Peak Oil Never Went Away

December 13, 2021

Originally published at Economics from the Top Down

Blair Fix

Do you remember peak oil? It was all the rage a decade ago. Now, almost no one is talking about it. The funny thing is, the problem never went away. If anything, it’s gotten worse.

In this post, I take a deep dive into peak oil. I show you that the peak in the production of conventional crude oil isn’t some distant prospect. It’s already happened. What’s more, the model that correctly predicted this peak suggests that conventional oil production is about to collapse.

Yes, talk of peak oil went away. But the problem didn’t.

Peak oil — A brief history

If you use an exhaustible resource, you will eventually run out. This fact is so obvious that everyone understands it … at least in principle. But in practice, humans are shockingly bad at predicting resource exhaustion. Why? The reason, I believe, is that we don’t understand things that are big.

Here’s an example. Imagine you’re stuck on a desert island with a one-year supply of food. What would you do? You’d probably ration the food so it lasted as long as possible. Now imagine that you had 100-year’s worth of food? Now what would you do? To hell with rationing … you’d probably gorge yourself without worry. This change in behavior is important. Like the 1-year stock, the 100-year stock of food is still exhaustible. But it’s so large that it seems infinite. And so you behave like the resource is actually infinite.

When this behavior plays out in the real world, the results are always the same. We exhaust a seemingly inexhaustible resource — and we do so sooner than we expect. Here are a few examples. The bison of North American were once so plentiful that they seemed infinite. Yet by the end of the 19th century, only a few hundred were left. The passenger pigeon once flocked in numbers that darkened the sky. And so we harvested them by the train car … until they went extinct. Whales seemed an inexhaustible source of fuel oil. But soon their numbers were decimated. I could go on …

Luckily, the switch to fossil fuels saved whales from extinction. Still, we’re doing the same thing with fossil fuels as we did with whales — treating them as though they were infinite. The difference, though, is that the stock of fossil fuels is vastly larger than any fuel stock we’ve used before. That makes perceiving its finite nature even harder.

To give you a sense of the size of fossil fuel reserves, Figure 1 compares the cumulative US production of crude oil to the cumulative US production of whale oil. Here’s how to read the plot. Pick a year on the horizontal axis. The value on the vertical axis indicates the amount of the resource harvested up to that year. By 1880, for instance, the US had harvested about 0.05 EJ of whale oil. In the same year, it had already harvested about 10 EJ of crude oil. (Note that the vertical axis uses a log scale, so each tick mark indicates a factor of 10.) By 1880, whale-oil production had mostly stopped. But crude-oil production kept growing. Today, the US has harvested about 20,000 times more crude oil than whale oil.

The immensity of this crude oil reserve is hard to fathom. Think of all the whales ever slaughtered. Put them in a pile … and then make it 20,000 times bigger. That’s the magnitude of the US stock of crude oil. It’s immense. But it’s not infinite.

In fact, the finite nature of US crude oil reserves is visible in Figure 1. When we plot cumulative production on a log scale, resource exhaustion appears as an f-curve. When the resource is first harvested, cumulative production grows rapidly. On the f-curve, this rapid harvest appears as a steep slope. From day one, though, the production growth rate actually declines. This gives rise to the upper part of the f-curve. Growth slows and eventually plateaus.

The f-curve shape is caused by a simple principle: when you harvest an exhaustible resource, you exploit the easy pickings first. Initial growth is therefore fast. But as you move on to resources that are harder to exploit, growth slows. Today, cumulative crude oil production is approaching a plateau similar to that reached by whale oil in the 1880s. It’s a foreshadow of resource exhaustion.

Despite the ominous trend, the scale of crude oil reserves misleads us. And so most people forget that these reserves are finite. Fortunately, not everyone is fooled. Back in 1956, US oil production was exploding. But the geologist M. King Hubbert was worried about a different trend. Yes, oil production was growing. But oil discovery was not. By 1956, the rate of US oil discovery was in steep decline. This fact led Hubbert to make a startling prediction: US oil production would soon peak.

