Abstract Neoclassical growth theory is the dominant perspective for explaining economic growth. At its core are four implicit assumptions: 1) economic output can become decoupled from energy consumption; 2) economic distribution is unrelated to growth; 3) large institutions are not important for growth; and 4) labor force structure is not important for growth. Drawing on […]

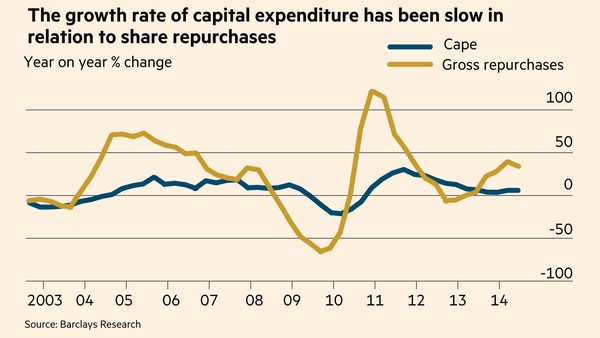

Continue ReadingStock Buybacks vs Greenfield Investment

Jonathan Nitzan In his November 29, 2013 piece, ‘Low Capex, High Market Cap: A New High for Corporate Sabotage?’, Edward Lam lends support to CasP’s sabotage thesis by showing how firms with relatively low ‘greenfield’ investment outperform those with relatively high ‘greenfield’ investment. A recent FT article, titled “Money Well Spent?” (Tom Braithwaite, Nicole Bullock […]

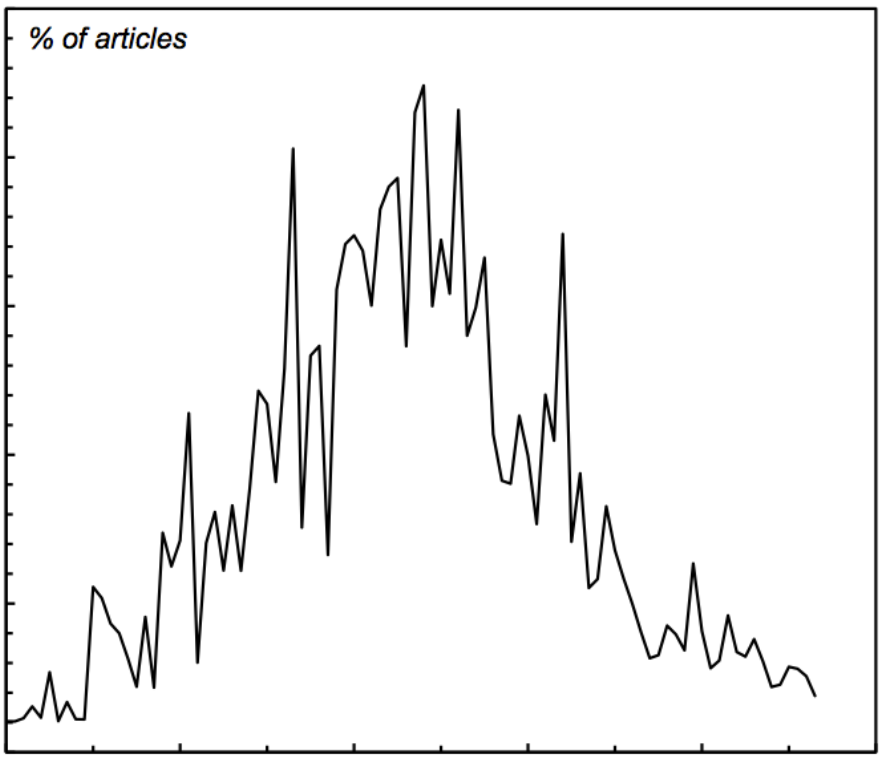

Continue ReadingThe Rise and Fall of Debate in Economics

Joe Francis New data illustrate the extent to which economists have stopped discussing each other’s work. Once upon a time, economists regularly used to publicly criticise each other’s work in academic journals. But not any more. In Figure 1 I have illustrated the degree to which economists have stopped debating. The data have been culled […]

