Kevin O’Leary, the Distillation of Capital

April 1, 2014

DT Cochrane

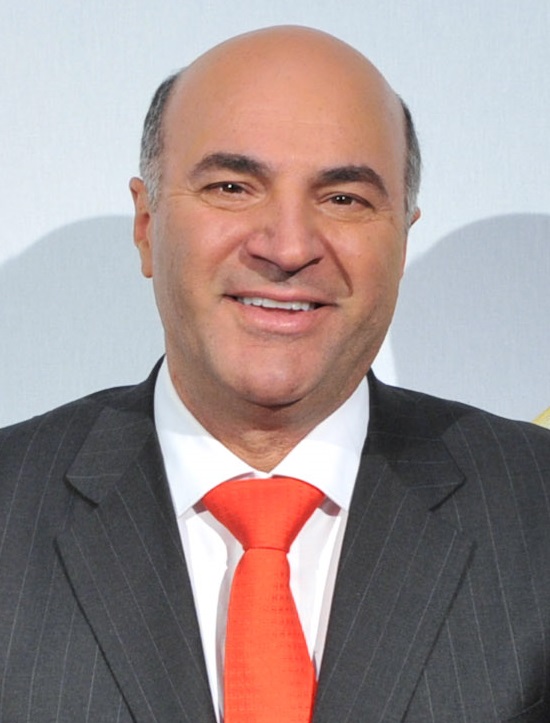

Television personality Kevin O’Leary is best known as the ‘asshole’ on the investment reality shows Dragon’s Den, in Canada, and Shark Tank, in the United States. The shows have self-styled entrepreneurs bring forth their inventions or business ideas in hopes of attracting investment from a panel of capitalists, which includes O’Leary. He has established himself as the unemotional ‘money guy.’ He is also the unabashed markets über alles cheerleader on CBC’s Lang and O’Leary Exchange. O’Leary is very aware of his media persona and works diligently to cultivate that image. In the process, he has become a caricature of The Capitalist.

On the Lang and O’Leary Exchange, he faces off against business reporter Amanda Lang, who offers a very middle-of-the-road contemporary liberal perspective: pro-market, with some role for government intervention. O’Leary, on the other hand, regards markets as an almost perfect instruments of resource allocation, only hindered by governments. Profit-seekers, like himself, seek out opportunities to make money. In doing so, he claims, they necessarily serve the broad interests of society. His analysis of any given topic frequently turns to the movements of capital markets. These movements, he believes, give him all the insight he needs, since markets always get it right. They do so because money is on the line. As such, he’s the perfect capitalist to help someone understand the capital as power framework. His worldview is almost entirely translated through the qualities of capitalization.

As an example, on the March 24th, 2014 episode, the issue of Russia’s annexation of the Crimea came up. Lang asked what “levers” the West has to pressure Russia. O’Leary says there is nothing that governments, or multilateral organization like the G8 or NATO, can do, but “the market will do what it’s going to do.” He explains that the cost of capital in Russia has increased about 30 basis points and total market capitalization has declined about 20%. Capital, O’Leary argues, will move from Russia to “places where they are acting better, like China.” Then, the Russia people, particularly the capitalist cronies, who are seeing their net worth decline will do something to constrain Russian President Valdimir Putin. This is the virtue of the market, according to O’Leary. It punishes bad behaviour, defined as behaviour contrary to the interests of business, which is synonymous with the interests of society. Regardless of the qualitative make-up of events, whether the annexation of part of another country or the release of a new product line, the market will transform those incommensurable qualities into the easily understood quantities of capital.

Actual blood and guts capitalists are complicated people, as we all are. They have families. They have hobbies. Most have interests beyond making money. However, what actual markets do is denude them of all these other interests, in as much as they are capitalists. The undertakings of capitalists must be considered potentially profitable. This is how capitalization serves to gird the entire qualitatively diverse system and how it is self-reinforcing. Love of technology, love of productivity, love of consanguineous relations, love of sustainability, all of this must be subordinate to the accumulatory drive. If capitalists want to pursue passion projects that are contrary to gain, they must do so outside the accumulatory institutions, as Bill Gates has done with his post-Microsoft life.

This is why Kevin O’Leary is such a suitable figure for understanding the disciplinary nature of capitalization. He espouses it so directly and unabashedly that he embodies the essence of capital.

Great post Troy! I’ve been watching those shows for years now and get my students to watch a few clips when Kevin is at his most extreme. It’s amazing how much one man’s subjectivity has embraced accumulation as the end goal of human endeavors.