Originally published at pluralistic.net Cory Doctorow The quest to bring antitrust law to bear against tech companies is finally paying off, but it’s been a long, hard slog. At the vanguard have been two legal scholars: Columbia law’s Lina M Khan linamkhan and Yale’s Dina Srinivasan. The first watershed moment was Khan’s Jan 2017 Yale […]

Continue ReadingJesús Suaste Cherizola Wins the 2021 CASP Essay Prize

Originally published on Economics from the Top Down Blair Fix As some of you may know, I recently became the editor of the Review of Capital as Power (RECASP), a journal that publishes research on the power underpinnings of capitalism. Each year, RECASP hosts an essay competition. I’m proud to announce that the winner of […]

Continue ReadingSuaste Cherizola, ‘From Commodities to Assets’

From Commodities to Assets Capital as Power and the Ontology of Finance JESÚS SUASTE CHERIZOLA May 2021 Abstract Assets are a crucial concept of the practice and mindset of the capitalist class. Critical analyses of capitalism, however, tend to admit that the exchange of commodities is the foundation of the analysis of capitalism. This article […]

Continue Reading2019/04: Hager and Baines, ‘Jurisdictional Tax Rates: How the Corporate Tax System Fuels Concentration and Inequality’

Abstract Corporate concentration in the United States has been on the rise in recent years, sparking a heated debate about its causes, consequences, and potential remedies. In this study, we examine a facet of public policy that has been largely neglected in current debates about concentration: corporate tax policy. As part of our analysis we […]

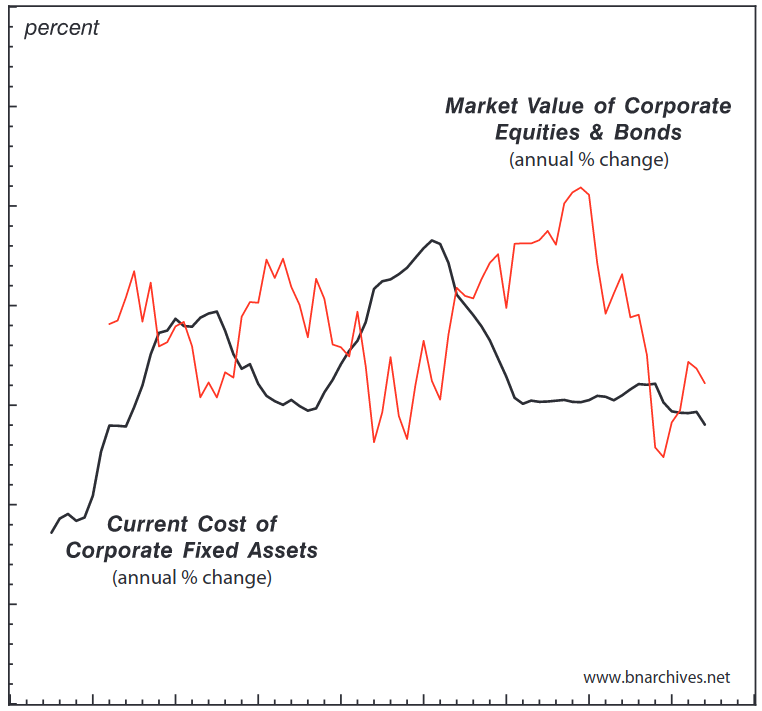

Continue ReadingNo. 2015/03: Bichler & Nitzan, ‘Capital Accumulation: Fiction and Reality’

Abstract What do economists mean when they talk about ‘capital accumulation’? Surprisingly, the answer to this question is anything but clear, and it seems the most unclear in times of turmoil. Consider the recent ‘financial crisis’. The very term already attests to the presumed nature and causes of the crisis, which most observers indeed believe […]

Continue ReadingNo. 2015/01: Hager, ‘Public Debt as Corporate Power’

Abstract In various writings Karl Marx made references to an ‘aristocracy of finance’ in Western Europe and the United States that dominated ownership of the public debt. Drawing on original research, this paper offers the first comprehensive analysis of the pattern of public debt ownership within the US corporate sector. The research shows that over […]

Continue Reading