Originally published at sbhager.com Sandy Hager THINKING ABOUT DEATH I’ve been thinking a lot about death recently. No, it’s not something that came about because of the global pandemic and my new daily ritual of checking graphs on COVID-19 death tolls around the world. It started a few years back when I became interested in […]

Continue Reading2019/02.1: Fix, ‘How the Rich are Different: Hierarchical Power as the Basis of Income Size and Class’

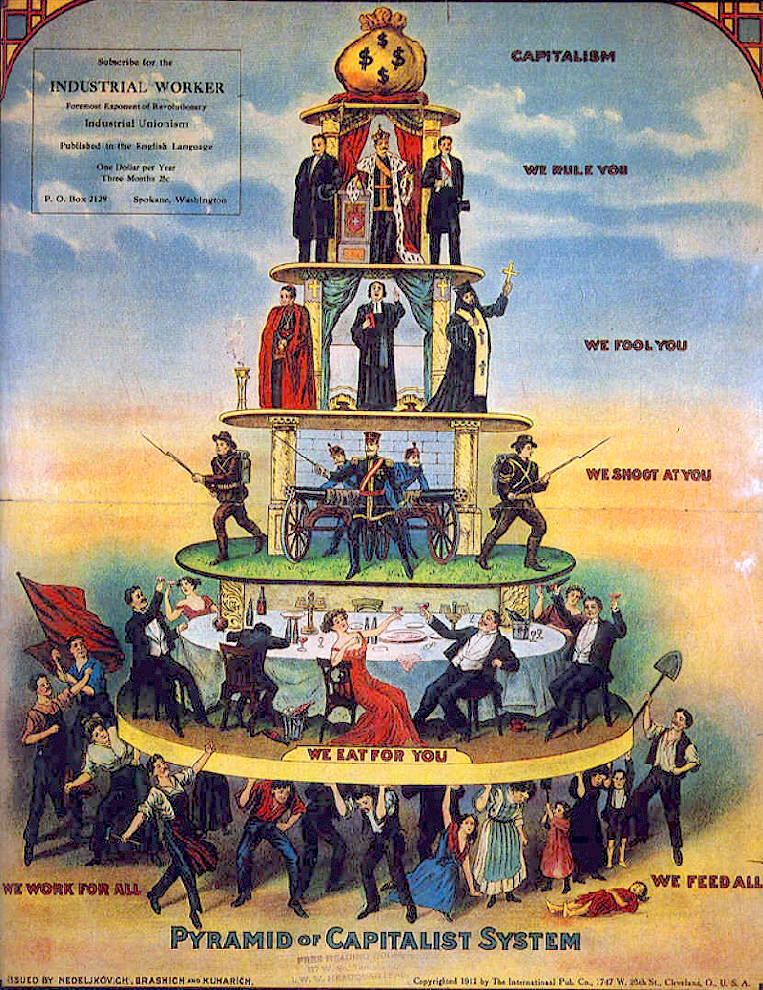

Abstract This paper investigates a new approach to understanding personal and functional income distribution. I propose that hierarchical power — the command of subordinates in a hierarchy — is what distinguishes the rich from the poor and capitalists from workers. Specifically, I hypothesize that individual income increases with hierarchical power, as does the share of […]

Continue Reading2019/04: Hager and Baines, ‘Jurisdictional Tax Rates: How the Corporate Tax System Fuels Concentration and Inequality’

Abstract Corporate concentration in the United States has been on the rise in recent years, sparking a heated debate about its causes, consequences, and potential remedies. In this study, we examine a facet of public policy that has been largely neglected in current debates about concentration: corporate tax policy. As part of our analysis we […]

