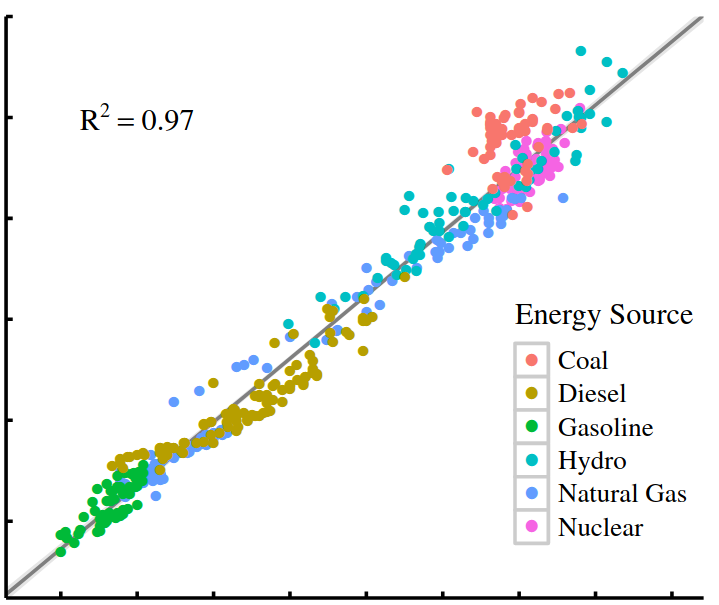

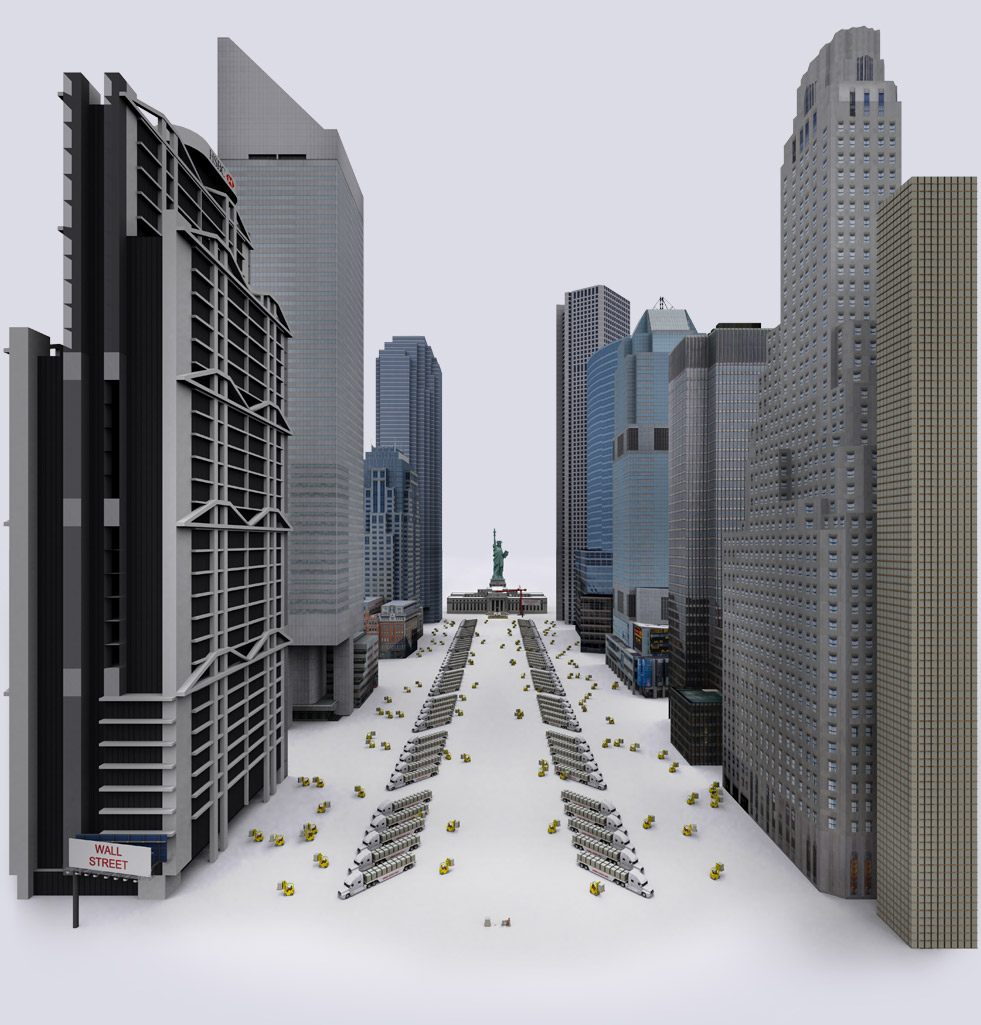

Abstract Why do institutions grow? Despite nearly a century of scientific effort, there remains little consensus on this topic. This paper offers a new approach that focuses on energy consumption. A systematic relation exists between institution size and energy consumption per capita: as energy consumption increases, institutions become larger. I hypothesize that this relation results […]

Continue ReadingNo. 2016/03: Di Muzio & Dow, ‘Uneven and Combined Confusion: On the Geopolitical Origins of Capitalism and the Rise of the West’

Abstract This article offers a critique of Alexander Anievas and Kerem Nişancioğlu’s How the West Came to Rule: The Geopolitical Origins of Capitalism. We argue that while all historiography features a number of silences, shortcomings or omissions, the omissions in How the West Came to Rule lead to a mistaken view of the emergence of […]

Continue ReadingCorporate Taxation and the Power Theory of Value

Sandy Hager This is a (longer) draft version of an article that is under consideration for the newsletter of the Tax Justice Network: Tax Justice Focus. Taxation is all about power. We are constantly reminded of this when flipping through any newspaper (or browsing any news website). The Panama Papers, the stuff of which front […]

Continue ReadingNo. 2016/02: Cochrane, ‘Why Diamonds and De Beers?, or The Need for Accumulation Studies’

Abstract I successfully defended my dissertation in December. This served as the introductory presentation for the defence. In it, I explain what I tried to do with the dissertation, the methods I used, and the larger project I hope it is initiating. Specifically, I suggest there is a need for accumulation studies as a field […]

Continue ReadingNo. 2016/01: Debailleul, Bichler & Nitzan, ‘Theory and Praxis, Theory and Practice, Practical Theory’

Abstract This working paper contains an intervention by Corentin Debailleul and an extended reply by Shimshon Bichler and Jonathan Nitzan. The exchange was first posted on the Capital as Power Forum in January 2016. Debailleul’s original questions are articulated at greater length here, while Bichler and Nitzan’s reply is reproduced as is. Citation Theory and […]

Continue ReadingNo. 2015/04: Bichler & Nitzan, ‘The CasP Project: Past, Present, Future

Abstract The study of capital as power (CasP) began when we were students in the 1980s and has since expanded into a broader project involving a growing number of researchers and new areas of inquiry. This paper provides a bird’s-eye view of the CasP journey. It explores what we have learned so far, reviews ongoing […]

