Economic Growth Theory … Bah Humbug!

February 2, 2021

Originally published on Economics from the Top Down

Blair Fix

I’ve written a lot on this blog about the absurdity of marginal productivity theory. But I haven’t said much about the other pillar of mainstream economics: neoclassical growth theory. Today I’ll break that silence.

Neoclassical growth theory is a textbook example of Murphy’s law. Everything that could go wrong with the theory did go wrong. From conceptual foundation to application to interpretation, neoclassical growth theory is a lesson in how not to do science.

I’ve compiled here a list of neoclassical growth theory’s failures. Each one of them is, in my opinion, fatal. Yet none of them has stopped neoclassical economists from applying their theory to the real world.

Failure 1: A flawed foundation

Neoclassical economics assumes that we can separate society into different ‘factors of production’. This thinking dates back to the origin of political economy itself. The field arose in the 18th century to explain the distribution of income between classes. Here’s how David Ricardo put it:

The produce of the earth … is divided among three classes of the community; namely, the proprietor of the land, the owner of the stock or capital necessary for its cultivation, and the labourers by whose industry it is cultivated.

… To determine the laws which regulate this distribution, is the principal problem in Political Economy.

In attempting to solve Ricardo’s ‘principal problem’, political economists made three foundational mistakes. They assumed that:

-

Wealth is ‘produced’. (It’s not.)

-

Social classes represent different ‘factors of production’. (They don’t.)

-

Wealth production can be attributed to one or more of these ‘factors of production’. (It can’t.)

Once these (false) conceptual foundations were set, the fight became about which factors of production were ‘productive’. The physiocrats (most famously, François Quesnay) thought that land was the source of all value. Classical political economists like Adam Smith, David Ricardo and Karl Marx argued that labor was the source of value. Neoclassical economists like John Bates Clark and Philip Henry Wicksteed added capital to the list of value producers.

The debate about the ‘source’ of value is long, bitter, and largely fruitless. The problem is simple: value has no source. It’s a cultural construct. So it’s impossible to tie value to ‘production’.

That’s the short summary of the problem. The longer summary is that political economists conflated two distinct processes: (1) resource exploitation; and (2) resource distribution. Looking at resource exploitation, political economists saw ‘wealth production’. That was a mistake. Resources aren’t produced. They’re transformed. And this transformation has nothing to do with ‘value’, as humans understand it. Yes, different factions of society are able to demand prices for various resources. But the prices are invented, not ‘produced’. They are a way of organizing the distribution of resources. Prices have nothing to say about the quantity of resource flows (and vice versa).

The easiest way to see the problem is to look outside our own myopia. Humans do the same thing as every other living organism. We transform matter and energy into forms that are useful to us. Attributing this process to a ‘factor of production’ is like attributing an animal’s metabolism to one or more of its organs.

Ask yourself these questions: What portion of a cow’s metabolism is ‘produced’ by the digestive tract? What portion is ‘produced’ by the heart? By the brain? By the hooves?

These questions have no answer because they are conceptually flawed. Organisms function collectively to harvest resources. So it’s meaningless to attribute metabolism to any one organ. The same goes for human societies.

Let’s take the metaphor a step further. Within organisms, we might think of hormones as the equivalent of prices. They convey information that then influences the behavior of different components of the organism. Releasing adrenaline, for instance, takes resources away from the digestive tract and sends them to the skeletal muscles.

Now imagine we analyzed an organism’s body the same way that political economists analyze society. We see that adrenaline influences how resources are distributed within the organism. We then trace the synthesis of adrenaline to the adrenal glands. Aha! We surmise that metabolism is ‘produced’ by this gland. We’ve found our ‘factor of production’!

If this operation seems foolish, that’s because it is. It’s foolish when applied to organisms. And it’s foolish when applied to human societies. Value is not ‘produced’. And there are no ‘factors of production’.

Failure 2: The one-commodity world

Modern humans consume a dizzying variety of commodities. Not so in neoclassical theory. Dating back to the work of John Bates Clark, neoclassical theory assumes that human societies produce a single commodity.

