The ‘Reversal of Fortune’: Institutions or Globalisation?

October 22, 2021

Originally published at joefrancis.info

Joe Francis

Daron Acemoglu, Simon Johnson and James Robinson (AJR, 2002) famously argued that a ‘reversal of fortune’ had taken place among ex-European colonies. Generally speaking, they argued, those ex-colonies that had been richest in 1500 would become the poorest by the end of the twentieth century. This, they claimed, was due to the different institutions established by Europeans.

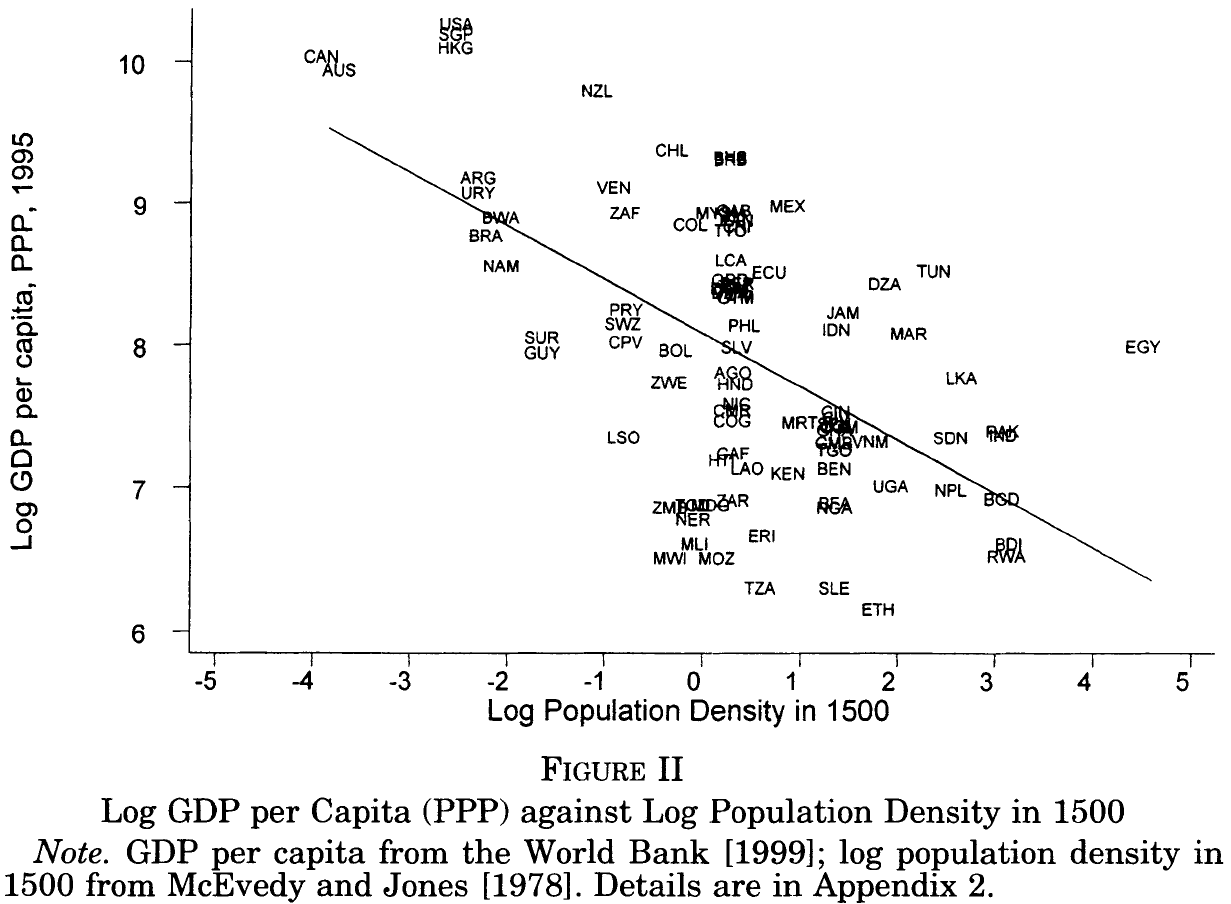

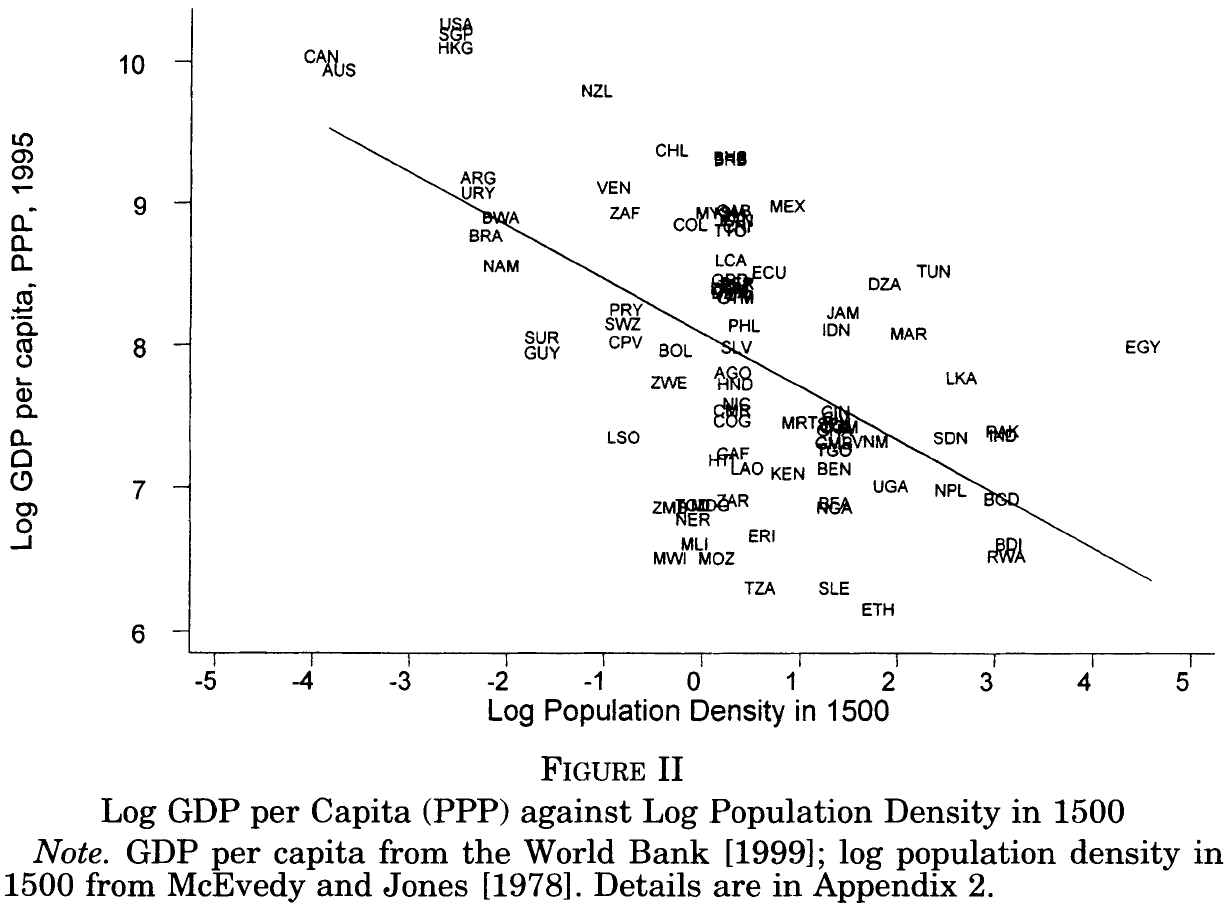

The basic illustration of AJR’s reversal of fortune is seen in Figure II from their 2002 article, which is reproduced below. On the vertical axis there is the log of GDP per capita in 1995, which indicates levels of wealth in the late twentieth century. And on the horizontal axis is the log of the number of people per square kilometre of arable land in 1500, which is taken to represent population density, which is in turn taken to be an indication of wealth. For the 80+ former European colonies included in the sample, there is a clear negative correlation between the population density in 1500 and incomes per capita in 1995. Assuming that population density really is a reliable proxy for wealth, the conclusion is that a reversal took place: those non-European countries that were richest in 1500 generally became the poorest 500 years later.

AJR point toward institutions to explain this reversal. In densely populated areas, they argue, European colonial administrators established institutions that were designed to exploit the natives rather than to attract European settlers, who were further discouraged by the greater prevalence of contagious diseases. Consequently, extractive institutions were established in much of Africa, Asia and Latin America, evolving into the corrupt and kleptocratic regimes that are so common in these countries today. By contrast, in sparsely populated North America and Australasia more inclusive institutions were formed in response to the demands of European settlers, leading to the strong protections for property owners that are needed for economic growth.

This narrative is attractive and has been hugely influential. Yet it is also wrong.

Most notably, AJR ignore the possibility that high population density may have caused underdevelopment. From the perspective of debates about ‘over-population’, it would seem unsurprising that the most densely populated countries of 1500 are the poorest today, given that they had less land per capita, whereas those countries that were more sparsely populated prospered because they had more land.

