Pensions and Power

The Political and Market Dynamics of Public Pension Plans

ERALD KOLASI

June 2022

Abstract

This paper uses the theory of ‘capital as power’ to analyze the struggle over public pensions in the United States. While mainstream commentators claim that public pensions must be ‘reformed’ because they are ‘under funded’, I argue that the metrics used to make this argument are unsound. Instead, the push to privatize public pension systems is driven less by actual funding problems, and more by the desires of elite investors who seek to control pension capital and reap the enormous investment fees associated with it. I propose that the deconstruction of public pensions is part of a larger effort to undermine collective action, so as to remove resistance to dominant capital.

Keywords

deregulation, dominant capital, pensions, privatization, public pensions

Citation

Kolasi, Erald. 2022. ‘Pensions and Power: The Political and Market Dynamics of Public Pension Plans’. Review of Capital as Power, Vol. 2, No. 2, pp. 46–80.

IN their book Capital as Power, Jonathan Nitzan and Shimshon Bichler argue that capitalism is a social order in which power is quantified through the ‘ritual of capitalization’. In this paper, I use Nitzan and Bichler’s theory to analyze the conflict over public pensions in the United States.

Over the last four decades, US capitalists have systematically triumphed over workers, as indicated by stagnating wages, low tax rates for the rich, weakened regulations for big corporations, the demise of unions, and the sharp increase in income inequality. As the labor movement has been beaten back, public pensions sponsored by state and local governments have not been spared. Millions of workers have seen their pensions reduced and/or shifted to plans that are tied to market performance (rather than guaranteed by law). Moreover, public pensions have been the subject of intense legal fights, which have left benefits more uncertain. And, perhaps most importantly, control of public pensions has become increasingly viewed by dominant capitalists as an untapped source of profit.

The purpose of this paper is to explain the political effort to reorganize public pensions, to question the assumptions underlying this effort, and to offer alternative ways of thinking about the future of the pension system. The paper is organized into three parts.

In Section 1, I review the basics of pension finance. In Section 2, I take a critical look at arguments from conservative economists who claim that public pensions are in a state of ‘crisis’. Crucial to this claim is a metric called the ‘funded ratio’, which is used as an indicator of pension health. I argue that this metric says little about pension viability. Instead, it is part of the wider ‘ritual of capitalization’ through which capitalists order the world. In Section 3, I explore the relationship between pension investment funds and the capitalist mode of power in which they are entangled.

I conclude by arguing that changes to public pensions are best understood in the context of a wider power struggle between capitalists and workers. The effort to privatize state and local pension systems is part of a larger fight over how to organize retirement in America, and to determine who should benefit from it.

1 An introduction to the US public pension system

In the United States, there are over 6,000 pension systems sponsored by state and local governments (Public Plans 2019). In 2019, these systems covered almost 15 million active workers and paid out about $283 billion in benefits to 10.3 million retirees.

State and local pension systems are heavily invested in stocks and equities, holding roughly $4.3 trillion in assets as of 2019. In fact, stock-market investment is so significant that from 1989 to 2018, investment earnings comprised 63% of pension revenues (NASRA 2019). Because of this heavy investment, changes in stock returns affect the viability of public pensions.

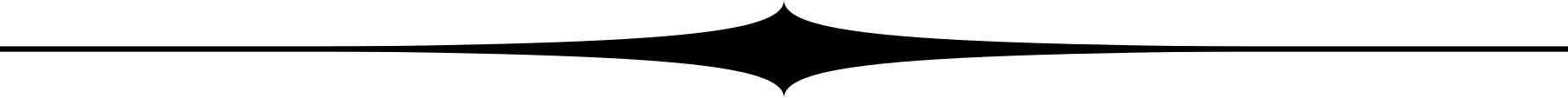

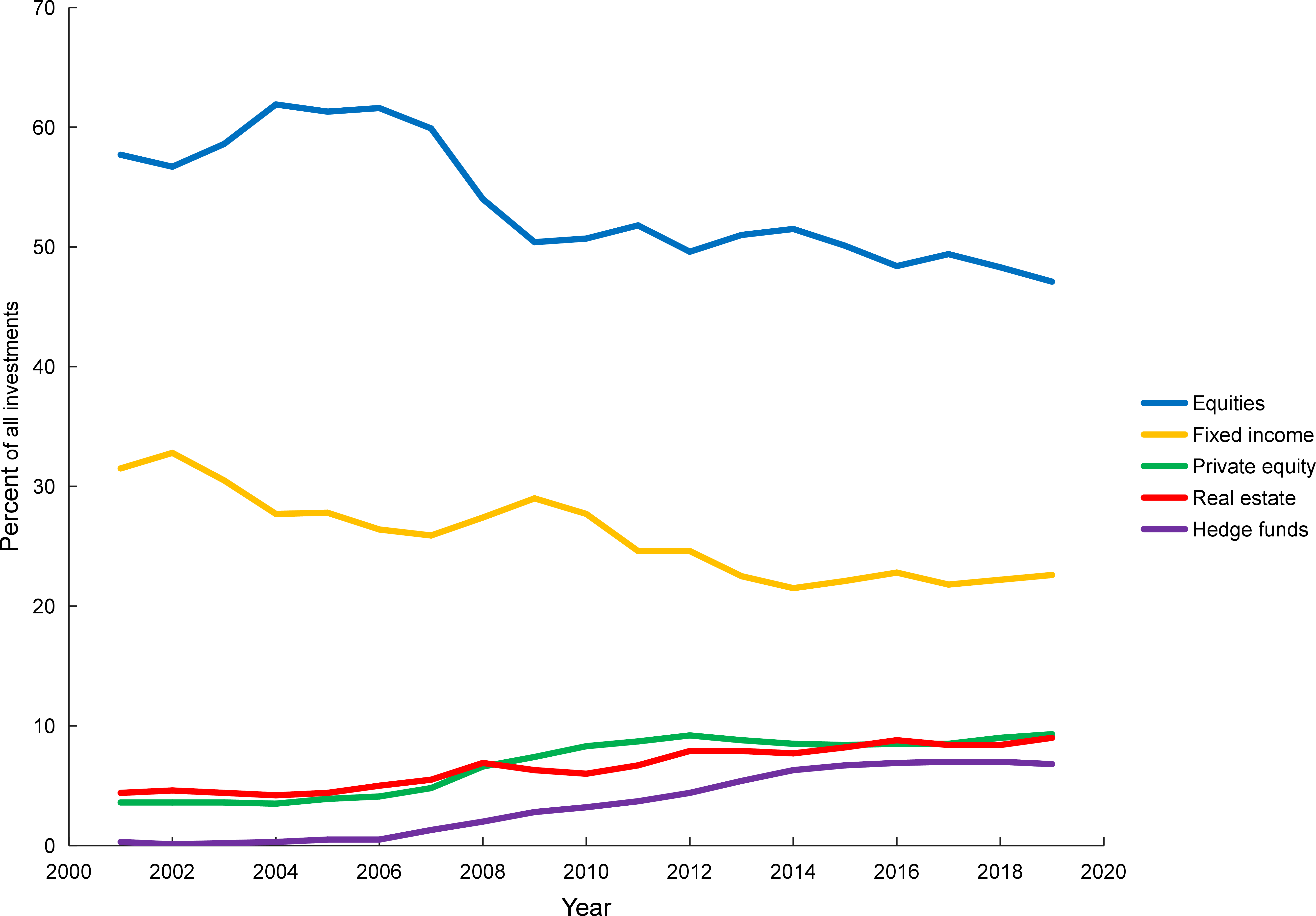

State and local pension funds hold many different types of assets. Figure 1 shows the aggregate portfolio mix in 2019. Equities are the most popular choice, comprising almost half of total investments. Treasury securities and other fixed-income assets are the second-most popular option, constituting over 20% of the portfolio. These ‘safe’ assets have traditionally been the only type of pension investment. However, over the last two decades, pension funds have started to invest in private equity, real estate, and hedge funds. Together, these non-traditional assets now comprise about one quarter of all pension investments.

Figure 1: The portfolio mix of state and local pension systems in 2019.

Figure 1: The portfolio mix of state and local pension systems in 2019.

Source: Public Plans database from the Center for Retirement Research at Boston College.

Pension types

When it comes to state and local pension systems, a unifying feature is that they all attempt to earn investment returns. What distinguishes the various pensions is the degree to which they guarantee pension benefits.

About three quarters of public-sector employees are covered under traditional defined benefit plans. These pensions provide retirees with a lifetime payment stream based on their years of work and their final salary (BLS 2017). Importantly, defined benefit plans guarantee a specific retirement benefit, regardless of the plans’ investment performance. For the quarter of state and local workers not covered by Social Security, these traditional pensions remain a lifeline (John Topoleski and Elizabeth Myers 2020).

Although defined benefit plans were once the only type of pension, governments have recently pushed workers into new types of plans in which benefits are more uncertain. The most popular alternative is the defined contribution plan, in which an employee and their employer make regular contributions to a retirement account. If investment returns are significant, the employee will have an ample pension. However, nothing is guaranteed. If investments collapse, the worker could be left with no pension at all.

Another option is the cash balance plan, which is similar to a defined contribution plan in that both the employee and the employer make regular contributions to a retirement account. The main difference is that in a defined contribution plan, investment returns depend on market performance. With a cash balance plan, the employee receives a guaranteed interest rate.

