DT Cochrane A recent episode of Planet Money describes a long running feud between two makers of hand bells. The story itself was interesting. However, two parts jumped out at me as relevant to CasP. The first was a comment by the host about how most people, when they hear of two companies fighting in […]

Continue ReadingThe Politics of Employment and the Limits of the Recovery

Jeremy Green The contested nature of the economic ‘recovery’ has become the central theme of British political debate. The next election, in 2015, will be fought on these terms, with the Coalition government trumpeting its claims of an economic recovery born through austerity, while Labour outlines the limits of the Coalition strategy. It is crucial […]

Continue ReadingThe Weekly Sabotage: Week 3

Tim Di Muzio Sabotage and Ownership Last week we considered how the capital as power framework seeks to conceptualize two different forms of sabotage: a general sabotage that limits the potential of humanity in which all business participates and; 2) a particular or differential form of sabotage that is relatively unique to each individual firm. […]

Continue ReadingFirst Speaker Series on the Capitalist Mode of Power

The First Speaker Series on the Capitalist Mode of Power was sponsored by the York Department of Political Science and the Graduate Programme in Social and Political Thought. Talks were held at York University, Toronto, Canada and the series ran from October to November 2013. Tuesday, Oct 29, 2013 Can Capitalists Afford Recovery? Economic Policy […]

Continue ReadingThe Colour of the Sun: A Metaphor for Methodology?

James McMahon Found this video when browsing Boing Boing. Originally posted by NASA, this video is fascinating. It may also stand as a metaphor for the methodological problems in political economic theory. Consider part of the explanation behind the video: “As the colors sweep around the sun in the movie, viewers should note how different […]

Continue ReadingThe Weekly Sabotage: Week 2

Tim Di Muzio Last week we looked briefly at the origin of the term ‘sabotage’ and found that it was more associated with the working class than it was with elite power – those who largely shape and reshape the terrain of social reproduction. In this formulation, workers sabotage while businessmen build useful industry for […]

Continue Reading‘Rigging’ the market for fun and profit

DT Cochrane The EU has fined a selection of European and U.S. American banks €1.7 billion for rigging major interest-rate benchmarks. The article notes that the benchmarks – Libor, and the Tokyo and euro area interbank – are used in the pricing of hundreds of trillions of assets. The problem, according to the prosecutors, is […]

Continue ReadingTargeting buying habits

DT Cochrane This is an interesting NYT article about buying habits, market research and advertising. It describes how Target has been able to compile and analyze customer data in order to identify women who are likely pregnant as early as possible. One of the reasons pregnant women are such an attractive market segment, the article […]

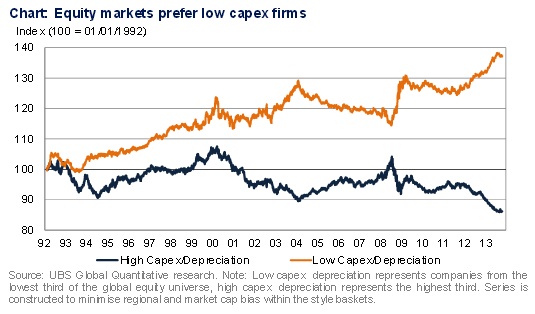

Continue ReadingLow Capex, High Market Cap: A New High for Corporate Sabotage?

Edward Lam Found amongst some recent market commentary the chart above seems to be quite striking evidence in favour of the Capital as Power framework. The data series have been put together by the investment bank UBS, based on their broad (though not comprehensive) global stock coverage. UBS has charted two lines: a) the stock […]

Continue ReadingThe Weekly Sabotage: Week 1

Tim Di Muzio Welcome to a weekly investigation into the fascinating world of corporate sabotage where human creativity, cooperation, mutual aid and well-being are all held ransom for the profit and power of dominant owners. Every week this column will explore various aspects of what Veblen called ‘strategic sabotage’. But first, a bit of context. […]

Continue ReadingThe Market Disapproves of Rob Ford

DT Cochrane The market has spoken: it disapproves of Rob Ford. A Bloomberg article notes that Toronto’s borrowing costs have risen relative to those of other Canadian municipalities. The determinants of bond prices are complex. Broadly, they translate the confidence of market participants in the ability of the borrower to service their debt. This is […]

Continue ReadingDiscussion: The Ups and Downs of Empirical Research

DT Cochrane It is exciting to see this website grow. Content is being added here and there, and our Working Paper Series has its first paper. What already stands out on this website, in my opinion, is the strength of the empirical research. With our feet planted in society itself, we have before us a […]

Continue ReadingNo. 2013/01: Bichler & Nitzan, ‘Can Capitalists Afford Recovery?’