Why adopt such a bizarre assumption? Because it’s required for neoclassical theory to be logically consistent. According to marginal productivity theory, each factor of production earns its (marginal) product. The problem is that to compare the productivity of different individuals (or groups), everyone must produce the same thing.

In the real world, this condition is never met. So when John Bates Clark formulated marginal productivity theory, he should have concluded that his theory had no foundation. It required a single-commodity world — a world that does not exist. So the theory was a dead end.

That’s not, however, what Clark concluded. Instead, he forged ahead with a theory that said nothing about the real world. He assumed that everyone produced and consumed a single commodity. Then he ‘proved’ that in this fictitious world, everyone earned their (marginal) product.

Neoclassical growth theory continues this dubious tradition. It assumes that there is a single commodity that serves as both capital and output. As with marginal productivity, this bizarre assumption is a requirement for neoclassical growth theory to be logically consistent. If there is more than one commodity, the quantity of both capital and output becomes ambiguous, and the theory falls apart [1]. The consequence is that neoclassical growth theory says nothing about the real world.

Failure 3: Unmeasurable components

When economists move from the imaginary world of a single commodity to the real world of many commodities, they encounter a problem. The components of their theory — the quantity of capital and the quantity of output — become ambiguous.

This problem was pointed out in the 1950s in a debate now called the ‘Cambridge capital controversy’. Economists Paul Samuelson and Robert Solow, hailing from Cambridge, Massachusetts, forged ahead with neoclassical growth theory. Continuing in the tradition of John Bates Clark, they developed their theory by assuming a single-commodity world. Then they applied this theory to the many-commodity world. The trick to doing so, they argued, was to aggregate all commodities into a single stock. Then you could treat this stock (they claimed) as consisting of a single commodity.

Economists Joan Robinson and Piero Sraffa, hailing from Cambridge, UK, saw through the trick. They pointed out that the capital stock couldn’t be aggregated objectively. (Curiously, they didn’t say the same thing about economic output, even though identical reasoning applies). The capital stock, they noted, was composed of different commodities that had no common ‘natural’ unit. This fact made aggregation ambiguous — it depended on the particular choice of dimension. Worse still, neoclassical economists used prices as their dimension of aggregation. This made the whole operation circular. Neoclassical theory was supposed to explain income as an outcome of productivity. But economists tested their theory by using income to measure productivity.

The critique raised by Robinson and Sraffa is, in my opinion, unassailable. The aggregation of many commodities is always subjective, depending on the particular choices made by the analyst. (I explore this issue in detail here.)

How did neoclassical economists respond to the Cambridge (UK) critique? Mostly by ignoring it. As an example, take Gregory Mankiw’s textbook Principles of Macroeconomics. Used to train a generation of economists, the textbook simply ignores the Cambridge capital controversy — as if it never happened.

Failure 4: A failed prediction becomes a ‘discovery’

Neoclassical theory proposes that capital and labor are the two ‘factors of production’. Logically, then, it follows that the growth of economic output should stem from the growth of capital and labor inputs.

Let’s put aside, for the moment, the (insurmountable) problems with measuring the growth of capital and the growth of output. Even though the foundations are dubious, economists forged ahead with growth accounting. And still they ran into a problem. The growth of capital and labor, they found, could not explain the growth of ‘output’ (as it was officially measured). Output grew far more than predicted by the growth of capital and labor alone.

The response to this failure was instructive. Instead of seeing this result for what it was — a failed prediction — economists claimed it as a discovery. This trick was first proposed by Robert Solow. He postulated that the growth residual (the portion of economic growth that was unexplained by neoclassical theory) was actually a measurement of ‘technical progress’. With this postulate, Solow invented the field of growth accounting. Economists could now ‘measure’ the growth of technical progress! And so they did. Today, if you google ‘total factor productivity’ (economists’ term for their measurement of technological progress), you’ll get some 3.5 million results.