Finally, hybrid plans require employers and employees to make contributions to two separate accounts, one of which functions like a defined benefit account while the other one functions like a defined contribution account.

Non-traditional pensions: gateways to government solvency?

Over the last few decades, there has been a growing movement to shift public pensions from traditional defined benefit plans to non-traditional defined contribution plans. The motivation is simple: non-traditional pension plans are viewed as gateways to government solvency.

The problem with traditional pension plans is that since benefits are guaranteed (at least in principle), investment losses can lead to a funding gap. In other words, the pension fund can end up with less money than it needs to fund its pension obligations. The advantage of non-traditional plans is that there can never be a funding gap. Whatever returns (or lack thereof) the pensioner earns on their investment, that is what funds their retirement.

This is the mainstream rhetoric, anyway. The reality, I argue, is that the push to eliminate traditional pension plans has little to do with their fiscal solvency. In what follows, I deconstruct the claim that defined benefit pensions are dangerous to government finances. I argue that the focus on pension ‘affordability’ serves as a cover for a more fundamental struggle: the fact that workers’ pensions have become a tool for capital accumulation.

Pensions as capital … capital as power

Although there is wide recognition that pension funds have become key players on the stock market, there have been relatively few attempts to connect the pension system with a wider theory of capitalism. I attempt to do so here using Nitzan and Bichler’s theory of ‘capital as power’.

For Nitzan and Bichler, ‘capital’ is not a productive asset. It is a commodification of power, the value of which is arrived at through the ritual of capitalization. In this ritual, future earnings from property rights are discounted to give a capitalized value. (As we will see, this ritual has become central to how pension funds are evaluated.) More generally, Nitzan and Bichler argue that capital accumulation is a differential power struggle that shapes how society is ordered. Articulating their approach, Nitzan and Bichler write:

Capitalism isn’t simply an order; it is a creorder. It involves the ongoing imposition of power and therefore the dynamic transformation of society. In this process the key is differential accumulation: the goal is not merely to retain one’s relative capitalization but to increase it. And since relative capitalization represents power, increases in relative capitalization represent the augmentation of power.

(Nitzan and Bichler 2009a)

Because state and local pensions hold trillions of dollars in investment assets, it seems clear that they are part of the engine of capital accumulation. However, for dominant investors (i.e. hedge funds) pension capital is problematic because it is centrally administered by pension fund managers. In other words, dominant investors have no control over how pension funds are invested, nor can they determine who receives the lucrative fees associated with this investment.

I argue that a main thrust of pension ‘reforms’ is to solve this ‘problem’. By pushing for privatized pensions, dominant investors can potentially gain control of trillions of dollars worth of capital and the billions of dollars in fees that come with it. Viewed this way, the battle over traditional pensions is not about government ‘solvency’; it is the struggle to convert public funds into a tool for capital accumulation. This class conflict is my focus here. But before discussing the power struggle over public pensions, I will first review mainstream arguments for pension reform.

2 Are public pensions ‘underfunded’?

According to many commentators, public pensions are facing a huge funding crisis. The claim is that pension obligations are now greater than the value of the assets used to fund them (Warshawsky and Marchand 2016; Farrell and Shoag 2017). Noting this problem, a 2005 New York Times article raised the specter of “The End of Pensions” (Lowenstein 2005). The bear market of the Great Recession enhanced these fears, causing widespread changes in state and local pension plans (Brainard and Brown 2018a).1

Before getting to the basis for these ‘underfunding’ claims, it is worth noting that fears of pension collapse have so far not come to fruition. From 2008 to 2012, fewer than 0.1% of all municipalities eligible for bankruptcy protection actually filed for it (Maciag 2013). Indeed, government bankruptcies are so rare that as of 2015, only 63 municipalities had filed for bankruptcy over the previous 60 years (Kil Huh et al. 2015a).2 Overall, pensions have been more resilient than many commentators believed. Around three quarters of state and local workers remain covered by traditional pensions that guarantee a defined benefit (Bureau of Labor Statistics 2017).

The funded ratio

Given that pension ‘end times’ have not come, it is worth investigating the measurements on which ‘underfunding’ claims are based. The typical way of gauging the financial health of a defined benefit pension plan is by calculating something called the funded ratio. This ratio takes the market value of a pension plan’s assets and divides it by the present value of the plan’s future liabilities:

\displaystyle \text{funded ratio} = \frac{ \text{market value of total assets}}{ \text{ present value of future liabilities }}

The funded ratio is supposed to indicate a pension system’s ability to cover future benefit payments. The idea is that a ‘healthy’ pension should have a funded ratio of at least 100%. In the real world, most public pensions fall below this target. For example, in 2018, the aggregate funded ratio for the 100 largest US public pensions was 72% (Sielman 2019). In this situation, pension plans are said to have an ‘unfunded liability’.

Although the underfunding language sounds scary, economists have long noted that public pension plans do not need to be pre-funded (Samuelson 1958; Lenney, Lutz, and Sheiner 2019). Indeed, federal pensions like Social Security meet their obligations without setting any money aside. Instead these programs adopt a ‘pay-as-you-go’ approach in which pension payments come from current revenue. As long as revenue keeps up with costs, this approach works well. On that front, it is worth remembering that prior to the 1970s, many state and local pensions were successfully funded through a pay-as-you-go approach. In other words, they met their pension obligations while having a funded ratio of zero.

Setting aside the fact the pensions need not be pre-funded, it remains unclear that a low funded ratio indicates a pension ‘crisis’. Noting this fact, the American Academy of Actuaries warns that the funded ratio is but one of many ways to quantify pension finances. “Understanding a pension plan’s funding progress,” the Academy observes, “should not be reduced to a single measure or benchmark at a single point in time” (American Academy of Actuaries 2012). When analyzing pension finances, the Academy recommends looking at many metrics, including the plan’s contribution policy and its investment strategy.

To better understand why the Academy of Actuaries issued these warnings, consider the example of the State Employees’ Retirement System (SERS) in Illinois. SERS has existed for seven decades, and for much of that time has been considered ‘underfunded’ … at least when judged by the ‘funded ratio’. Yet SERS has never missed a benefit payment. The point is that a low funded ratio does not mean that a pension system is about to fail. In fact, a funded ratio says little if anything about the objective state of a pension’s finances.

The reason that the funded ratio cannot be trusted is that it is less a ‘measurement’ and more a ‘ritual’. In fact, it is based on the same ritual that capitalists use to assess the value of their property rights. To understand this ritual, recall that the funded ratio divides a pension plan’s total assets by the present value of its future liabilities.

Because pension liabilities are in the future, their actual value is unknown. Faced with this problem, the ritual of capitalization comes to the rescue. To ‘capitalize’ a future flow of money, we take the annual flow and ‘discount’ it by a rate of our choosing. As Nitzan and Bichler observe, capitalists apply this ritual to their future profits. Here, we are concerned with pension fund analysts, who apply the capitalization ritual to pension liabilities. These analysts take (a guess about) annual liabilities and then discount these liabilities by a rate of their choosing. The result is the present (capitalized) value of pension liabilities:

\displaystyle \text{present value of future liabilities} = \frac{ \text{ annual liabilities }}{ \text{ discount rate}}

What’s important about the ritual of capitalization is that it is not an objective statement about the present. It is a subjective judgement about the future. The key is that the discount rate is not ‘observed’. It is chosen by the analyst. And this choice, in turn, affects the valuation of pension liabilities.

The effect can be substantial. For example, a 2010 review by Douglas Elliott looked at different estimates of the liabilities of state and local pensions. Depending on the discount rate used, these estimates varied from a low of $2.8 trillion to a high of $5.3 trillion (Elliott 2010). As another example, the Teacher Retirement System in Texas recently switched from a discount rate of 8% to 7.25% (Williamson 2018). Following this decision, the funded ratio dropped by four points, from 81% to 77% (Gabriel, Roeder, Smith and Company 2018).3

It is not just the choice of discount rate that affects the present value of liabilities. Because annual pension obligations occur in the future, they too are uncertain. (To estimate future costs, actuaries make guesses about things like salary growth and the life expectancy of retirees.) Because so many subjective decisions are involved, it is difficult to meaningfully compare different funded ratios (Chen and Matkin 2017a).

To summarize, the funded ratio is not an objective statement about a pension plan’s ‘health’. It is a guesstimate that depends on a host of assumptions. So if two pension plans have differing funded ratios, this does not necessarily mean that the one with the higher funded status is ‘healthier’. It could be that the higher funded ratio simply reflects more optimistic assumptions.

What is the ‘correct’ discount rate?

In the debate about pension finances, a main source of controversy is the choice of discount rate used to quantify pension liabilities. I briefly review the details here. As I discuss the debate, keep in mind that the choice of discount rate has real-world consequences for pensioners. This is because the discount rate affects the funded ratio, and many pension plans have linked cost-of-living-adjustments (which bump up benefits to compensate for inflation) to the value of this ratio. If the funded ratio falls below some threshold, cost-of-living-adjustments may be reduced or eliminated entirely.

