Capital as Power in the 21st Century A Conversation MICHAEL HUDSON, JONATHAN NITZAN, TIM DI MUZIO, and BLAIR FIX February 2025 Abstract On December 3, 2024, Michael Hudson met with capital-as-power researchers Jonathan Nitzan, Tim Di Muzio, and Blair Fix to discuss the intersections between their two lines of research. What follows is a transcript […]

Continue ReadingBichler & Nitzan, ‘Manuscripts Don’t Burn’

Manuscripts Don’t Burn SHIMSHON BICHLER and JONATHAN NITZAN September 2023 Keywords censorship, ideology, marxism, neoliberalilsm, peer review, plagiarism Citation Bichler, Shimshon, and Nitzan, Jonathan. 2023. ‘Manuscripts Don’t Burn’. Review of Capital as Power, Vol. 2, No. 2, pp. 175–189. Download PDF 1 Flat Reality The French Revolution changed the world. In the new order, the masters […]

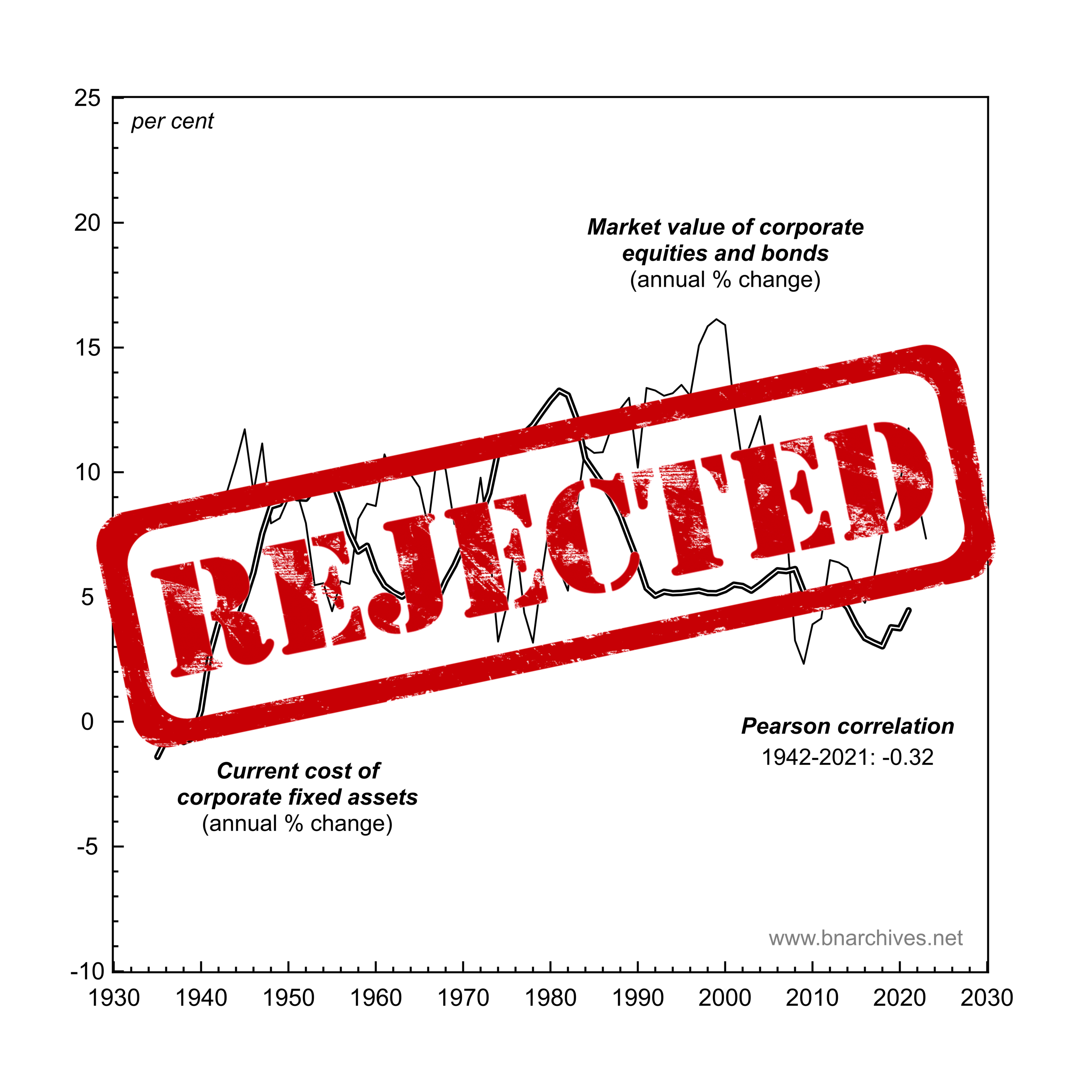

Continue ReadingBichler & Nitzan, ‘The Capital as Power Approach: An Invited-then-Rejected Interview’

The Capital as Power Approach An Invited-then-Rejected Interview with Shimshon Bichler and Jonathan Nitzan SHIMSHON BICHLER and JONATHAN NITZAN September 2023 Keywords capital accumulation, capitalization, interview, Marxism, modes of power, stagflation, systemic fear, value theory Citation Bichler, Shimshon, and Nitzan, Jonathan. 2023. ‘The Capital as Power Approach: An Invited-then-Rejected Interview with Shimshon Bichler and Jonathan […]

Continue ReadingBichler & Nitzan, ‘The Business of Strategic Sabotage’