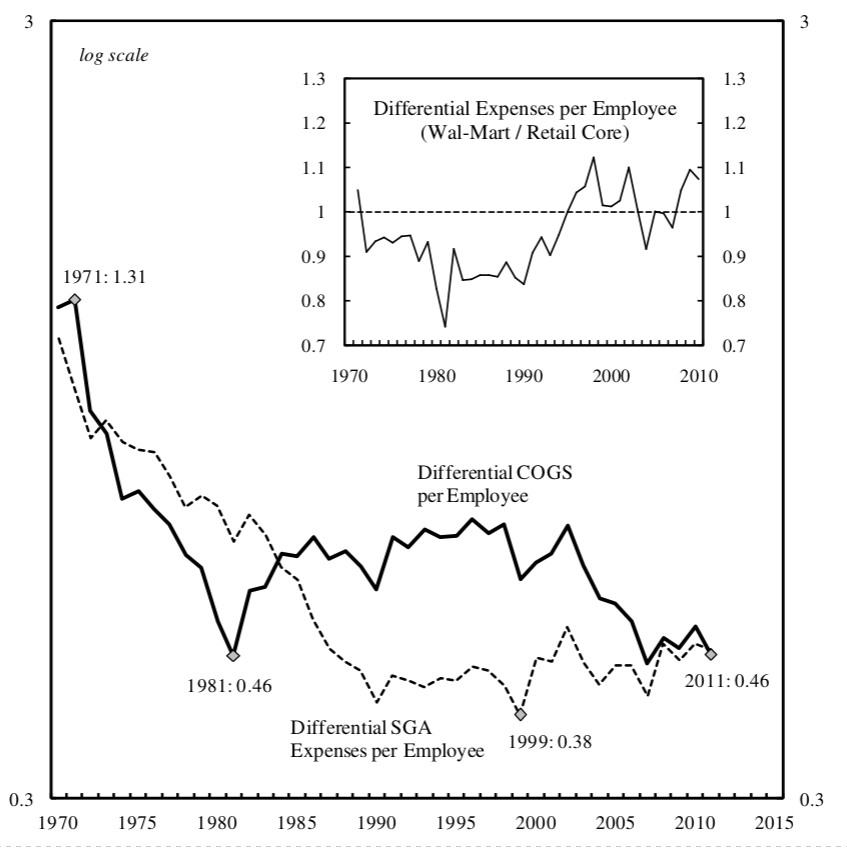

Continue ReadingBaines, ‘Encumbered Behemoth: Wal-Mart, Differential Accumulation and International Retail Restructuring’

Abstract This chapter draws on, and develops, some aspects of the capital as power framework so as to provide the first clear quantitative explication of the company’s power trajectory to date. After rapid growth in the first four decades of its existence, the power of Wal-Mart appears to be flat-lining relative to dominant capital as […]