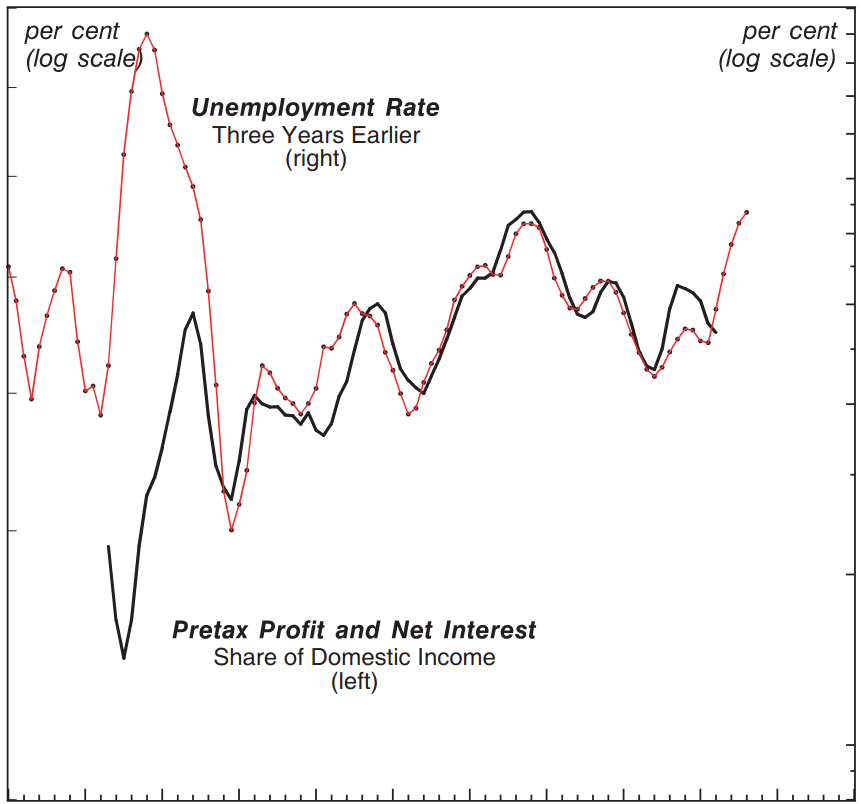

Abstract Economic, financial and social commentators from all directions and persuasion are obsessed with the prospect of recovery. The world remains mired in a deep, prolonged crisis, and the key question seems to be how to get out of it. The purpose of our paper is to ask a very different question that few if […]

Continue ReadingNeither here nor there, both here and there

DT Cochrane The media is notoriously short sighted. Its reports on recent events are largely devoid of any historical consideration. This is equally true of market reports. Despite not putting market events into a historical setting, the journalists do not hesitate to offer reasons for the day’s price movements. Usually, some high profile event over […]