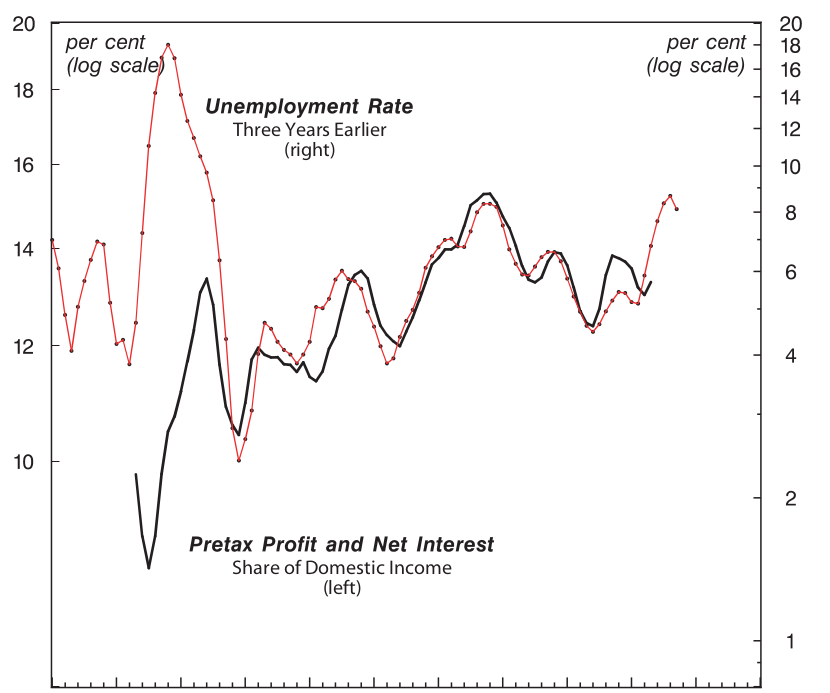

The Business of Strategic Sabotage SHIMSHON BICHLER and JONATHAN NITZAN January 2023 Abstract In a recent article, Nicolas D. Villarreal claims that our empirical analysis of the relation between business power and industrial sabotage in the United States is unpersuasive, if not deliberately misleading. Specifically, he argues that we cherry-pick specific data definitions and smoothing […]

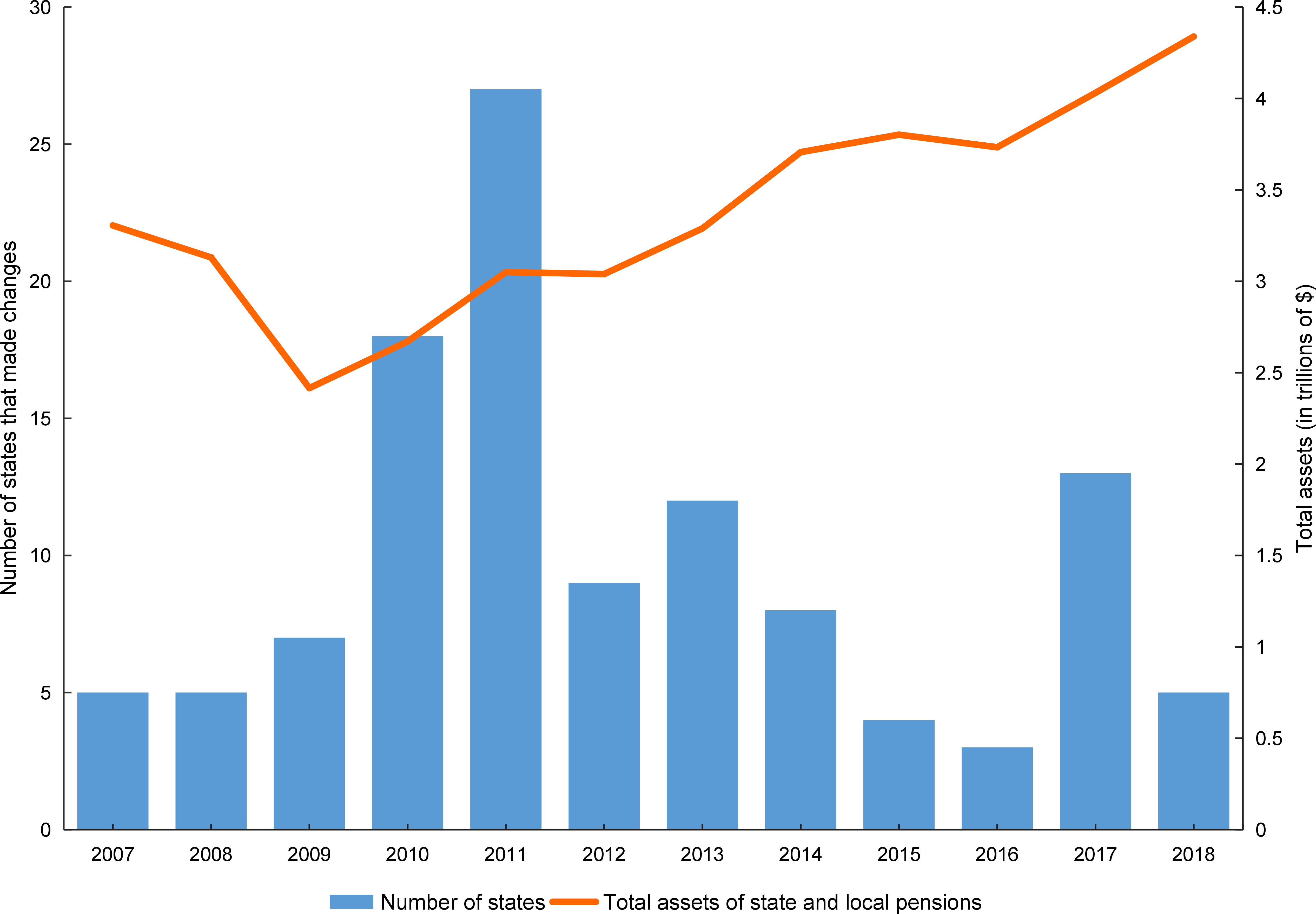

Continue ReadingKolasi, ‘Pensions and Power: The Political and Market Dynamics of Public Pension Plans’