With these real-world consequences in mind, let’s have a look at the controversy over the pension discount rate. In 2009, the finance economists Robert Novy-Marx and Joshua Rauh raised eyebrows by claiming that state and local pension plans were applying discount rates that were unjustifiably high (Novy-Marx and Rauh 2009a). By using high rates, Novy-Marx and Rauh argued, states were artificially lowering the present value of their future liabilities. The effect was to make it seem like pension finances were doing better than they really were.

Drawing from the neoclassical theory of finance, Novy-Marx and Rauh argue that the discount rate for future cash flows should be set by their level of ‘risk’. The idea is that cash flows from a ‘risky’ investment should be discounted more heavily than cash flows from a ‘risk-free’ investment. This reasoning means that investors should pay less to purchase a risky income stream than to purchase an equivalent ‘risk-free’ cash flow.

So what is the ‘risk’ associated with government pensions? According to Novy-Marx and Rauh, there is essentially no risk. That’s because government assets are legally and constitutionally protected, meaning public pension obligations are guaranteed. As a result, Novy-Marx and Rauh argue that pension liabilities should be discounted at a ‘risk-free’ rate:

Standard financial theory suggests that financial streams of payment should be discounted at a rate that reflects their risk, and in particular their covariance with priced risks. In the case of state pension funds, the “risk” is the level of certainty as to whether certain payments will need to be made. From this point of view, the right discount rate for … pension liabilities is not 8%, a rate which implicitly assumes a high covariance with the market, but rather a risk-free interest rate, like the interest rate on Treasury bills and bonds.

(Novy-Marx and Rauh 2009b)

In neoclassical economics, the ‘risk-free’ rate represents the hypothetical return on a ‘riskless’ investment. But what is this riskless investment? No one knows for sure. In practice, many economists take Federal debt as the most secure investment. And so they use Treasury yields as a proxy for the risk-free rate.4

Regardless of the choice of risk-free proxy, two general problems should be noted. First, interest rates are subject to change, meaning the ‘risk-free’ rate is necessarily uncertain. Second, there is no way to confirm that interest rates actually indicate ‘risk’. In neoclassical economics, shifting interest rates are supposed to indicate changing perceptions of risk tolerance. But the only way to know about our risk tolerance is by first measuring interest rates. In other words, economists argue that interest rates indicate risk tolerance, but provide no independent measure to back up their claim.5

Putting aside these general concerns, it remains unclear that discounting state and local pension obligations by (Federal) Treasury yields is appropriate. Doing so implies that state-level debt is as ‘risk free’ as federal debt. But is it really? Compared to the national constitution, state constitutions are fairly easy to change, meaning state and local pension ‘guarantees’ can be rewritten. And to the degree that debt default is a risk, the federal government is far more secure. The federal government has never defaulted on its debt (although some scholars argue that it did so once in 1933). States, however, have defaulted about 20 times in American history, including 8 defaults in the 1840s alone following the Panic of 1837 (Reinhart and Rogoff 2013; English 1996). Since state-level debt seems riskier than federal debt, by the standards of neoclassical economics, state pensions ought to be discounted at a rate that is higher than Treasury yields.

Although the liabilities of most state pension plans are not publicly traded, the few that are suggest that investors agree with this risk assessment. As Table 1 shows, investors deem that state debt is riskier than federal debt. To interpret this evidence, note that I compare the yield of Treasury notes and bonds to the interest rates on ‘pension obligation bonds’ (POBs) issued by state and local governments. These bonds are pension obligations that have been collateralized and sold to investors as debt securities. In this small but representative sample, the interest rates on pension obligation bonds are noticeably higher than the yields on Federal securities issued in the same year. In the language of neoclassical economics, that means investors see state debt as a riskier investment.

Table 1: Interest rates on pension obligation bonds (POB) issued by state and local governments, compared to the average interest rates on Treasury securities issued in the same year

| Jurisdiction and year | POB interest rate | Average Treasury 10-year note | Average Treasury 30-year bond | POB amount |

|---|---|---|---|---|

| Kansas (2015) | 4.68% | 2.14% | 2.84% | $1 billion |

| New Orleans (2000) | 11.20% | 6.03% | 5.94% | $170 million |

| Connecticut (2008) | 5.88% | 3.66% | 4.28% | $2.28 billion |

| New Jersey (1997) | 7.64% | 6.35% | 6.61% | $2.8 billion |

| Stockton (2007) | 5.81% | 4.63% | 4.84% | $125 million |

| Oregon (2003) | 5.75% | 4.01% | Not issued in 2003 | $2.1 billion |

| Los Angeles (1994) | 7.4% to 9.19% | 7.09% | 7.37% | $2 billion |

Sources: State and local records, such as actuarial and financial reports.

Notes: The 30-year Treasury bond was not auctioned for several years in the 2000s, including the year 2003. Interpolated values are often used for the missing years, which would imply a rate of around 4.5% in 2003.

Here are a few details. In 2008, for example, Connecticut issued a POB at a borrowing rate of 5.9% — much higher than the corresponding Treasury yields for that year (Munnell et al. 2010). In 2015, Kansas issued roughly $1 billion in POBs at a borrowing rate of 4.7%, also higher than the comparable Treasury yields for that year (Conroy 2017). Municipalities have generally fared worse than states. In 2000, New Orleans issued $170 million of POBs with a fluctuating interest rate that amounted to more than 10% by the time the debt was refinanced a decade later (Niraula 2018).

Overall, investors seem to disagree with Novy-Marx and Rauh’s assessment that state and local pension obligations are ‘risk-free’ assets. On the (rare) occasions when pension obligations are collateralized and sold as debt securities, investors usually demand interest rates above the federal baseline. In other words, judged by the standards of finance economics, discounting pension liabilities using a universal rate of 2 or 3 percent seems misguided.6

Note that Novy-Marx and Rauh’s argument also implies that the valuation of a pension plan’s liabilities can be decoupled from the plan’s asset performance. In practice, this separation makes little sense because assets are what fund the liabilities (Mixon 2015). In contrast, actuaries argue that if you want to know what it would actually cost to fund pension benefits, one should discount future liabilities by the assumed rate of return on investments.7 But even then, this rate of return remains unknown.

Because the choice of discount rate is fundamentally ambiguous, the present value of future pension obligations is equally ambiguous, as is the funded ratio. In other words, the funded ratio says more about the subjective evaluation of risk than it does about the actual solvency of public pensions.

3 Pensions and power

Given the problems with the funded ratio, it seems odd that this metric dominates the discussion of pension finance. But it is only odd if we think of the funded ratio as a ‘scientific’ tool. If we treat the funded ratio as a ‘political’ tool, things make more sense. The reality is that public pensions are the focal point for an intense power struggle between workers (who want reasonable benefits during retirement) and elite investors (who see pension funds as an untapped source of profit). Since it can be manipulated to tell different stories, the funding ratio is a pawn in this game.

To understand the conflict over public pensions, we need to focus on the accumulation of power. Doing so requires abandoning neoclassical economics, because it views the economy as a ‘frictionless’ market in which power is largely absent. Instead, I will use Nitzan and Bichler’s theory of ‘capital as power’ to analyze the struggle over public pensions.

Nitzan and Bichler discard the dichotomy between economics (markets) and politics (government). Instead, they see society as a ‘creorder’ — a social structure that is created and ordered as elites attempt to impose their will. In capitalism, this power struggle is captured by the ritual of capitalization, which quantifies the value of capitalist property rights. While governments are not capitalized directly, they play a central role in capital accumulation. As Nitzan and Bichler observe, “the power to generate earnings and limit risk goes far beyond the narrow spheres of ‘production’ and ‘markets’ to include the entire state structure of corporations and governments” (2009b). Nitzan and Bichler call this structure the ‘state of capital’.

What’s important for the present discussion is that pensions are part of the state of capital — a joint outcome of private and public policy. Because most pension benefits are funded by investment earnings, pensions are locked in the game of capital accumulation. And when this game changes — for instance, when investment returns collapse — lawmakers respond by restructuring pension benefits.8

The legal landscape of public pensions

To understand the power struggle over pensions, the best place to start is to review the legal dynamics that influence pension benefits. Although traditional ‘defined benefit’ pensions are supposed to have benefits that are ‘guaranteed’, lawmakers have the power to redefine their obligations.

Consider, for example, the point during a worker’s employment tenure when their pension becomes ‘guaranteed’. It seems that only 22 states protect pension benefits from the beginning of employment (Pew 2019). Nine states protect accrued benefits from the time of ‘vesting’ (the point at which employees qualify for pensions). Four states protect pension benefits after minimum age and service requirements are met. And three states protect pension income only at the point of retirement. In these states, a worker could be a few weeks away from retiring with an expected benefit, only to have the state government change the their pension income at the last moment.

To protect pension benefits, many states have put constitutional limits on how pension obligations can be altered. Unfortunately, the language of these constitutional amendments is often ambiguous, giving courts significant flexibility to interpret the law. Perhaps the best way to sum up the legal situation is to say that it is complex. Constitutional protections for pensions (and their legal interpretations) vary greatly by state.

Some states, like Indiana and Texas, have no constitutional protections for their public pension systems (Munnell and Quinby 2012a). Other states, like Michigan and Louisiana, protect an employee’s accrued pension benefits up to the present point of employment, but do not protect benefits that will be earned from future years of work. Meanwhile, states like Illinois, California, and New York protect both past and future benefit accruals. And then there are states like Ohio, which have ambiguous constitutional language or flexible legal standards. To summarize, most states protect past accruals, but future accruals are more uncertain.