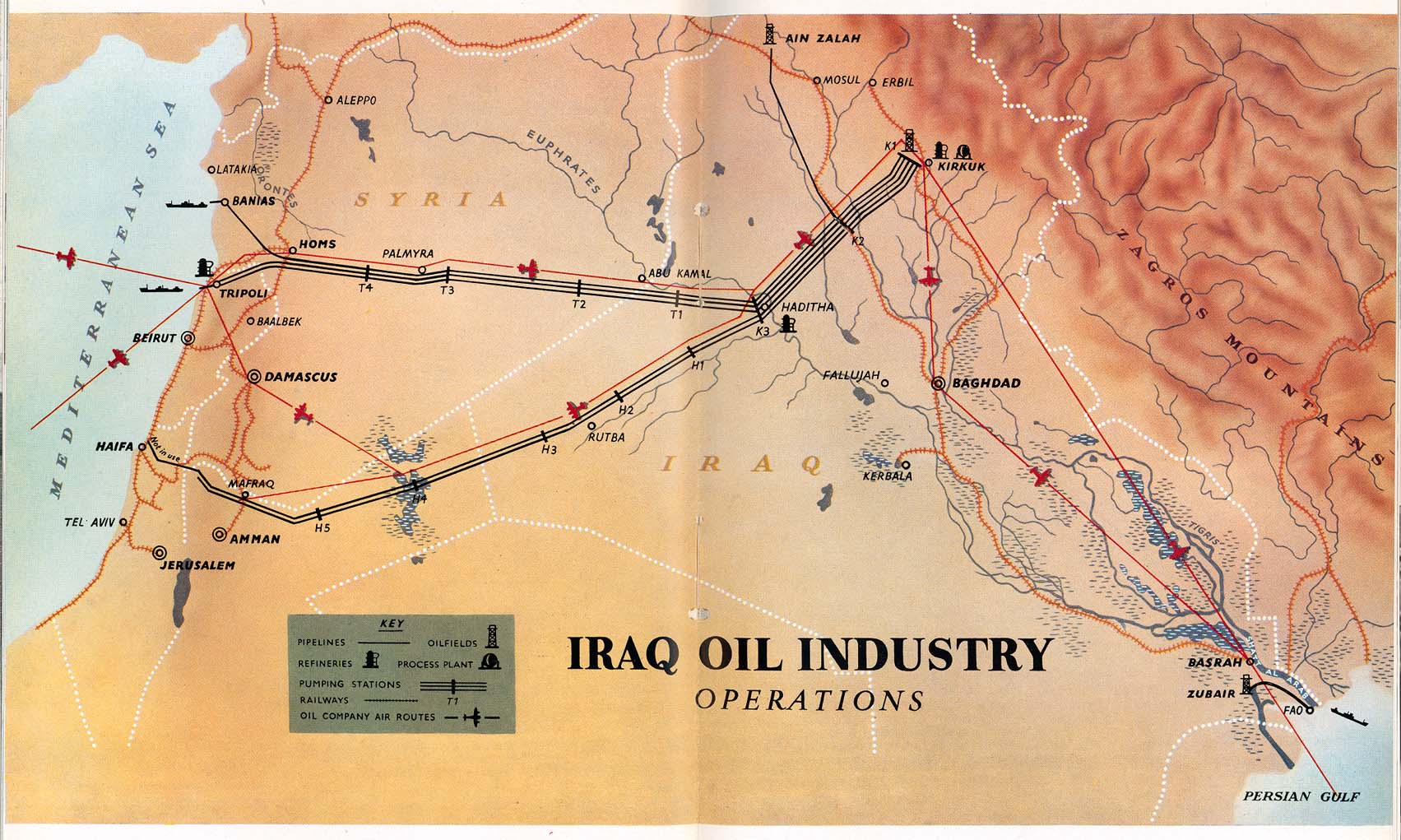

Continue ReadingThe Oil Price: Differential Accumulation and Punishing One’s Rivals

Phil Leech According to some forecasters the price of oil might hit $75 a barrel soon. Goldman Sachs has even predicted a $70 barrel of West Texas Intermediate (WTI) in 2015. If the price does drop this low it will be a dramatic change from the recent status quo; a relatively stable, higher price of […]

Continue ReadingNo. 2014/04: Bichler & Nitzan, ‘Still About Oil?’

Abstract During the late 1980s and early 1990s, we identified a new Middle East phenomenon that we called ‘energy conflicts’ and argued that these conflicts were intimately linked with the global processes of capital accumulation. This paper outlines the theoretical framework we have developed over the years and brings our empirical research up to date. […]

Continue ReadingAccumulatory Struggles in the Labratory

DT Cochrane A systemic review [PDF] of systemic reviews of scientific literature on the relationship between sugar and obesity found, unsurprisingly, that there is bias in the reviews conducted on behalf of the sugar business. The review’s conclusion reads: “Financial conflicts of interest may bias conclusions from SRs [systemic reviews] on SSB [sugar-sweetened beverages] consumption […]