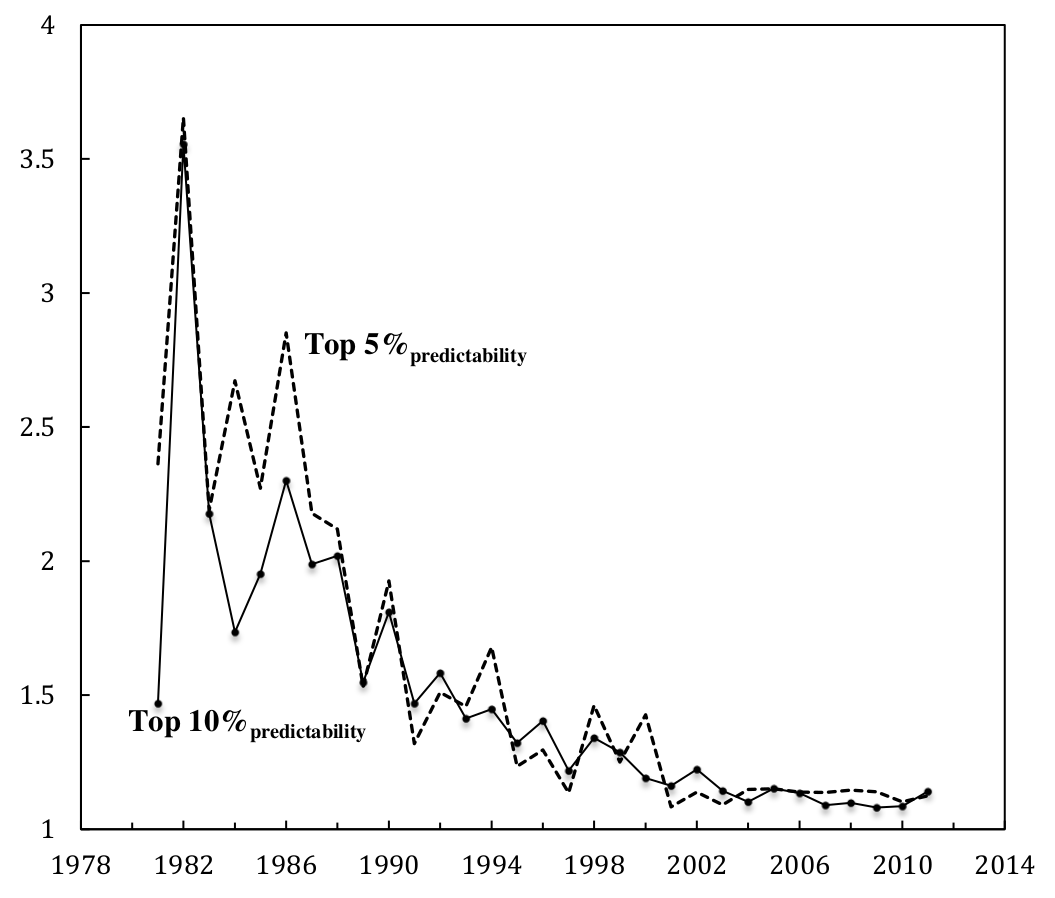

Continue ReadingThe Rise of a Confident Hollywood: Risk and the Capitalization of Cinema

The Rise of a Confident Hollywood Risk and the Capitalization of Cinema JAMES MCMAHON February 2013 Abstract This paper investigates the historical development of risk in the Hollywood film business. Using opening theatres as a proxy for future expectations, the paper demonstrates how, from 1981 to 2011, Hollywood has improved its ability to predict the […]

Continue ReadingAmerica’s Real ‘Debt Dilemma’

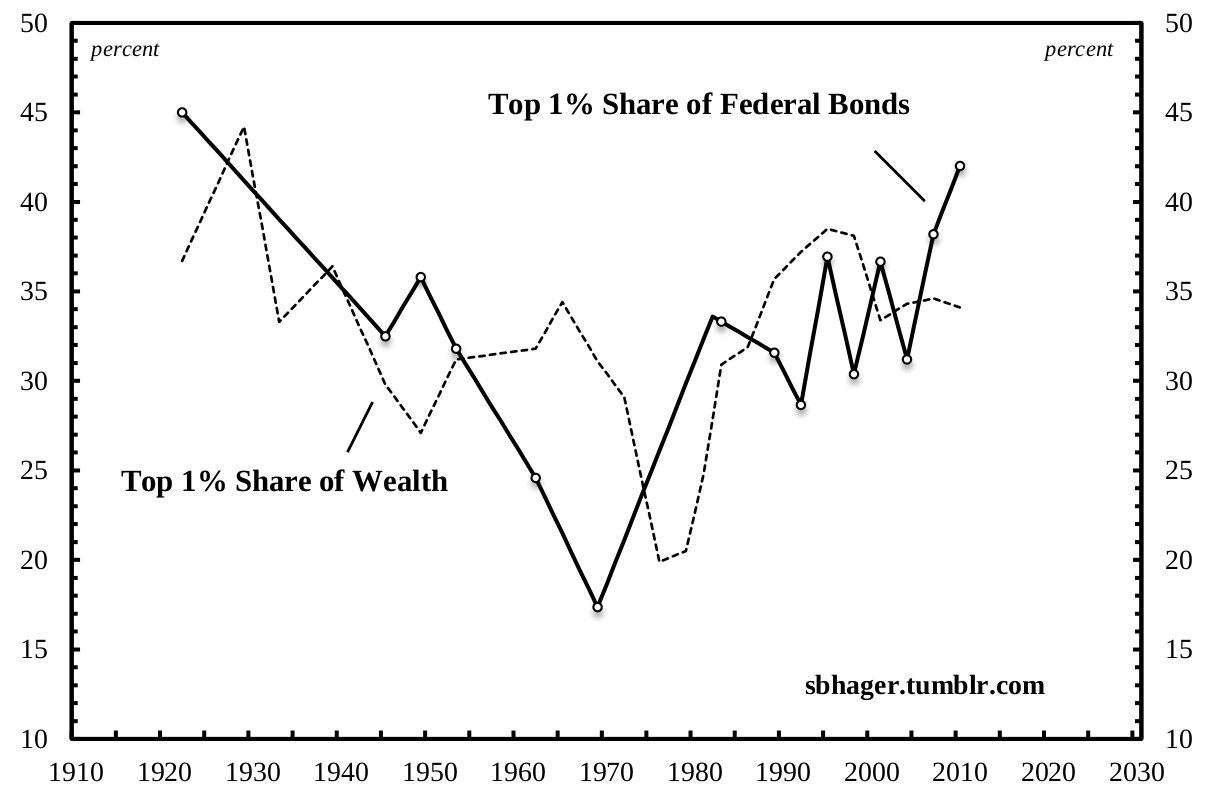

America’s Real ‘Debt Dilemma’ SANDY BRIAN HAGER July 2013 Abstract In the wake of the current crisis there has been an explosive rise in the level of the US public debt. These massive levels of public indebtedness are expected to keep growing unless there are drastic changes to existing budgetary policies. According to a recent […]