The peak would come, Hubbert predicted, around 1970. And that’s exactly what happened. As Figure 2 shows, US oil production peaked in 1970 and then began to decline. True, Hubbert’s prediction wasn’t perfect. He got the height of the peak (and subsequent decline) wrong by about 30%. Still, we should give credit where it’s due. Before Hubbert, most people thought that the peak of US oil production was a problem for the distant future. It was not.

Until the late 2000s, US oil production continued to decline as Hubbert predicted. Then in 2008, something changed. Oil production began to rise. Today, Hubbert’s prediction is flat out wrong. He predicted that by 2020, the US would produce 20% as much oil as it did in 1970. Instead, it produces 20% more oil. Why the reversal?

What you’re seeing after 2008 is the shale-oil boom. Unlike conventional crude oil, shale oil is found in solid form. It’s essentially oil trapped within sedimentary rock. Over the last decade, the US has exploited its shale-oil reserves, with dramatic results that Hubbert didn’t predict. To many people, this boom spells the end of Hubbert’s ‘doomism’.

I think this euphoria is unwarranted. Like conventional crude, shale oil is a finite resource that will eventually be exhausted. What’s more, none of the shale oil currently being harvested is a new discovery. In fact, Hubbert knew about it in 1956. He pegged US shale-oil reserves at about 1 trillion barrels of oil. (Modern estimates peg US shale reserves between 0.3 – 1.5 trillion barrels.) To give you some perspective, that’s about 5 times more shale oil than Hubbert’s estimate for the total US reserve of conventional crude oil (which he pegged at 200 billion barrels). But while he knew about shale reserves, Hubbert didn’t include them in his peak-oil prediction. Why?

His reason was simple — there was no commercially viable way to extract shale oil. Today, evidently, things have changed (although perhaps not as much as you might think.) In 2008, oil companies started to harvest shale oil using a process called hydraulic fracturing (i.e. fracking). This involves pumping high-pressure liquid into a wellbore, which then fractures the shale formation, causing oil to flow. It’s a technology that existed (experimentally) when Hubbert made his prediction. But he never foresaw its widespread use.

For many people, the shale-oil revolution spells the end of peak oil — pushing it into the indefinite future. The problem, though, is that it’s easy to be misled by big numbers. Yes, the US probably has some 1 trillion barrels of shale oil in its reserves. But that doesn’t mean that all of it — or even a significant fraction of it — will be harvested.

The reason is that when it comes to harvesting energy, quality is as important as quantity. Here’s a simple example. Every year the Earth releases about 1500 EJ (1018 Joules) of energy in the form of geothermal heat. To give you some perspective, that’s about 250% more energy than humanity used in 2019.1 Can this vast geothermal reserve solve our energy problems?

Not really.

The problem is that while the quantity of geothermal energy is enormous, its quality is poor. Most geothermal energy comes as low-temperature heat that’s spread across the Earth’s surface. This diffuseness makes geothermal energy difficult to harvest. Because of this poor quality, we’ll probably harvest only a minuscule fraction of the Earth’s geothermal energy.

The same is probably true of shale oil. Yes, there are potentially 1 trillion barrels of shale oil waiting to be harvested. But this oil is difficult to extract. And for that reason, my guess is that most of it will probably remain unused.

Although shale-oil production has exploded in the last decade, cracks in the euphoria are starting to appear. That’s because the shale boom has been driven largely by the promise of profit. Shale companies swallowed big losses while they ramped up production. The assumption was that windfall profits would eventually come. They haven’t. As Jed Graham observes, “Shale companies simply haven’t made much money from the fracking revolution.” In many ways, this lack of profit vindicates what many peak-oil theorists have been saying for years. Yes, the stock of shale oil is huge. But most of this stock, they say, is probably not worth harvesting.