The majority of states (including California and Pennsylvania) protect pensions under a ‘contracts-based’ approach which is enshrined either in state law or the state constitution (Munnell and Quinby 2012b). This legal framework prohibits a state from passing any law that violates or impairs the pension ‘contract’. The contracts-based approach makes it difficult to alter benefits for current workers.9

A more flexible method for protecting pension benefits (used by Ohio, Wisconsin, and a few other states) is the ‘property-based’ approach. This approach argues that pension benefits constitute ‘property’, meaning they are protected by the Fourteenth Amendment to the Constitution and cannot be taken away without due process.

Unfortunately, this approach to protecting pension benefits has been largely unsuccessful. Courts have generally held that amendments to pension benefits do not constitute the confiscation of property. Instead, courts typically see pension amendments as “adjustments to the benefits and burdens of economic life”. Because of this judicial stance, property-based challenges rarely stop state officials from changing pension rules.

In a 2017 review, Kristen Barnes studied whether state constitutional provisions actually protect public pension benefits. She found that the record is mixed. For example, in 1998, the Supreme Court of Ohio ruled that accrued pension benefits are not protected at the start of employment, but rather at the start of retirement. In 2003, the Supreme Court of Louisiana ruled that accrued pension benefits are only protected at the point when someone qualifies for retirement. Looking at this record, Barnes concludes: “placing constitutional limits on government power can achieve the goal of protecting retirement benefits from the incursion of politicians, though it depends upon how the protection clauses are drafted.”

Table 2 lists some notable court cases that have impacted public pensions. These cases show that prior to retirement, pension benefits are vulnerable to change. Even when states claim to protect earned pension benefits under a contracts-based approach, the exact timing of this protection is often vague. And so courts have latitude to decide when it kicks in. When it comes to pension protections, it seems that court decisions are all over the map. Looking at 54 pension lawsuits filed between 2009 and 2013, legal scholar Stuart Buck finds that courts often arrive at “diametrically opposite conclusions”. “Reductions of cost-of-living adjustments were upheld in Colorado, Minnesota, New Jersey, and South Dakota state courts,” Buck observes, “whereas the same adjustments were struck down in Arizona.” In short, workers cannot rely on courts to protect their pensions. “To date,” Buck concludes, “there is little to no definitive guidance or uniformity of interpretation on [pension protection], either at a state or federal level” (Buck 2013).

Table 2: Court cases that have impacted public pensions

| State | Court case | Year | Outcome | Pensions reduced? |

|---|---|---|---|---|

| Ohio | State ex rel. Horvath v. State Teachers Retirement Board | 1998 | Supreme Court of Ohio ruled that public school teachers do not have contract rights in any retirement benefits until they reach the point of retirement itself. | Yes |

| Louisiana | Smith v. Board of Trustees of Louisiana Employees’ Retirement System | 2003 | Supreme Court of Louisiana ruled that accrued pension benefits for public employees are protected only once the employees have vested in the plan. | Yes |

| Minnesota | Swanson v. State of Minnesota | 2011 | Minnesota Supreme Court held that reductions in COLA rates are constitutional, adding that “statutes are not contracts absent plain and unambiguous terms that show an intent to contract.” | Yes |

| Michigan | In re City of Detroit, Michigan | 2013 | United States Bankruptcy Court for Eastern District of Michigan ruled that bankruptcy courts can modify municipal pension obligations for retirees during federal bankruptcy proceedings, despite the protections guaranteed under the Michigan Constitution. | Yes |

| Illinois | In re Pension Reform Litigation | 2015 | Supreme Court of Illinois held that a 2013 law which reduced pension benefits for current employees violated the pension protection clause of the Illinois Constitution. | No |

Sources: Buck (2013) and Barnes (2017).

Note: In 2016, a federal appeals court ruled that the pension cuts implemented in Detroit’s bankruptcy proceedings could not be revoked.

Government tools for reducing pensions

Given the lack of clarity from the courts, states have a variety of tools for clawing back their pension obligations. Here are some of the most popular tactics:

-

Reduce or eliminate cost-of-living-adjustments. Some state and local pension plans (including MERS in Rhode Island and PERA in Colorado) have tied cost-of-living adjustments to the plan’s investment performance. So if investment returns drop, these adjustments can be eliminated.

-

Change the pension reductions for early retirement. In most pension plans, employees can decide to retire early in exchange for a reduced pension. Governments can lower their pension costs by steepening this reduction, meaning early retirees receive a smaller pension. In 2013, the Ohio Public Employees Retirement System used this method to reduce pensions for active workers.

-

Change the methods used to calculate pension income. Pensions income is typically determined by taking a retiree’s final salary and multiplying it by the number of years they worked, mediated by some ‘multiplier’. For example, if the multiplier was 2%, a retiree who worked for 40 years would receive a pension which was 80% (40 \footnotesize \times 0.02) of their final salary. Governments can reduce pension benefits by changing the multiplier, changing the period used to calculate the ‘final salary’, or by increasing the time required to qualify for a full pension. In 2012, the State Teachers’ Retirement System in Ohio implemented such changes (both for current workers and new hires), leading to a $16 billion reduction in unfunded liabilities. The cost of funding pensions dropped from 15.7% of annual payroll to 12% (Brainard and Brown 2018b).

-

Transfer non-vested employees to a new pension plan. Employees must typically work for a period of time before they become ‘vested’ in their employer’s pension plan. Employers can save costs by switching non-vested employees to a different pension plan with worse benefits. This is what Virginia did in 2012, and what Colorado did in 2018 (Brainard and Brown 2018c).

-

Incentivize delayed retirement. Delayed retirement means that workers collect their pension benefits over a shorter period, thus reducing the cost of providing the pension.

Over the last decade, dozens of states have used the above tactics to make (or attempt to make) changes to the pension benefits of current employees. Unsurprisingly, these efforts have been controversial, inviting numerous lawsuits. Some of these reform efforts failed, notably in Illinois, but others succeeded, like in Florida (Spiotto 2018). When state and local governments go bankrupt (as in Detroit) even current retirees are susceptible to reduced pensions (Tompor 2018). Over the last decade, the threat of pension reduction has caused large numbers of employees to either retire early or to leave their profession altogether (Maciag 2014).

The main point here is that although traditional pensions claim to have ‘defined’ benefits that are protected by law, these benefits are far from guaranteed. Governments have a variety of tools for reducing pension payments. In short, nothing in social life is guaranteed. To the extent that workers receive ample pensions, it is because they have fought to earn and protect them.

Pensions and the stock market

Let’s turn now from pension protections to pension fund performance. Because public pensions are heavily invested in the stock market, they are part of capitalist finance. To untangle the relation between pensions and the financial system, I will use Nitzan and Bichler’s theory of ‘capital as power’.

In this theory, Nitzan and Bichler claim that stock prices provide a window into the power struggle between capitalists and workers. For example, when stock prices rise relative to wages, Nitzan and Bichler argue that this indicates that capitalists have increased their power relative to workers (Nitzan and Bichler 2016). I believe we can apply similar thinking to the study of public pensions. In other words, we can use pension finance to study the power struggle between capitalists and workers.

Let’s lay out the opposing goals. For workers, the goal is to have a decent pension. On that front, traditional pension plans are the best option, as they generally have benefits that are higher than privatized plans (Rhee and Fornia 2017). For capitalists, the goal is to make money from pension investments, which is easier to do if you control the money (and associated investment fees) directly. Also, privatizing pensions is good for capitalists because it reduces workers’ collective power.