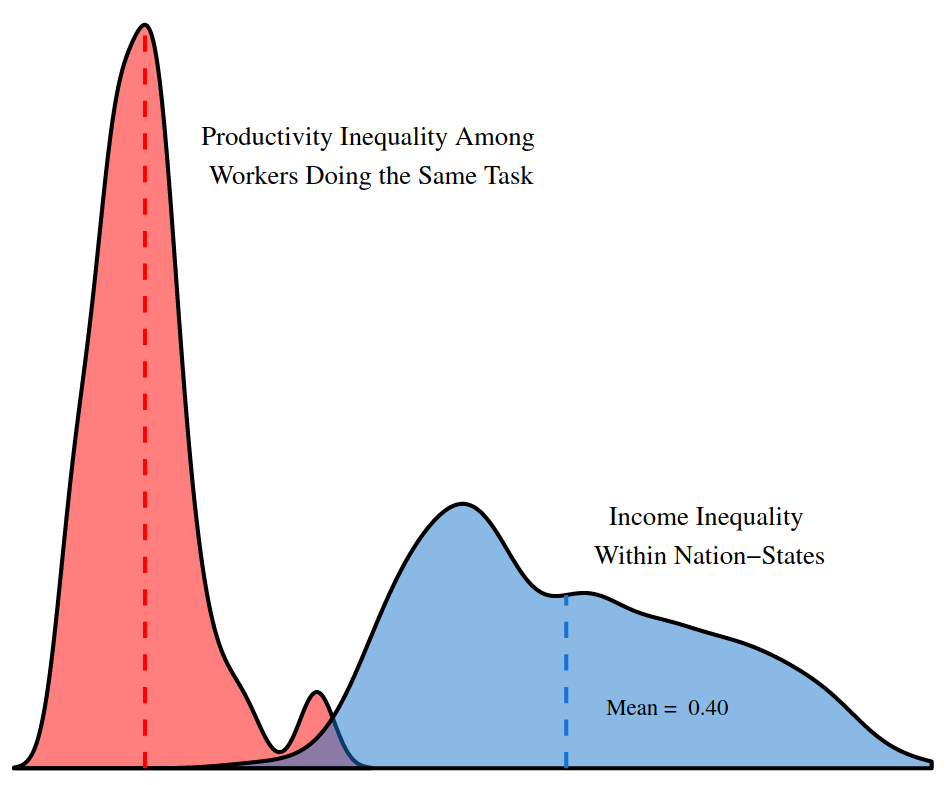

Continue Reading2018/09: Fix, ‘Energy, Hierarchy and the Origin of Inequality’

Abstract Where should we look to understand the origin of inequality? Most research focuses on three windows of evidence: (1) the archaeological record; (2) existing traditional societies; and (3) the historical record. I propose a fourth window of evidence — modern society itself. I hypothesize that we can infer the origin of inequality from the […]

Continue Reading2018/07: Fix, ‘The Trouble with Human Capital Theory’

Abstract Human capital theory is the dominant approach for understanding personal income distribution. According to this theory, individual income is the result of ‘human capital’. The idea is that human capital makes people more productive, which leads to higher income. But is this really the case? This paper takes a critical look at human capital […]