What fraction of its shale oil will the US eventually exploit? That’s hard to know. But suppose it’s 20%. If Hubbert was correct to peg shale reserves at 1 trillion barrels, that means the US will eventually harvest 200 billion barrels of shale oil. That’s a lot of oil — about the same as Hubbert’s estimate for the entire US reserve of conventional crude oil. This plethora of oil should buy us a lot of time, right?

Actually, no. Figure 3 shows what happens when we add 200 billion barrels of shale oil to Hubbert’s original peak-oil prediction. What it gets us is a second peak … today. If this guess is correct, what’s ahead is not the euphoric growth of oil production, but steep decline.

Time will tell if this prediction is correct. (If you’re reading this post in 2030, remind me to revisit my prediction.)

Peak oil goes away

After Hubbert’s 1956 prediction, the idea of peak oil went largely undiscussed for the rest of the 20th century. The reason was familiar — the peak of global oil production was a problem for the distant future.

Hubbert predicted that global oil production would peak at the turn of the 21st century. Unsurprisingly, it was around this time that interest in peak oil was revived. In 2005, The Oil Drum was born, sparking much peak-oil commentary. At the same time, geologists like Colin J. Campbell and Jean H. Laherrère revisited Hubbert’s predictions for global oil production and found that the timing was on track. Conventional oil production, they argued, would soon peak.

Then came the US shale-oil boom. It’s no exaggeration to say that the shale boom killed talk of peak oil. Figure 4 tells the story. I’ve plotted here the frequency of the phrase ‘peak oil’ in the Google books corpus. Its popularity exploded in the early 2000s. But after 2008 — the year that the shale boom began — talk of peak oil plummeted.

Today, peak oil is again a fringe idea. But while discussion went away, the problem didn’t. In fact, the peak of conventional crude oil is already behind us.

