The Rise of a Confident Hollywood

Risk and the Capitalization of Cinema

JAMES MCMAHON

February 2013

Abstract

This paper investigates the historical development of risk in the Hollywood film business. Using opening theatres as a proxy for future expectations, the paper demonstrates how, from 1981 to 2011, Hollywood has improved its ability to predict the financial rankings of its films. More specifically, the Hollywood film business has become better at predicting which films will earn a greater-than average share of all US box-office gross revenues through a wide release strategy. This greater predictability suggests that confidence in film earnings projections has increased.

Keywords

capitalization, cinema, Hollywood, risk

Citation

James McMahon (2013), ‘The Rise of a Confident Hollywood: Risk and the Capitalization of Cinema’, Review of Capital as Power, Vol. 1, No. 1, pp. 23-40.

Nature ceased to be inscrutable, subject to demonic incursions from another world: the very essence of Nature, as freshly conceived by the new scientists, was that its sequences were orderly and therefore predictable: even the path of a comet could be charted through the sky. It was on the model of this external physical order that men began systematically to reorganize their minds and their practical activities: this carried further, and into every department, the precepts and practices empirically fostered by bourgeois finance. Like Emerson, men felt that the universe itself was fulfilled and justified, when ships came and went with the regularity of heavenly bodies.

— Lewis Mumford, Technics and Civilization

The Rise of a Confident Hollywood: Risk and the Capitalization of Cinema1

The Hollywood film business, like any other business enterprise, operates according to the logic of capitalization. Capitalization in an instrumental logic that is forward-looking in its orientation. Capitalization expresses the present value of an expected stream of future earnings. And since the earnings of the Hollywood film business depend on cinema and mass culture in general, we can say that the current fortunes of the Hollywood film business hinge on the future of cinema and mass culture. The ways in which pleasure is sublimated through mass culture, and how these ways may evolve in the future, have a bearing on the valuation of Hollywood’s control of filmmaking. Thus, the major filmed entertainment firms of Hollywood discount expected future earnings to present prices according to their perception of the social-historical state of pleasure.

Included in the capitalization formula is a risk coefficient (δ). This coefficient denotes the degree of confidence capitalists have in their earnings predictions. This relationship between expected earnings and risk is visible when we write the capitalization equation in a simplified form.2 Capitalization at any given time (Kt) is equal to the discounted value of expected future earnings (EE). Expected future earnings are discounted by two variables: a rate of return that capitalists feel they can confidently get (rc) and the risk coefficient (δ). Put all of these pieces together and you have the following equation:

Risk is an important variable in the capitalization of cinema. From the perspective of investment, the future shape of cinema cannot be so uncertain that capitalists are unable to estimate, with even a modicum of confidence, how the earnings of a possible film project will rank in the order of cinema. For capitalists to invest, the risk coefficient has to be finite, which in turn means that, however uncertain, capitalists expect the future of cinema to have determinable boundaries. Even uncertain estimations cannot retain the idea that infinite possibilities make the future order of cinema — e.g., how many films, what types of films, and what is popular — completely unknowable. Conversely, confidence in the capitalization of cinema can increase if risk perceptions about the volatility of a film’s earnings can be decreased. Thus, capitalists are interested in creating a cultural environment where films have financial trajectories like comets in the sky. If the world of cinema can be made to have ‘stable’ laws of motion, vested interests can depend on this machine-like regularity when it translates the art of cinema into the quantities of capital.3

The first section of this paper will outline how the order of cinema itself is relevant to the capitalization of cinema. The rest of the paper investigates the historical development of risk in the Hollywood film business. Using opening theatres as a proxy for future expectations, the paper demonstrates how, from 1981 to 2011, Hollywood has improved its ability to predict the financial rankings of its films. More specifically, the Hollywood film business has become better at predicting what films will earn a greater-than-average share of all US box-office gross revenues through a wide release strategy. This finding suggests that confidence in film earnings projections has increased.

Before proceeding, a quick note on the scope of this paper: The capital-as-power framework, which was first developed by Jonathan Nitzan and Shimshon Bichler, is instrumental to this analysis of risk in the Hollywood film business (Nitzan & Bichler 2009). The capital-as-power framework, however, automatically nudges the empirical analysis found in this paper towards much larger empirical and theoretical questions. Most importantly, the capital-as-power framework, by design, engenders curiosities about the connection between risk and differential accumulation. While it would certainly make for a more robust picture of the Hollywood film business, an analysis of differential accumulation is beyond the scope of this paper.

For one thing, an applied theory of differential accumulation would need to break the category “the Hollywood film business” into smaller parts. Indeed, firms in the Hollywood film business can be separated according to whether they produce, distribute or exhibit films; and this separation would allow us to focus on major filmed entertainment, the group of firms that warrant a comparison with the historical performance of dominant capital. Commonly known as the “Hollywood studios,” major filmed entertainment is primarily in the business of distribution and is comprised of six firms: Disney, Paramount, Colombia, 20th Century Fox, Warner Bros. and Universal.

Yet, for the more immediate purpose of analyzing risk and the capitalization of cinema, “the Hollywood film business” remains an appropriate category, at least as a starting point for future research. Just as Nitzan and Bichler note how the universal quality of the capitalization formula makes “people the world over march to the invisible command of capital” (Nitzan & Bichler 2009, p.270), risk perceptions about cinema are not simply particular to the owners of major filmed entertainment. In the Hollywood film business, producers, exhibitors, agents, actors and directors are united with major filmed entertainment because they are all ‘free’ to apply the instrumental logic of capitalization to the world of cinema and the industrial art of filmmaking.

