- This topic has 7 replies, 2 voices, and was last updated November 15, 2021 at 7:57 pm by .

-

Topic

-

Mainstream economics likes models, especially models that are nonsense.

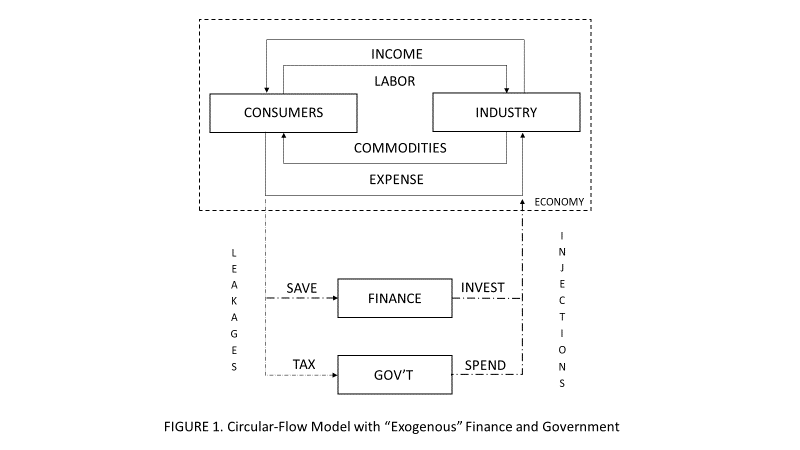

Figure 1, below, shows a typical “circular flow” model of the economy such as you would find in mainstream economics texts by Mankiw (his is a bit more colorful and has some additional detail, but not anything material):

This model perpetuates several falsehoods (normative myths) that are central to mainstream economics, including at least:

- The politics-economics duality (government and money are exogenous to the economy)

- An economy in a state of equilibrium; and

- The loanable funds model of banking, where banks just intermediate between savers and borrowers (i.e., they don’t create money)

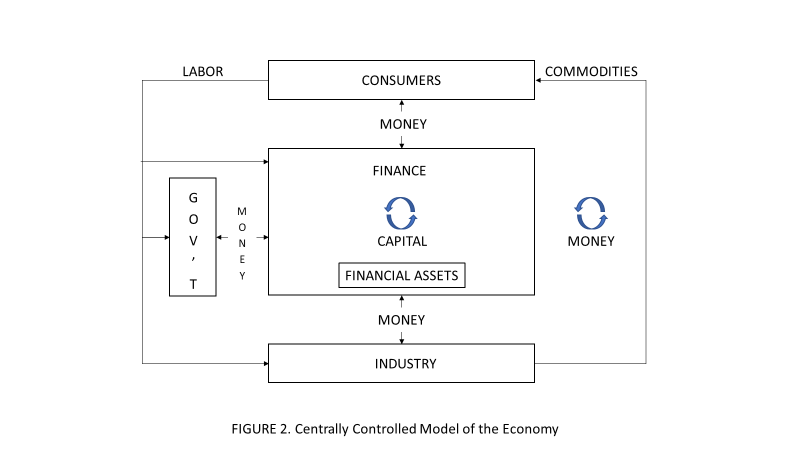

Figure 2 proposes an alternative, centrally controlled model that reflects our credit-money system:

In a credit-money system, all money begins as bank credit subject to the payment of interest (i.e., every dollar “borrowed” must be “repaid” as 1.x dollar). As a consequence, every sale of a commodity or service involves two distinct transactions: (1) the delivery of the commodity or service and (2) the exchange of money. Every exchange of money in our economy includes Finance as an intermediary; even all cash transactions are accomplished using central bank notes.

In Figure 2, I begin to distinguish between money and capital, which itself suggest disequilibrium. Specifically, money is exchanged for commodities and services outside of Finance, and capital is exchanged for financial assets. I consider capital to be money that accumulates and circulates within Finance (e.g., as deposits appearing in the accounting records of financial institutions), but it is also available for redemption as money for circulation outside of Finance, as long as it has not been used to purchase a financial asset. Regardless of whether the medium of exchange is money or capital, Finance (which includes the FIRE sector and the governmental agencies that support it) stands in the middle of every transaction.