Pensions and Power The Political and Market Dynamics of Public Pension Plans ERALD KOLASI June 2022 Abstract This paper uses the theory of ‘capital as power’ to analyze the struggle over public pensions in the United States. While mainstream commentators claim that public pensions must be ‘reformed’ because they are ‘under funded’, I argue that […]

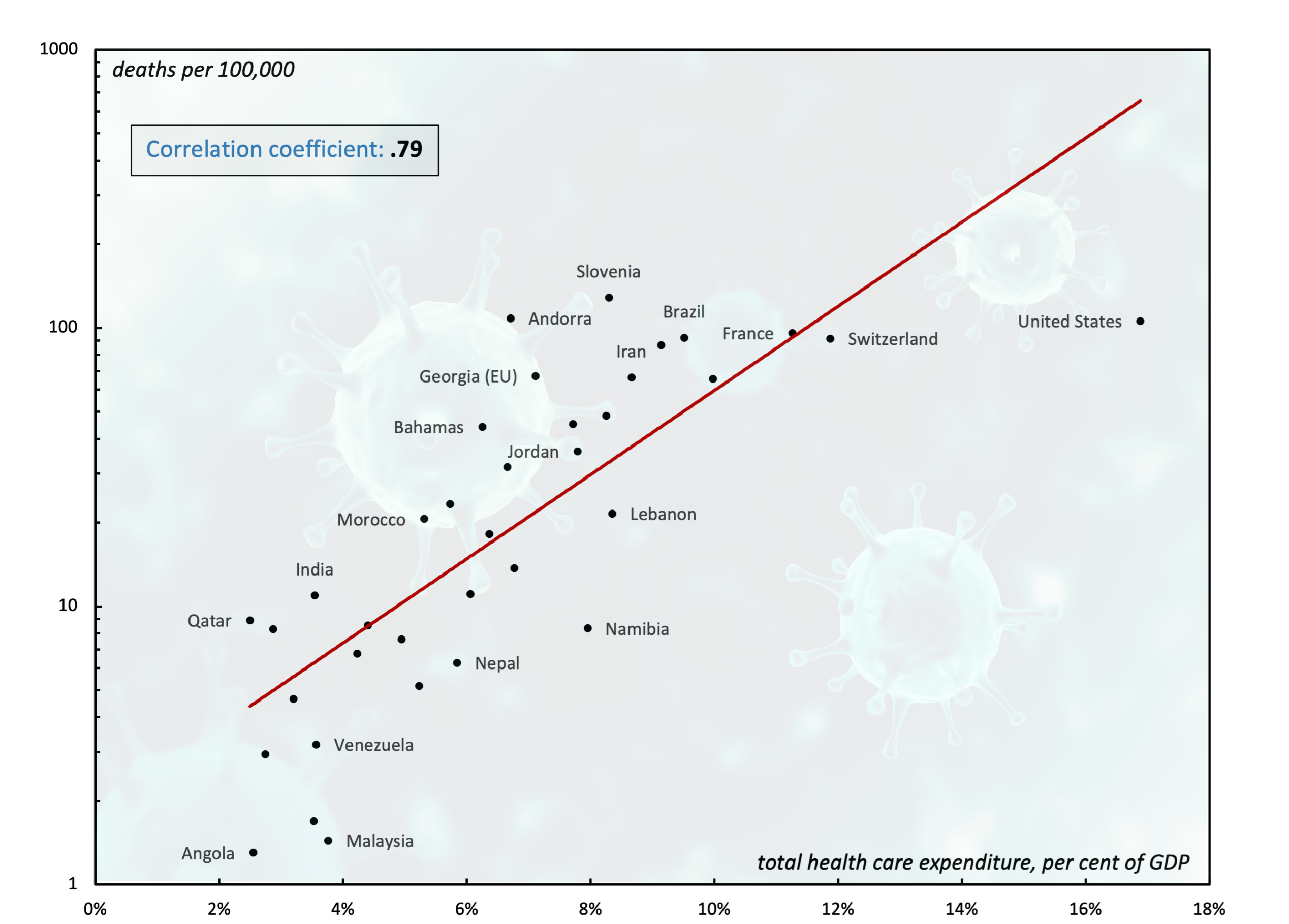

Continue ReadingMouré, ‘Costly Efficiencies: Healthcare Spending, COVID-19, and the Public/Private Healthcare Debate’