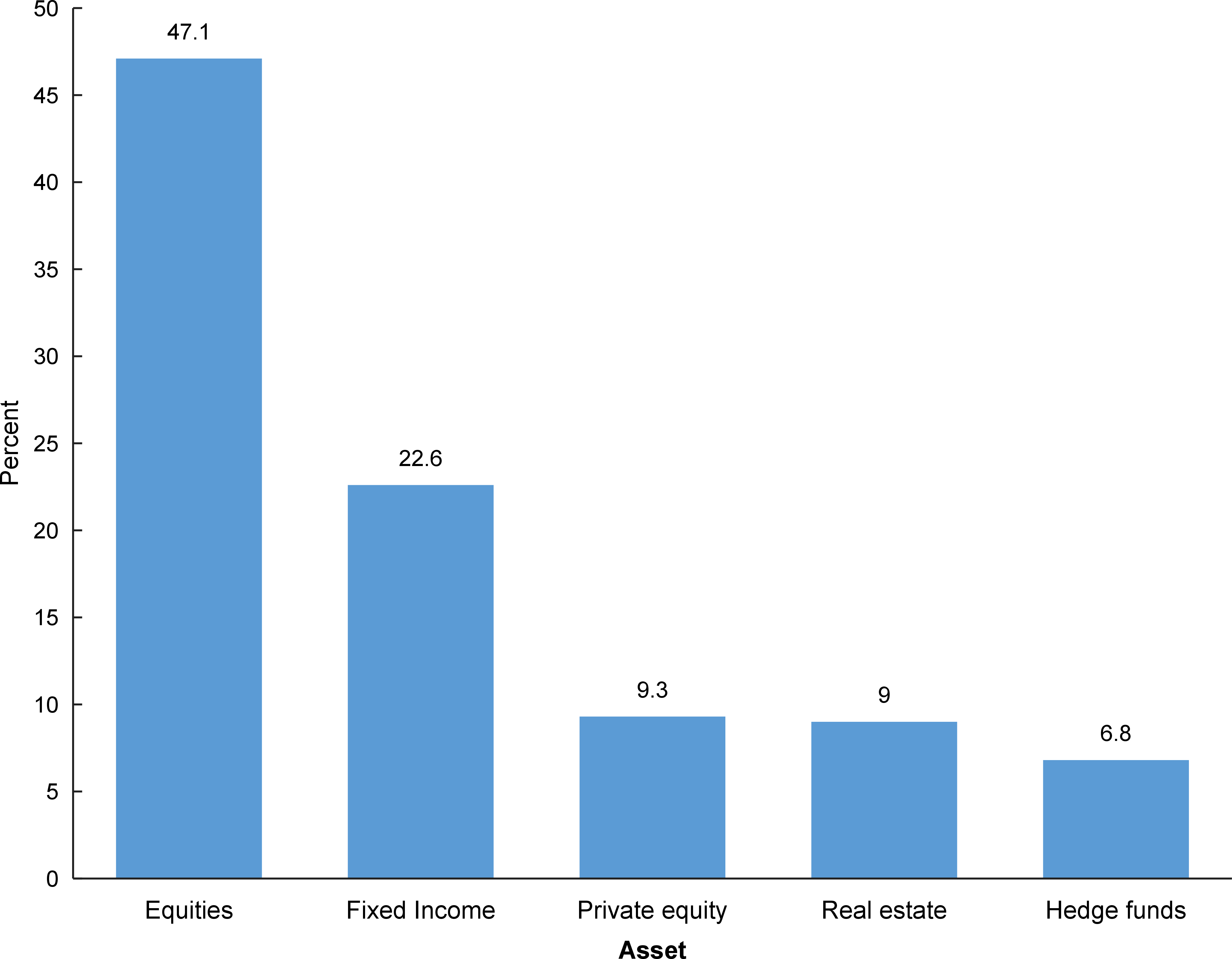

Because the power struggle over pensions is rooted in capital accumulation, it seems likely that pension reforms might relate to stock-market returns. And indeed they do. Consider what happened following the Great Recession. In 2007 (prior to the recession), only five states enacted pension reforms. Following the recession in 2010, 18 states reformed their pensions. In 2011, 27 states followed suit. Unsurprisingly, this reform followed the 2008-2009 collapse of pension assets, driven by falling stock prices. At the end of 2007, state and local pension investment funds were valued at $3.15 trillion. But by March 2009, this value had fallen to $2.17 trillion (Brainard and Brown 2018e).

Figure 2 shows the connection between pension-fund value and the pace of pension reforms. When pension-plan assets collapsed in 2008 and 2009, a wage of pension reforms followed a few years later. And as stock markets recovered, pension reforms died down.

Figure 2: Asset valuations and number of states making pension-related reforms.

Figure 2: Asset valuations and number of states making pension-related reforms.

Sources: Brainard and Brown (2018) and the Public Plans database from the Center for Retirement Research at Boston College.

The role of dominant investors

The evidence in Figure 2 indicates that pension reforms are linked to market performance. But what is not obvious is why the thrust of these reforms is to replace defined benefit plans with privatized plans. Since 2009, eight states have created hybrid pension plans for new hires. Rhode Island went so far as to transfer some active workers into a new hybrid plan (Brainard and Brown 2018d). Two states established cash-balance plans for new hires.

Given the fact that states have the power to alter pension plans, why are they not meeting (perceived) funding shortages by keeping traditional plans but lowering the defined benefits? A plausible answer is that lawmakers are being influenced by dominant investors, who stand to gain from privatizing pensions.

To see the influence of dominant investors on pension reform, the case of Rhode Island is instructive. In 2011, the state government passed the ‘Rhode Island Retirement Security Act’, which affected the pensions of all new hires and any current workers who had less than twenty years of service. The legislation eliminated the annual cost-of-living adjustment and created a new hybrid plan which required employees to contribute a portion of their salary to both a defined benefit plan and a defined contribution plan.

Rhode Island’s pension reform went through thanks in large part to Gina Raimondo, a venture capitalist who was then State Treasurer. Part of Raimondo’s plan included transferring the management of $1 billion in plan assets to three hedge funds, which would each collect millions of dollars in fees every year (Taibbi 2013). Edward Siedle, a lawyer for the Securities and Exchange Commission, estimated that the new plan would require Rhode Island to pay roughly $2.1 billion in fees to hedge funds and private equity firms over the next 20 years. To put that number in perspective, it is about the same as the $2.3 billion saved by eliminating cost-of-living adjustments (Taibbi 2013). In other words, the state took $2 billion that would have gone to retirees and handed it to Wall Street.

One of the biggest backers of Rhode Island’s new law was John Arnold, a former Enron commodities trader turned hedge fund guru. Arnold poured his fortune into the organization ‘Engage RI’, which became a staunch advocate for Raimondo’s pension overhaul. In October and November of 2011, Engage RI spent more than $740,000 on a campaign to influence state legislators and convince the public of the efficacy of pension reform (Hassan 2018). The lobbying blitz worked, scaring several Democratic lawmakers into supporting the controversial bill. Arnold also gave hundreds of thousands more to Raimondo during her campaign for governor. And through his foundation (‘Arnold Ventures’), John Arnold has has exerted considerable national influence over the pension debate. One estimate puts his spending on the issue at over $50 million (Webber 2018).

In the battle over public pensions, Rhode Island is not an isolated example. Whenever state and local pensions switch to defined contribution plans, Wall Street firms usually grab hefty management fees. For example, Alicia Munnell and Mauricio Soto find that when states and local governments run defined benefit plans, they typically spent about 0.2% of their assets on annual management expenses. However, when governments switch to private defined contribution plans, investment fees range from 0.6% to 1.7% (Munnell and Soto 2007).10 Although these fee differences may sound inconsequential, when applied to trillions of dollars of assets, they are monumental. So, clearly, dominant investors stand to gain from privatizing pensions.

The changing pension-fund portfolio

In addition to moving pensions to defined contribution plans, pension reforms have also driven traditional plans to adopt more aggressive investment strategies. Over the last two decades, state and local pension funds have shifted their investment portfolios away from equities and fixed-income assets and towards private equities and hedge funds.

Figure 3 shows how the state and local pension portfolio has changed. From 2001 to 2019, equity investment decreased from 57.7% of all assets to 47.1%. Over the same period, fixed income assets went from 31.6% to 22.6%. Meanwhile, unconventional assets expanded. In the early 2000s, public pension funds had virtually no investments in hedge funds. But by 2019, that number had swelled to almost 7%.

Figure 3: Asset allocation of state and local pensions over the last two decades.

Figure 3: Asset allocation of state and local pensions over the last two decades.

Source: Public Plans database from the Center for Retirement Research at Boston College.

Note: The aggregate portfolio mix is weighted by plan size.

