Abstract This essay opposes the idea that contemporary critical events like pandemics, global warming, environmental deterioration, et cetera, are to be considered as affecting humanity in a uniform way. Instead of seeing these phenomena like abstract universal threats, I propose to look at them through the lens of my concept of differential harm. By drawing […]

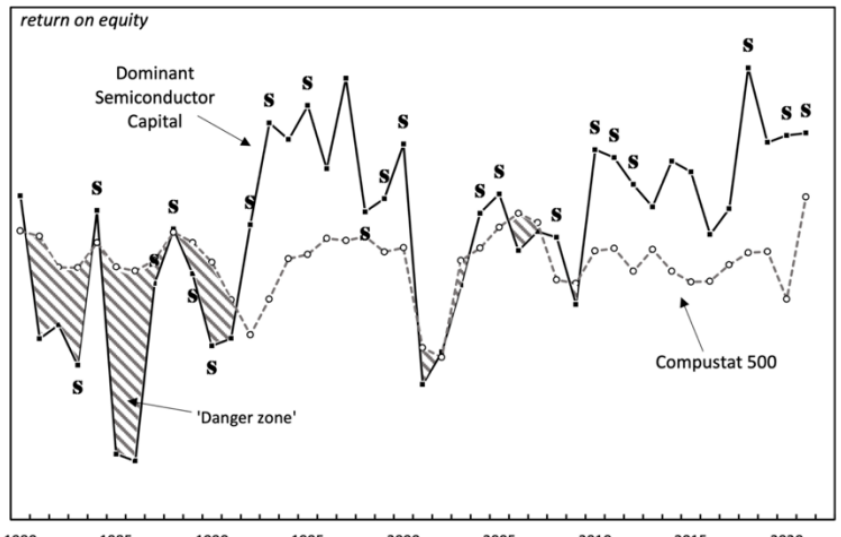

Continue ReadingMouré, ‘Technological Change and Strategic Sabotage: A Capital as Power Analysis of the US Semiconductor Business’

Abstract Rapid technological change is often touted as a fundamental reality of capitalist societies. It is also presented as concrete evidence for the supposed progressive improvement of material well-being that characterises the capitalist system of social order. Since its emergence in the mid-20th century, semiconductor technology in many ways exemplifies this view. Yet the rapid […]

Continue ReadingGlobal Capital: Political Economy of Capitalist Power (YorkU, GS/POLS 6285 3.0, Graduate, Fall Term, 2022-23)

Jonathan Nitzan What is capital? Despite centuries of debate, there is no clear answer to this question – and for a good reason. Capital is a polemic term. The way we define it attests our theoretical biases, ideological disposition, view of politics, class consciousness, social position, and more. Is capital the same as machines, or […]

Continue ReadingPietryka, ‘Kapitał, by rządzić, musi sabotować postęp’

Abstract Od głodu i biedy po zwykłe marnotrawstwo i nawracające fale przeróżnych kryzysów – to nie niepożądane skutki uboczne kapitalizmu, ale przejawy sabotażu. Bo nic nie utrwala władzy kapitału skuteczniej niż istnienie szerokiej rzeszy ludzi, którzy ani na chwilę nie mogą przestać pracować, by przeżyć. Capital, in order to rule, must sabotage progress From hunger […]