Continue ReadingCapital as Power and Freelance Creative Work 4

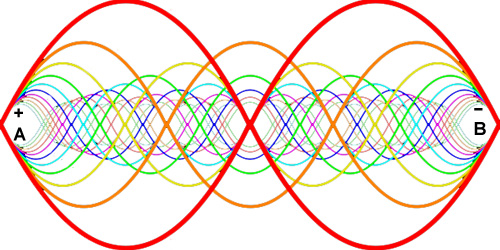

Frederick H. Pitts Resonance and dissonance in the rhythms of freelance creative work In the last blog, I applied some of Nitzan and Bichler’s ideas to freelance work in the creative industries. I utilised their conceptualisation of the distinction between creativity and power, and of the sabotage of the former by the latter. Nitzan and […]

Continue ReadingCapital as Power and Freelance Creative Work 3

Frederick H. Pitts Creativity, sabotage and the management of risk and responsibility in freelance creative work Nitzan and Bichler theorise a dissonant relation of sabotage between power and creativity, business and industry. What they show is that the control of creative processes of production is not antithetical to their success. Rather, it is constitutive of […]

Continue ReadingCapital as Power and Freelance Creative Work 2

Frederick H. Pitts Capital as Power, risk-aversion and the avoidance of uncertainty Mainstream critiques of contemporary capitalism conducted in the wake of the Great Recession tend to indict a number of factors. Perceived short-termism. The dangerous compulsion to speculate. An attraction to growth for growth’s sake. The propensity towards the greedy and rapid accumulation of […]

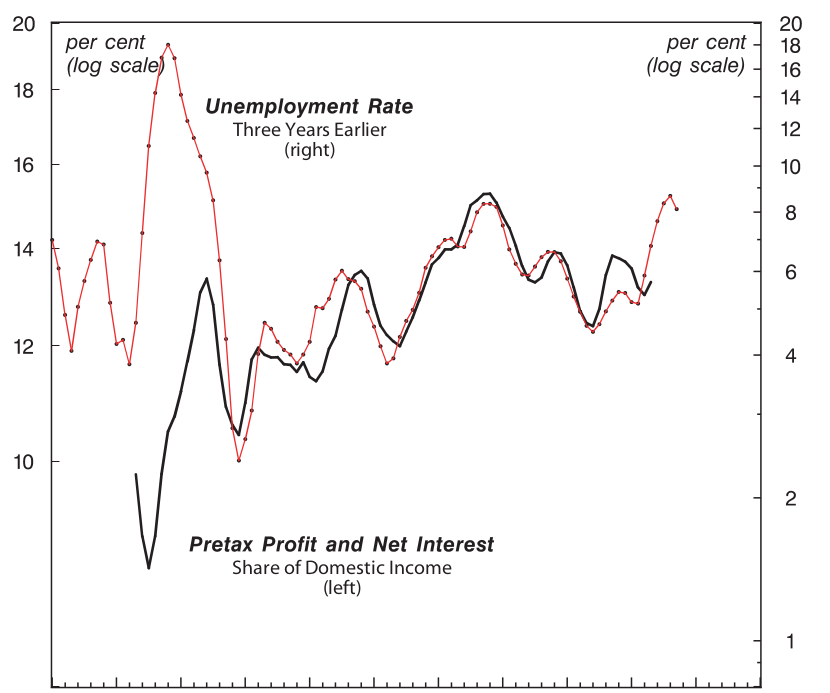

Continue ReadingCan Capitalists Afford Recovery?

Can Capitalists Afford Recovery? Three Views on Economic Policy in Times of Crisis JONATHAN NITZAN and SHIMSHON BICHLER October 2014 Abstract Economic, financial and social commentators from all directions and of various persuasions are obsessed with the prospect of recovery. The world remains mired in a deep, prolonged crisis, and the key question seems to […]

Continue ReadingWal-Mart’s Power Trajectory: A Contribution to the Political Economy of the Firm

Wal-Mart’s Power Trajectory A Contribution to the Political Economy of the Firm JOSEPH BAINES March 2014 Abstract This article offers a power theory of value analysis of Wal-Mart’s contested expansion in the retail business. More specifically, it draws on, and develops, some aspects of the capital as power framework so as to provide the first […]

Continue ReadingCapital as Power and Freelance Creative Work 1

Frederick H. Pitts Rhythms of Risk and Responsibility in Freelance Creative Work This series of blogs applies Nitzan and Bichler’s theory of capital as power to the empirical concern of freelance work in the creative industries. It reports some findings from a research project I conducted earlier this year. The research was part of a […]

