Capital as Power in the 21st Century A Conversation MICHAEL HUDSON, JONATHAN NITZAN, TIM DI MUZIO, and BLAIR FIX February 2025 Abstract On December 3, 2024, Michael Hudson met with capital-as-power researchers Jonathan Nitzan, Tim Di Muzio, and Blair Fix to discuss the intersections between their two lines of research. What follows is a transcript […]

Continue ReadingBichler & Nitzan, ‘The Mismatch Thesis. Fiction and Reality in the Accumulation of Capital’

Abstract Political economists, both mainstream and Marxist, find it difficult to reconcile the «real» and «financial» appearances of capital. The conventional view is that «real» capital is an objective productive entity; that «finance» merely reflects this reality; and that, unfortunately, the reflection is often inaccurate, causing the two to «mismatch». This convention, we argue, is […]

Continue ReadingBaines & Hager, ‘From Passive Owners to Planet Savers? Asset Managers, Carbon Majors and the Limits of Sustainable Finance’

Abstract This article examines the role of the Big Three asset management firms — BlackRock, Vanguard and State Street — in corporate environmental governance. Specifically, it charts the Big Three’s relationships with the public–owned Carbon Majors: a small group of fossil fuels, cement and mining companies responsible for the bulk of industrial greenhouse gas emissions. […]