Risk and the Future Order of Cinema

Capitalization is not a crystal ball in which the future is revealed to vested interests. As Nitzan and Bichler emphasize in their description of capitalization, capitalists are no better at predicting the future than anyone else — “like the rest of us, they can never see [the future]” (Nitzan & Bichler 2009, p.187).4 However, capitalization is, by design, concerned with the future of investment; it is a logic that is obsessed with estimating future earnings and whether they will or will not translate into actual earnings. By following the rituals of capitalization, the Hollywood film business is concerned with the future of mass culture.

Risk is a variable in the capitalization equation. It is an ex ante variable in the valuation of an asset and not an ex post explanation for why a capitalist ‘deserved’ a particular rate of return.5 Risk is a partly subjective factor that shapes the way a claim on future earnings is assessed. If capitalization discounts the size and pattern of a future stream of earnings, risk is the expression of the “degree of confidence capitalists have in their own predictions” (Nitzan & Bichler 2009, p.208). Nitzan and Bichler argue that this degree of confidence appears in the capitalization equation as a risk coefficient (δ). A smaller δ indicates a greater the degree of confidence and a larger capitalization, and vice versa when δ is larger. If, for instance, there is growing uncertainty about the size and pattern of a future stream of earnings, δ will increase and the asset in question will be discounted to a lower present price. This outcome can be derived from the capitalization equation, which can be presented once more:

How can we understand the role of risk in the capitalization of cinema? One of the ways is to think of how the world of cinema itself, as a composition of films, is an object of risk perceptions. The shape and order of cinema becomes significant for the rituals of capitalization because, in a sense, every film is in a cohort. For every year, a set of films is released and each film in the set acquires a financial ranking by virtue of being capitalized. To explain how this relates to risk perceptions in the Hollywood film business, let me provide some background about the quantitative language of capital and its application in the art of filmmaking.

The application of capitalization to the qualitative world of cinema implies that the qualities of films have become what Herbert Marcuse would call “quantifiable qualities” (Marcuse 1991, p.136). From the perspective of investment, the industrial art of filmmaking and the social world of mass culture are meant to be controlled in the interest of pecuniary gain. The Hollywood film business may or may not have successful strategies for creating an order of cinema through the control of filmmaking — that is yet to be determined — but it must translate the political, cultural and aesthetic qualities of cinema into the quantitative language of capital. Nitzan and Bichler’s argument about the eye of capitalization explains why a film’s many qualities — e.g., its genre, style, story, cast, director, production quality — and its possible resonance with established cultural and political attitudes would all be “integrated into the numerical architecture of capital”: the many dimensions of cinema could impact “the level and pattern of capitalist earnings” (Nitzan & Bichler 2009, p.166).

A film project is translated into the language of capital in its germinal stages, well before the first day of filming. Expectations about future earnings are being discounted to present prices when some scripts are sold while others are ignored, when some projects are properly developed while others sit idle, and when some projects are produced while others never make it out of “development hell.”6 As Janet Wasko points out in contrast to popular belief, “Hollywood films do not begin when the camera starts rolling, but involve a somewhat lengthy and complex development and pre-production phase during which an idea is turned into a script and preparations are made for actual production followed by post-production” (Wasko 2008, p.43). A project begins as a film concept, usually in the form of a full script in its first draft. If approved by management, the project then goes into development (which is far from the production stage), usually under the wing of a development executive (Wasko 2008, p.45). In development, the film concept is polished, the script is edited and re-edited, sometimes even rewritten completely, and producers and agents start talking about the film’s possible “players” (main cast and director).

Throughout this process, the capitalization of cinema is concerned with how films will rank in the order of cinema. For one thing, the quantitative language of capital makes every film financially comparable. When a film is given an expected theatrical revenues plateau (e.g., $10 million, $50 million, $200 million), the Hollywood film business is making an estimate about the future popularity of the film (Barry Russell Litman 1998, p.44). And how a specific film is capitalized has something to do with its particular political, cultural and aesthetic qualities. Yet, this financial estimate automatically positions a film among other films. An estimate that a film will, for instance, earn $100 million in theatrical revenues is meaningful in relation to how other contemporary films are capitalized. An expectation of $100 million means one thing when, at a given time, $125 million in box-office revenues is the average expectation for most Hollywood films. It means something else when an estimation of $100 million puts the particular film at the top of its cohort. Depending on how other films are capitalized, capitalists could expect that $100 million in box-office revenues would make this film one of the top grossing films of its year of release.

Knowing how the expectations of one film relates to the expectations of all other films in the same time period is also significant when there is historical evidence that top ranking films have been able to differentially perform. Predicting that a film will be one of the top grossing films of the year matters given that, since the late 1940s, the top one percent of films have increased their share of all box-office revenues per year. Mark Weinstein describes this phenomenon: “In the late 1940s, the top 1 percent of films represented 2 percent to 3 percent of studio revenue; by the early 1960s, this had tripled, to an average of about 6 percent. This trend has continued in recent years. In 1993 the world-wide revenues for the top 1 percent (two films) of 163 major-studio released films were 13.8 percent of the total [revenues]” (Weinstein 2005, p.252).