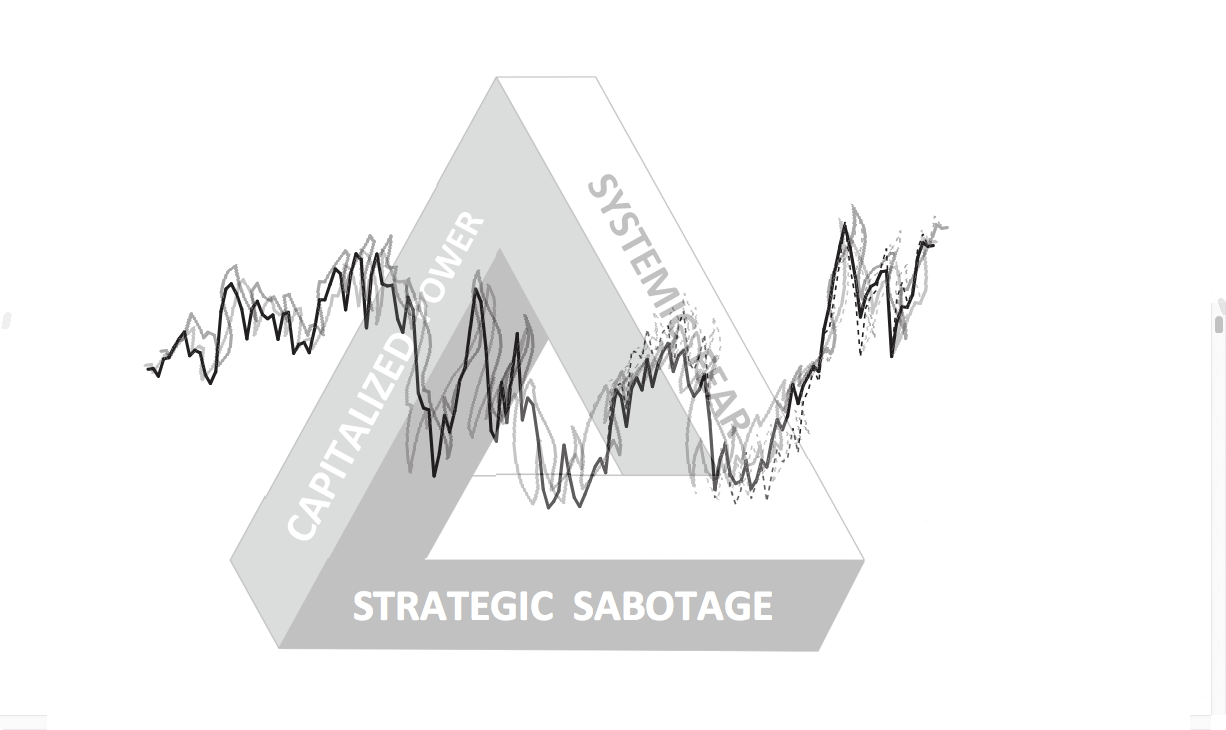

Continue ReadingBichler & Nitzan, ‘The Business of Strategic Sabotage’

Abstract Marxists love to hate the theory of capital as power, or CasP for short. And they have two good reasons. First, CasP criticizes the logical and empirical validity of the labour theory of value on which Marxism rests. And second, it offers the young at heart a radical, non-Marxist alternative with which to research, […]

Continue ReadingMouré, ‘No Shortage of Profit: Technological Change, Chip ‘Shortages’, and Capital Accumulation in the Semiconductor Business’

Abstract Rapid technological change is often touted as a fundamental reality of capitalist societies. It is also often presented as concrete evidence for the supposed progressive improvement of material well-being that characterises the capitalist system of social order. Since its emergence in the mid-20th century, semiconductor technology in many ways exemplifies this reality. Yet the […]

Continue ReadingPrivate Equity has sabotaged every attempt to end emergency room “surprise billing”

Originally published at pluralistic.net Cory Doctorow “Surprise billing” is when you go to the ER and discover that the doc, the specialist, or the test you got were performed by “independent contractors” who are not part of the hospital’s deal with your insurer. It means bills for thousands (literally) for an ice-pack. https://www.healthexec.com/topics/healthcare-economics/5751-ice-pack-hefty-bills-await-patients-just-walking-er The surprise […]

Continue ReadingDi Muzio on ‘Sabotage’

Note from Blair Fix: In a series of essays published in 2013 and 2014 on capitaspower.com, political economist Tim Di Muzio explored the concept of ‘sabotage’ as it applies to capitalist power. I recently rediscovered these essays and was so impressed by them that I have reposted them here as a single piece. About the […]