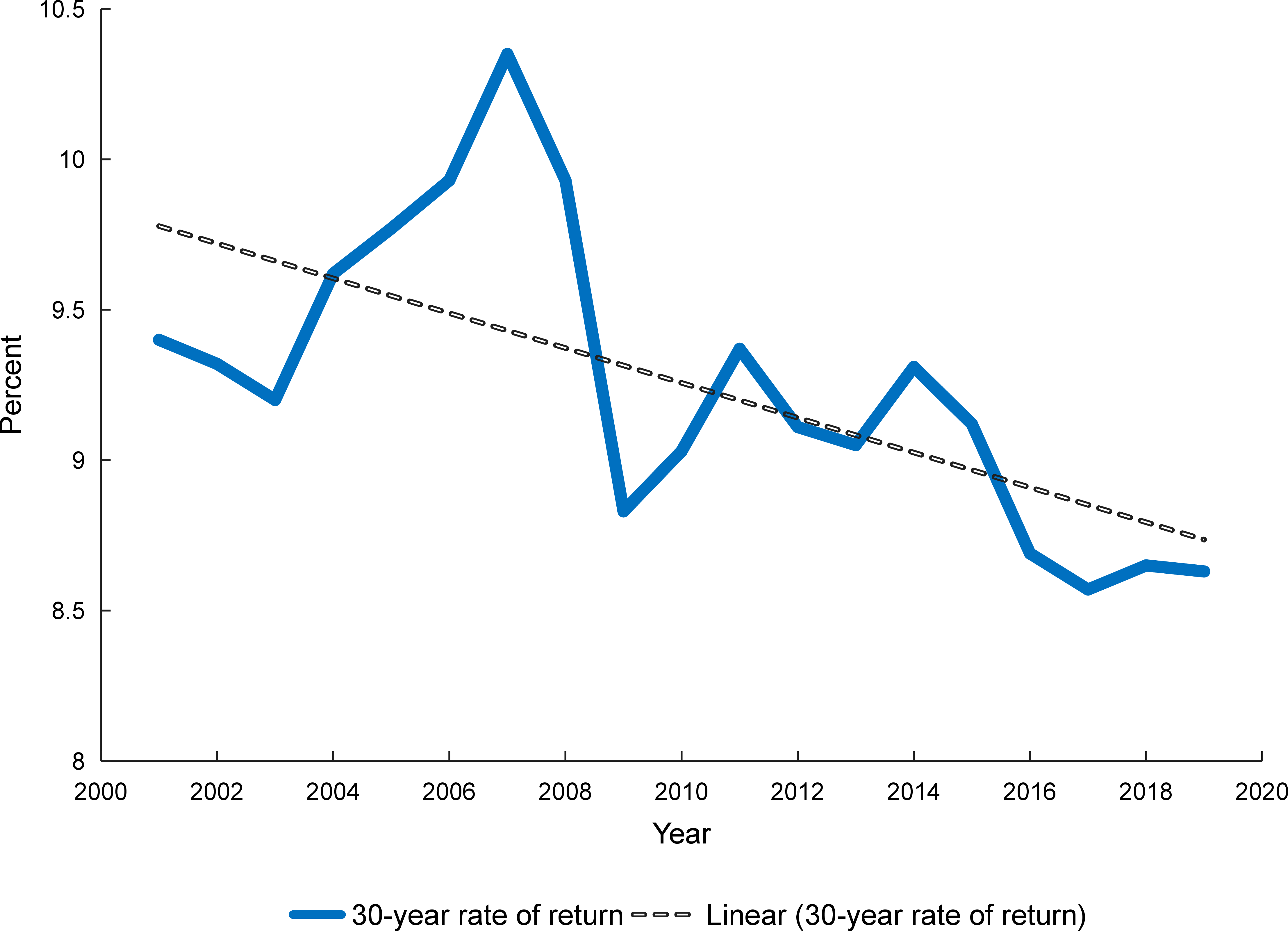

The goal of this changing portfolio mix is to generate greater investment returns. Despite this goal, there is no evidence that it has worked. Figure 4 attests to this fact. Here I plot the rolling 30-year average rate of return for all state and local pensions in the United States. Despite a shifting portfolio mix, from 2001 to 2019, pension returns actually fell from 9.4% to 8.6%. (Note that these returns are still consistently higher than the average assumptions made by plan actuaries.)

Figure 4: Rolling average 30-year rate of return and the average assumed rate of return for all state and local pensions.

Figure 4: Rolling average 30-year rate of return and the average assumed rate of return for all state and local pensions.

Source: Public Plans database from the Center for Retirement Research at Boston College.

Note: The rate of return is weighted by plan size.

Unions in a hard place

As public pensions have become increasingly invested in capitalist finance, unions have been put in a difficult position. On the one hand, unions want to protect public pensions. On the other hand, they want to minimize the cost to their members, which leads them to support aggressive investment decisions (Dippel and Sauers 2019).11 The problem with the latter goal is that it can undermine the livelihood of unionized workers.

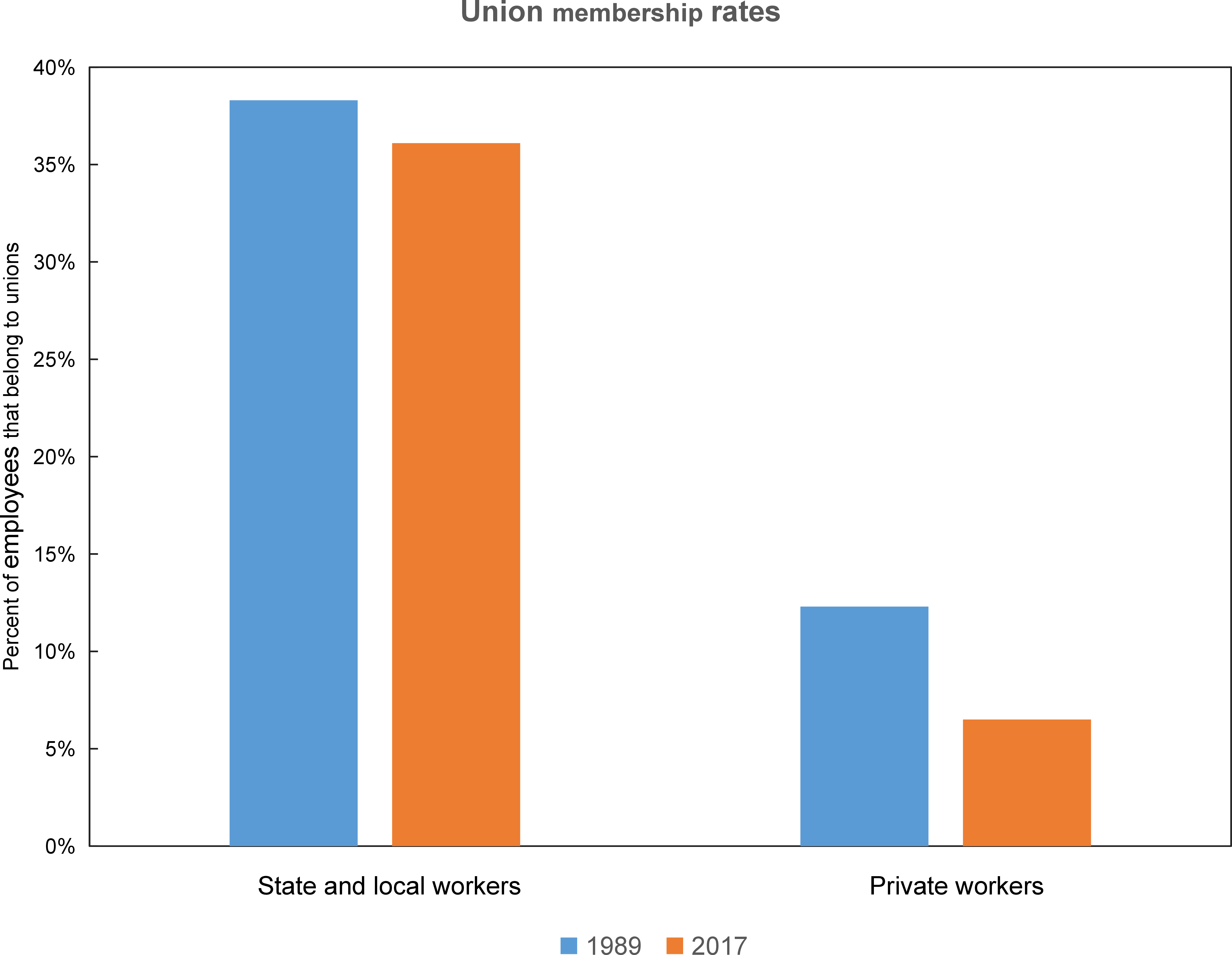

In general, unions have been essential to preserving traditional pension plans. For example, in 2020, only 11% of private sector workers participated in some kind of defined benefit plan, compared to 76% of state and local workers (John Topoleski and Elizabeth Myers 2020). The reason that public workers have kept their defined benefit pensions is likely that because they are highly unionized, they have the power to do so. As Figure 5 shows, about one third of state and local workers belong to a union. In the private sector, the unionization rate is far lower, at around 1 in 20.

Figure 5: Union membership rates of private workers and state and local workers, in 1989 and 2017.

Figure 5: Union membership rates of private workers and state and local workers, in 1989 and 2017.

Source: ‘A profile of union workers in state and local government’ by the Economic Policy Institute.

Despite the fact that unions have fought to preserve traditional pensions, they have also played a role in undermining workers’ jobs. Unions have pushed for high investment returns on pension funds, largely because such returns reduce the contribution burden paid by workers. Yet for the most part, unions have failed to consider that their pension funds might invest in firms who undermine their own jobs.

Consider the case of Rick Thorne. For years, Thorne worked as a custodian in a public school district in Massachusetts, earning a decent wage of $20 per hour (Webber 2014). As a unionized worker, Thorne made regular contributions to his local pension fund, which then took that money and placed it in the care of the bigger Pension Reserve Investment Trust (PRIT), an investment fund that manages the assets of state and local workers across Massachusetts. In 2007, something unsettling happened: PRIT put up funds to help a private equity pool acquire Aramark, a global food-services company that works with public schools. Four years later, Aramark underbid Thorne’s union and won the custodial contract at his school. Aramark offered Thorne his previous job, but at a reduced wage of $8.75 an hour. Thorne refused the offer and got fired.

Stories like this one highlight the problems of funding public pensions through capitalist finance. As public pensions attempt to increase their investment returns, they empower capitalists and undermine the collective bargaining power of the workers they support.

The importance of collective bargaining

Much has been written about the importance of collective bargaining for empowering workers and putting a check on corporate power. However, less attention has been paid to the importance of collectively bargained pension pensions.

Unsurprisingly, collectively bargained pensions tend to be better for workers. The evidence suggests that collective bargaining requirements tend to boost pension benefit levels for public workers while also reducing the amount of money they need to contribute towards their retirement (Frandsen and Webb 2017).

Less recognized is the fact that public pension funds can be active investors who look out for the interests of workers. For example, David Webber observes that public pensions are more likely to sue or scrutinize investment funds that are underperforming the market (Webber 2010). It is for precisely this reason, Webber argues, that capitalists want to push workers into privatized pensions. These defined contribution plans remove workers’ collective bargaining power. Public pension plans are powerful institutional investors who have often been a thorn in the side of corporate cheats. Pension funds have launched major lawsuits against fraudsters like Enron, Worldcom, and Wells Fargo. Public pensions have also secured numerous corporate reforms, such as having all board members stand for re-election in every cycle, instead of every few years (Webber 2018).