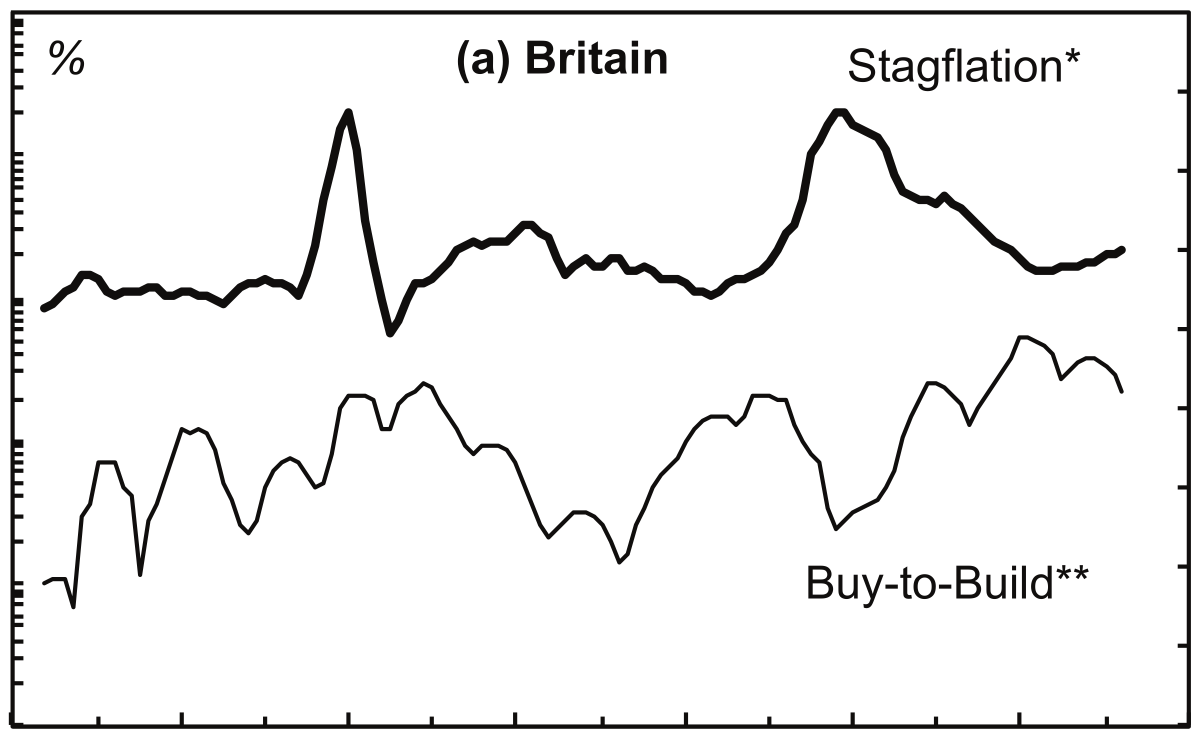

Continue ReadingFrancis, Bichler & Nitzan, ‘The Buy-to-Build Indicator: An Exchange’

Abstract The first part of the exchange is a short article by Joe Francis. The article provides new long-term estimates and an assessment of the buy-to-build indicator for the United States and Britain, going back to the end of the 19th century. The second part offers commentary by Shimshon Bichler and Jonathan Nitzan. Citation The […]

Continue ReadingSpeculation vs Hedging: A False Dichotomy?

