Home › Forum › Political Economy › Differential breadth of accumulation

- This topic has 5 replies, 3 voices, and was last updated March 30, 2022 at 4:09 am by Jonathan Nitzan.

-

CreatorTopic

-

March 29, 2022 at 10:05 am #247893

Maybe a simplistic question but I wanted to make sure I understand why “(1) The large firms could augment their differential breadrh of accumulation by raising their employment per firm faster than the average” (Inflation as Restructuring p.366)

Is this the case because raising employment leads to increased production and market share?

Thanks

-

CreatorTopic

-

AuthorReplies

-

-

March 29, 2022 at 11:46 am #247894

Define:

1. differential breadth = differential employment per firm

2. differential depth = differential profit per employee

Then expand the following truism:

3. differential profit per firm = differential profit per firm

= (differential profit per firm / differential employment per firm) x differential employment per firm

= differential profit per employee x differential employment per firm

= differential depth x differential breadth

As they stand, equations 1, 2 and 3 hold independently of the level of production.

***

To your question: firms will seek to raise their differential breadth if they anticipate the increase will not lower their differential depth by more, and this assessment will be affected by what happens to production, as well as numerous other considerations.

- This reply was modified 3 years, 3 months ago by Jonathan Nitzan.

- This reply was modified 3 years, 3 months ago by Jonathan Nitzan.

- This reply was modified 3 years, 3 months ago by Jonathan Nitzan.

-

March 29, 2022 at 12:56 pm #247898

Maybe a simplistic question but I wanted to make sure I understand why “(1) The large firms could augment their differential breadrh of accumulation by raising their employment per firm faster than the average” (Inflation as Restructuring p.366)

Is this the case because raising employment leads to increased production and market share?

Thanks

The assumption is that the firm can maintain the same rate of profitability as it grows, so increasing the size of a firm should lead to increasing the accumulated profits (and increased market share). If the firm increases its size faster than average, then it will achieve positive differential accumulation.

The other day I revisited Joseph Baines’ “Wal-Mart’s Power Trajector,” which may be found here https://bnarchives.yorku.ca/394/

His article has a good distillation of the breadth-depth theory embedded in Figure 1: The Axes of Corporate Power, which makes everything easy to visualize (which I find helpful).

-

March 29, 2022 at 1:55 pm #247899

The assumption is that the firm can maintain the same rate of profitability as it grows, so increasing the size of a firm should lead to increasing the accumulated profits (and increased market share). If the firm increases its size faster than average, then it will achieve positive differential accumulation.

To be precise:

1. For an increase in differential breadth to raise differential profit, the only condition is that differential depth does not decline (% wise) by more than the % increase in differential breadth.

2. Changes in market share (% of aggregate universe sales) do not have a one-to-one mapping with differential profit.

-

-

March 29, 2022 at 10:35 pm #247900

The assumption is that the firm can maintain the same rate of profitability as it grows, so increasing the size of a firm should lead to increasing the accumulated profits (and increased market share). If the firm increases its size faster than average, then it will achieve positive differential accumulation.

To be precise: 1. For an increase in differential breadth to raise differential profit, the only condition is that differential depth does not decline (% wise) by more than the % increase in differential breadth. 2. Changes in market share (% of aggregate universe sales) do not have a one-to-one mapping with differential profit.

Sometimes, it helps people to sacrifice precision for clarity.

In any event. true precision would require adding a third axis to the differential accumulation model that accounts for corporate debt, which is another way to affect the expected effective annualized return (aka discount rate) of a firm, something that becomes very clear when doing a discounted cash flow to the firm analysis, which is based in part of the Weighted Average Cost of Capital (WACC). “Capitalization” embraces both debt and equity.

-

March 30, 2022 at 4:09 am #247901

Sometimes, it helps people to sacrifice precision for clarity.

Very true, but, in this case, I think you oversimplify. In your explanation you write that, ‘The assumption is that the firm can maintain the same rate of profitability as it grows.” This assumption may be correct in the case of expanding internal breadth (M&A), when no new capacity is created. But when firms expand through external breadth (greenfield), the assumption that profitability will remain constant is often false. Indeed, the key threat of greenfield is that it undermines corporate coordination, reduces pricing power, and compresses markups and profitability. This is one of the reasons why firms have drifted away from greenfield in favour of M&A.

[…] true precision would require adding a third axis to the differential accumulation model that accounts for corporate debt, which is another way to affect the expected effective annualized return (aka discount rate)

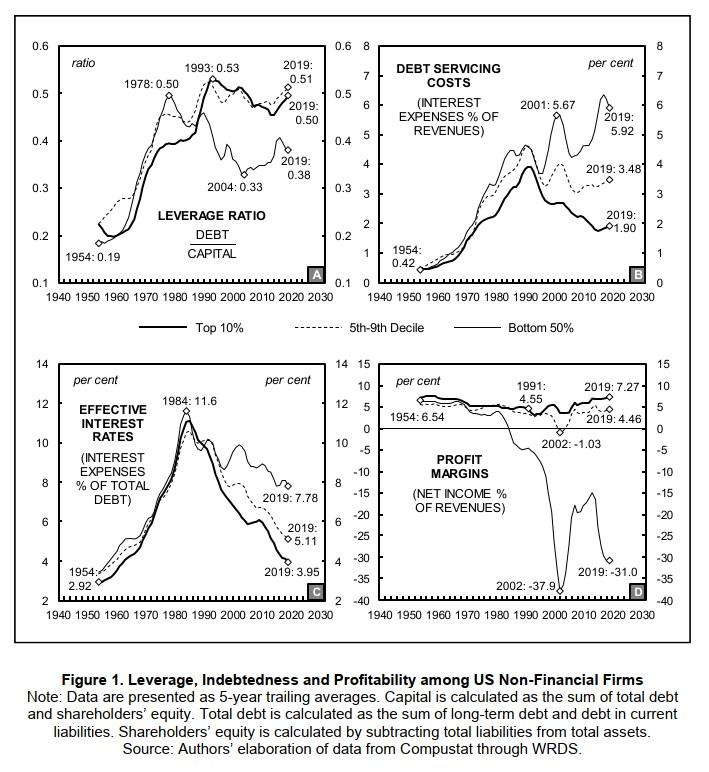

You are correct again — the cost of debt is very important. But I believe that this cost is already included in internal differential depth (differential cost cutting). For more, see the recent work of Baines and Hager, where they examine, among other things, differential interest costs.

Baines, Joseph, and Sandy Brian Hager. 2021. The Great Debt Divergence and its Implications for the Covid-19 Crisis: Mapping Corporate Leverage as Power. New Political Economy (OnlineFirst, January 6): 1-17.

-

-

AuthorReplies

- You must be logged in to reply to this topic.