The peak of conventional oil

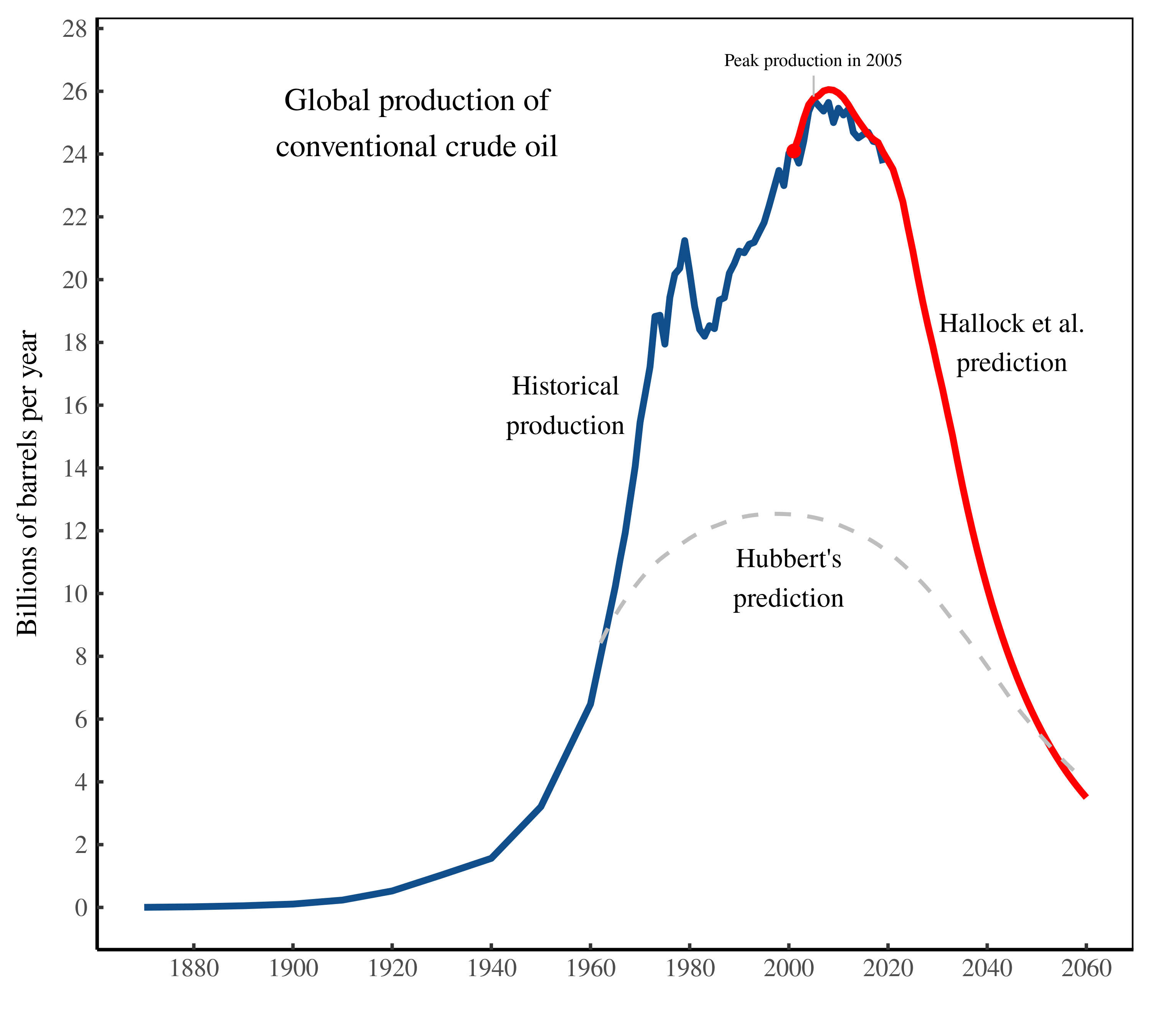

In 1956, M. King Hubbert predicted that the global production of oil would peak around the year 2000. Looking only at conventional crude oil, it turns out that Hubbert got the timing right. As Figure 5 shows, the global peak of conventional crude production came in 2005. But despite getting the timing right, Hubbert got the height of the peak wrong by a factor of 2.

It may just be luck that Hubbert got the height of the peak wrong but the timing right. But this luck still illustrates an important principle: exponential growth can quickly eat away at any resource. Hubbert underestimated the amount of crude oil we would discover. But we exploited this larger reserve faster than he anticipated. So his timing remained correct.

To be fair to Hubbert, when he made his prediction, the size of the crude oil stock was uncertain. Today there is less uncertainty, which makes modeling easier.

Perhaps the most rigorous prediction (to date) for conventional oil production comes from John Hallock Jr. and colleagues. In 2004, Hallock estimated the conventional oil reserves in all of the major oil-producing countries. Based on the range of these estimates, Hallock then created different scenarios for future oil production. In 2014, Hallock and colleagues revisited these scenarios to see which one was correct. Global oil production, they found, was following the low-end estimate. Figure 5 shows Hallock’s low-end model. It’s shockingly accurate. For the last 20 years, the model has predicted the global production of conventional oil to within 2%.

The real test for Hallock’s prediction will come in the next few decades. If the model is correct, we’re on the precipice of an oil-production collapse. By 2040, the model predicts that we’ll be back to 1960-levels of oil production. But by then, the oil will be used by 3 times the population.

If you’re reading this post in 2040 (and I haven’t kicked the bucket), remind me to revisit Hallock’s prediction.

The path ahead

Predicting the peak of global oil production has always involved a large dose of uncertainty. To predict peak oil, you must estimate 3 things:

- The size of oil reserves that will be discovered in the (indefinite) future

- The portion of these reserves we will exploit

- How rapidly we will exploit these reserves

Needless to say, estimating these 3 quantities is not easy. That’s why peak oil predictions are often wrong. Imagine at the beginning of the industrial revolution trying to predict the amount of crude oil humanity would eventually discover. You’d be lucky to get within a factor of 10.