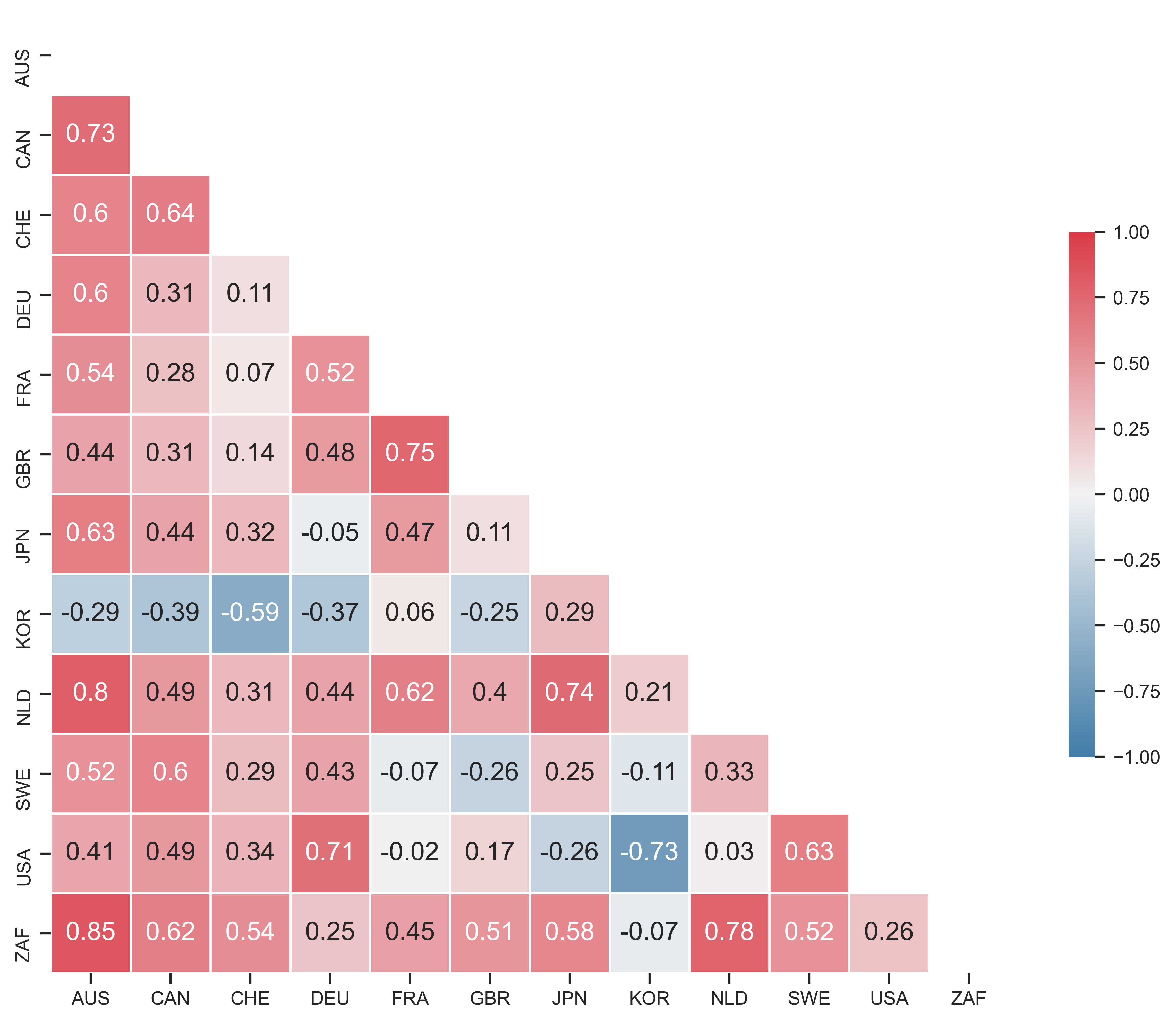

Costly Efficiencies Healthcare Spending, COVID-19, and the Public/Private Healthcare Debate CHRIS MOURÉ May 2022 Abstract Proponents of private healthcare often claim that the private sector is more ‘efficient’ at delivering healthcare services. This paper tests the privatization thesis in the context of the COVID-19 pandemic. Using a large sample of countries, I investigate how healthcare […]

Continue ReadingDi Liberto, ‘Hype: The Capitalist Degree of Induced Participation’

Hype The Capitalist Degree of Induced Participation YURI DI LIBERTO April 2022 Abstract Power is usually considered as either a ‘positive’ or ‘negative’ construct, as in the power to force action versus the power to forbid it. This paper explores a hybridized approach to power based on the idea of ‘induced participation’. Building on Bichler […]

Continue ReadingMouré, ‘Soft-wars: A Capital-as-Power Analysis of Google’s Differential Power Trajectory’

Soft-wars A Capital-as-Power Analysis of Google’s Differential Power Trajectory CHRIS MOURÉ October 2021 Abstract The capital as power framework, developed by Jonathan Nitzan and Shimshon Bichler, argues that the aim of business is not ‘profit maximization’ but the differential accumulation of social power. Using this framework as a theoretical starting point, I analyze the differential […]

Continue ReadingMcMahon, ‘Reconsidering Systemic Fear and the Stock Market’

Reconsidering Systemic Fear and the Stock Market A Reply to Baines and Hager JAMES MCMAHON August 2021 Abstract This article responds to Baines and Hager’s recent critique of the capital-as-power model of the stock market. Proposed by Bichler and Nitzan, this model seeks to explain how financial crises are tied to the concept of ‘systemic […]

Continue ReadingSuaste Cherizola, ‘From Commodities to Assets’

From Commodities to Assets Capital as Power and the Ontology of Finance JESÚS SUASTE CHERIZOLA May 2021 Abstract Assets are a crucial concept of the practice and mindset of the capitalist class. Critical analyses of capitalism, however, tend to admit that the exchange of commodities is the foundation of the analysis of capitalism. This article […]

Continue ReadingBichler and Nitzan, ‘Growing Through Sabotage’

