Is it possible to make an extensive list of all the factors that affect capitalization. My google searches are inadequate, because i don’t know the correct search terms to look for.

You might find the following observations overly general, but it is useful to point them out.

1.

You can make a list, but it will include everything that capitalists believe affects earnings, hype, risk and the normal rate of return. In other words, it will include anything and everything that capitalist modellers (and now days, also their AI algorithms) manage to map — and then some (gut feelings, animal spirits, etc.). However, I don’t think this long list will get you anywhere.

In my view, the first step is to create not a list, but a theory/model that allows us to organize, interrelate and, most importantly, weigh the different forces that bear on differential capitalization. This is what CasP research proposes and tries to do, and it is anything but simple.

In our paper ‘Growing Through Sabotage’ (2020), we have a section on ‘Full-Spectrum Hierarchy’, where we write that:

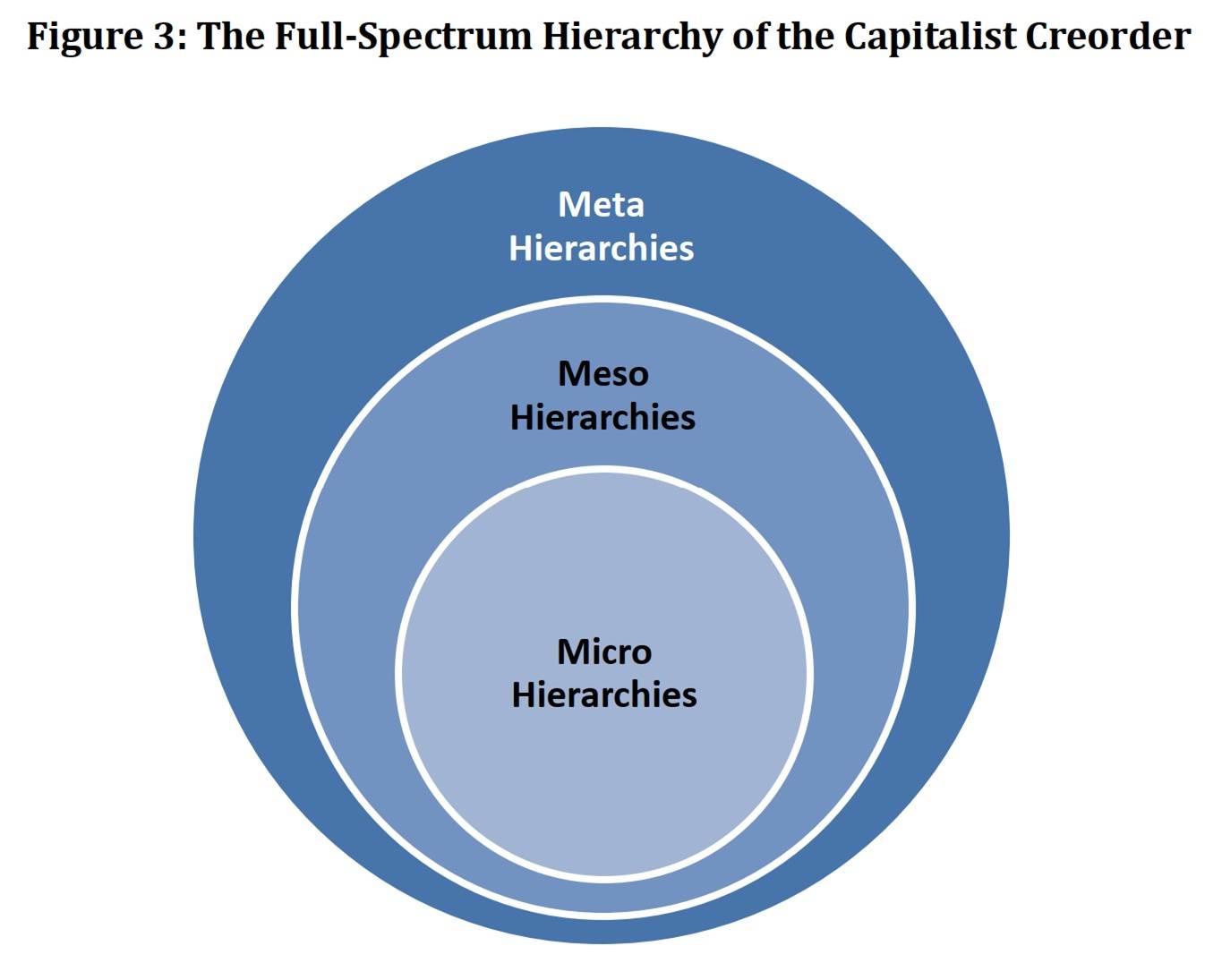

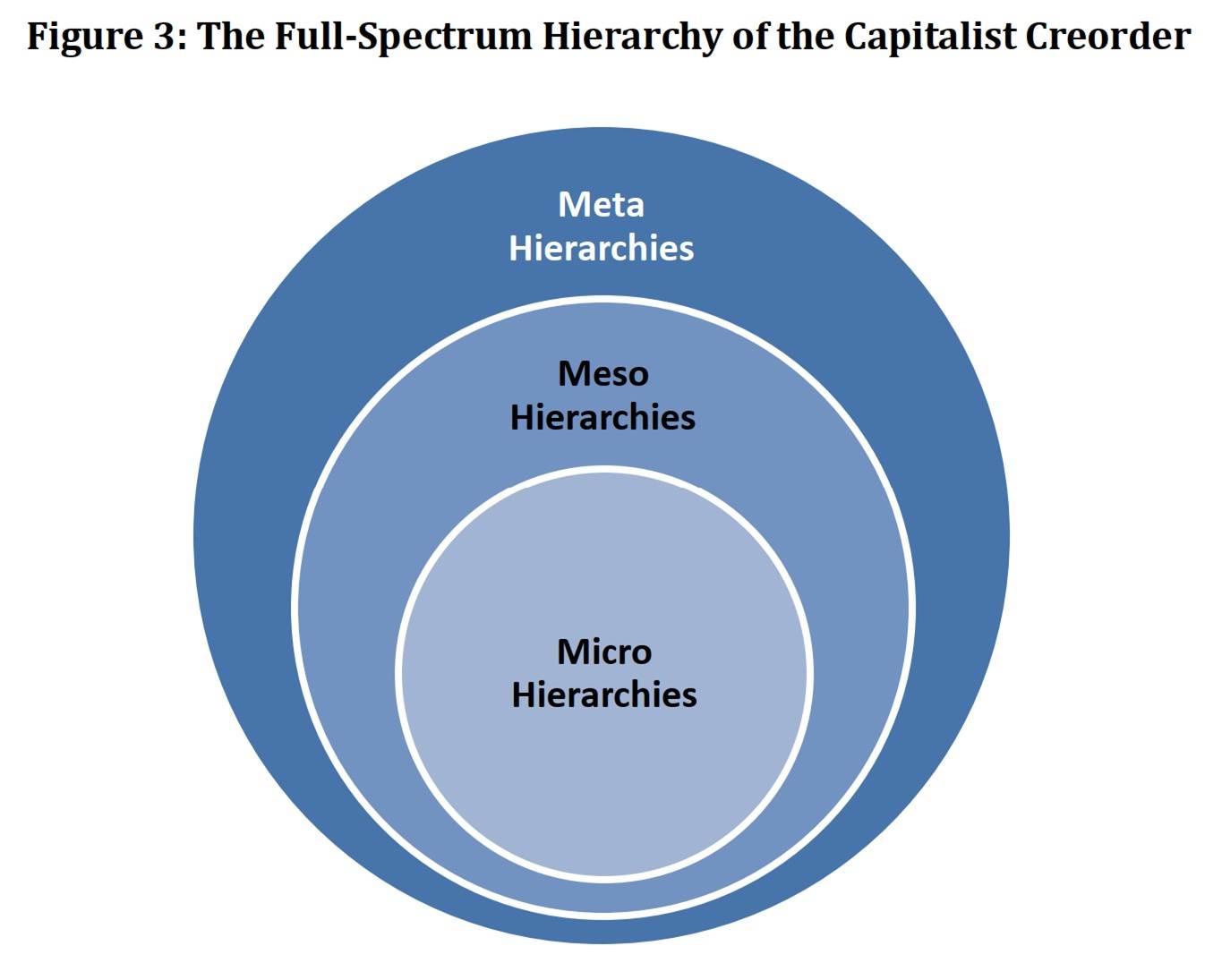

[…] the capitalist creorder can be conceived of as a full-spectrum hierarchy, an ever-changing enfoldment of vertical structures nested within other vertical structures. Ranking the different hierarchies of capitalism from the most abstract down to the most concrete, we can say that the more concrete hierarchies are regulated by – and in this sense enfolded in – the more abstract ones. A simplified illustration of this enfoldment is shown in Figure 3: the lowest level of abstraction comprises micro hierarchies; the micro hierarchies are nested in meso hierarchies; and the meso hierarchies are themselves encompassed by the meta hierarchies.