As another example of pensions putting pressure on big corporations, consider the 2004 Safeway strike. When the company threatened to slash wages and benefits, nearly 60,000 workers walked off the job. Although the strike itself didn’t lead to many tangible changes for workers, it did lead to changes in Safeway management. When the California Public Employees Retirement System pressured Safeway to meet the demands of its workers, the company responded by firing three of its board members.

This incident underscores the leverage wielded by large public pension funds, and the challenges they present to elite investors. To dominant investors, the elimination of traditional pensions doesn’t just offer control of more money; it likely means less scrutiny of their power.

4 Conclusions

This paper aimed to use Nitzan and Bichler’s theory of ‘capital as power’ to study the struggle over state and local pensions in the United States. At the heart of the pension debate is the so-called ‘funded ratio’ — the ratio between a pension plan’s assets and its discounted future liabilities. Although this ratio is frequently taken as an objective measure of a pension’s financial health, it is anything but. By itself, the funded ratio tells us virtually nothing about the fiscal health of a pension plan.

What many workers (and indeed, pension researchers) seem not to realize is that the funded ratio is not a ‘measurement’ so much is it is a ritual. In fact, it is but one example of the wider ‘ritual of capitalization’, in which capitalists discount future earnings to capitalize their property rights. There is nothing objective about this ritual; it is simply how capitalists ‘creorder’ the world.

Given this reality, public workers should worry less about the funded ratio of their pensions, and more about the fact that their pension funds are deeply wedded to the system of corporate power. Although this wedding is now common place, there is no reason that pensions must be ‘pre-funded’, nor must they have any investment in the stock market. As programs like Social Security indicate, pensions can be successfully funded entirely out of current government revenue.

That said, a complete change in the state and local pension system is unlikely to happen anytime soon. As such, researchers, administrators, and the general public should try to take the focus off the funded ratio and put it onto more important issues. These include the investment strategies of pension plans, issues of short-term liquidity, demographic changes, and retention concerns among younger workers.

And, perhaps most importantly, workers need to realize that the fight for decent pensions is part of the wider struggle against capitalist power. The project to destroy traditional pensions is funded by right-wing billionaires who are, at the same time, pushing for lower taxes, weaker regulations, and greater control over the financial system. Although the US labor movement is today at a weak point, there is nothing predestined about the accumulation of capitalist power. There is always an alternative.

Notes

Erald Kolasi writes about issues related to energy, society, and politics. He obtained his PhD in physics in 2016. Email: erald.kolasi@gmail.com.

-

The fact that the debate around public pensions focuses on fiscal solvency shows the extent to which the wider political economy of retirement is ignored. The focus on ‘affordability’ implies that the goal of pensions is to prevent government retirees from being a ‘drag’ on public coffers. Questions about how to give workers a decent and healthy retirement are an afterthought.↩︎

-

The most high-profile case of government bankruptcy occurred in Detroit. However, Detroit’s problems were caused by economic and demographic issues that went back decades. In other words, the bankruptcy cannot be reduced to pension costs alone (Kil Huh et al. 2015b).↩︎

-

In more technical terms, the Teacher Retirement System revised its assumed rate of return on investment, and this assumed return served as a proxy for the discount rate. This use of investment return as a discount rate is common practice among state and local pension plans.↩︎

-

A decade ago, Treasury yields were between 2 and 3 percent (Brigham and Ehrhardt 2007). Today, they are even lower. Another option is to use high-quality corporate bonds as a proxy for the ‘risk-free’ rate. Doing so pegs the discount rate at around 4%, based on recent high-quality bond yields (Siddiqi and Benjamin 2018; IAS 2011; FRED 2019).↩︎

-

It is also worth questioning whether the neoclassical theory of finance even applies to public pensions. The problem is that neoclassical economics assumes that assets are priced in a competitive market. But public pension liabilities are, for the most part, neither traded nor priced in a market. Traditional pension obligations are paradoxical in the sense that they resemble income-bearing assets, but these assets are not exchanged in competitive markets. In other words, governments usually do not collateralize pension debts and sell them to investors. (Some struggling states and municipalities have issued pension obligation bonds, especially to fund expensive benefits. But this market remains small and sporadic.)

This absence of markets is a problem for neoclassical valuation. In neoclassical economics, asset prices are supposed to reveal the discounted present value of expected future returns (Wessel 2014). When we apply this reasoning to pensions, we run into difficulty. Unlike the capitalization of a public corporation (which is known with certainty down to the second), no one knows the market value of a pension plan. This is important, because neoclassical economics assumes that markets convey information through prices. But the market currently tells us almost nothing about state and local pension obligations, because these assets have no prices.

Despite these problems, neoclassical economists have forged ahead anyway, taking a hint from Irving Fisher who asured us that a discount rate exists in all capital:

It is evident that not bonds and notes alone, but all securities, imply in their price and their expected returns a rate of interest. There is thus an implicit rate of interest in stocks as well as in bonds … It is, to be sure, often difficult to work out this rate definitely, on account of the elusive element of chance; but it has an existence in all capital.

(Fisher 1907, emphasis mine) -

Pension obligation bonds are usually issued by state or municipal governments, not by the pension systems themselves. One could therefore argue that the interest rates in Table 1 reflect a level of confidence in state and local government debt more broadly, not in pension debt specifically. But the two forms of confidence cannot be so neatly separated because investors are aware that the bond sales are specifically meant to support public pension systems, and so they will consider the financial health and stability of those systems when deciding on a corresponding rate of return.↩︎

-

Discounting pension liabilities at a risk-free rate might provide a better indication of how much pension benefits are worth to future retirees. But that does not tell you what it takes to fund them, which is what the funded ratio is supposed to measure. Finance economists might respond by saying that this point is irrelevant, since public pension payments are still ‘guaranteed’ by law, meaning they should be discounted at the ‘risk-free’ rate. The problem with this argument is that pension payments are not guaranteed, because laws can change, and pension benefits can be reduced.↩︎

-

After the Great Recession wiped out pension investments, many lawmakers responded by introducing ‘tiered’ pensions which give different benefits to newly hired workers than to their older peers. Research suggests that these tiered pensions generally give worse benefits to new hires (Aubry and Crawford 2017; Johnson and Kolasi 2020).↩︎

-

To examine the constitutionality of pension-related legislation, courts apply a three-part test. First, they determine if a contract exists, which means determining when the contract was formed and what it protects. Second, the courts determine if the state action represents a substantial impairment of the contract. Third and finally, if there is a substantial impairment, the courts have to decide whether the action is justified by an important public purpose and if the action taken in the public interest is reasonable and necessary.↩︎

-

Research also shows that compared to defined contribution plans, traditional defined benefit plans tend to earn higher investment returns. For example, from 1990 to 2012, defined benefit plans earned 0.7% more than 401(k) plans (Munnell, Aubry, and Crawford 2015).↩︎

-

The union drive for low pension fees has had tangible results. Politicians in cities dominated by the Democratic Party are more likely to boost pension benefits for their union supporters without any corresponding increase in taxation (Dippel 2019).↩︎

References

American Academy of Actuaries. 2012 ‘The 80% Pension Funded Standard Myth.’ Washington, DC. https://www.actuary.org/sites/default/files/files/80_Percent_Funding_IB_071912.pdf

Barnes, Kristen. 2017. ‘The Public Pension Crisis Through the Lens of State Constitutions and Statutory Law.’ Chicago-Kent Law Review 92: 393. https://scholarship.kentlaw.iit.edu/cgi/viewcontent.cgi?article=4157&context=cklawreview

Bauer, Elizabeth. 2019. “‘Go North, Young Man,’ To the Wisconsin Public Pension System.” Forbes. https://www.forbes.com/sites/ebauer/2019/03/08/go-north-young-man-to-the-wisconsin-public-pension-system/#74c3330340d4

—. 2018b. Brainard, Keith and Alex Brown. 2018. ‘Significant Reforms to State Retirement Systems.’ National Association of State Retirement Administrators, p. 71. https://www.nasra.org/files/Spotlight/Significant%20Reforms.pdf

—. 2018c. Brainard, Keith and Alex Brown. 2018. ‘Significant Reforms to State Retirement Systems.’ National Association of State Retirement Administrators, p. 19, 92. https://www.nasra.org/files/Spotlight/Significant%20Reforms.pdf

—. 2018d. Brainard, Keith and Alex Brown. 2018. ‘Significant Reforms to State Retirement Systems.’ National Association of State Retirement Administrators, p. 5. https://www.nasra.org/files/Spotlight/Significant%20Reforms.pdf

—. 2018e. Brainard, Keith and Alex Brown. 2018. ‘Significant Reforms to State Retirement Systems.’ National Association of State Retirement Administrators, p. 1 https://www.nasra.org/files/Spotlight/Significant%20Reforms.pdf

Brigham, Eugene and Michael Ehrhardt. 2007. Financial Management: Theory and Practice. Boston, MA: Cengage Learning, p. 175.