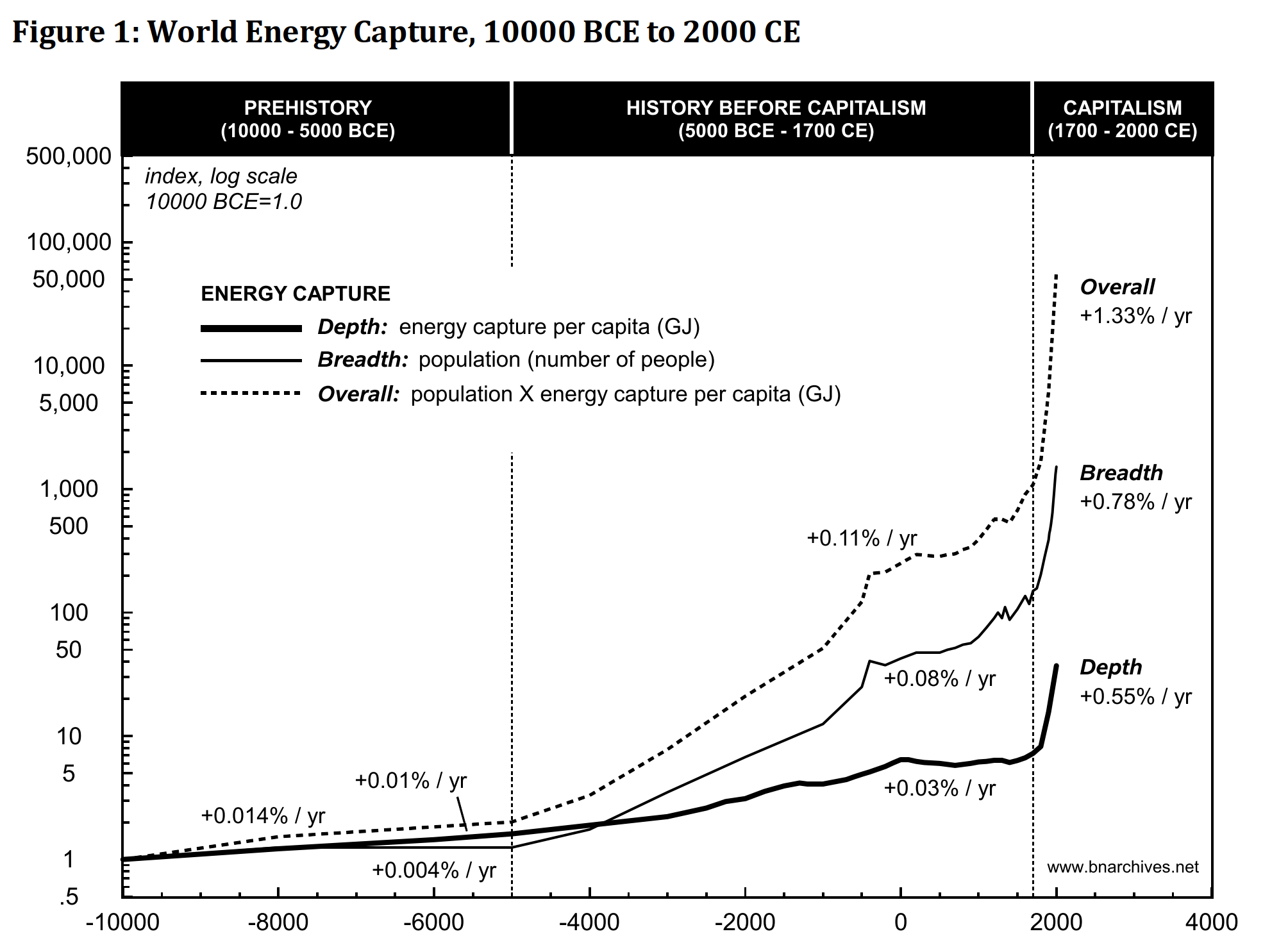

Growing Through Sabotage Energizing Hierarchical Power SHIMSHON BICHLER and JONATHAN NITZAN June 2020 Abstract According to the theory of capital as power, capitalism, like any other mode of power, is born through sabotage and lives in chains — and yet everywhere we look we see it grow and expand. What explains this apparent puzzle of […]

Continue ReadingThe Autocatalytic Sprawl of Pseudorational Mastery

The Autocatalytic Sprawl of Pseudorational Mastery ULF MARTIN May 2019 Abstract According to Jonathan Nitzan and Shimshon Bichler (2009), capital is not an economic quantity, but a mode of power. Their fundamental thesis could be summarized as follows: capital is power quantified in monetary terms. But what do we do when we quantify? What is […]

Continue ReadingPropertization: The Process by which Financial Corporate Power has Risen and Collapsed

Propertization The Process by which Financial Corporate Power has Risen and Collapsed JONGCHUL KIM September 2018 Abstract Elsewhere I argue that the legal concept of property was created in the image of money in the late Roman Republic. Since then, the division of property and contract has been an underlying structure of Western law. The […]

Continue ReadingTheory and Praxis, Theory and Practice, Practical Theory

Theory and Praxis, Theory and Practice, Practical Theory CORENTIN DEBAILLEUL, SHIMSHON BICHLER and JONATHAN NITZAN April 2018 Abstract In their paper ‘The CasP Project: Past, Present and Future’, Shimshon Bichler and Jonathan Nitzan invite readers to engage critically with their theoretical framework, known as capital as power (CasP). This call for further research, reactions and […]

Continue ReadingThe CasP Project Past, Present, Future

The CasP Project Past, Present and Future SHIMSHON BICHLER and JONATHAN NITZAN April 2018 Abstract The study of capital as power (CasP) began when we were students in the 1980s and has since expanded into a broader project involving a growing number of researchers and new areas of inquiry. This paper provides a bird’s-eye view […]