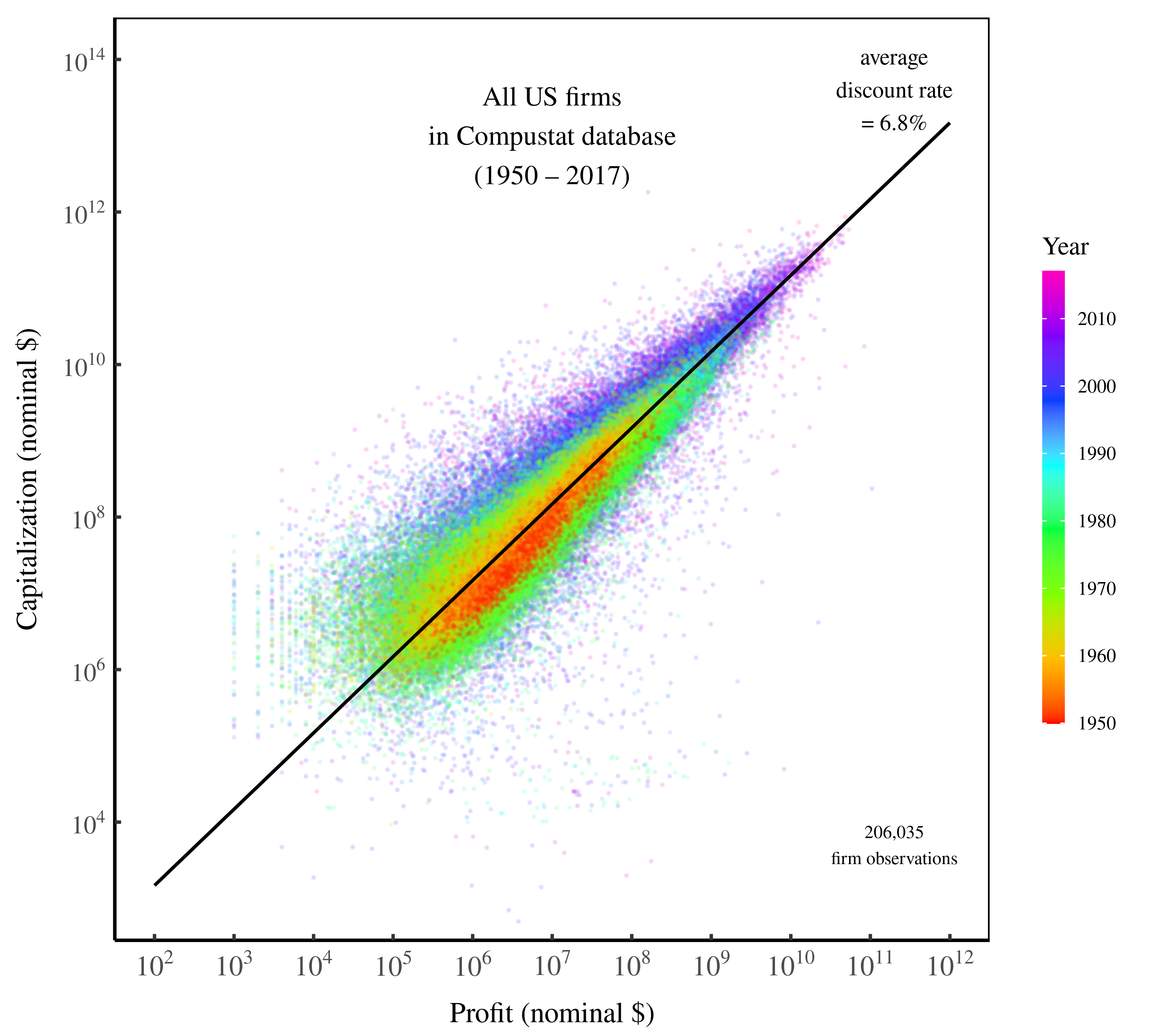

Continue ReadingFix, ‘The Ritual of Capitalization’

Abstract For more than a century, political economists have sought to understand the nature of capital. The prevailing wisdom is that there must be something ‘real’ — some productive capacity — that underpins capitalized values. This thinking, I argue, is a mistake. Building on Jonathan Nitzan and Shimshon Bichler’s theory of capital as power, I […]

Continue ReadingHoward et al., ‘Protein Industry Convergence and Its Implications for Resilient and Equitable Food Systems’

Abstract Recent years have seen the convergence of industries that focus on higher protein foods, such as meat processing firms expanding into plant-based substitutes and/or cellular meat production, and fisheries firms expanding into aquaculture. A driving force behind these changes is dominant firms seeking to increase their power relative to close competitors, including by extending […]

Continue ReadingBichler & Nitzan, ‘Unbridgeable: why political economists cannot accept capital as power’

Abstract The theory of capital as power (CasP) is radically different from conventional political economy. In the conventional view, mainstream as well as heterodox, capital is seen a ‘real’ economic entity engaged in the production of goods and services, and capitalism is thought of as a mode of production and consumption. Finance in this approach […]

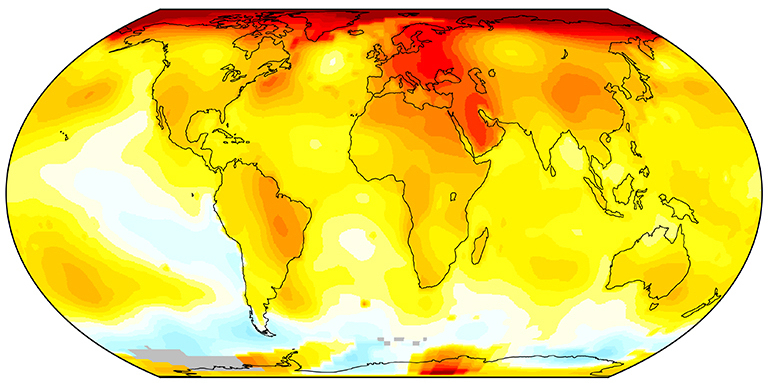

Continue ReadingLucas, ‘Risking the earth, parts 1 and 2’

Abstract This two-part paper details the arguments and evidence that have been marshalled by both climate scientists and social scientists to critique the current procedures and methodologies deployed by the Intergovernmental Panel on Climate Change (IPCC) and the United Nations Framework Convention on Climate Change (UNFCCC) to represent the risks of anthropogenic forcing and a […]

Continue ReadingBaines & Hager, ‘Commodity Traders in a Storm: Financialization, Corporate Power and Ecological Crisis’

Abstract Commodity trading firms occupy a central position in global supply chains and their activities have been associated with financial instability, social upheaval and manifold forms of ecological devastation. This paper examines these companies in the context of debates regarding corporate financialization. We find that since the 2003–2011 commodity boom, trading firms have become less […]