Despite the ubiquity of growth accounting, economists seem to forget that there’s trouble underneath the hood. Their ‘measurement’ of technological progress is nothing of the sort. It’s actually a failed prediction that is turned into a ‘discovery’. The reality is that neoclassical economists have never measured technical progress. They have measured their own ignorance. [2]

Failure 5: The accounting identity

Despite the failures of neoclassical growth theory, economists cling to their model. One reason they do so is because they claim that the model ‘works’. By this, economists mean that neoclassical growth theory gives results that are consistent with marginal productivity theory.

Let’s unpack this claim. According to neoclassical growth theory, the growth of output is caused by the growth of capital and labor inputs. Economists postulate that there exists a ‘production function’ that relates output to these inputs. Importantly, this production function must be consistent with marginal productivity theory. That is, it must show that both workers and capitalists earn their marginal product.

The convention, in neoclassical economics, is to assume a ‘Cobb-Douglas’ production function. This is an equation named after the economists who first proposed it (Charles Cobb and Paul Douglas). The equation looks like this:

Here Y is economic output, L is labor input, and K is the capital stock. The parameter A was initially assumed to be a constant. Later, however, it came to represent the growth of technological progress.

Let’s talk about the exponents α and β. In the Cobb-Douglas equation, these exponents are free parameters, determined by regressions on real-world data. But if neoclassical theory is correct, these exponents have a special meaning. They should represent each factor’s share of income: α is capital’s share of income; β is labor’s share.

When economists started using the Cobb-Douglas equation, they found that their results supported marginal productivity theory. When they regressed this equation onto empirical data, the fitted values for α and β almost always summed to one — just as they should if they represented each factor’s share of income. Moreover, the fitted value for β was close to labor’s share of income. This seemed to confirm marginal productivity theory.

Writing in 1963, A. A. Walters celebrated this success. The Cobb-Douglas equation seemed to ‘work’, he noted, in two ways:

First, the sum of the coefficients usually approximates closely to unity. The linearity of the production function seems to be a remarkably consistent finding between one country and another. The second important result is the agreement between the labour exponent and the share of wages in the value of output. These two findings have been interpreted as confirmation that the aggregate production function has constant returns to scale and that the marginal productivity of labour is equal to the wage rate.

Despite the many problems in their theory, neoclassical economists clung to this success. Their theory ‘worked’.

The trouble was, the Cobb-Douglas function ‘worked’ even when it shouldn’t. This startling fact was discovered in 1971 by Franklin Fisher. He had created a simulation in which the Cobb-Douglas production function shouldn’t work. The simulation consisted of many different firms, each of which had its own production function. Fisher purposefully designed the model so that the conditions for an aggregate production function were not met. (These conditions, Fisher noted, were “far too stringent to be believable”.)

Now comes the interesting part. Fisher found that he could still fit his simulated economy with an aggregate Cobb-Douglas function. All that was needed for a successful fit, Fisher discovered, was that labor’s share of income be roughly constant over time. This suggested that something strange was going on. Neoclassical growth theory seemed to ‘work’ even when it shouldn’t. How could this be?

In 1974, Anwar Shaikh found the answer. He showed that when labor’s share of income was constant, the Cobb-Douglas function ‘worked’ because it was a tautology. It was a rearrangement of a national accounting identity. To show this fact, Shaikh noted that in the national accounts, national income (Y) is defined as the sum of labor and capitalist income:

Labor income, in turn, equals the average wage w times labor hours L. And capital income equals the return on capital r times the value of the capitalist stock K. So national income is defined as:

Shaikh showed that with a little algebra, you could rearrange this identity into the Cobb-Douglas equation. The term β in the Cobb-Douglas equation, Shaikh found, was algebraically equivalent to wL/Y — labor’s share of national income.