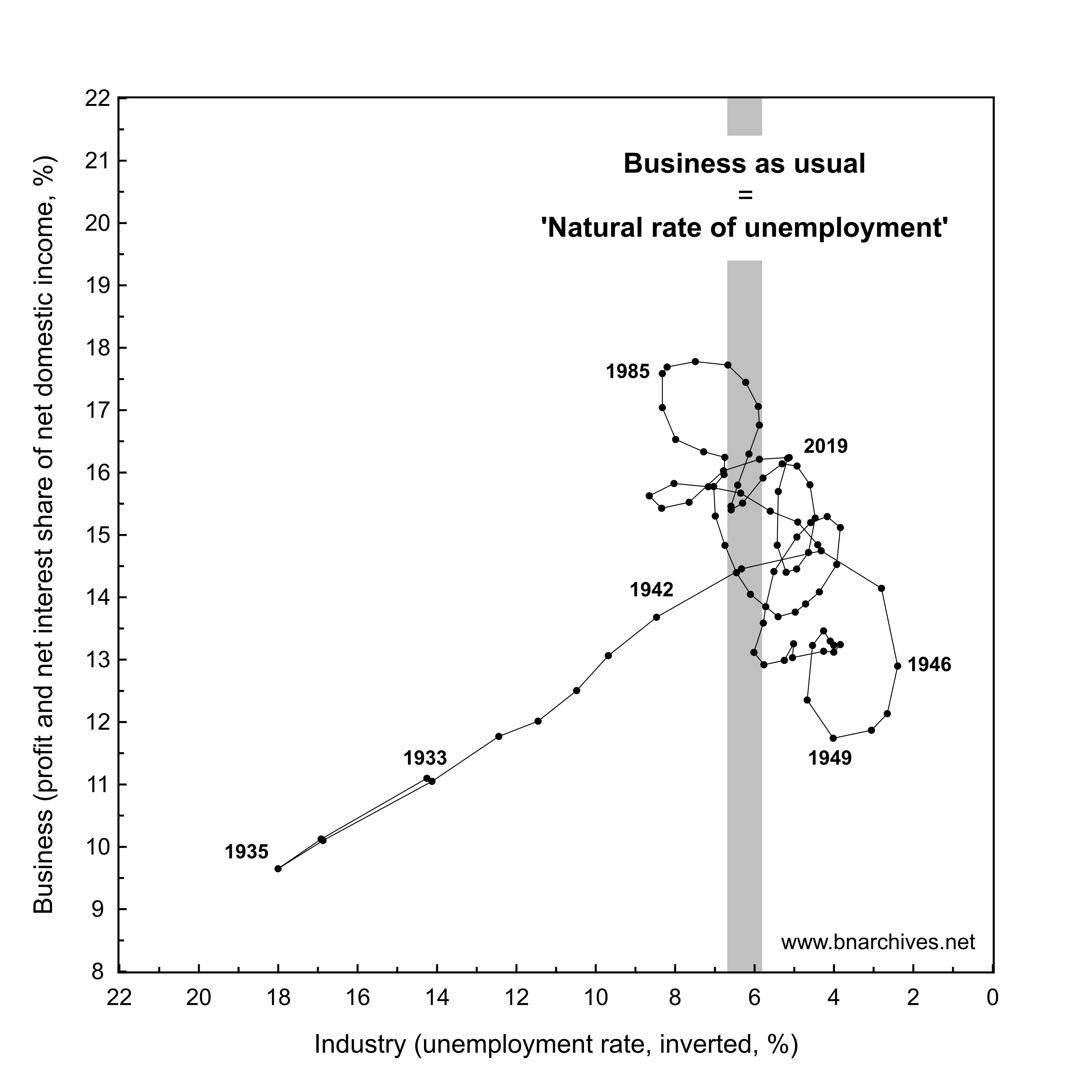

Continue ReadingPutting Power Back into Growth Theory

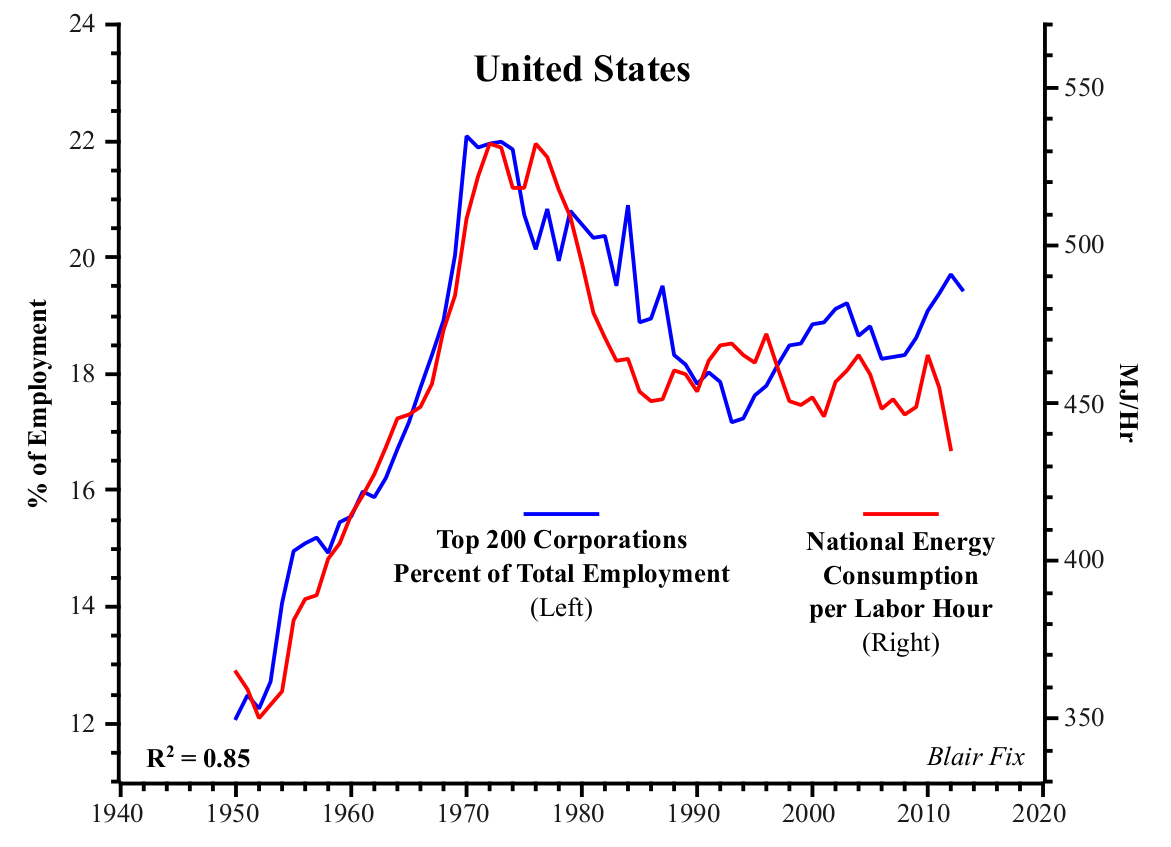

Putting Power Back Into Growth Theory BLAIR FIX June 2015 Abstract Neoclassical growth theory assumes that economic growth is an atomistic process in which changes in distribution play no role. Unfortunately, when this assumption is tested against real-world evidence, it is systematically violated. This paper argues that a reality-based growth theory must reject neoclassical principles […]

Continue ReadingCan Capitalists Afford Recovery?

Can Capitalists Afford Recovery? Three Views on Economic Policy in Times of Crisis JONATHAN NITZAN and SHIMSHON BICHLER October 2014 