Continue ReadingMcMahon, ‘Selling Hollywood to China’

Abstract From the 1980s to the present, Hollywood’s major distributors have been able to redistribute U.S. theatrical attendance to the advantage of their biggest blockbusters and franchises. At the global scale and during the same period, Hollywood has been leveraging U.S. foreign power to break ground in countries that have historically protected and supported their […]

Continue ReadingBaines & Hager, ‘The Great Debt Divergence and its Implications for the Covid-19 Crisis: Mapping Corporate Leverage as Power’

Abstract The COVID-19 pandemic has amplified longstanding concerns about mounting levels of corporate debt in the United States. This article places the current conjuncture in its historical context, analysing corporate indebtedness against the backdrop of increasing corporate concentration. Theorising leverage as a form of power, we find that the leverage of large non-financial firms increased […]

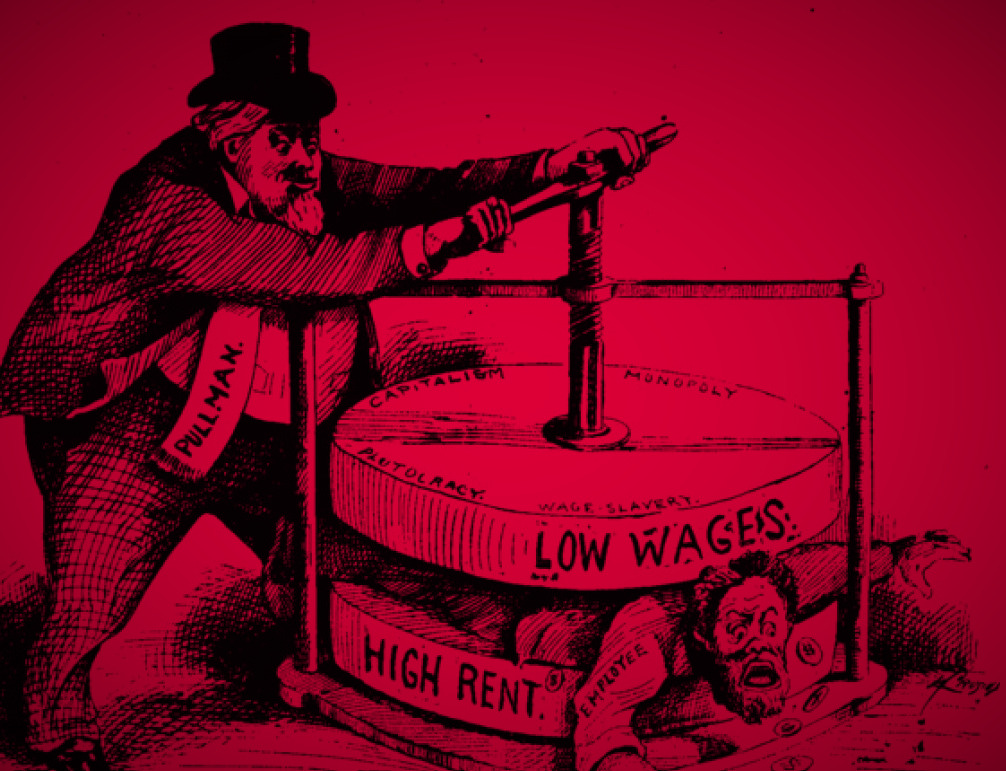

Continue ReadingMonaghan & Cochrane, ‘Fight to Win! Tools for Confronting Capital’

Abstract Anarchists have generally rejected the idea that there is or ought to be a pure or inherently revolutionary strategy or tactic. In this chapter we make use of the capital-as-power theory of value and capital in a way that informs and supports the ad hoc perspective on struggle and fighting to win. Our primary […]

Continue Reading2020/04: McMahon, ‘Reconsidering Systemic Fear and the Stock Market: A Reply to Baines and Hager’

Abstract A recent New Political Economy article by Baines and Hager (2020) critiqued Shimshon Bichler and Jonathan Nitzan’s capital-as-power (CasP) model of the stock market (Bichler & Nitzan, 2016). Bichler and Nitzan’s model of the stock market seeks to explain how financial crises are tied to the (upper) limits of redistributing income through power. Bichler […]

Continue ReadingHas Wealth Gone Digital?