Moreover, a confident prediction about how a film will rank in the order of cinema is also a strong recommendation about distribution strategy. It is common practice for the Hollywood film business to give wide theatrical releases to what it thinks will be “blockbusters” or “must-see events.” This strategy is also known as saturation booking, in which a film is simultaneously shown on many screens in many theatres (Maltby 2003, p.182). While it is a common one, this wide release strategy is relevant for our analysis of risk because it is not a universal strategy. Unlike “platform” releases, which open in a small number of theatres, usually in select cities (New York, Los Angeles, etc.), “wide” releases are designed to begin, from their very first week, in thousands of theatres across America. For example, Star Wars opened on nearly 3,000 theater screens in the United States (De Vany 2004, p.48). Furthermore, a wide release is meant to pull in the bulk of its revenues in the first few weeks of its theatrical release — e.g., the 2001 film The Mummy Returns earned 90 percent of its total theatrical revenues in the first five weeks. Conversely, a platform release like O Brother, Where Art Thou? took four months to earn 90 percent of its total theatrical revenues.7

The History of Risk Perceptions in Hollywood

The remainder of this paper traces the historical development of risk in Hollywood cinema. This type of analysis is useful for the creation of an alternative, critical perspective on the Hollywood film business. Essentially, the historical development of risk is useful because it can frame any subsequent questions about how Hollywood has reduced risk. A critical study of how risk is effectively reduced through particular techniques, such as the repetition of genres, sequels and remakes, the cult of movie stars, and the institution of false needs and wants, can still head in the wrong direction if one is not cognizant of where latent theoretical assumptions in political economy leads them. While all of the differences between mainstream economics, Marxism and the capital-as-power theory cannot be enumerated here, we can, with respect to the purpose of this section, briefly focus on one important point. Risk-reduction strategies in Hollywood is a popular subject in mainstream economic literature, but these investigations tend to run into theoretical problems because the historical development of risk is virtually ignored (De Vany 2004; Barry Russell Litman 1998; Nelson & Glotfelty 2012; Pokorny 2005).

Much of the academic literature on the Hollywood film business moves from the particular to the universal; its general conclusions about risk are drawn out of its empirical analyses that focus on one or many risk-reduction strategies. By making risk-reduction strategies its primary concern, mainstream academic literature turns filmmaking into a production function, and from there, the debate is about whether certain techniques are effective. Famous movie stars, with their perceived ability to draw consumers to some movies rather than others, are most commonly analyzed as being factors of production that are employed to reduce the financial risks of Hollywood cinema (Elberse 2007; Hadida 2010; Ravid 1999). Style is also a risk-reduction technique, particularly the blockbuster method of filmmaking (Barry R. Litman 1983; Ravid 1999; Denisoff & Plasketes 1990).

These investigations, however, say little about the historical development of risk. In fact, the possibility for risk perceptions to significantly change over time is out of place in studies that also assume so-called economic actors are too small to change the historical circumstances of risk. In the mainstream literature, risk-reduction strategies like using movie stars or making blockbuster movies, no matter how effective, never transform the business environment itself (De Vany 2004, p.270). In part because its oligopolistic character is downplayed or even ignored, the Hollywood film business, as a whole, is seen to have an ‘inherent’ level of risk that remains in spite of any strategy. In this “power-free” version of Hollywood cinema, risk-reducing techniques are essentially conservative reactions to consumer sovereignty, which is always an extraneous force. Techniques can be effective, they can even somehow “lower risks for subsequent projects,” but, in this theoretical narrative, capitalists cannot create a cultural environment that favors their pecuniary interests. The world of cinema can never be made to have machine-like regularity if it is assumed the sovereign consumer is an unalterable variable that always has the same “economic” freedom to be fickle when the next film is released (Garvin 1981, p.4).

The notion that risk has an ‘inherent’ level because firms only ever mitigate the volatility of consumer sovereignty adds an unnecessary theoretical obstacle to an investigation of how Hollywood’s risk coefficient has changed over time. This is certainly the case when an individual author considers the ‘inherent’ level of risk to be so high that ex ante predictions are impossible. Arthur De Vany, for instance, uses complex statistical modeling to substantiate screenwriter William Goldman’s statement that, with respect to making predictions about the future of Hollywood cinema, “nobody knows anything.” According to De Vany,

revenue forecasts have zero precision, which is just a way of saying that ‘anything can happen’…. The ‘nobody knows’ principle…is revealed in the infinite variance and scale-free form of the probability distribution. When the probability distribution is scale free it has no characteristic size and there is no typical movie. If variance is infinite, the prediction is impossible; one can only say that the expected revenue of a movie is X plus or minus infinity.

(De Vany 2004, pp.71, 260)

De Vany’s conclusion that “the confidence interval of [a] forecast is without bounds” (De Vany 2004, p.71) is unsatisfying because it is embedded in a framework that assumes the Hollywood film business is eternally beholden to this extremely high degree of uncertainty. To be sure, it could certainly be possible that Hollywood has had a period of great uncertainty; however, an analysis of risk cannot help but reify its conclusions when the analysis also holds onto a hollow concept of history.8

How can we investigate the historical development of risk in Hollywood cinema? My method involves using opening theatres as a proxy for future expectations. Opening theatres stands as a proxy for future expectations because the decision about the size of opening theatres is made before a stream of box-office revenues actually begins to flow; decisions about what is a good release strategy for each film derive from financial expectations about what will happen to each film on its opening weekend and onwards. Furthermore, as I established above, the Hollywood film business is concerned with the future pecuniary rank of its films, which relates to the strategy of giving some films, but not all, wide theatrical releases. To be sure, not every high grossing film is the product of a wide release strategy. A platform release can, over time, become popular and consequently earn a relatively high level of gross revenues. For example, Schindler’s List opened in 25 theatres and was the ninth highest grossing film of 1993. Yet, behind the fact that some films are, from day one, released in 1500, 2000 or even more theatres, is an assumption about expected revenues. In a sense, major filmed entertainment does not wait for its wide releases to eventually become popular. A wide release has, in comparison to a platform release, a shorter lifespan because its impact is supposed to be quick but big.