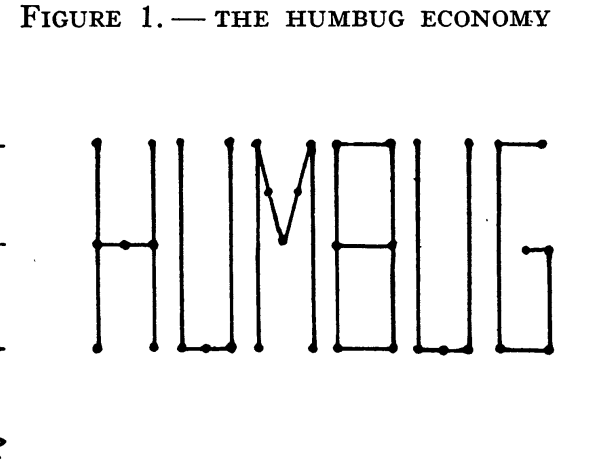

Shaikh’s discovery was an academic mic drop. The Cobb-Douglas equation ‘worked’ because it had to. It was a mathematical rearrangement of a national accounting identity — an equation that was true by definition. To illustrate the point, Shaikh successfully fit the Cobb-Douglas function to an economy who’s production traced the word ‘HUMBUG’. (See the cover image.)

How did neoclassical economists respond to this devastating discovery? Mostly by ignoring it. Again, take Gregory Mankiw’s macroeconomics textbook as an example. It contains 19 references to ‘accounting identities’. None of them is Shaikh’s identity.

The winners write history

What’s most frustrating to heterodox economists is not that neoclassical growth theory is irredeemably flawed. It’s okay for a theory to be wrong — that’s part of doing science. What’s infuriating is that neoclassical growth continues to be taught as if it had no problems. Search standard economics textbooks for a discussion of the problems reviewed here, and you’ll likely find nothing.

This blistering silence is a classic example of the winner writing history. Neoclassical economists dominate economics departments in universities, and so they can promulgate their vision without challenge. Neoclassical textbooks are massive lies — the equivalent of a European history book that omits colonialism.

Will the repeated failures of economic growth theory eventually make it into mainstream textbooks? Time will tell. But I’m not holding my breath.

Notes

[1] In deriving the neoclassical model of economic growth, Robert Solow tucked in a subtle admission. He needed a world with only one commodity so he could “speak unambiguously of the community’s real income”.

[2] I wish I had invented the term ‘measure of ignorance’. But Moses Abramovitz beat me to it. Writing in 1956 about the residual between the measured and predicted growth of output, he wrote: “this element may be taken to be some sort of measure of our ignorance about the causes of economic growth in the United States.”

[Cover image is from Anwar Shaikh’s paper Laws of Production and Laws of Algebra: The Humbug Production Function]

Further reading

Cohen, A. J., & Harcourt, G. C. (2003). Retrospectives: Whatever happened to the Cambridge capital theory controversies? Journal of Economic Perspectives, 17(1), 199–214.

Felipe, J., & Holz, C. A. (2001). Why do aggregate production functions work? Fisher’s simulations, Shaikh’s identity and some new results. International Review of Applied Economics, 15(3), 261–285.

Fisher, F. M. (1971). Aggregate production functions and the explanation of wages: A simulation experiment. The Review of Economics and Statistics, 53(4), 305–325.

Fix, B. (2015). Rethinking economic growth theory from a biophysical perspective. New York: Springer.

Fix, B. (2019). The aggregation problem: Implications for ecological and biophysical economics. BioPhysical Economics and Resource Quality, 4(1), 1.

Hodgson, G. M. (2005). The fate of the Cambridge capital controversy. In Capital controversy, post keynesian economics and the history of economic thought (pp. 112–125). Routledge.

McCombie, J. S. L. (2001). What does the aggregate production function show? Further thoughts on Solow’s “second thoughts on growth theory”. Journal of Post Keynesian Economics, 23(4), 589–615.

Robinson, J. (1953). The production function and the theory of capital. The Review of Economic Studies, 21(2), 81–106.

Shaikh, A. (1974). Laws of production and laws of algebra: The humbug production function. The Review of Economics and Statistics, 56(1), 115–120.

Solow, R. M. (1956). A contribution to the theory of economic growth. The Quarterly Journal of Economics, 70(1), 65–94.

Solow, R. M. (1957). Technical change and the aggregate production function. The Review of Economics and Statistics, 39(3), 312–320.

Sraffa, P. (1960). Production of commodities by means of commodities: Prelude to a critique of economic theory. London: Cambridge University Press.