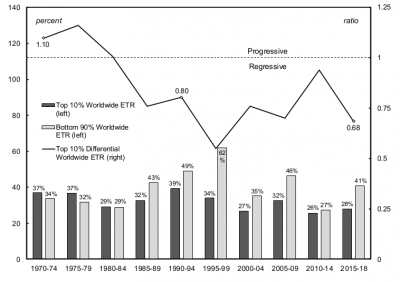

Abstract Corporate concentration in the United States has been on the rise in recent years, sparking a heated debate about its causes, consequences, and potential remedies. In this study, we examine a facet of public policy that has been largely neglected in current debates about concentration: corporate taxation. As part of our analysis we develop […]

Continue Reading2019/04: Hager and Baines, ‘Jurisdictional Tax Rates: How the Corporate Tax System Fuels Concentration and Inequality’

Abstract Corporate concentration in the United States has been on the rise in recent years, sparking a heated debate about its causes, consequences, and potential remedies. In this study, we examine a facet of public policy that has been largely neglected in current debates about concentration: corporate tax policy. As part of our analysis we […]

Continue ReadingDifferential Taxation: A Convergence of Interests between American Banking and Government

Mladen Ostojic Recommended reading by the Transnational Institute (TNI) of Policy Studies: This paper demonstrates that the interests of American banking and government have converged since the early 1980s and relates this trend to modern financial deregulation, revealing a symbiosis that would later influence the global financial crisis of 2007-2008. An examination of corporate profit […]

Continue Reading