Historical data on opening theatres enables us to approximate the evolution of Hollywood’s risk coefficient (δ), which denotes the confidence the Hollywood film business has in its predictions about the future financial performance of cinema. This approach demonstrates that from 1981 to 2011, Hollywood has been able to improve its ability to predict the financial performance of its films. This increased predictability reflects a better understanding of and perhaps a greater ability to shape popular culture. And this greater understanding and ability in turn translates into higher confidence, lower risk perception and higher capitalization.

How can we use opening theatres to approximate the long-term trajectory of Hollywood’s risk perceptions? On the idea that opening theatres is a proxy for future expectations, opening theatres data can be used to compare expected theatrical gross revenues and actual theatrical gross revenues. Take, for example, 1986. To get a sense of Hollywood cinema in 1986, one can go to a website like boxofficemojo.com and reproduce Table 1, which is presented here in abridged format. This table ranks, in descending order, 1986 films in the first column by their domestic box-office gross revenues in the second. In addition, a third column shows the number of opening theatres for each film.

Table 1: Films Released in 1986: Ranked by Box-Office Gross Revenues

| Film | Box-Office Gross Revenues | Opening Theatres |

|---|---|---|

| Top Gun | $176,786,701 | 1,028 |

| Crocodile Dundee | $174,803,506 | 879 |

| Platoon | $138,530,565 | 6 |

| The Karate Kid Part II | $115,103,979 | 1,323 |

| Star Trek IV: The Voyage Home | $109,713,132 | 1,349 |

| Back to School | $91,258,000 | 1,605 |

| Aliens | $85,160,248 | 1,437 |

| The Golden Child | $79,817,937 | 1,667 |

| … | … | … |

Source: www.boxofficemojo.com for US theatrical gross revenues and opening theatres.

Table 1 is interesting for a few reasons. What first stands out is Platoon, which opened in six theatres but eventually went on to become the third highest grossing film of 1986. This would be a good example of a highly successful platform release. The second and perhaps more important point is that there is no one-to-one match between revenue rankings and opening theatre rankings. For example, the two top grossing films — Top Gun and Crocodile Dundee — did not have the two widest releases of that year. Already on this abridged list, we can see five films that had wider releases in 1986.

Table 2 offers a different view of the same year. It sorts out all of the films released in 1986 not by box-office revenues, but by opening theatres. Aside from two films, Back to School and The Golden Child, none of the films in Table 2 appear in Table 1. The films in Table 2 had the widest releases in 1986 but only two of them were able to even reach the $50 million plateau.

Table 2: Films Released in 1986: Ranked by Opening Theatres

| Film | Box-Office Gross Revenues | Opening Theatres |

|---|---|---|

| Cobra | $49,042,224 | 2,131 |

| Police Academy 3: Back in Training | $43,579,163 | 1,788 |

| Raw Deal | $16,209,459 | 1,731 |

| The Delta Force | $17,768,900 | 1,720 |

| The Golden Child | $79,817,937 | 1,667 |

| Friday the 13th Part VI | $19,472,057 | 1,610 |

| Back to School | $91,258,000 | 1,605 |

| Poltergeist II: The Other Side | $40,996,665 | 1,596 |

| … | … | … |

Source: www.boxofficemojo.com for US theatrical gross revenues and opening theatres.