Continue ReadingBichler and Nitzan, ‘Growing Through Sabotage’

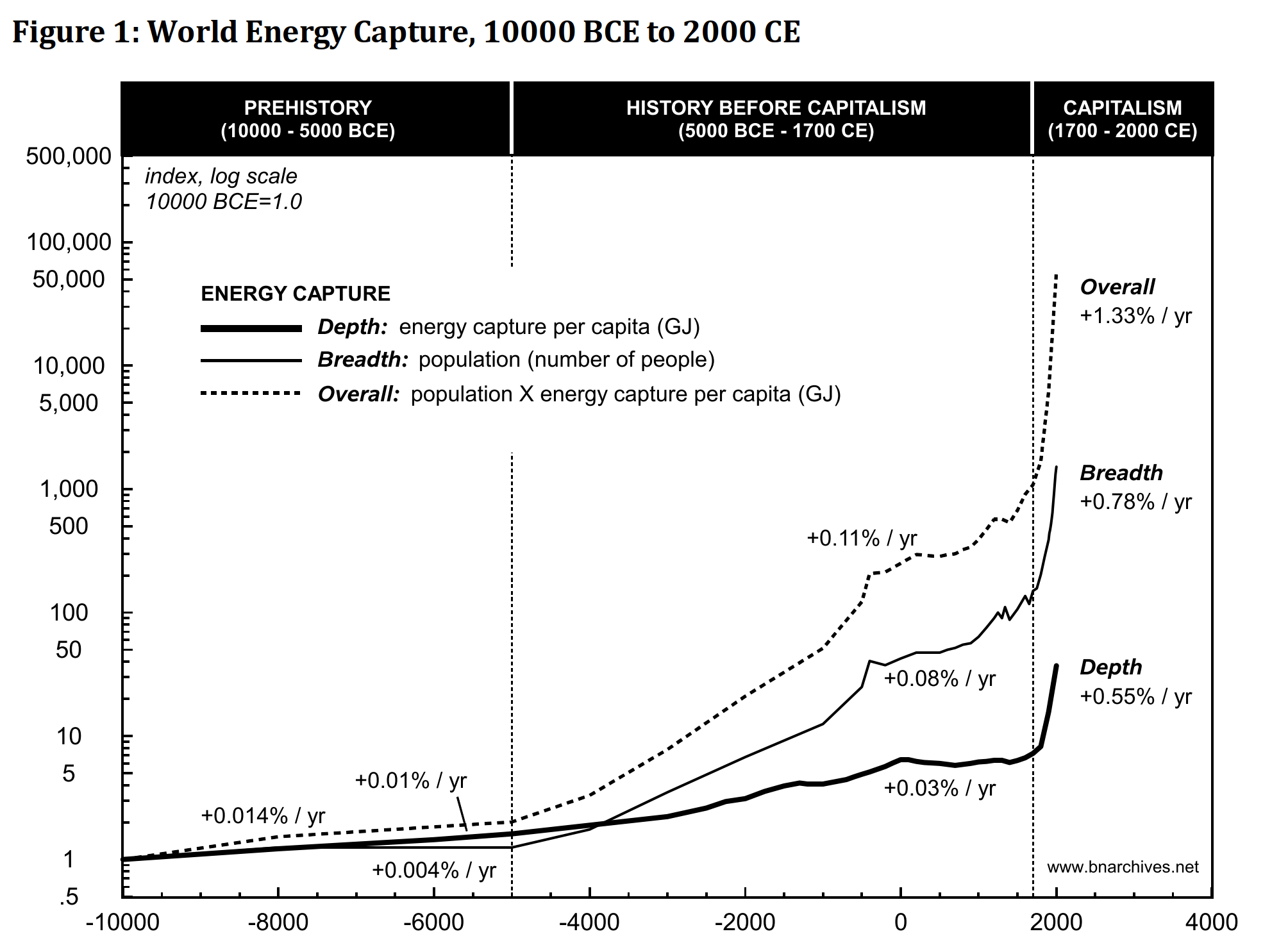

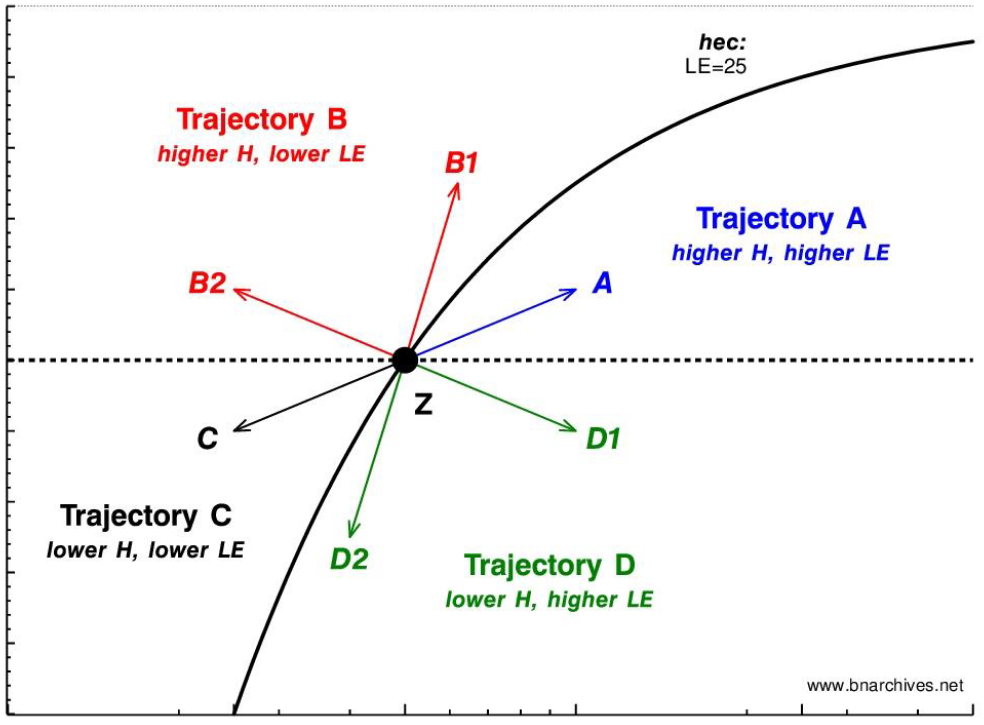

Growing Through Sabotage Energizing Hierarchical Power SHIMSHON BICHLER and JONATHAN NITZAN June 2020 Abstract According to the theory of capital as power, capitalism, like any other mode of power, is born through sabotage and lives in chains — and yet everywhere we look we see it grow and expand. What explains this apparent puzzle of […]

Continue ReadingBichler & Nitzan, ‘Growing through Sabotage: Energizing Hierarchical Power’

Abstract According to the theory of capital as power, capitalism, like any other mode of power, is born through sabotage and lives in chains – and yet everywhere we look we see it grow and expand. What explains this apparent puzzle of ‘growth in the midst of sabotage’? The answer, we argue, begins with the […]

Continue Reading2018/08: Bichler & Nitzan, ‘CasP’s Differential Accumulation versus Veblen’s Differential Advantage’

