Abstract This paper builds an empirical and theoretical model to analyze how the financial goal of risk reduction changed the insides of Hollywood’s star system. For the moviegoer looking at Hollywood cinema from the outside, the function of the star system has remained the same since the 1920s: to have recognizable actors attract large audiences […]

Continue ReadingHollywood’s mantra: “Nobody knows anything”

Originally published at notes on cinema James McMahon Your movie turned out the be a flop? “Nobody knows anything”. You mistakenly believed consumers wanted to see a movie set in the 1920s? “Nobody knows anything”. You thought your casting decisions were going to be loved by all? “Nobody knows anything”. “Nobody knows anything”–this was the […]

Continue ReadingThe CasP Project Past, Present, Future

The CasP Project Past, Present and Future SHIMSHON BICHLER and JONATHAN NITZAN April 2018 Abstract The study of capital as power (CasP) began when we were students in the 1980s and has since expanded into a broader project involving a growing number of researchers and new areas of inquiry. This paper provides a bird’s-eye view […]

Continue ReadingMcMahon, ‘Is Hollywood a Risky Business? A Political Economic Analysis of Risk and Creativity’

Abstract This paper seeks to explain why Hollywood’s dominant firms are narrowing the scope of creativity in the contemporary period (1980–2015). The largest distributors have sought to prevent the art of filmmaking and its related social relations from becoming financial risks in the pursuit of profit. Major filmed entertainment, my term for the six largest […]

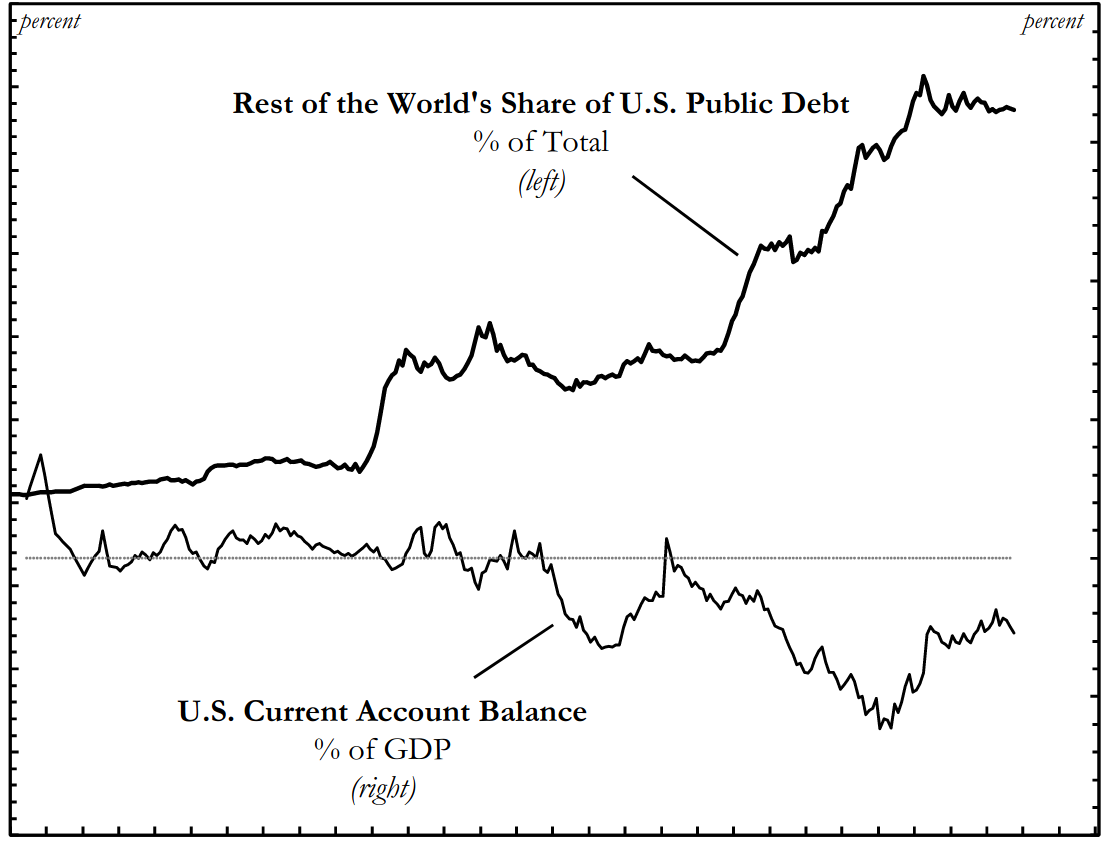

Continue ReadingHager, ‘A Global Bond: Explaining the Safe Haven Status of U.S. Treasury Securities’

Abstract This article offers new theoretical and empirical insights to explain the resilience of U.S. Treasury securities as the world’s premier safe or “risk free” asset. The standard explanation of resilience emphasizes the relative safety of U.S. Treasuries due to a shortage of safe assets in the global political economy. The analysis here goes beyond […]

Continue ReadingIs Hollywood running out of risk?