Joseph Baines How do we make sense of the role of different participants in futures markets? According to the conventional wisdom, market participants can be put into two different categories: hedgers and speculators. Hedgers, such as farmers and other commercial entities, assume positions in the futures market that are equal and opposite to their positions […]

Continue ReadingThe Value of Corporate Nationalism

DT Cochrane Canadians take pride in Tim Hortons. It is an icon of contemporary Canadiana. When news emerged that Burger King (BKW) was planning a takeover, the media was filled with stories of people’s outrage. The political economic issues this raises are myriad. For example, what value is there to the passion of Canadians for […]

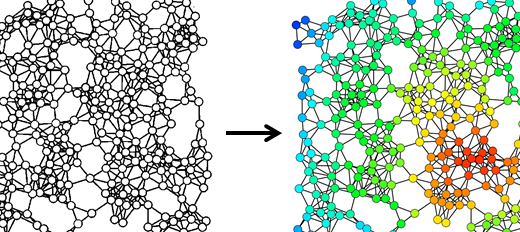

Continue ReadingComplexity Science and Political-Economy: Post 1 – Networks

Shai Gorsky This series of posts will explore some contemporary fields in “complexity science”. They summarize experiences from the Santa-Fe Institute Complex Systems Summer School 2014, with the hope of suggesting to readers useful research tools for political-economy. Please feel free to contact the author if you are interested in discussing or utilizing any of […]

Continue ReadingThe Brawl on Bay Street

DT Cochrane The world of traders has largely been outside political economic analysis. With financial values treated as ‘fictitious’ representations of real values, trading is, at best, a distortion. The actual individuals who perform this role, and supporting roles in the realm of financial intermediation, are given no consideration. From the perspective of CasP, on […]

Continue ReadingPublic vs Private Interests in Cancer Research

DT Cochrane Harvard Medical School researchers Michelle Holmes and Wendy Chen wrote an op-ed in the New York Times about research they published in 2010 that found aspirin may be an effective treatment for breast cancer patients. The op-ed was not just calling attention to these results. Rather, it was a complaint that the research […]

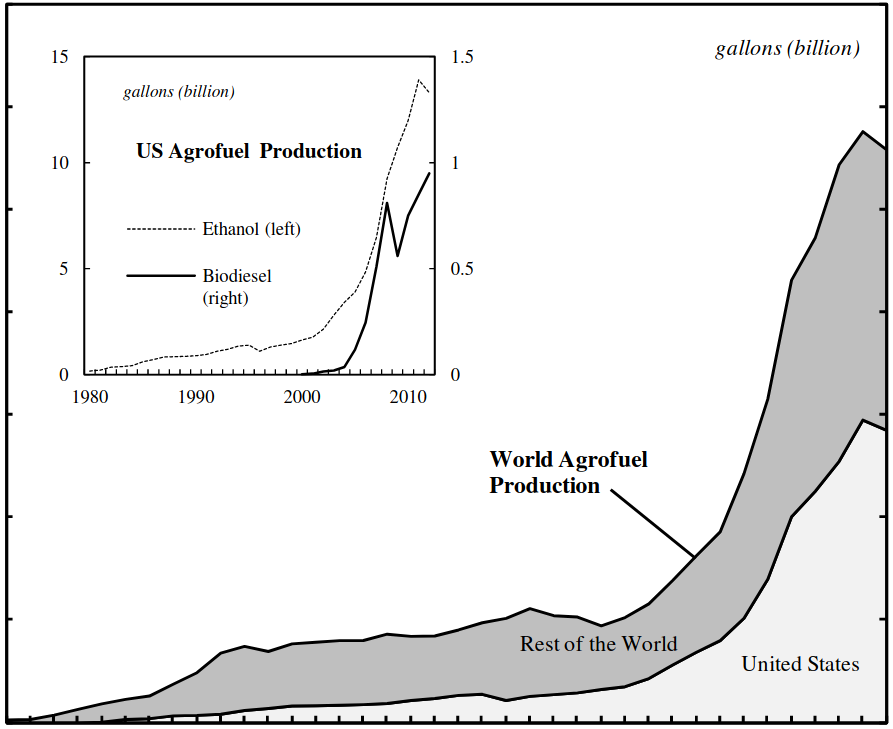

Continue ReadingNo. 2014/03: Baines, ‘The Ethanol Boom and the Restructuring of the Food Regime’

Abstract The agrofuel boom has brought about some of the most significant transformations in the world food system in recent decades. A rich and diverse body of agrarian political economy research has emerged that elucidates the conflicts and redistributional shifts engendered by these transformations. However, hitherto this point, less attention has been given to differences […]

Continue Reading