Abstract Economic, financial and social commentators from all directions and of various persuasions are obsessed with the prospect of recovery. The world remains mired in a deep, prolonged crisis, and the key question seems to […]

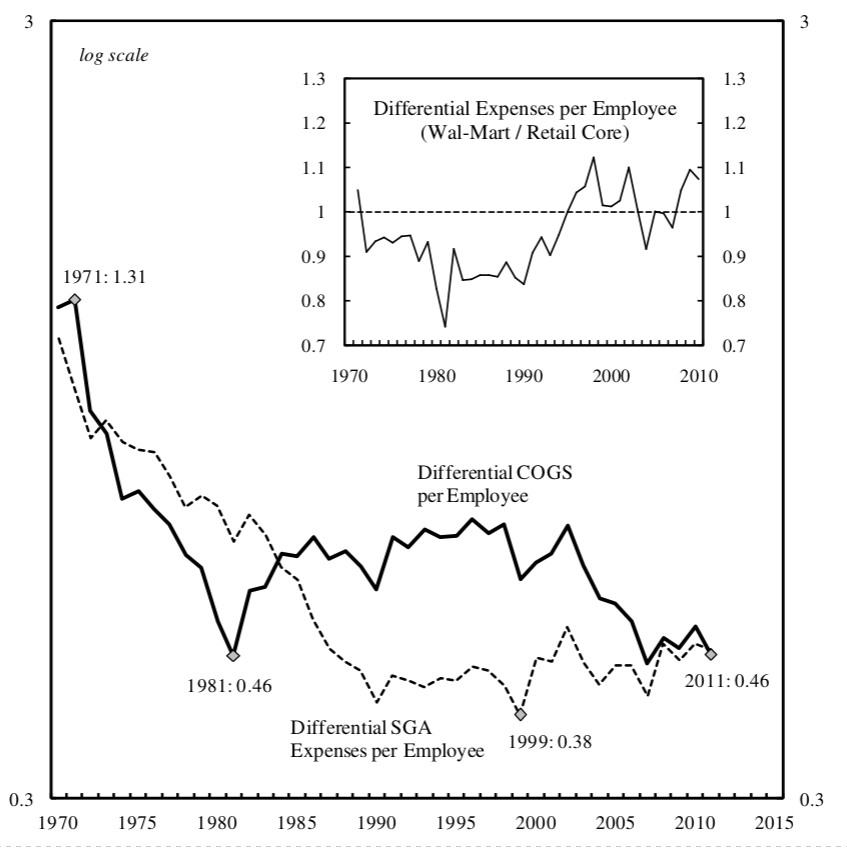

Continue ReadingWal-Mart’s Power Trajectory: A Contribution to the Political Economy of the Firm

Wal-Mart’s Power Trajectory A Contribution to the Political Economy of the Firm JOSEPH BAINES March 2014 Abstract This article offers a power theory of value analysis of Wal-Mart’s contested expansion in the retail business. More specifically, it draws on, and develops, some aspects of the capital as power framework so as to provide the first […]