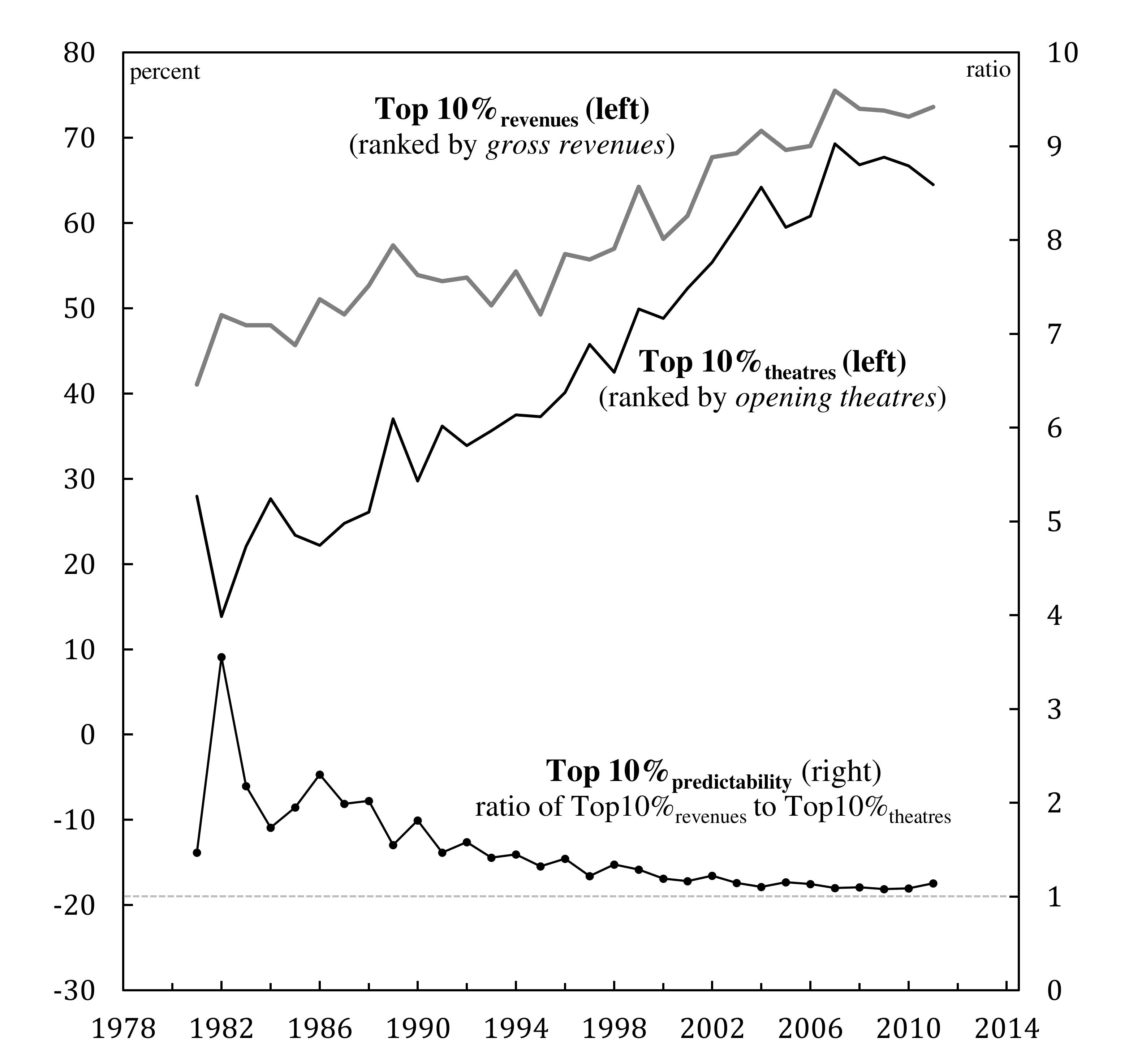

Taken together, Tables 1 and 2 compare the top performing films (ranked by gross revenues) to what Hollywood expected the top performing films to be (ranked by opening theatres). Figure 1 extends this comparison over time. The figure contains three time series. Top 10%revenues measures, for each year, the US box-office gross revenues of the top ten percent of all films, ranked by box-office gross revenues (comparable to Table 1). The revenue data are presented as a percent share of all US box-office gross revenues for each year. The second series, Top 10%theatres, measures, for each year, the US box-office gross revenues of the top ten percent of all films, ranked by opening theatres (comparable to Table 2). This series is also presented as a percent share of all US box-office gross revenues.

Figure 1: US Gross Theatre Revenues: The Share of the Top 10% of All Films.

Note: Boxofficemojo.com provides, from 1981 to 2011, data for each film released in the United States. After grouping every film from 1981 to 2011 by their year of release, I sort each year twice: once to rank all films by their gross revenues, and another time by their opening theatres. Both times I measure the Top 10% share of the yearly total of US gross revenues. Each year, the measure of Top 10% is adjusted by the annual total of films released in the United States.

Note: The series that is sorted by opening theatres is not simply measuring opening weekend revenues. It measures total theatrical gross of each relevant film.

Source: www.boxofficemojo.com for number of films released per year, US theatrical gross revenues and opening theatres for each film, and the sum of all US theatrical gross revenues.

Similar to Weinstein’s observations, Top 10%revenues demonstrates how the top tier of films has, over a twenty-year period, increased its share of all US box-office gross revenues. The top ten percent of films in 1981 grabbed approximately 41 percent of all US box-office gross revenues for that year. In 2007 the top ten percent grabbed a 75 percent share of all US box-office revenues.

What is more interesting for our purpose, however, is the relationship between Top 10%revenues and Top 10%theatres. From the mid-1990s onwards, their fluctuations grow increasingly correlated.9 Additionally, over time the two series converge. This second observation is expressed with the third series of Figure 1, Top 10%predictability. Top 10%predictability presents, from 1981 to 2011, the ratio of Top 10%revenues to Top 10%theatres.

We can see that, over time, (1) the size of the ratio has decreased, getting closer and closer to 1, and (2) that the fluctuations in this ratio have lessened. What does it mean when Top 10%predictability is close to 1? Technically, it means that Top 10%revenues and Top 10%theatres are counting more of the same films. In other words, in a year when Top 10%predictability is close to 1, the highest grossing films were also, more or less, given the widest releases. Conceptually, the declining ratio and fluctuations of Top 10%predictability suggest that Hollywood is getting better at predicting which movies will financially perform better than their cohorts. As the ratio approaches 1, the top 10% of the films put up for wide release end up also being the top 10% in terms of gross revenues, which is significant if the top tier of films are grabbing larger shares of all box-office revenues.

Table 3: Rankings in 2007

| Ranked by Box-Office Gross Revenues | Ranked by Opening Theatres | |

|---|---|---|

| Spider-Man 3 | Pirates of the Caribbean: At World’s… | |

| Shrek the Third | Harry Potter and the Order… | |

| Transformers | Spider-Man 3 | |

| Pirates of the Caribbean: At World’s… | Shrek the Third | |

| Harry Potter and the Order… | Transformers | |

| I Am Legend | Fantastic Four: Rise of the Silver Surfer | |

| The Bourne Ultimatum | Ratatouille | |

| National Treasure: Book of Secrets | Bee Movie | |

| … | … |

Source: www.boxofficemojo.com for US theatrical gross revenues and opening theatres.