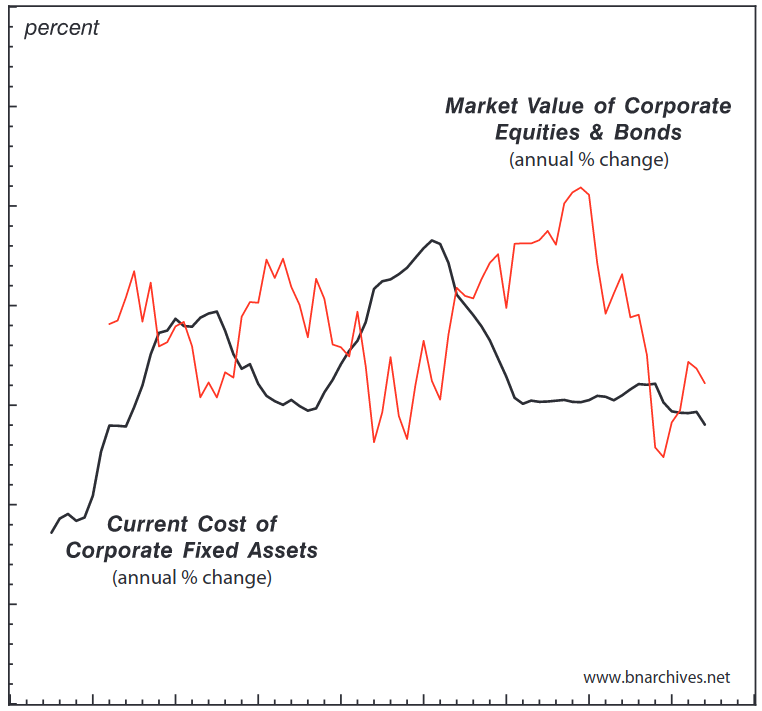

Continue ReadingNo. 2015/03: Bichler & Nitzan, ‘Capital Accumulation: Fiction and Reality’

Abstract What do economists mean when they talk about ‘capital accumulation’? Surprisingly, the answer to this question is anything but clear, and it seems the most unclear in times of turmoil. Consider the recent ‘financial crisis’. The very term already attests to the presumed nature and causes of the crisis, which most observers indeed believe […]

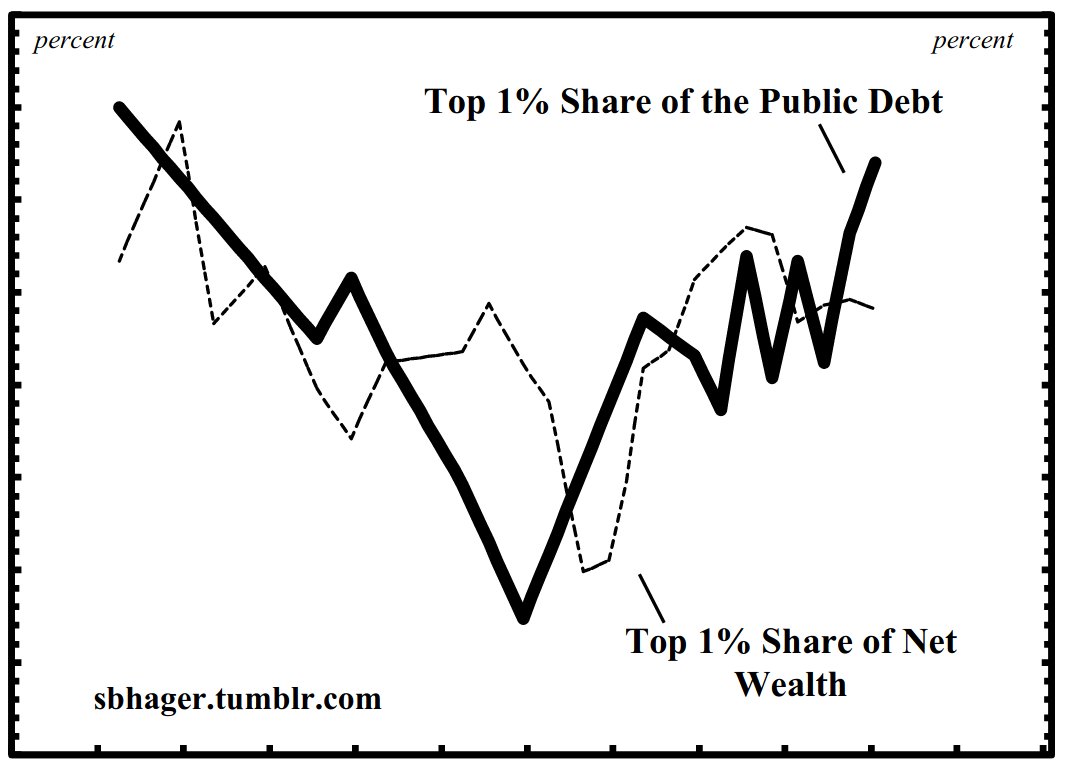

Continue ReadingNo. 2015/01: Hager, ‘Public Debt as Corporate Power’

