Regan Boychuk British, American, and Russian elites planned global domination through one great war a century ago, but it did not quite work out. Instead, today we approach a third world war to avoid democracy and the rational conservation of resources on a finite planet. It appears imperial monarchs were colluding in 1914 to vanquish […]

Continue ReadingMouré, ‘Consolidation and Crisis in the US Banking Sector 1980-2022’

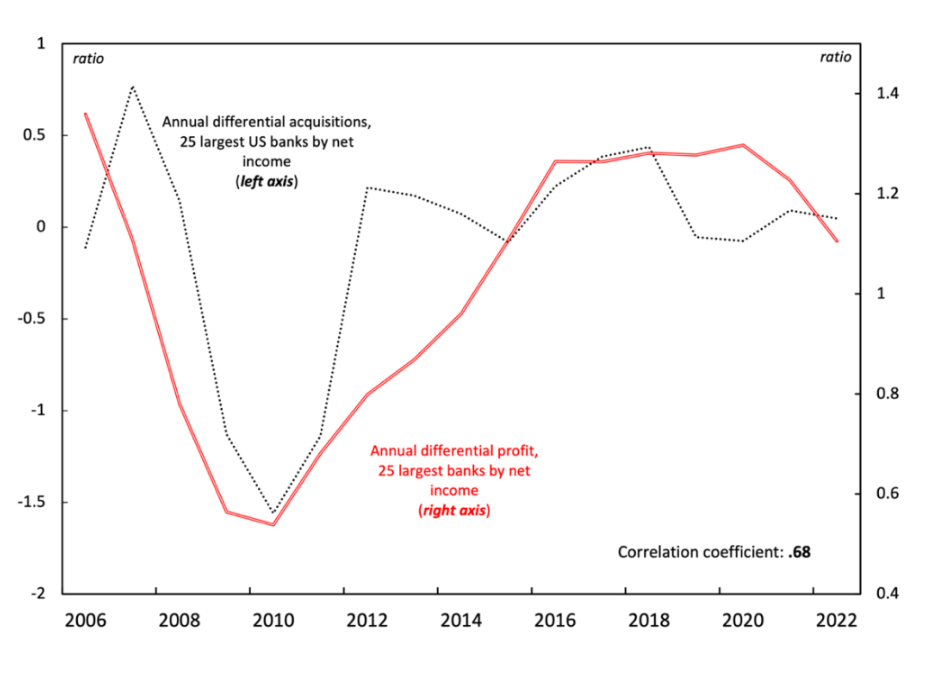

Abstract Much of the economic analysis of banking crises focuses on the interplay between concentration and stability. A common theory is that concentration is associated with greater stability, whereas competition is associated with instability. In this view, there is a trade-off between, on the one hand, the higher prices and higher profits associated with a […]

Continue ReadingSpiegel Online Analysis of Deutsche Bank’s Differential Misfortune

DT Cochrane Deutsche Bank was a central figure of the 2008 global financial crisis. While some of its compatriots, such as Goldman Sachs, have re-ascended to the commanding heights of global capital, Deutsche remains a shadow of its former self as seen in the graph below (screenshot from Yahoo! Finance). A comparison of Deutsche Bank […]

Continue ReadingLogics AND the Logic of Accumulation

DT Cochrane The presiding logic of capitalism is that of accumulation. CasP re-emphasizes and re-theorizes accumulation as ‘Moses & the Prophets’ of capitalism. However, Nitzan and Bichler’s theorization severs the link between accumulation and productivity that grounds both mainstream and critical value theory. Instead, they emphasize the meaning of the nominal quantities of capital as […]

Continue ReadingOstojić, ‘Differential Taxation: The Case of American Banking’

Abstract This paper maps an empirical history of corporate profit and taxation in the United States, with a special focus on the differential profit and taxation of banks relative to other corporations. An examination of these trends reveals a striking anomaly within the American banking sector: from the early 1980s until the financial crisis of […]

Continue Reading