-17.