Abstract In various writings Karl Marx made references to an ‘aristocracy of finance’ in Western Europe and the United States that dominated ownership of the public debt. Drawing on original research, this paper offers the first comprehensive analysis of the pattern of public debt ownership within the US corporate sector. The research shows that over […]

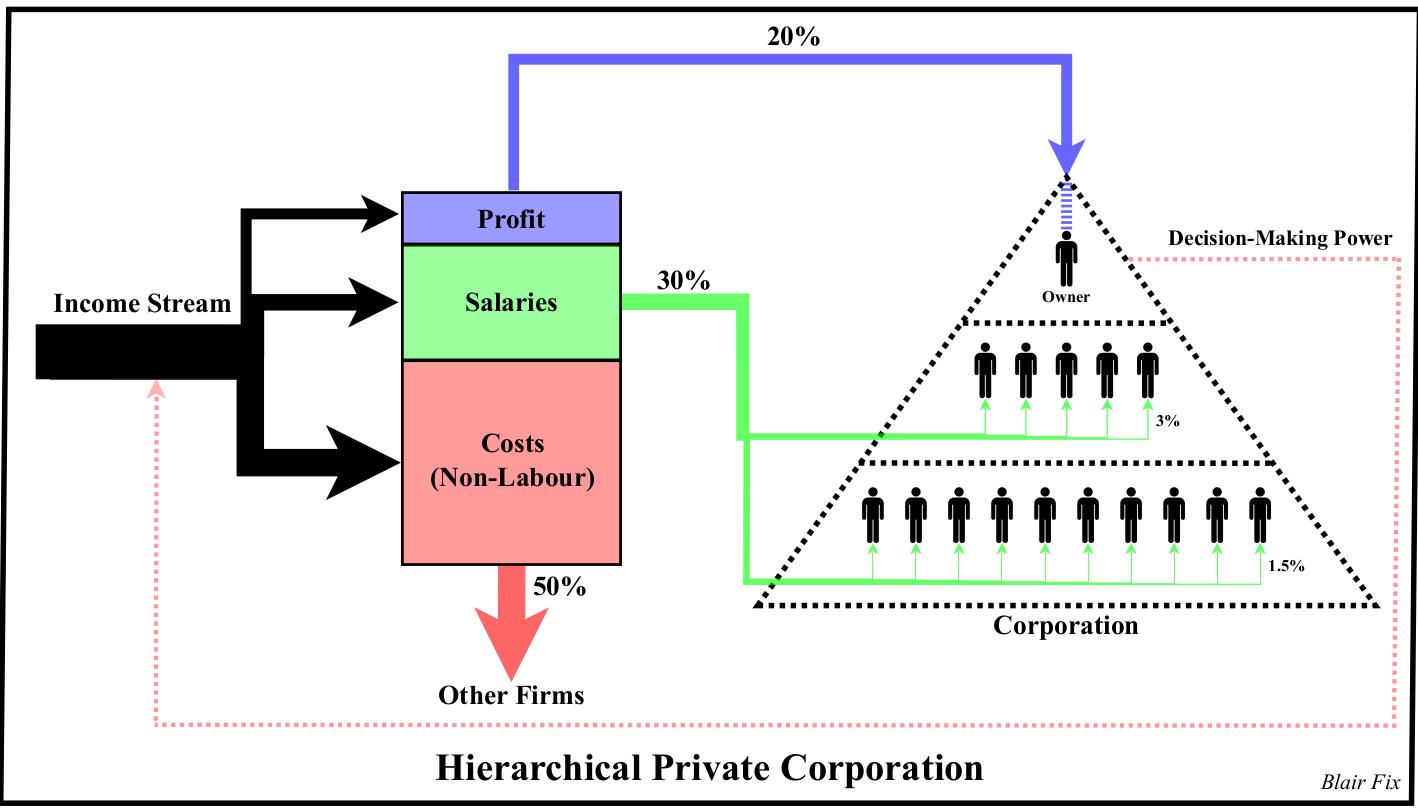

Continue ReadingNo. 2014/05: Fix, ‘Putting Power Back Into Growth Theory’