Originally published on Economics from the Top Down Blair Fix A revolution is underway around us and it’s called the digital. And it’s changing everything. More than 80% of wealth is now non-material. — Charles Foran in Just don’t say his name: the modern left on Karl Marx’s place in politics (41:30) Has wealth gone […]

Continue ReadingAgent-Based Models and the Ghost in the Machine

Originally published on Economics from the Top Down Blair Fix In the opening post of this blog, I described my ‘top-down’ approach to studying society. This means studying groups of people without trying to reduce everything to the actions of individuals. It’s not that I think individual actions are unimportant. Of course they are important. […]

Continue ReadingGroping in the Dark: The Untold Side of Research

Originally published on Economics from the Top Down Blair Fix There is an exciting side of blogging that I want to explore here. Blogging can tell the story behind research. This is something you don’t get in journals. Most scientific articles obey a formula that goes like this: Here is the question I asked. Here […]

Continue ReadingVideo: Can Capitalists Afford Economic Growth? An Animation

Elvire Thouvenot has produced an animated video that summarizes the key points of Bichler and Nitzan’s 2014 paper “Can Capitalists Afford Recovery? Three Views on Economic Policy in Times of Crisis.” This paper was first printed in Review of Capital as Power. It was reprinted in Philosophers for Change. Watch the video below:

Continue ReadingFix, Nitzan & Bichler, ‘Real GDP: The Flawed Metric at the Heart of Macroeconomics’

Abstract The study of economic growth is central to macroeconomics. More than anything else, macroeconomists are concerned with finding policies that encourage growth. And by ‘growth’, they mean the growth of real GDP. This measure has become so central to macroeconomics that few economists question its validity. Our intention here is to do just that. […]

