Low Capex, High Market Cap: A New High for Corporate Sabotage?

November 29, 2013

Edward Lam

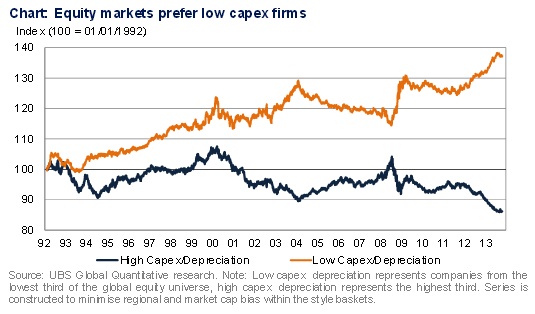

Found amongst some recent market commentary the chart above seems to be quite striking evidence in favour of the Capital as Power framework. The data series have been put together by the investment bank UBS, based on their broad (though not comprehensive) global stock coverage. UBS has charted two lines: a) the stock market returns of companies within the bottom third of capex to depreciation ratios (i.e. those spending too little on capex vs history) b) the stock market returns of companies within the top third of capex to depreciation ratios (i.e. those that are investing more in capex vs history).

Mainstream economic theory suggests that returns are generated by real investment: the larger the investment, the larger the return (eventually). The logic should be that firms that have high capex spending will outperform and those that spend too little should not be able to survive and compete.

What is suggested by the data is exactly the opposite: companies that don’t spend on capex actually seem to have been rewarded by the market over this 20 year period. A possible cause is that forms of strategic sabotage are more important to the capitalization of investments – i.e., cartels, regulations, monopolies.

This chart undermines the main argument in favour of low corporate taxes. We’re told that keeping these taxes low will encourage investment, which creates jobs. However, if there are greater returns from not investing, then why would corporations invest in productive capacity?