For instance, in 2007, the value of the ratio was 1.089. Out of a possible 63 films, 46 films are included in both Top 10%revenues and Top 10%theatres of that year. We can catch a glimpse of this fact by examining the top films of 2007 in Table 3. Table 3 reproduces for 2007, in abbreviated form, the two perspectives of Tables 1 and 2. In 1986 only one film appeared in both Table 1 and Table 2 — Back To School. As Table 3 demonstrates, five films appear in both rankings for 2007. Furthermore, the same five films of 2007 occupy, although in different order, both top five spots.

Future Research on the Hollywood Film Business

Figure 1 demonstrates how, from 1981 to 2011, the Hollywood film business has been able to improve its predictions about what films will be in the top ten percent of each calendar year, ranked by box-office gross revenues. This improvement is a product of predicting, with greater confidence, which films will earn a greater share of all revenues through a wide release strategy. If the example of 2007 is any indication of risk perceptions about the contemporary order of Hollywood cinema, we can infer that major filmed entertainment has been able to predict the shape of this order with a greater degree of confidence.

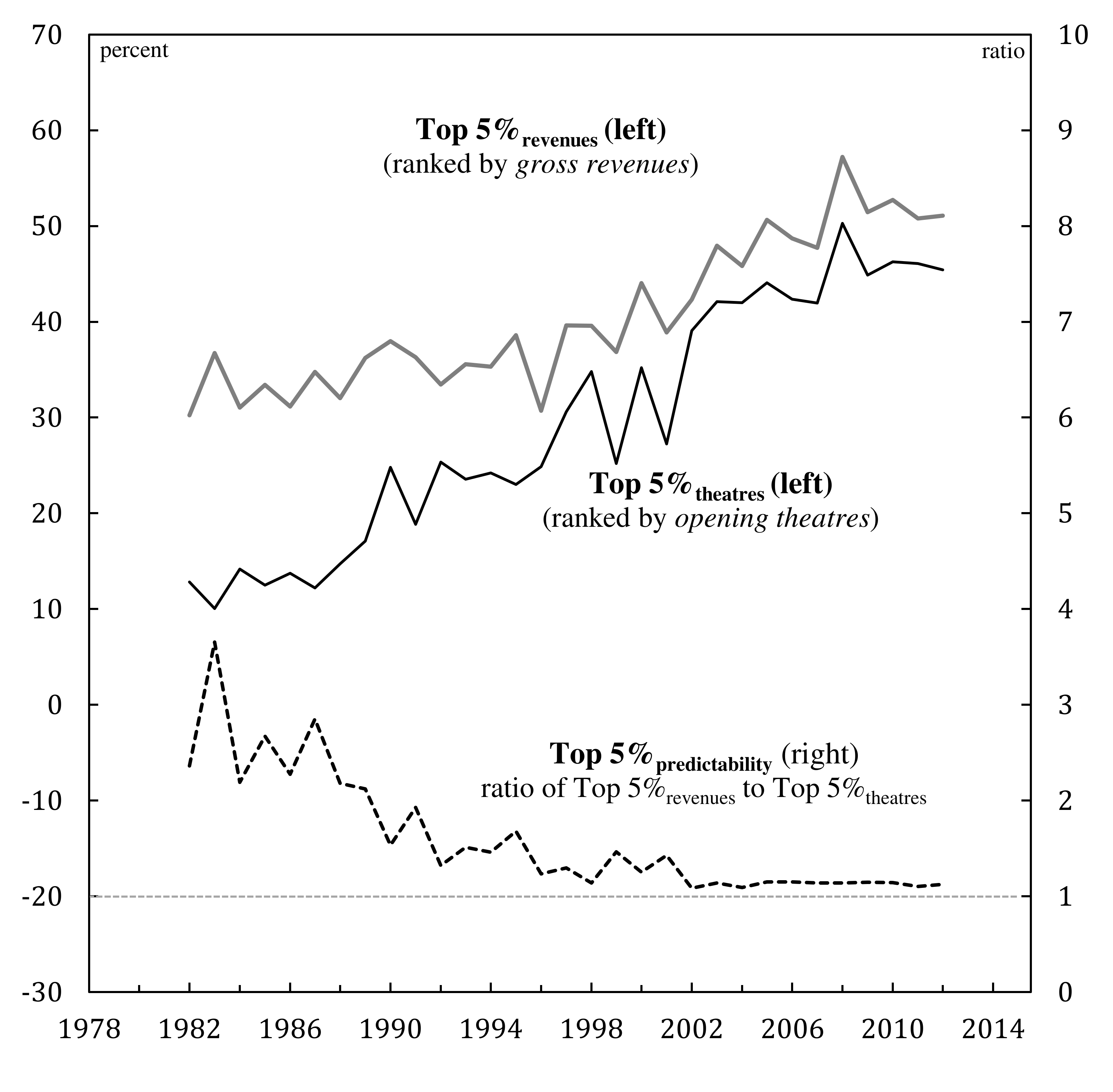

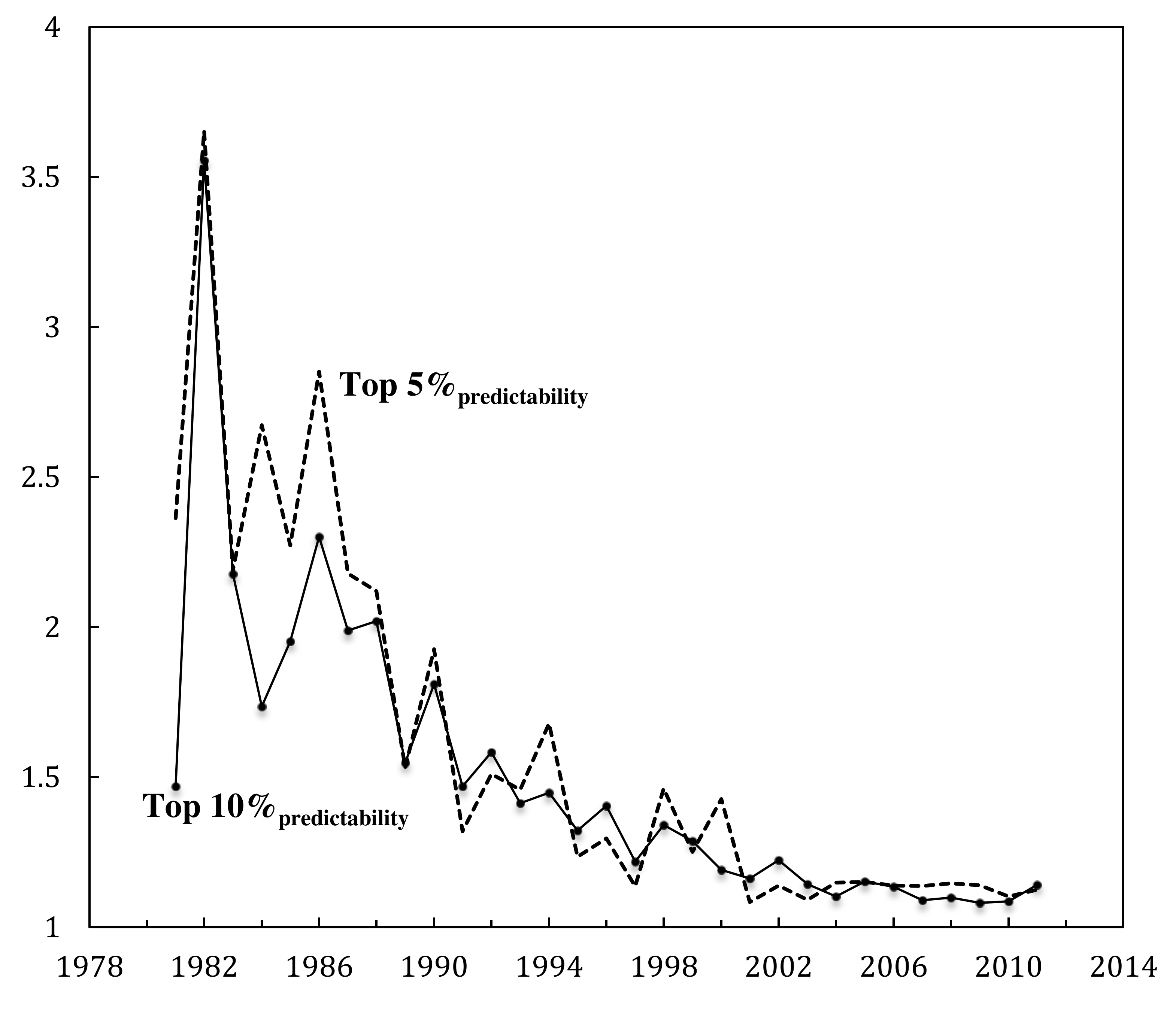

Figure 1 can extend into future research on the capitalist nature of Hollywood. Its implications can be developed both empirically and theoretically. The next research task at hand is to refine this method of accounting for the future expectations of the Hollywood film business. For instance, the scope of Figure 1 is the top ten percent of each year. This scope can be widened or narrowed with future applications. Figure 2, for example, is the same as Figure 1, except that the former focuses on the top five percent of each year. Not only does Figure 2 corroborate what Figure 1 implies, Top 5%predictability can be compared to Top 10%predictability. This comparison is made in Figure 3.