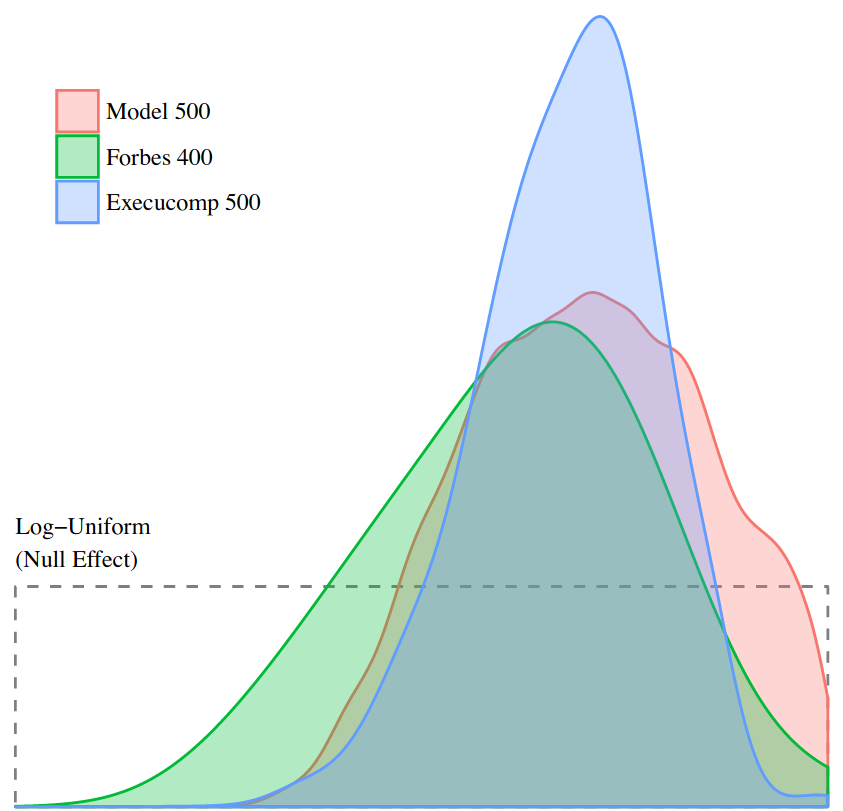

Continue Reading2018/06: Fix, ‘Capitalist Income and Hierarchical Power: A Gradient Hypothesis’

Abstract This paper offers a new approach to the study of capitalist income. Building on the ‘capital as power’ framework, I propose that capitalists earn their income not from any productive asset, but from the legal right to command a corporate hierarchy. In short, I hypothesize that capitalist income stems from hierarchical power. Based on […]

Continue Reading2018/05: Fix, ‘The Growth of US Top Income Inequality: A Hierarchical Redistribution Hypothesis’

Abstract What accounts for the growth of US top income inequality? This paper proposes a hierarchical redistribution hypothesis. The idea is that US firms have systematically redistributed income to the top of the corporate hierarchy. I test this hypothesis using a large scale hierarchy model of the US private sector. My method is to vary […]

Continue Reading2018/04: Martin, ‘The Autocatalytic Sprawl of Pseudorational Mastery’

Abstract According to Shimshon Bichler and Jonathan Nitzan capital is not an economic quantity but a mode of power; it could be sumarized as: “Capital is power quantified in monetary terms”. So, what do we do when we “quantify”? What is the nature of “money” in a capitalist society? And, indeed, what is “power” in […]

Continue Reading2018/03: Fix, ‘The Aggregation Problem’

Abstract This article discusses the aggregation problem and its implications for ecological economics. The aggregation problem consists of a simple dilemma: when adding heterogeneous phenomena together, the observer must choose the unit of analysis. The dilemma is that this choice affects the resulting measurement. This means that aggregate measurements are dependent on one’s goals, and […]

Continue Reading2018/02: Fix, ‘A Hierarchy Model of Income Distribution’

Abstract Based on worldly experience, most people would agree that firms are hierarchically organized, and that pay tends to increase as one moves up the hierarchy. But how this hierarchical structure affects income distribution has not been widely studied. To remedy this situation, this paper presents a new model of income distribution that explores the […]

Continue Reading2018/01: Bichler & Nitzan, ‘With their Back to the Future: Will Past Earnings Trigger the Next Crisis?’