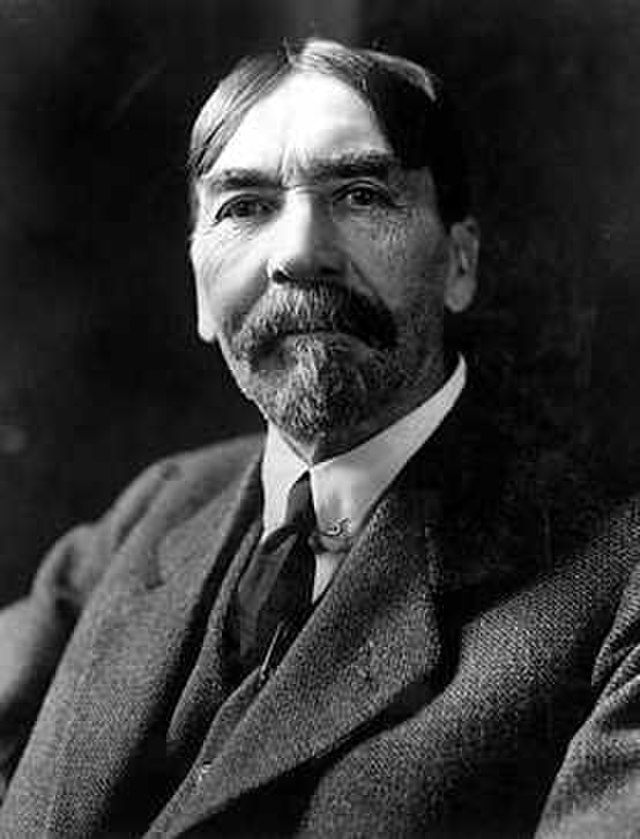

Abstract This paper clarifies a common misrepresentation of our theory of capital as power, or CasP. Many observers tend to box CasP as an ‘institutionalist’ theory, tracing its central process of ‘differential accumulation’ to Thorstein Veblen’s notion of ‘differential advantage’. This view, we argue, betrays a misunderstanding of CasP, Veblen or both. As we show, […]

Continue ReadingNo. 2017/02: Bichler & Nitzan, ‘Growing through Sabotage’

Abstract According to the theory of capital as power, capitalism, like any other mode of power, is born through sabotage and lives in chains – and yet everywhere we look we see it grow and expand. What explains this apparent puzzle of ‘growth in the midst of sabotage’? The answer, we argue, begins with the […]