Figure 2: US Gross Theatre Revenues: The Share of the Top 5% of All Films.

Note: Boxofficemojo.com provides, from 1981 to 2011, data for each film released in the United States. After grouping every film from 1981 to 2011 by their year of release, I sort each year twice: once to rank all films by their gross revenues, and another time by their opening theatres. Both times I measure the Top 5% share of the yearly total of US gross revenues. Each year, the measure of Top 5% is adjusted by the annual total of films released in the United States.

Note: The series that is sorted by opening theatres is not simply measuring opening weekend revenues. It measures total theatrical gross of each relevant film.

Source: www.boxofficemojo.com for number of films released per year, US theatrical gross revenues and opening theatres for each film, and the sum of all US theatrical gross revenues.

Figure 3: Two Measures of Declining Risk

Note: See Figures 1 and 2.

This paper can also be the stepping-stone to a larger investigation of the power underpinnings of Hollywood’s risk perceptions. The rise of a confident Hollywood suggests that its firms have found more effective means of developing, green-lighting and producing the “right” set of films. Using the capital-as-power framework, we can ask bigger questions about the ways in which the art of filmmaking is made to dance to the tune of business enterprise. The capitalization of cinema, like that of every other creative activity, requires that the industrial art of filmmaking be strategically sabotaged. For the Hollywood film business to invest in — and therefore enable the creation of — some films but not all possible types of film, is to strategically sabotage aspects of social creativity and imagination. Future research on strategic sabotage could go a long way in helping us understand how cinema, under the eye of capitalization, is an order of quantifiable qualities, where the hope is that its films develop predictable financial trajectories, just like the paths of comets in the sky.