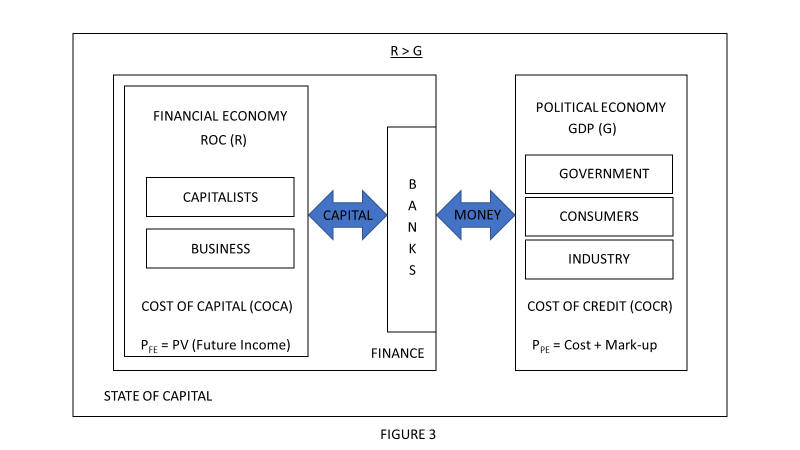

Figure 3 attempts to translate the model of Figure 2 into a model of “the state of capital” by adding detail that is nowhere discussed in mainstream economics but is often touched upon, sometimes in different ways, in CasP as well as in the work of Thomas Piketty and Steve Keen.

The existence of two different mediums of exchange (money and capital), two different types of objects of exchange (commodities and financial assets), and the two different approaches to pricing them (cost-plus v. present valuation of future income), suggest two distinct economies (even two distinct poleis), which are shown here in Figure 3 as the “Political Economy” and the “Financial Economy.” I considered labeling each domain a “market,” but the market metaphor suggest freedom that does not exist in the state of capital. The key concept is that there are two distinct domains that are inter-dependent, but the domain of Finance/capital dominates.

The concept of differential accumulation is central to CasP and is represented at a macro level by Piketty’s R>G formulation, where R is the annual growth rate of capital (return on capital), and G is the annual growth rate of the political economy, aka GDP.

The “state of capital” is constructed to ensure R>G by imposing differential taxation, differential pricing and differential costs of capital/credit, all of which favor Finance. For example, for transactions involving commodities, any tax typically will be imposed on the buyer based on the purchase price. Conversely, for transactions involving financial assets, any tax typically will be imposed on the seller based on the difference between the seller’s cost basis and the sale price. Moreover, all capital losses incurred in the Financial Economy are applied as direct offsets against capital gains, whereas losses of property incurred in the Political Economy are, at best, subject to a limited deduction on income tax liability and not as an adjustment to gross income.

CasP researchers have discussed prices (especially the pricing of financial assets) at length, but something that I have not seen discussed before in CasP is the importance of the cost of capital (Financial Economy) and the cost of credit (Political Economy) to differential accumulation. For example, larger companies, whether size is measured by market cap or annual revenues, generally have lower costs of capital, i.e., it costs larger companies less to increase their power. The same dynamic plays out in the political economy, where the more money you have, the less credit costs you. Within each economy (or polis), relative capitalization/wealth creates self-perpetuating hierarchies, which in the Political Economy we call classes.

From this perspective, power manifests itself both as price (e.g., capitalization) and cost (e.g., cost of capital), where cost is one major determinant of price, another being growth rate (i.e., the discount rate or the rate of compounding). Indeed, I believe that the cost of capital/credit was the primary mechanism by which capital enforced differential accumulation until the 1980s, when it began goosing stock market returns by lowering the cost of capital/credit (which also reduced GDP growth).

I am going to stop for now, but there is more to say. For example, I have not discussed the concept of feedback that comes from “financialization” of a corporation, by which I mean the creation of a financial avatar known as a stock ticker or bond number.

I recognize that conceptualizing the state of capital as two economies or two poleis may seem like I am embracing the “real v. nominal” duality, but both domains, whatever you label them, are real, and the primary domain of capital controls everything else through setting the prices of purchases and the costs of capital/credit. Capitalism requires the complete enclosure of a society to render the “market” as nothing more than a company store in a company town.

One of the reasons I prefer to think of the twin domains of the state of capital as different poleis is because, as a political matter, they are. To access, the market/economy of the material world, you need access to the money that Finance creates through “loans.” This money is just “company scrip,” all of which flows back to Finance as capital plus interest. In the U.S., the “citizens” of the Financial polis represent maybe 10% of the total population of the U.S., most of whom blink in and out of existence in the Financial world as they live from paycheck to paycheck. In other words, the consumers of the Political Economy who are not also members of the Financial Economy are, in fact, consumed by the Financial Economy.

Any thoughts or comments? I have left a lot out, so I understand there may be some gaps in this particular presentation of my model, and, of course, I am sure I probably missed some things completely.

- You must be logged in to reply to this topic.