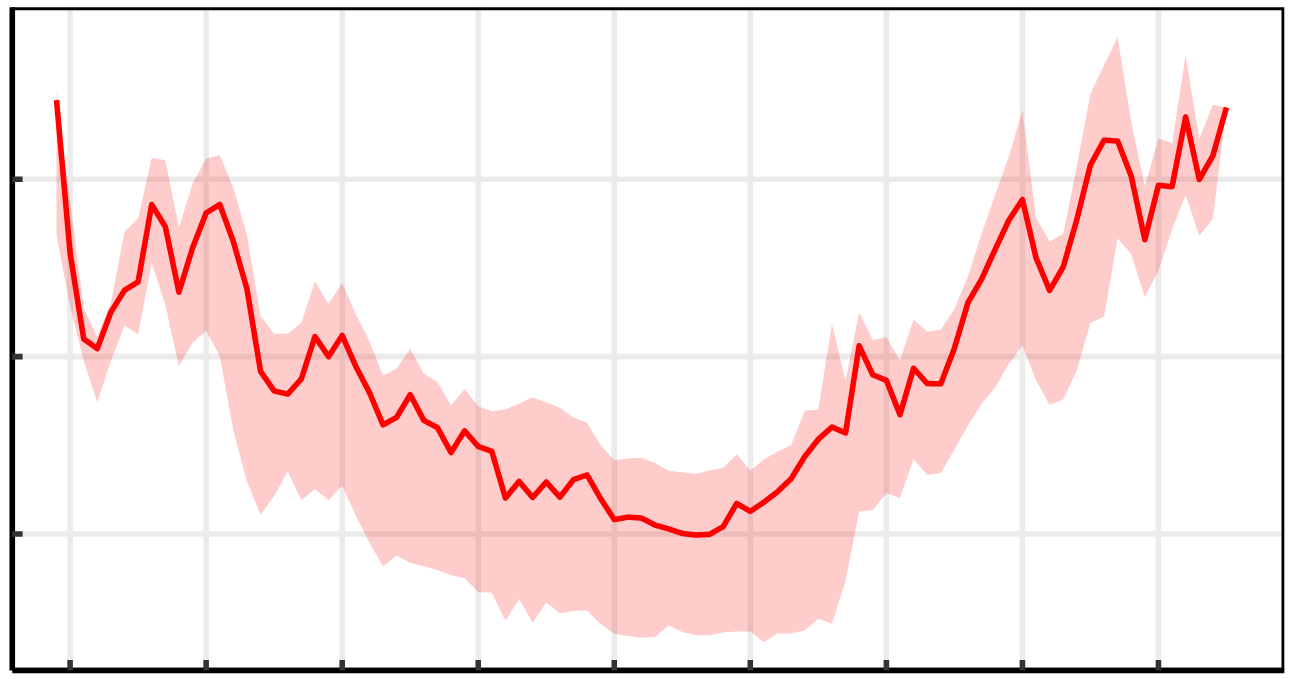

Abstract The U.S. stock market is again in turmoil. After a two-year bull run in which share prices soared by nearly 50 per cent, the market is suddenly dropping. Since the beginning of 2018, it lost nearly 10 per cent of its value, threatening investors with an official ‘correction’ or worse. As always, there is […]