Continue ReadingHager, ‘Public Debt, Ownership and Power: The Political Economy of Distribution and Redistribution’

Abstract This dissertation offers the first comprehensive historical examination of the political economy of US public debt ownership. Specifically, the study addresses the following questions: Who owns the US public debt? Is the distribution of federal government bonds concentrated in the hands of a specific group or is it widely held? And what if the […]

Continue ReadingColour Coded Gender

DT Cochrane Girls wear pink. Boys wear blue. This seemingly universal gender dichotomy is actually a very recent invention, as this post on smithsonian.com makes clear. At the end of the 19th century, most boys and girls were dressed in ‘gender neutral’ white dresses. These were considered a practical option, convenient for play and easily […]

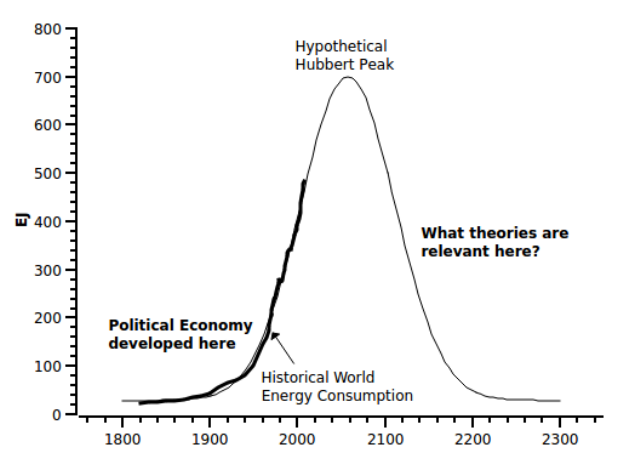

Continue ReadingFix, ‘Human Activity, Energy & Money in the United States’

Abstract There is no consensus, in political economy, about the exact relationship between the biophysical and the pecuniary spheres. This paper enters into the debate by asking the following question: how can a biophysical approach to political economy be used to gain insight into the complex interrelationship between the biophysical sphere of economic activity and […]

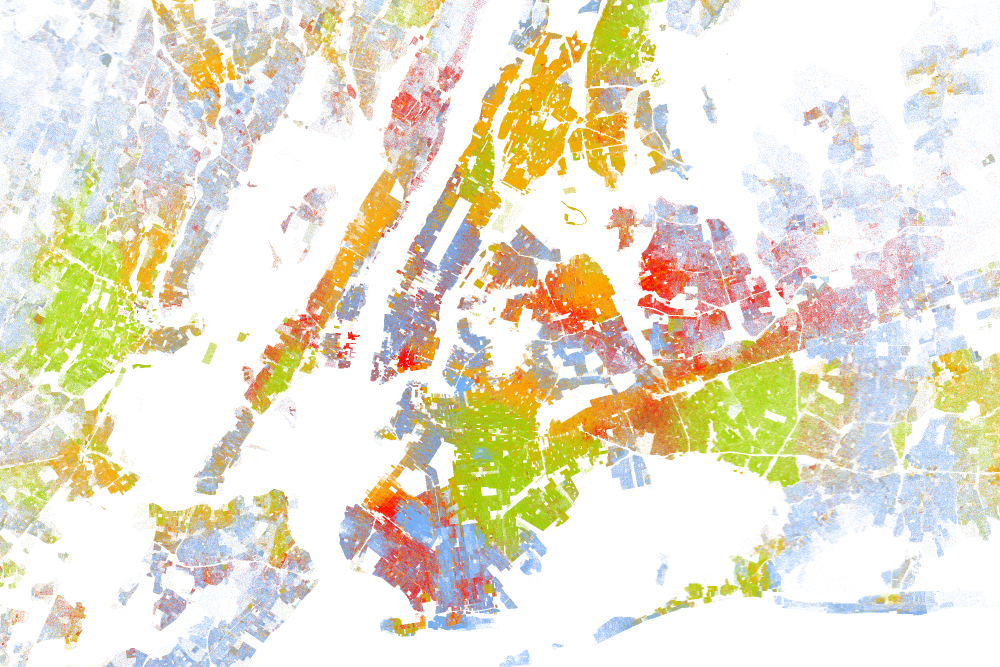

Continue ReadingVisualizing Racial Segregation in America

DT Cochrane Wired has published a series of maps that try to visualize racial segregation in many of America’s biggest cities. From Wired: “The [maps], created by Dustin Cable at University of Virginia’s Weldon Cooper Center for Public Service, is stunningly comprehensive. Drawing on data from the 2010 U.S. Census, it shows one dot per […]

Continue Reading