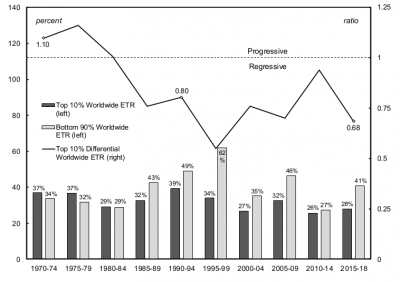

Abstract Corporate concentration in the United States has been on the rise in recent years, sparking a heated debate about its causes, consequences, and potential remedies. In this study, we examine a facet of public policy that has been largely neglected in current debates about concentration: corporate taxation. As part of our analysis we develop […]

Continue Reading2019/04: Hager and Baines, ‘Jurisdictional Tax Rates: How the Corporate Tax System Fuels Concentration and Inequality’

Abstract Corporate concentration in the United States has been on the rise in recent years, sparking a heated debate about its causes, consequences, and potential remedies. In this study, we examine a facet of public policy that has been largely neglected in current debates about concentration: corporate tax policy. As part of our analysis we […]

Continue ReadingHager, ‘Public Debt, Inequality, and Power: The Making of a Modern Debt State’

Abstract Who are the dominant owners of US public debt? Is it widely held, or concentrated in the hands of a few? Does ownership of public debt give these bondholders power over our government? What do we make of the fact that foreign-owned debt has ballooned to nearly 50 percent today? Until now, we have […]

Continue ReadingCorporate Taxation and the Power Theory of Value

Sandy Hager This is a (longer) draft version of an article that is under consideration for the newsletter of the Tax Justice Network: Tax Justice Focus. Taxation is all about power. We are constantly reminded of this when flipping through any newspaper (or browsing any news website). The Panama Papers, the stuff of which front […]

Continue ReadingNo. 2015/01: Hager, ‘Public Debt as Corporate Power’

Abstract In various writings Karl Marx made references to an ‘aristocracy of finance’ in Western Europe and the United States that dominated ownership of the public debt. Drawing on original research, this paper offers the first comprehensive analysis of the pattern of public debt ownership within the US corporate sector. The research shows that over […]

Continue Reading