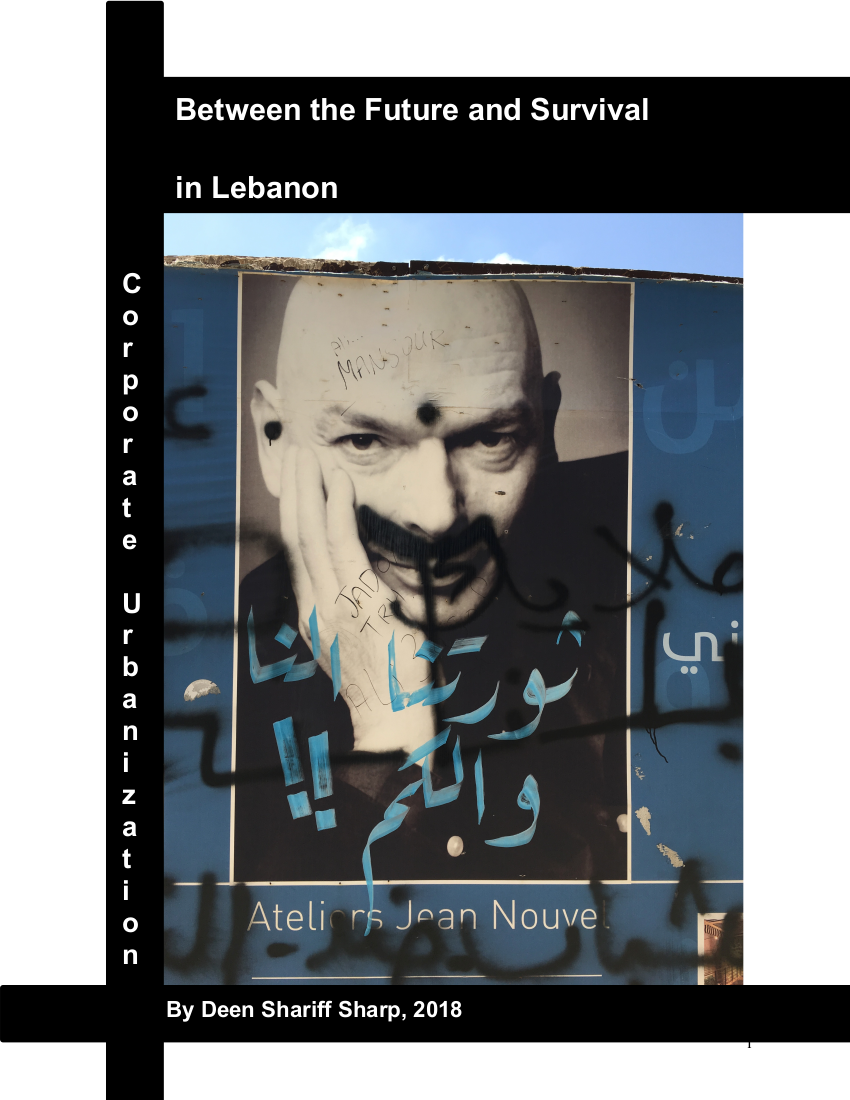

Continue ReadingSharp, ‘Corporate Urbanization: Between the Future and Survival in Lebanon’

Abstract If you look today at the skyline of downtowns throughout the Middle East and beyond, the joint-stock corporation has transformed the urban landscape. The corporation makes itself present through the proliferation of its urban mega-projects, including skyscrapers, downtown developments and gated communities; retail malls and artificial islands; airports and ports; and highways. Built into […]