Shimshon Bichler and Jonathan Nitzan Repost from Real-World Economics Review Blog If we are to believe the conventional creed, Hollywood films are highly risky investments. According to De Vany, revenue forecasts have zero precision, which is just a way of saying that ‘anything can happen’. . . . The ‘nobody knows’ principle . . . […]

Continue ReadingMcMahon, ‘What Makes Hollywood Run? Capitalist Power, Risk and the Control of Social Creativity’

Abstract This dissertation combines an interest in political economy, political theory and cinema to offer an answer about the pace of the Hollywood film business and its general modes of behaviour. More specifically, this dissertation seeks to find out how the largest Hollywood firms attempt to control social creativity such that the art of filmmaking […]

Continue ReadingCapital as Power and Freelance Creative Work 4

Frederick H. Pitts Resonance and dissonance in the rhythms of freelance creative work In the last blog, I applied some of Nitzan and Bichler’s ideas to freelance work in the creative industries. I utilised their conceptualisation of the distinction between creativity and power, and of the sabotage of the former by the latter. Nitzan and […]

Continue ReadingCapital as Power and Freelance Creative Work 3

Frederick H. Pitts Creativity, sabotage and the management of risk and responsibility in freelance creative work Nitzan and Bichler theorise a dissonant relation of sabotage between power and creativity, business and industry. What they show is that the control of creative processes of production is not antithetical to their success. Rather, it is constitutive of […]

Continue ReadingCapital as Power and Freelance Creative Work 2

Frederick H. Pitts Capital as Power, risk-aversion and the avoidance of uncertainty Mainstream critiques of contemporary capitalism conducted in the wake of the Great Recession tend to indict a number of factors. Perceived short-termism. The dangerous compulsion to speculate. An attraction to growth for growth’s sake. The propensity towards the greedy and rapid accumulation of […]

Continue ReadingCapital as Power and Freelance Creative Work 1

Frederick H. Pitts Rhythms of Risk and Responsibility in Freelance Creative Work This series of blogs applies Nitzan and Bichler’s theory of capital as power to the empirical concern of freelance work in the creative industries. It reports some findings from a research project I conducted earlier this year. The research was part of a […]

Continue ReadingNo. 2014/01: McMahon, ‘Capitalist Power, Distribution and the Order of Cinema’

Abstract In this paper, the structure of Hollywood film distribution will be analyzed through the lens of risk. In both its technical and conceptual senses, risk is relevant to the study of Hollywood’s dominant firms. In the interest of lowering risk, the business interests of Hollywood look to predetermine how new films will function in […]

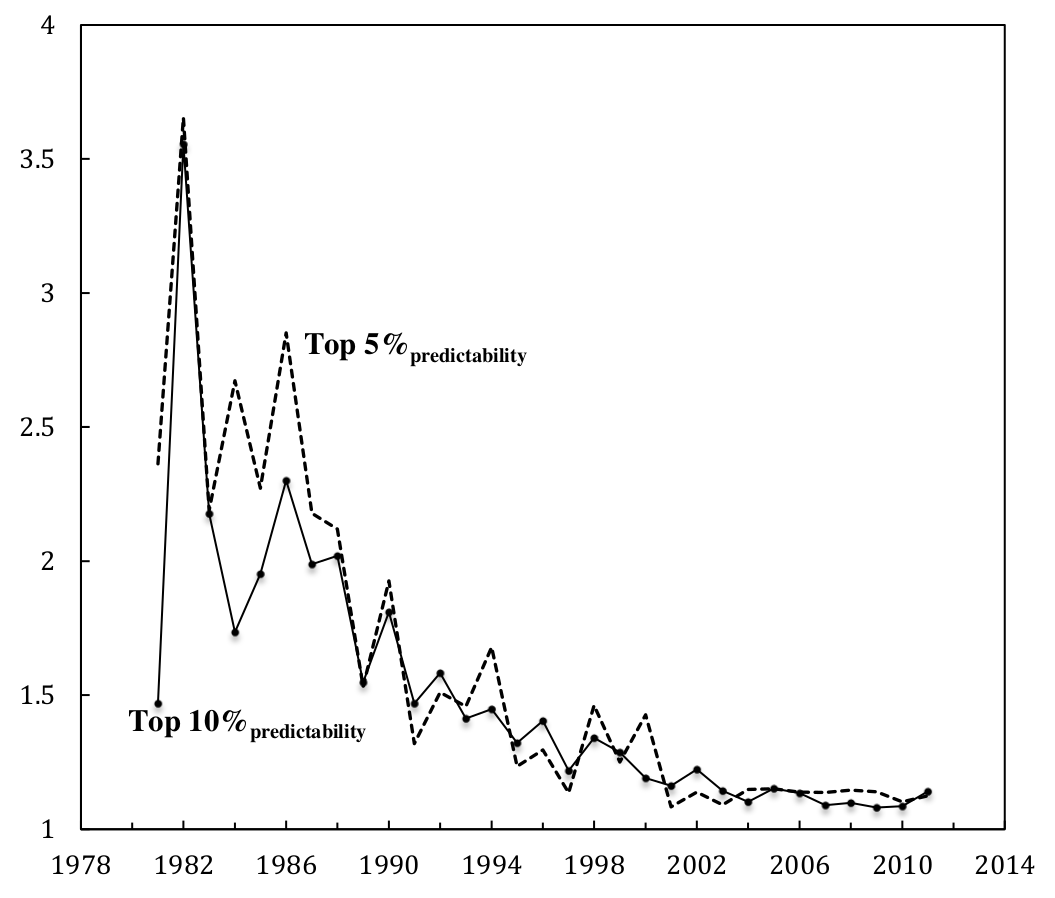

Continue ReadingThe Rise of a Confident Hollywood: Risk and the Capitalization of Cinema

The Rise of a Confident Hollywood Risk and the Capitalization of Cinema JAMES MCMAHON February 2013 Abstract This paper investigates the historical development of risk in the Hollywood film business. Using opening theatres as a proxy for future expectations, the paper demonstrates how, from 1981 to 2011, Hollywood has improved its ability to predict the […]

Continue ReadingMcMahon, ‘The Rise of a Confident Hollywood: Risk and the Capitalization of Cinema’

Abstract This paper investigates the historical development of risk in the Hollywood film business. Using opening theatres as a proxy for future expectations, the paper demonstrates how, from 1981 to 2011, Hollywood has improved its ability to predict the financial rankings of its films. More specifically, the Hollywood film business has become better at predicting […]

Continue Reading