Notes

-

The author would like to thank Sandy Hager, Jonathan Nitzan and two anonymous reviewers for commenting on drafts of this paper. Thanks are also owed to those that attended “Capitalizing Power: The Qualities and Quantities of Accumulation,” a conference that was held at York University in Toronto on September 28-30, 2012.↩

-

For the purposes of the paper, I am temporarily ignoring hype (H), which is also in the numerator of the capitalization equation.↩

-

These metaphors are taken from Mumford’s Technics and Civilization (Mumford 2010).↩

-

For a concise anthropology of capitalization, see (Nitzan & Bichler 2009, pp.147–166).↩

-

Nitzan and Bichler’s concept of risk is different from the neo-classical theory of risk. For their critique of the ‘risk premium’ and its role in the construction of the capital asset pricing model (CAPM), see (Nitzan & Bichler 2009, pp.198–210)↩

-

A project is in “development hell” when “a script is in development but never receives production funds” (Wasko 2008, p.53). In his “how-to” book about film financing, Michael Wiese estimates that major filmed entertainment produces one film for every fifty projects that remain damned in purgatory (Wiese 1991, p.32).↩

-

These two examples, The Mummy Returns and O Brother, Where Art Thou?, are taken from Maltby’s Hollywood Cinema (Maltby 2003, pp.200, 204).↩

-

On this point, it is helpful to briefly juxtapose the concept of history that is at the core of the capital-as-power approach. For Nitzan and Bichler, we say that societies are historical because human beings have the ability to change the foundations of a social order through active creation. Nitzan and Bichler capture this point with the verb-noun creorder:

Historical society is a creorder. At every passing moment, it is both Parmenidean and Heraclitean: a state in process, a construct reconstructed, a form transformed. To have history is to create order…”

(Nitzan & Bichler 2009, p.305).This concept of history draws from the philosophy of Cornelius Castoriadis, who offers us the term “social-historical.” For Castoriadis, it is

impossible to maintain an intrinsic distinction between the social and the historical, even if it is a matter of affirming that historicity is the ‘essential attribute’ of society or that society is the ‘essential presupposition’ of history…. It is not that every society is necessarily ‘in’ time or that a history necessarily ‘affects’ every society. The social is this very thing—self-alteration, and it is nothing if it is not this. The social makes itself and can make itself only as history.

(Castoriadis 1998, p.215) -

The correlation coefficient between Top 10%revenues and Top 10%theatres can be broken down into five periods: 1981-1987 (-0.49), 1988-1993 (+0.22), 1994-1999 (+0.86), 2000-2005 (+0.94) and 2006-2011 (+0.89).↩

References

Castoriadis, C., 1998. The Imaginary Institution of Society, Cambridge, Massachusetts: The MIT Press.

Denisoff, R.S. & Plasketes, G., 1990. Synergy in 1980s Film and Music: Formula for Success or Industry Mythology? Film History, 4(3), pp.257–276.

Elberse, A., 2007. The Power of Stars: Do Star Actors Drive the Success of Movies? Journal of Marketing, 71(4), pp.102–120.

Garvin, D.A., 1981. Blockbusters: The Economics of Mass Entertainment. Journal of Cultural Economics, 5(1), pp.1–20.

Hadida, A.L., 2010. Commercial Success and Artistic Recognition of Motion Picture Projects. Journal of Cultural Economics, 34(1), pp.45–80.

Litman, Barry R., 1983. Predicting Success of Theatrical Movies: An Empirical Study. Journal of Popular Culture, 16(4), pp.159–175.

Litman, Barry Russell, 1998. The Motion Picture Mega-Industry, Boston, MA: Allyn and Bacon.

Maltby, R., 2003. Hollywood Cinema 2nd ed., Malden, MA: Blackwell Publishing.

Marcuse, H., 1991. One-Dimensional Man: Studies in the Ideology of Advanced Industrial Society, Boston, MA: Beacon Press.

Mumford, L., 2010. Technics and Civilization, Chicago, IL: University of Chicago Press.

Nelson, R.A. & Glotfelty, R., 2012. Movie Stars and Box Office Revenues: An Empirical Analysis. Journal of Cultural Economics, 36(2), pp.141–166.

Nitzan, J. & Bichler, S., 2009. Capital as Power: A Study of Order and Creorder, New York: Routledge.

Pokorny, M., 2005. Hollywood and the Risk Environment of Movie Production in the 1990s. In J. Sedgwick & M. Pokorny, eds. An Economic History of Film. New York: Routledge, pp. 277–311.

Ravid, S.A., 1999. Information, Blockbusters, and Stars: A Study of the Film Industry. The Journal of Business, 72(4), pp.463–492.

De Vany, A.S., 2004. Hollywood Economics: How Extreme Uncertainty Shapes the Film Industry, New York: Routledge.

Wasko, J., 2008. Financing and Production: Creating the Hollywood Film Commodity. In P. McDonald & J. Wasko, eds. The Contemporary Hollywood Film Industry. Malden, MA: Blackwell Publishing, pp. 43–62.

Weinstein, M., 2005. Movie Contracts: Is “Net” “Gross”? In J. Sedgwick & M. Pokorny, eds. An Economic History of Film. New York: Routledge, pp. 240– 276.

Wiese, M., 1991. Film & Video Financing, Studio City, CA: Focal Press.