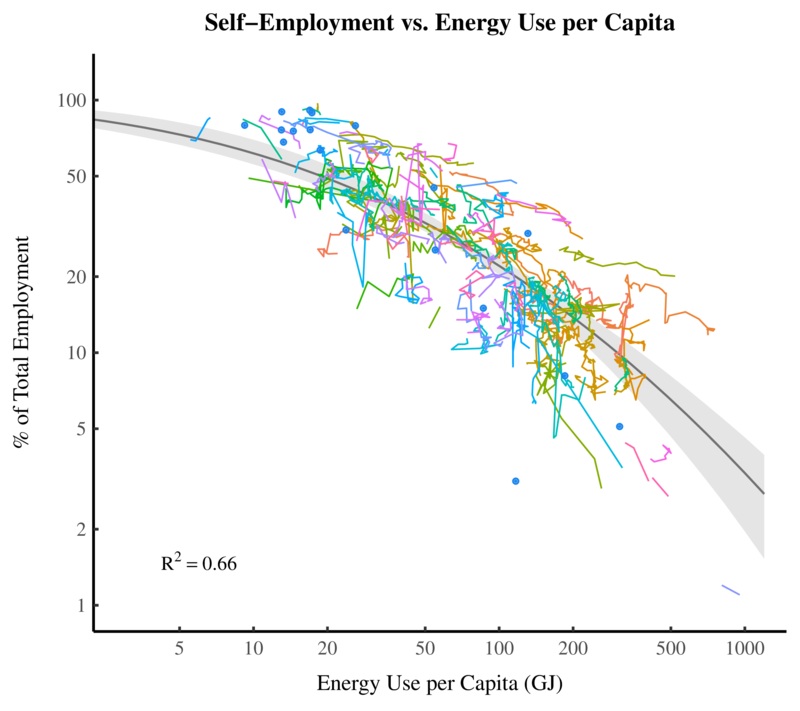

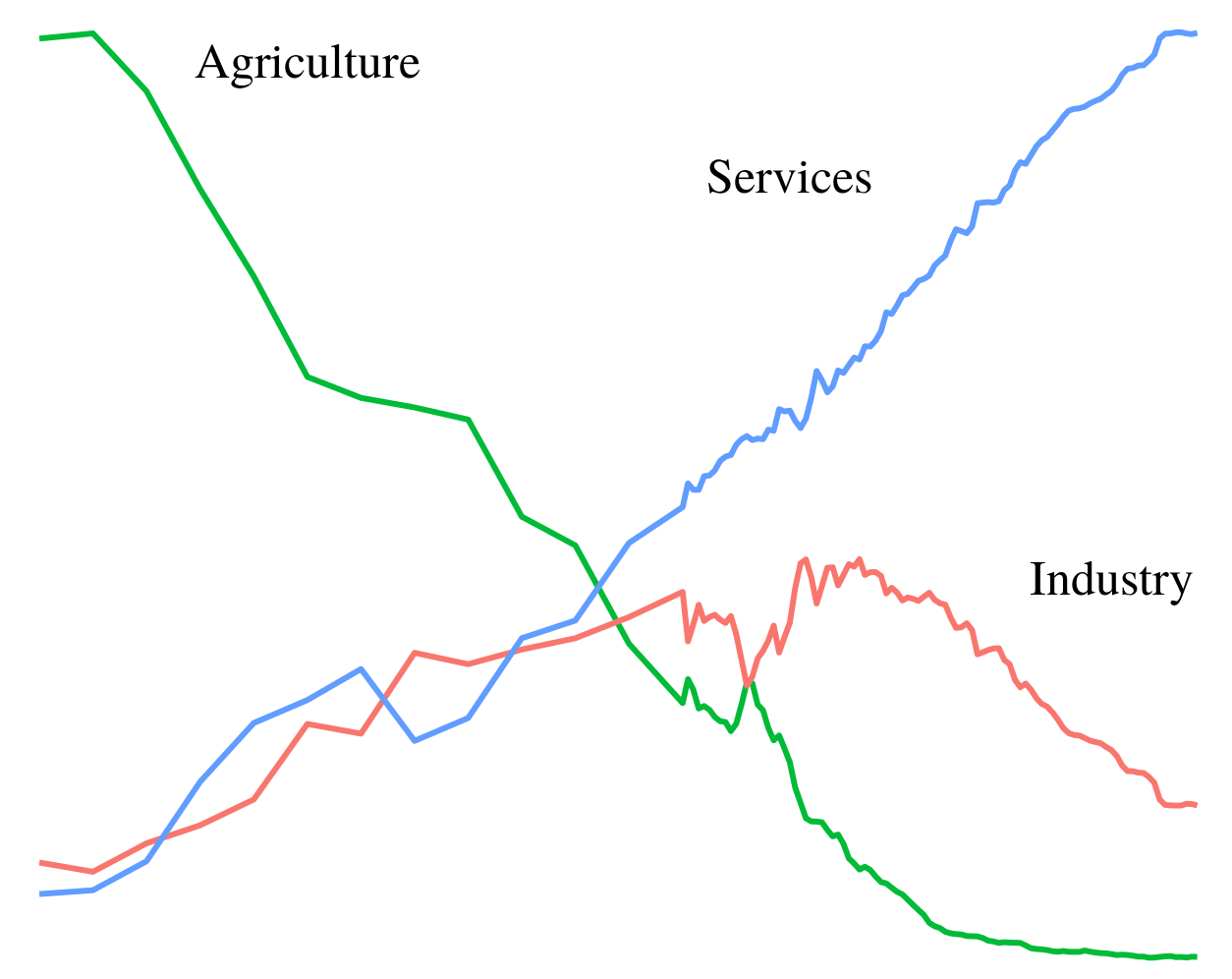

Continue ReadingFix, ‘Dematerialization Through Services: Evaluating the Evidence’

Abstract Dematerialization through services is a popular proposal for reducing environmental impact. The idea is that by shifting from the production of goods to the provision of services, a society can reduce its material demands. But do societies with a larger service sector actually dematerialize? I test the ‘dematerialization through services’ hypothesis with a focus […]

Continue Reading2019/01: Bichler & Nitzan, ‘CasP’s Differential Accumulation versus Veblen’s Differential Advantage (Revised and Expanded)’

Abstract This paper clarifies a common misrepresentation of our theory of capital as power, or CasP. Many observers tend to box CasP as an ‘institutionalist’ theory, tracing its central process of ‘differential accumulation’ to Thorstein Veblen’s notion of ‘differential advantage’. This view, we argue, betrays a misunderstanding of CasP, Veblen or both. First, we are […]

Continue Reading