Stock Buybacks vs Greenfield Investment

December 10, 2014

Jonathan Nitzan

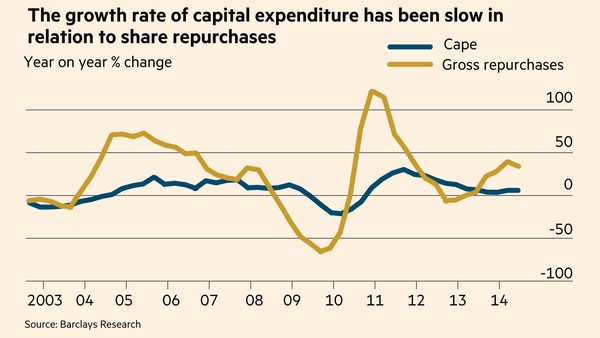

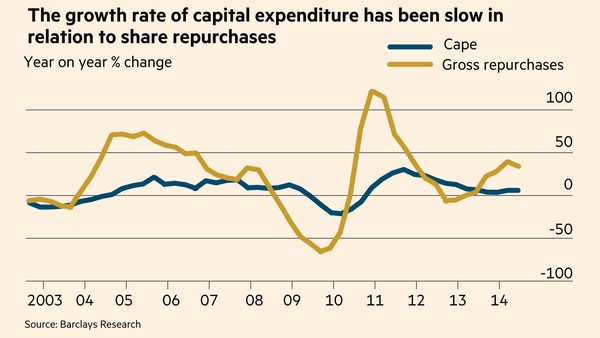

In his November 29, 2013 piece, ‘Low Capex, High Market Cap: A New High for Corporate Sabotage?’, Edward Lam lends support to CasP’s sabotage thesis by showing how firms with relatively low ‘greenfield’ investment outperform those with relatively high ‘greenfield’ investment. A recent FT article, titled “Money Well Spent?” (Tom Braithwaite, Nicole Bullock and Michael Mackenzie, October 13, 2014), illustrates the other side of the process. Instead of spending their earnings on new productive capacity, the outperformers tend to use them to buy back their own shares: