2018/05: Fix, ‘The Growth of US Top Income Inequality: A Hierarchical Redistribution Hypothesis’

July 29, 2018

Abstract

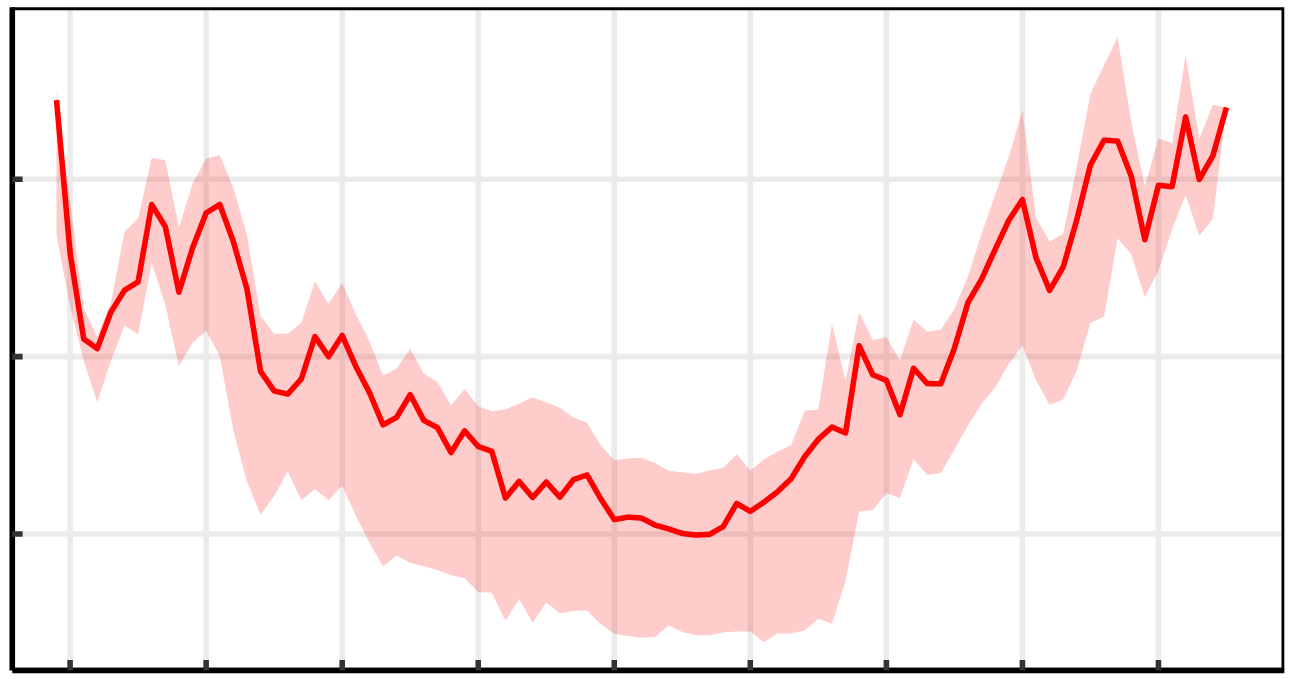

What accounts for the growth of US top income inequality? This paper proposes a hierarchical redistribution hypothesis. The idea is that US firms have systematically redistributed income to the top of the corporate hierarchy. I test this hypothesis using a large scale hierarchy model of the US private sector. My method is to vary the rate that income scales with hierarchical rank within modeled firms. I find that this model is able to reproduce four intercorrelated US trends: (1) the growth of the top 1% income share; (2) the growth of the CEO pay ratio; (3) the growth of the dividends share of national income; and (4) the ‘fattening’ of the entire income distribution tail. This result supports the hierarchical redistribution hypothesis. It is also consistent with the available empirical evidence on within-firm income redistribution.

Citation

The Growth of US Top Income Inequality: A Hierarchical Redistribution Hypothesis

Fix, Blair. (2018). Working Papers on Capital as Power. No. 2018/05.