Abstract Neoclassical growth theory assumes that economic growth is an atomistic process in which changes in distribution play no role. Unfortunately, when this assumption is tested against real-world evidence, it is systematically violated. This paper argues that a reality-based growth theory must reject neoclassical principles in favour of a power-centered approach. Building on Nitzan and […]

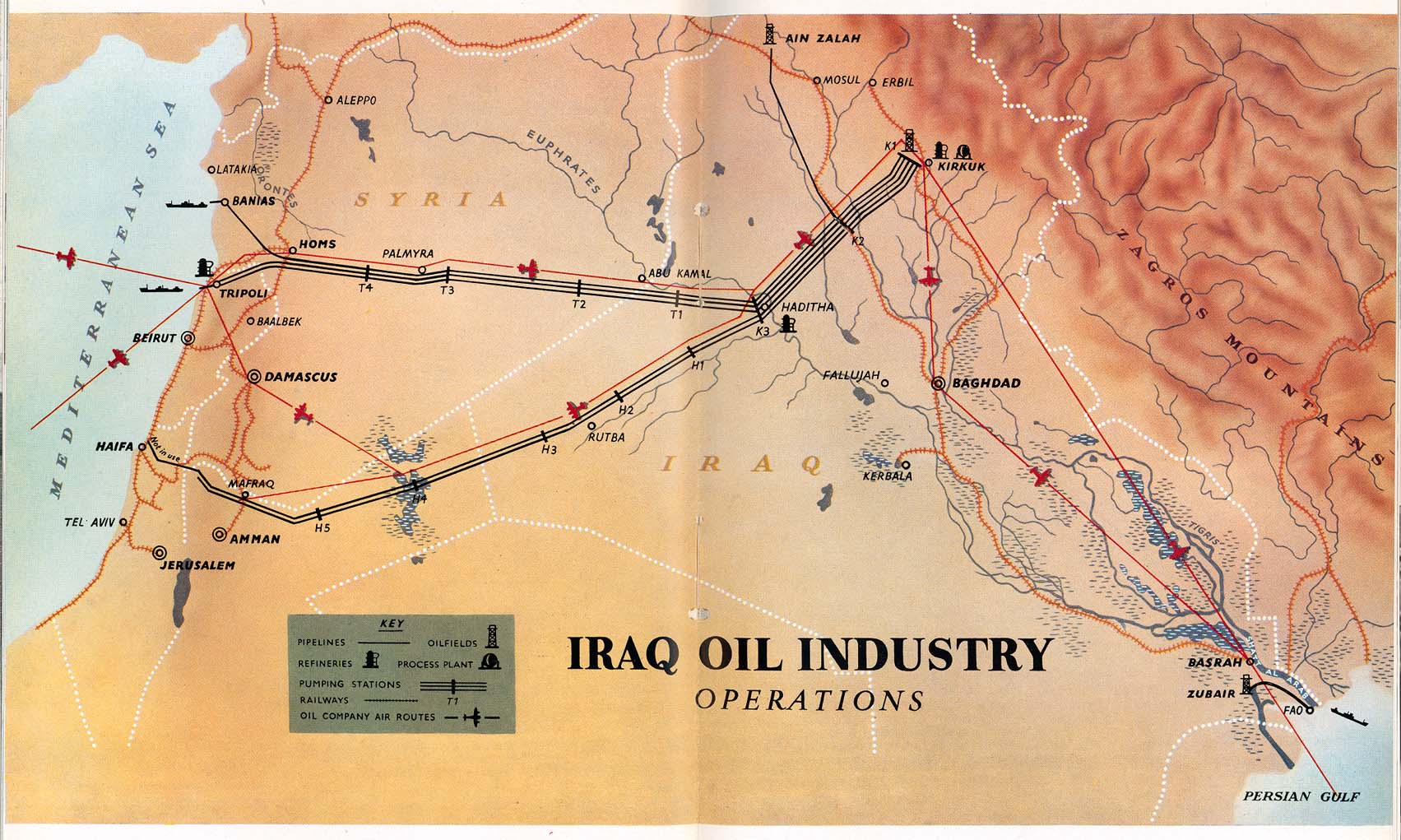

Continue ReadingNo. 2014/04: Bichler & Nitzan, ‘Still About Oil?’