As time goes by, though, the future becomes easier to see. That’s because fewer and fewer oil reserves remain undiscovered. In 1956, Hubbert guessed that humanity would eventually harvest 1.25 trillion barrels of (conventional) oil. How close was he? We won’t know until we’ve exhausted all our oil. But if Hallock’s model is correct, humanity will eventually harvest 1.9 trillion barrels of conventional crude. So Hubbert may have gotten it right to within a factor of 2. That’s not bad.

When it comes to unconventional oil, estimates become even harder. For one thing, the size of these reserves are poorly known. Worse still, we have no idea what portion of these reserves we will eventually exploit. (With conventional crude, we know that we’ll exploit almost everything we discover.) So the future of total oil production (both conventional and unconventional) remains uncertain.

Technological optimists think that unconventional oil will push the peak of total oil production into the distant future. I’m more skeptical. Assuming Hallock’s model is right, I doubt that unconventional oil sources will offset the coming collapse of conventional crude production. In fact, I’d go a step further and say that we’re able to harvest low-quality shale oil precisely because we’re producing so much conventional crude. Take away the conventional crude, and I’d guess that harvesting low-quality shale oil will become unfeasible.

Whatever happens, it’s clear that the future will be unlike the past. Every living human has known nothing but energy boom. But when you harvest an exhaustible resource, the bust always comes. It’s just a matter of when.

[Update: A reader has pointed out that tight oil is the preferred term for fracked shale oil. Also, Hubbert’s prediction for US oil production (Fig. 2) was for the lower 48 states. I’ve compared it to oil production in all 50 states — not a particularly fair comparison.]

Sources and methods

Whale oil production is from Peter A. O’Connor and Cutler J. Cleveland’s paper U.S. Energy Transitions 1780–2010. I’ve digitized Figure 5 and extracted the data.

US oil production data comes from:

- 1860–1919: Historical Statistics of the United States (HSUS) Millenial Edition,

Table Db157 - 1920–present: Energy Information Agency, Series

MCRFPUS2 - I’ve indexed the HSUS series to the EIA series in 1920

Hubbert’s prediction for US and world oil production comes from his 1956 paper Nuclear Energy and Fossil Fuels. I’ve digitized Figures 20 and 21 and extracted the data.

In Figure 3, I’ve estimated future US oil production using a logistic curve. I’ve assumed that total recoverable reserves are 400 billion barrels.

The word frequency of ‘peak oil’ (Figure 4) is from the Google Ngram corpus, retrieved with the R ngramr package.

Data for global oil production comes from:

- 1820–1960: Appendix in Vaclav Smil’s Energy Transitions: History, Requirements, Prospects

- 1965–2001: BP Statistical Review of World Energy, 2020

- 2001–2012: John L. Hallock’s data for USGS-Conventional Oil. Download it here.

- 2013–present: various editions of the International Energy Agency’s World Energy Outlook

- I index the IEA data to Hallock’s data in 2012. I index the BP data to Hallock’s data in 2001, and Smil’s data to the reindexed BP data in 1970.

Hallock’s prediction is for the following scenario for USGS conventional oil: ‘Decline Point 60%, 5% Production Growth Limit, Low EUR Low Demand Growth’. Get the data here.

Notes

- J. H. Davies and D. R. Davies estimate that the total heat flux from the Earth’s surface is about 47 TW. That translates to about 1500 EJ per year. According to the BP Statistical review, in 2019 the world used about 580 EJ of primary energy.↩

Further reading

Hallock, J. L., Wu, W., Hall, C. A., & Jefferson, M. (2014). Forecasting the limits to the availability and diversity of global conventional oil supply: Validation. Energy, 64, 130–153.

Hallock Jr, J. L., Tharakan, P. J., Hall, C. A., Jefferson, M., & Wu, W. (2004). Forecasting the limits to the availability and diversity of global conventional oil supply. Energy, 29(11), 1673–1696.

Hubbert, M. K., & others. (1956). Nuclear energy and the fossil fuel. Drilling and production practice. American Petroleum Institute.

O’Connor, P. A., & Cleveland, C. J. (2014). US energy transitions 1780–2010. Energies, 7(12), 7955–7993.