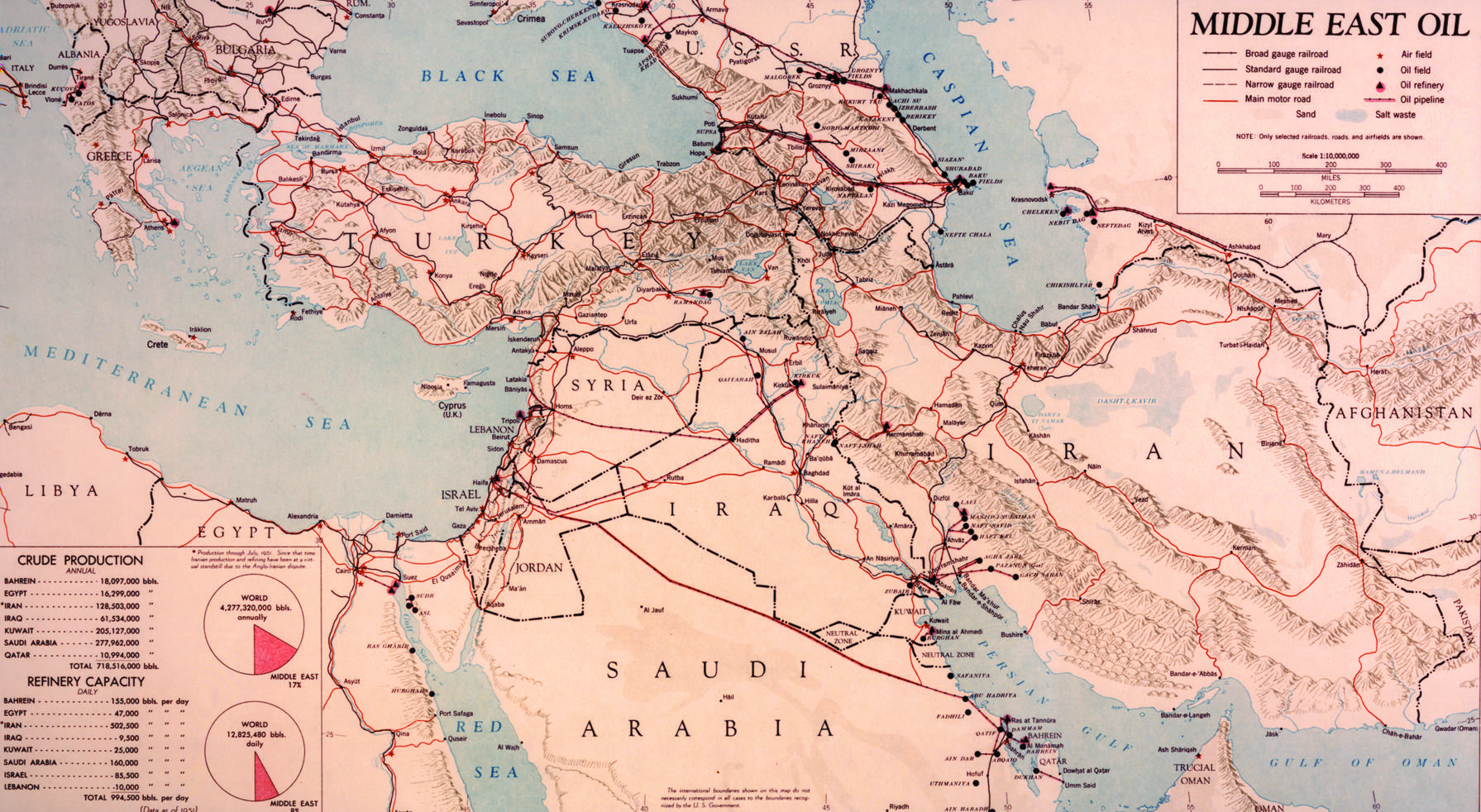

Continue ReadingNo. 2017/04: Bichler & Nitzan, ‘Arms and Oil in the Middle East: A Biography of Research’

Abstract During the late 1980s, we printed a series of working papers, offering a new approach to the political economy of Israel and wars in the Middle East. Our approach in these papers rested on three new concepts. It started by identifying the Weapondollar-Petrodollar Coalition – an alliance of armament firms, oil companies and financial […]

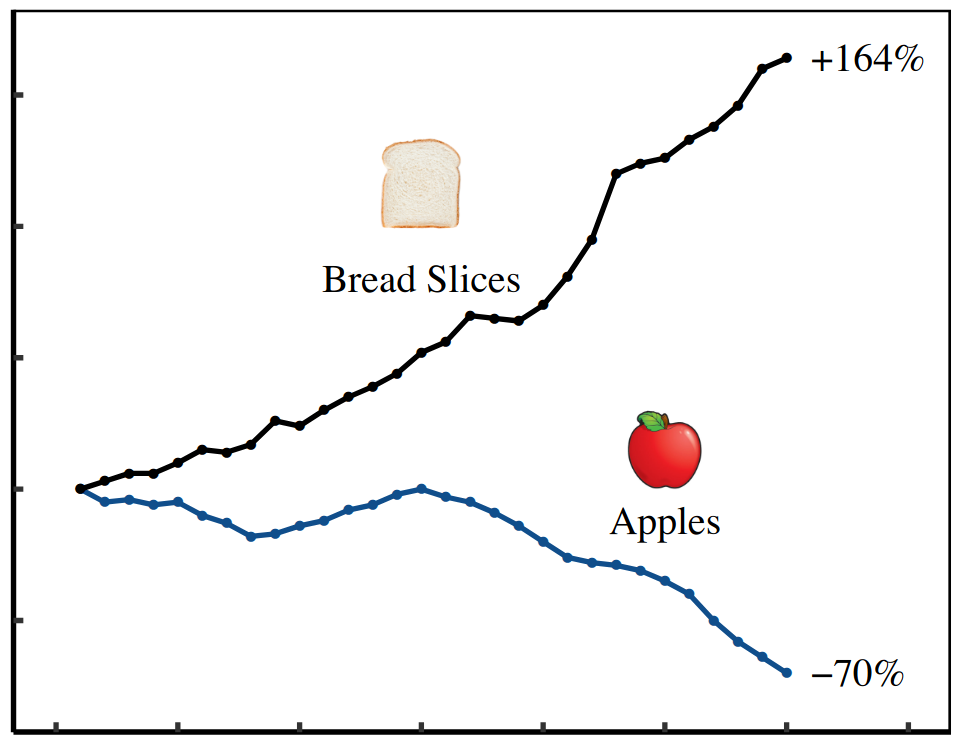

Continue ReadingNo. 2017/03: Fix, ‘Evidence for a Power Theory of Personal Income Distribution’