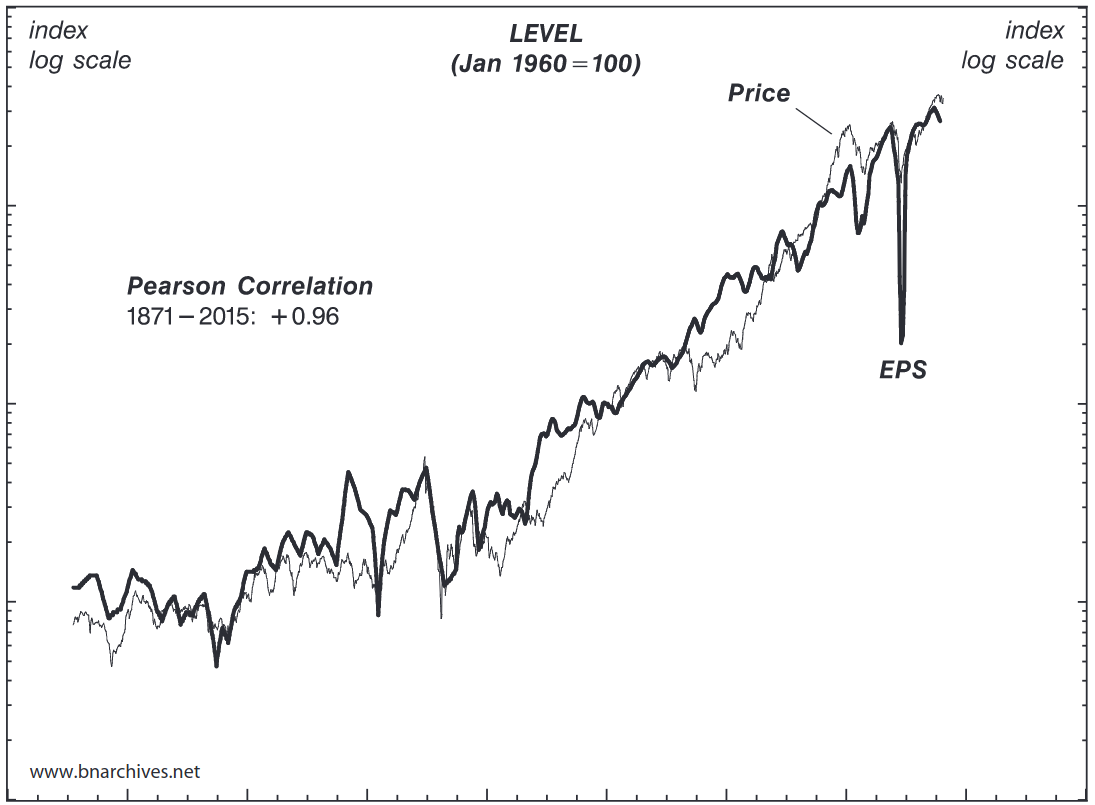

Continue ReadingBichler & Nitzan, ‘A CasP Model of the Stock Market’

Abstract Most explanations of stock market booms and busts are based on contrasting the underlying ‘fundamental’ logic of the economy with the exogenous, non-economic factors that presumably distort it. Our paper offers a radically different model, examining the stock market not from the mechanical viewpoint of a distorted economy, but from the dialectical perspective of […]

Continue ReadingNo. 2016/07: Bichler & Nitzan, ‘A CasP Model of the Stock Market’

Abstract Most explanations of stock market booms and busts are based on contrasting the underlying ‘fundamental’ logic of the economy with the exogenous, non-economic factors that presumably distort it. Our paper offers a radically different model, examining the stock market not from the mechanical viewpoint of a distorted economy, but from the dialectical perspective of […]

Continue ReadingBichler & Nitzan, ‘The Scientist and the Church’

Abstract The Scientist and the Church is a wide-ranging biography of research, showcasing Bichler and Nitzan’s attempts to break through the stifling dogmas of the academic church and chart a new scientific cosmology of capitalism. Central to the authors’ work is the notion that capital is not a productive economic category but capitalized power, and […]

Continue ReadingCapital as Power and Freelance Creative Work 4

Frederick H. Pitts Resonance and dissonance in the rhythms of freelance creative work In the last blog, I applied some of Nitzan and Bichler’s ideas to freelance work in the creative industries. I utilised their conceptualisation of the distinction between creativity and power, and of the sabotage of the former by the latter. Nitzan and […]

Continue ReadingCapital as Power and Freelance Creative Work 3

Frederick H. Pitts Creativity, sabotage and the management of risk and responsibility in freelance creative work Nitzan and Bichler theorise a dissonant relation of sabotage between power and creativity, business and industry. What they show is that the control of creative processes of production is not antithetical to their success. Rather, it is constitutive of […]

Continue ReadingCapital as Power and Freelance Creative Work 2

Frederick H. Pitts Capital as Power, risk-aversion and the avoidance of uncertainty Mainstream critiques of contemporary capitalism conducted in the wake of the Great Recession tend to indict a number of factors. Perceived short-termism. The dangerous compulsion to speculate. An attraction to growth for growth’s sake. The propensity towards the greedy and rapid accumulation of […]

Continue ReadingCapital as Power and Freelance Creative Work 1

Frederick H. Pitts Rhythms of Risk and Responsibility in Freelance Creative Work This series of blogs applies Nitzan and Bichler’s theory of capital as power to the empirical concern of freelance work in the creative industries. It reports some findings from a research project I conducted earlier this year. The research was part of a […]

Continue ReadingThe Weekly Sabotage: Week 7

Tim Di Muzio The Privatization of Money: The Greatest Sabotage in Human History? Part II Last time we found out that modern money is created when commercial banks make loans to people and businesses. They are not loaning out other people’s money at all, but effectively creating it by entering numbers into a computer. Between […]

Continue Reading