Abstract During the late 1980s and early 1990s, we identified a new Middle East phenomenon that we called ‘energy conflicts’ and argued that these conflicts were intimately linked with the global processes of capital accumulation. This paper outlines the theoretical framework we have developed over the years and brings our empirical research up to date. […]

Continue ReadingNo. 2014/02: Fix, ‘Rethinking Profit: How Redistribution Drives Growth’

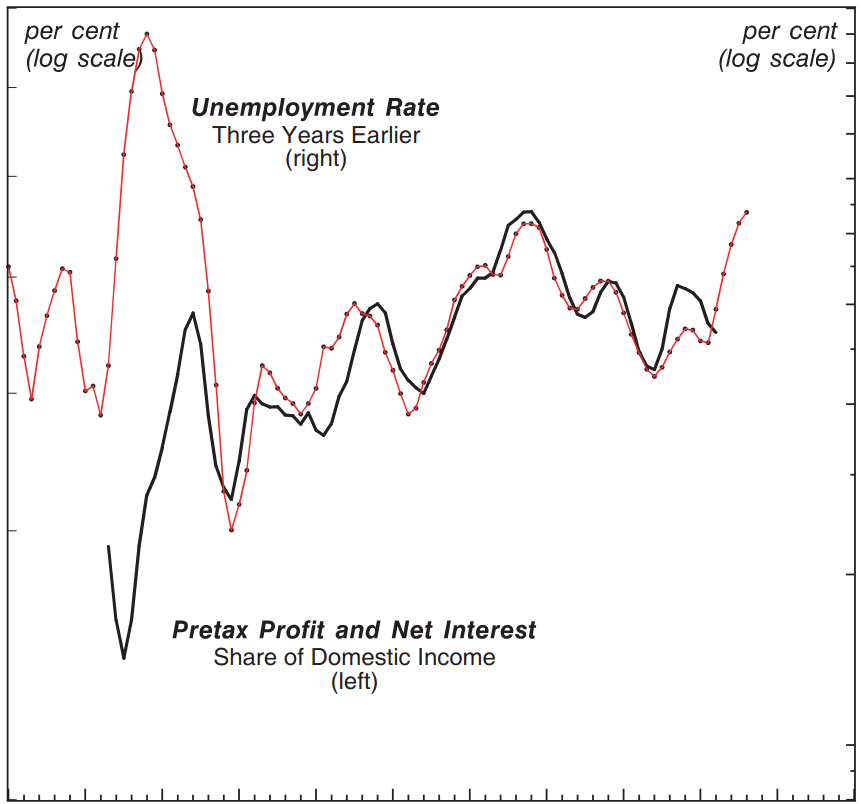

Abstract Using a combination of heterodox economics and biophysical analysis, this paper investigates the relationship between economic distribution and the growth of material throughput. Empirical results show that the growth of “useful work” correlates with redistribution towards profit. Furthermore, increases in energy consumption are correlated with increases in the largest corporations’ share of total employment. […]

Continue ReadingThe President and the Tech Giants

Sandy Hager In an interesting piece for the Financial Times, Christopher Caldwell assesses Obama’s declaration to ‘go it alone’ in light of the ‘obstructionist Republican agenda’ in the US Congress. In a recent State of the Union address, Obama pledged a year of action, one that would see the president push for major policy reforms […]

Continue ReadingNo. 2013/01: Bichler & Nitzan, ‘Can Capitalists Afford Recovery?’

Abstract Economic, financial and social commentators from all directions and persuasion are obsessed with the prospect of recovery. The world remains mired in a deep, prolonged crisis, and the key question seems to be how to get out of it. The purpose of our paper is to ask a very different question that few if […]

Continue ReadingHager, ‘What Happened to the Bondholding Class? Public Debt, Power and the Top One Per Cent’

Abstract In 1887 Henry Carter Adams produced a study demonstrating that the ownership of government bonds was heavily concentrated in the hands of a ‘bondholding class’ that lent to and, in Adams’s view, controlled the government like dominant shareholders control a corporation. The interests of this bondholding class clashed with the interests of the masses, […]

Continue Reading