What do the different levels consist of? Begin with the most abstract, meta hierarchies. The hubs of these hierarchies comprise the foundational institutions of capitalism, including, among others, the notion of ‘liberty’ (the differential Latin libertates fused into a universal notion of freedom), the concept of ‘private property’ (the negative Latin privatus inverted into a positive notion of possession), the idea of ‘investment’ (the feudal power of investiture reincarnated as a productive act) and the ritual of ‘capitalization’ (the ancient Mesopotamian caput, or head, made into a fractal-like algorithm of power) (Nitzan and Bichler 2009: 26, 227-228; Part III). The nodes of the meta hierarchies are the broad facets of society – the various dimensions of culture, ethnicity, religion and nationalism, among other things. And the links that tie the hubs to the nodes are the conduits through which the former gradually, and with plenty of setbacks and reversals, mould, leverage, internalize and encompass the latter. [Footnote: Think of how the fractal-like sprawl of concepts such as ‘financial accounting’, ‘investment’ and ‘capitalization’ penetrate and permeate all levels of business – from the small grocery store, family firm and largest conglomerate, to mutual, pension and sovereign wealth funds, to patents and copyrights – as well as other social institutions and organization, such as the military (the capitalized ‘quantity’ of the military arsenal and the ‘return on military assets’), organized religion (‘Islamic finance’ and ‘faith-based funds’), NGOs (‘cultural capital’ and ‘social capital’), workers (‘human capital’) and so on (Nitzan and Bichler 2009: Ch. 9).] At the meso level, the hubs are capitalist polities, corporations and NGOs, the nodes are individual subjects and the links are the capitalist institutions, patterns of thought and modes of behaviour that weave them into shifting hierarchies. And it is only at the lower, micro level of this full-spectrum enfoldment that we find the inner structures of formal organizations examined by Fix.