Australia, for instance, prospered less because of the institutions established by Europeans than due to its abundant land being brought into production during the long nineteenth century. Up to then, the ‘tyranny of distance’ had prevented Australia’s land from being exploited, as high trade costs meant that it would have been too expensive to profitably export most of the goods that could be produced there. In the nineteenth century, however, trade costs plummeted due to cheaper shipping and greater competition among merchants. Improved terms of trade then attracted Europeans to Australia, where they settled in order to bring its land into production, largely for export. In doing so, they turned it into one of the world’s richest countries.

Egypt, by contrast, was at the other end of the population-density spectrum in 1500, and its subsequent (under)development was fairly typical of the periphery’s land-scarce regions. Prior to the long nineteenth century, it had been a predominantly agricultural country, but with widespread handicraft industries providing employment for peasants during seasonal periods of low work. During the long nineteenth century handicraft production was undermined, however, by the cheaper manufactured goods, particularly textiles, being produced in the factories of the North Atlantic core. The result was greater ‘over-population’, as increasing quantities of labour had to look for employment on a relatively fixed quantity of land.

From this perspective, the divergence between Australia and Egypt was due to the differential impacts of nineteenth-century globalisation on land-abundant and land-scarce countries. What Egypt lacked, in comparison with Australia, was abundant new land that could be brought into production in response to improved terms of trade. Consequently, it and other land-scarce countries in Africa, Eurasia and Latin America tended to fall behind the land-abundant European offshoots in North America and Australasia. This was why AJR found population density in 1500 to have been correlated with wealth at the end of the twentieth century.

Reference

Acemoglu, D., S. Johnson, and J.A. Robinson, ‘Reversal of Fortune: Geography and Institutions in the Making of the Modern World Income Distribution’, Quarterly Journal of Economics, 117:4, 2002, pp. 1231-94.