Abstract This paper proposes a new ‘power theory’ of personal income distribution. Contrary to the standard assumption that income is proportional to productivity, I hypothesize that income is most strongly determined by social power, as indicated by one’s position within an institutional hierarchy. While many theorists have proposed a connection between personal income and power, […]

Continue ReadingNo. 2017/02: Bichler & Nitzan, ‘Growing through Sabotage’

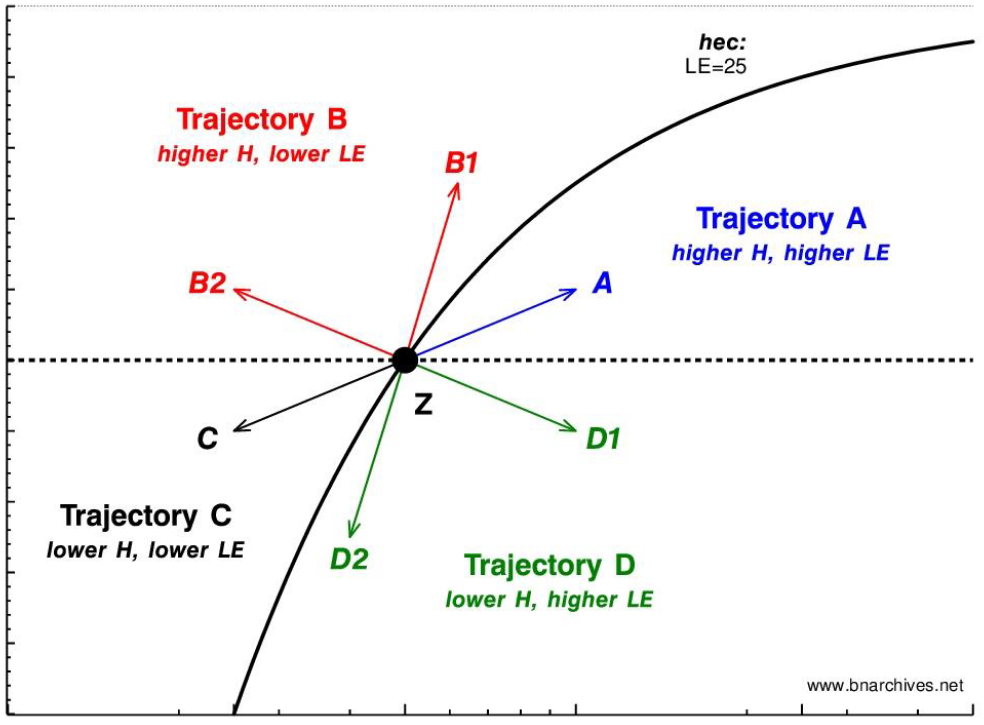

Abstract According to the theory of capital as power, capitalism, like any other mode of power, is born through sabotage and lives in chains – and yet everywhere we look we see it grow and expand. What explains this apparent puzzle of ‘growth in the midst of sabotage’? The answer, we argue, begins with the […]