So if [Blair] Fix is right in arguing that greater energy capture per capita requires more hierarchical coordination, we can go even further: we can hypothesize that, as the capitalist mode of power deepens and globalizes, a significant – and perhaps growing – proportion of this hierarchical coordination will occur outside the boundaries of formal organizations. It will take place not only at the intestinal micro hierarchies of corporations and governments, but also – and increasingly so – at the meso and meta levels of scale-free networks: the hubs and nodes here are the foundational institutions of capitalism, the broad cultural and political facets of societies and their basic organizational units, while the connecting edges are trade, production and ownership ties, the various media of ideology, religion and education, the law and, ultimately, the threat of force and violence.

2.

No matter how successful the theory, it is at best an approximation anchored in its own time and history. Moreover, and crucially, CasP theorizes and researches capitalized power, not the undermining of capitalized power. It is a guide to what is, not to what can be made. This is a crucial distinction. In order to overturn capitalism, you need to understand it; but understanding of what currently exists is not enough. The reason is that every step of overturning capitalism, even the smallest, generates new formations whose structures and constellations are difficult and often impossible to foresee. It took capitalists half a millennium of turbulent, path-dependent trial and error to undo feudalism. There is no reason to think that autonomous formations can overturn capitalism on a preset list or even a theory, no matter how insightful. Theory-informed action is forever work in progress.