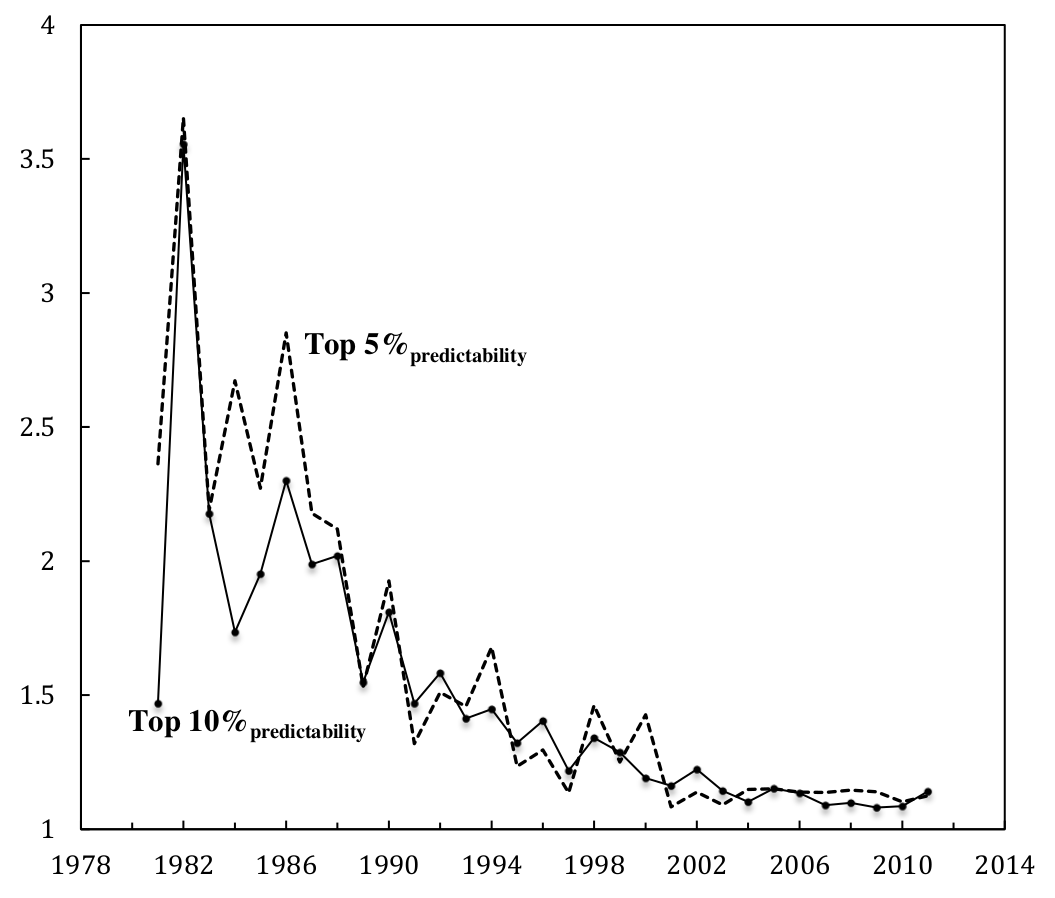

Continue ReadingThe Rise of a Confident Hollywood: Risk and the Capitalization of Cinema

The Rise of a Confident Hollywood Risk and the Capitalization of Cinema JAMES MCMAHON February 2013 Abstract This paper investigates the historical development of risk in the Hollywood film business. Using opening theatres as a proxy for future expectations, the paper demonstrates how, from 1981 to 2011, Hollywood has improved its ability to predict the […]

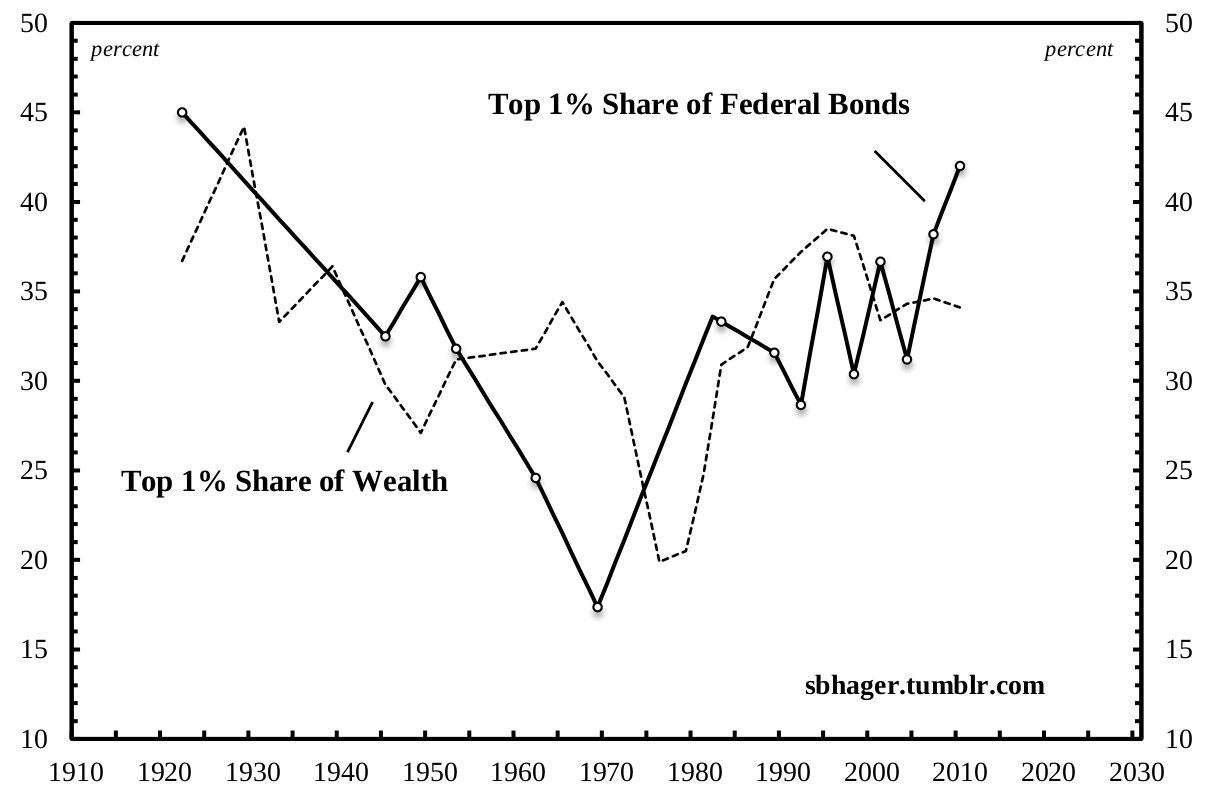

Continue ReadingAmerica’s Real ‘Debt Dilemma’

America’s Real ‘Debt Dilemma’ SANDY BRIAN HAGER July 2013 Abstract In the wake of the current crisis there has been an explosive rise in the level of the US public debt. These massive levels of public indebtedness are expected to keep growing unless there are drastic changes to existing budgetary policies. According to a recent […]

Continue Reading