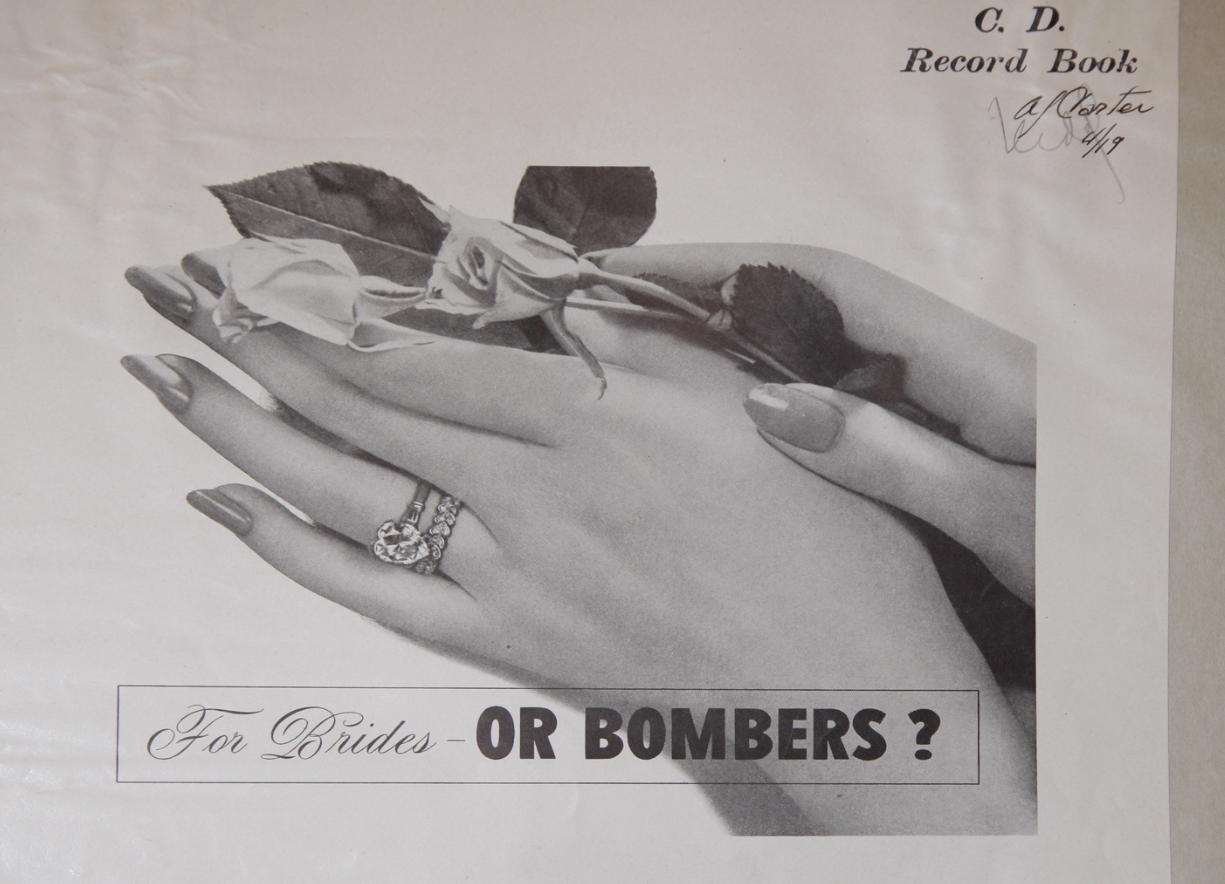

Continue ReadingNo. 2017/01: Cochrane, ‘Differentiating Diamonds: Transforming Knowledge and the Accumulation of De Beers’

Abstract In 1939, the De Beers diamond company faced a dire situation. The company’s accumulation had been dwindling for decades. The Great Depression not only pushed diamond sales to historic lows, it shifted American attitudes around consumption and thriftiness to the detriment of the luxury object. In this article, I bring together Liz McFall’s assertion […]

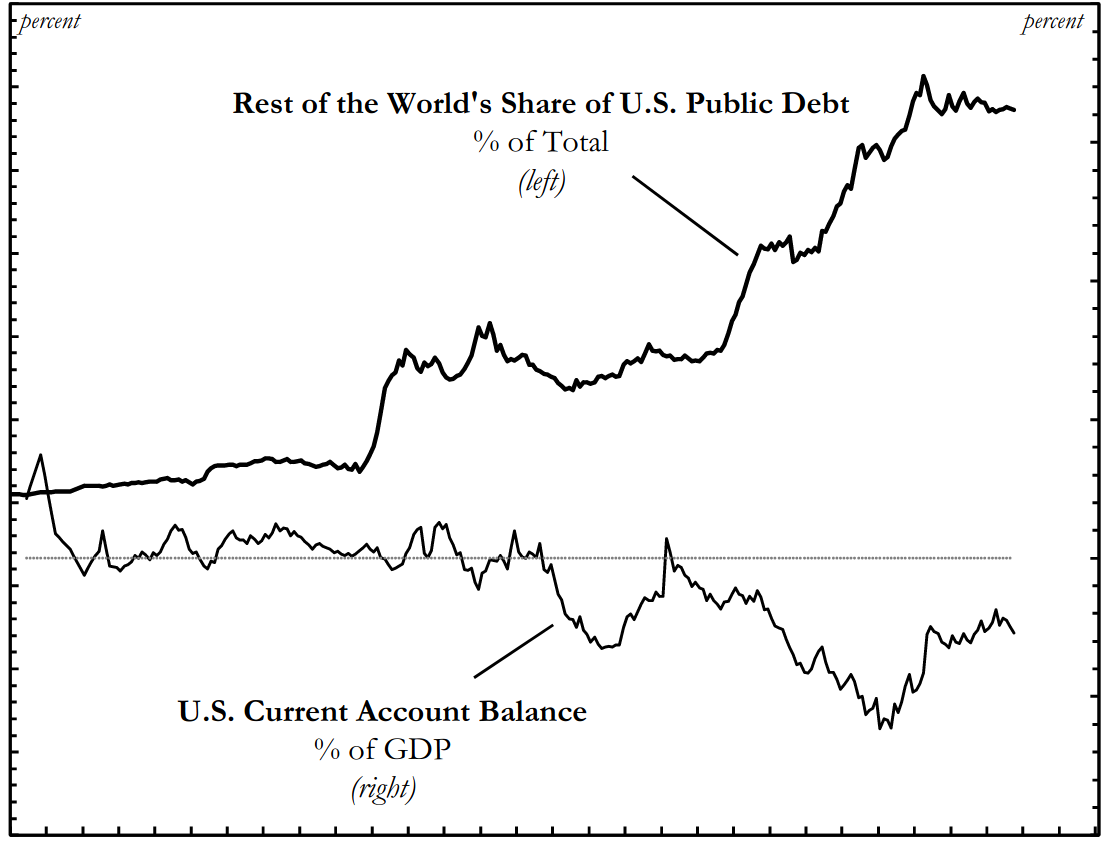

Continue ReadingTrump, US Public Debt, and the Future of Global Financial Power

Sandy Hager The following post is based loosely on my presentation at the first annual Thammasat University-Conference for Asia Pacific Studies in Phuket, Thailand (8-9 December 2016). What a difference a few months makes. This past summer I published a piece in the European Journal of International Relations on the role of US Treasury securities […]

Continue ReadingNo. 2016/6: Pitts, ‘Capital as Power in the Creative Industries’

Abstract Using Nitzan and Bichler’s understanding of the dissonant relationship between creativity and power and business and industry, this paper investigates the rhythms of freelance creative work. It reports findings from interviews conducted with freelancers working in the Dutch creative industries. The findings suggest that freelancers enjoy more responsibility and autonomy than formal employees. But this autonomy represents a risk […]

Continue ReadingNo. 2016/5: Cochrane, ‘Disobedient Things: The Deepwater Horizon oil spill and accounting for disaster’

Abstract Analysis of the Deepwater Horizon disaster and the accumulatory decline of BP demonstrates both the analytical efficacy of the capital-as-power (CasP) approach to value theory, and the irreducible role of objects in the process of accumulation. Rather than productivity per se, accumulation depends on control of productivity. Owners’ control is over both the human […]

Continue ReadingHager, ‘A Global Bond: Explaining the Safe Haven Status of U.S. Treasury Securities’

Abstract This article offers new theoretical and empirical insights to explain the resilience of U.S. Treasury securities as the world’s premier safe or “risk free” asset. The standard explanation of resilience emphasizes the relative safety of U.S. Treasuries due to a shortage of safe assets in the global political economy. The analysis here goes beyond […]

Continue ReadingHager, ‘Public Debt, Inequality, and Power: The Making of a Modern Debt State’

Abstract Who are the dominant owners of US public debt? Is it widely held, or concentrated in the hands of a few? Does ownership of public debt give these bondholders power over our government? What do we make of the fact that foreign-owned debt has ballooned to nearly 50 percent today? Until now, we have […]

Continue Reading