Buck, Stuart. 2013. ‘Pension Litigation Summary.’ Laura and John Arnold Foundation. https://www.issuelab.org/resources/15132/15132.pdf

Bureau of Labor Statistics, U.S. Department of Labor, The Economics Daily. ‘Three quarters of state and local government workers were in defined benefit pension plans in 2016.’ 2017. https://www.bls.gov/opub/ted/2017/three-quarters-of-state-and-local-government-workers-were-in-defined-benefit-pension-plans-in-2016.htm

Chen, Gang and David S. T. Matkin. 2017. ‘Actuarial Inputs and the Valuation of Public Pension Liabilities and Contribution Requirements: A Simulation Approach.’ Center for Retirement Research at Boston College. https://crr.bc.edu/wp-content/uploads/2017/05/wp_2017-4-1.pdf

—. 2017b. Chen, Gang and David S. T. Matkin. 2017. ‘Actuarial Inputs and the Valuation of Public Pension Liabilities and Contribution Requirements: A Simulation Approach.’ Center for Retirement Research at Boston College, p. 5. https://crr.bc.edu/wp-content/uploads/2017/05/wp_2017-4-1.pdf

Conroy, Alan. 2017. ‘Pension Obligation Bonds.’ Kansas Public Employees Retirement System. http://www.kslegislature.org/li_2018/b2017_18/committees/ctte_jt_pensions_1/documents/testimony/20171127_03.pdf

Dippel, Christian and Zachary Sauers. 2019. ‘Does Increasing Union Power Cause Pension Under-Funding in the Public Sector?’ University of California, Los Angeles. https://www.anderson.ucla.edu/faculty_pages/christian.dippel/Benefits_Unions.pdf

Dippel, Christian. 2019. ‘Political Parties Do Matter in U.S. Cities…For Their Unfunded Pensions.’ National Bureau of Economic Research. https://www.nber.org/system/files/working_papers/w25601/w25601.pdf

Dunkelberger, Lloyd. ‘Florida state workers to see pay raise, pension changes.’ The Palm Beach Post. May 1, 2017. https://www.palmbeachpost.com/news/state–regional-govt–politics/florida-state-workers-see-pay-raise-pension-changes/pkhE3ugsrMnftprLTHLTCL/

Elliott, Douglas. 2010. ‘State and Local Pension Funding Deficits: A Primer.’ Washington, DC: The Brookings Institution. https://www.brookings.edu/wp-content/uploads/2016/06/1206_state_local_funding_elliott.pdf

English, W. B. ‘Understanding the Costs of Sovereign Default: American State Debts in the 1840’s.’ The American Economic Review 86:1, p. 259. https://www.jstor.org/stable/2118266?seq=1#metadata_info_tab_contents

Farrell, James and Daniel Shoag. 2017. ‘Risky Choices: Simulating Public Pension Funding Stress with Realistic Shocks.’ Brookings. https://www.brookings.edu/wp-content/uploads/2017/11/wp37.pdf

Fisher, Irving. The Rate of Interest: Its Nature, Determination and Relation to Economic Phenomena. New York: The Macmillan Company, 1907. p. 10-11.

Fox, Justin. 2018. ‘Wisconsin’s Pension System Works for Everyone.’ Bloomberg. https://www.bloomberg.com/opinion/articles/2018-05-09/wisconsin-s-pension-system-works-for-taxpayers-and-employees

Frandsen, Brigham and Michael Webb. 2017. ‘Public Employee Pensions and Collective Bargaining Rights; Evidence from State and Local Government Finances.’ Washington, DC: Brookings Institution. https://www.brookings.edu/wp-content/uploads/2017/10/wp35-frandsen1.pdf

FRED Economic Research. 2019. ‘12-Year High Quality Market (HQM) Corporate Bond Spot Rate.’ Federal Reserve Bank of St. Louis. https://fred.stlouisfed.org/series/HQMCB12YR

Gabriel, Roeder, Smith & Company. August 31, 2018. Teacher Retirement System of Texas: Actuarial Valuation Report. Irving, TX. https://www.trs.texas.gov/TRS%20Documents/actuarial_valuation_pension_fund_2018.pdf

Hassan, Abdullah Wais. 2018. ‘How Policy Entrepreneurs and Business Groups Shape U.S. Pension Retrenchment.’ Contra Costa College. https://www.academia.edu/36233232/How_Policy_Entrepreneurs_and_Business_Groups_Shape_U_S_Pension_Retrenchment

Huh, Kil et al. 2015a. ‘After Municipal Bankruptcy’ Washington, DC: Pew Charitable Trusts, p. 2. https://www.pewtrusts.org/~/media/Assets/2015/08/After-Municipal-Bankruptcy-PDF.pdf?la=en

— Huh, Kil et al. 2015b. ‘After Municipal Bankruptcy’ Washington, DC: Pew Charitable Trusts, p. 3. https://www.pewtrusts.org/~/media/Assets/2015/08/After-Municipal-Bankruptcy-PDF.pdf?la=en

IAS. 2011. ‘Employee Benefits.’ International Accounting Standards. https://www.iasplus.com/en/standards/ias/ias19

Johnson W., Richard and Erald Kolasi. 2020. ‘How Have Teacher Pensions Changed since the Great Recession?’ Washington, DC: Urban Institute. https://www.urban.org/research/publication/how-have-teacher-pensions-changed-great-recession

Lowenstein, Roger. 2005. ‘The End of Pensions.’ New York Times. https://www.nytimes.com/2005/10/30/magazine/the-end-of-pensions.html

Maciag, Mike. ‘How Rare are Municipal Bankruptcies?’ Governing, January 24, 2013. https://www.governing.com/blogs/by-the-numbers/municipal-bankruptcy-rate-and-state-law-limitations.html

Maciag, Mike. ‘Pension Reforms Push Employees Out the Door in Some States.’ Governing, January 23, 2014. https://www.governing.com/topics/mgmt/gov-pension-reforms-cause-more-public-employee-retirements-analysis.html

Mixon, Peter. 2015. ‘Estimating future costs at public pension plans: Setting the discount rate.’ Pensions & Investments. https://www.pionline.com/article/20150429/ONLINE/150429853/estimating-future-costs-at-public-pension-plans-setting-the-discount-rate

Munnell, Alicia, Aubry, Jean-Pierre, and Caroline Crawford. ‘Investment Returns: Defined Benefit vs. Defined Contribution Plans.’ Center for Retirement Research at Boston College. http://crr.bc.edu/wp-content/uploads/2015/12/IB_15-211.pdf

Munnell, Alicia and Laura Quinby. 2012a . ‘Legal Constraints on Changes in State and Local Pensions.’ Center for Retirement Research at Boston College. https://crr.bc.edu/wp-content/uploads/2012/08/slp_25-1.pdf

—. 2012b. Munnell, Alicia and Laura Quinby. ‘Legal Constraints on Changes in State and Local Pensions.’ Center for Retirement Research at Boston College. https://crr.bc.edu/wp-content/uploads/2012/08/slp_25-1.pdf

Munnell, Alicia and Mauricio Soto. ‘State and Local Pensions are Different from Private Plans.’ Center for Retirement Research at Boston College. https://crr.bc.edu/wp-content/uploads/2007/11/slp_1.pdf

Munnell et al. 2008. ‘The Miracle of Funding by State and Local Pension Plans.’ Center for Retirement Research at Boston College. https://crr.bc.edu/wp-content/uploads/2008/04/slp_5-508.pdf

Munnell et al. 2010. ‘Pension Obligation Bonds: Financial Crisis Expose Risks,’ Center for Retirement Research at Boston College. https://crr.bc.edu/wp-content/uploads/2010/01/SLP_9-508.pdf

NASRA (National Association of State Retirement Administrators). 2019. ‘Contributions.’ https://www.nasra.org/contributions

Niraula, Anil. 2018. ‘Governments Issuing Pension Obligation Bonds Risk Worsening, Not Improving, Their Financial Shape.’ Reason. https://reason.org/commentary/governments-issuing-pension-obligation-bonds-risk-worsening-not-improving-their-financial-shape/

Nitzan, Jonathan and Shimshon Bichler. 2009a. Capital as Power. London, UK: Routledge, 2009, p. 312.

—. 2009b. Nitzan, Jonathan and Shimshon Bichler. Capital as Power. London, UK: Routledge, 2009, p. 8.

Nitzan, Jonathan and Shimshon Bichler. 2016. ‘A CasP Model of the Stock Market.’ Real-World Economics Review, p. 132. https://www.econstor.eu/bitstream/10419/157801/1/bna-494_20161200_bn_a_casp_model_of_the_stock_market_rwer.pdf

Novy-Marx, Robert and Joshua Rauh. 2009a. ‘The Liabilities and Risks of State-Sponsored Pension Plans.’ Journal of Economic Perspectives 23:4. http://rnm.simon.rochester.edu/research/JEP_Fall2009.pdf

Novy-Marx, Robert and Joshua Rauh. 2009a. ‘The Liabilities and Risks of State-Sponsored Pension Plans.’ Journal of Economic Perspectives 23:4, p. 194-5. http://rnm.simon.rochester.edu/research/JEP_Fall2009.pdf

—. 2009b. Novy-Marx, Robert and Joshua Rauh. 2009. ‘The Liabilities and Risks of State-Sponsored Pension Plans.’ Journal of Economic Perspectives 23:4, p. 195. http://rnm.simon.rochester.edu/research/JEP_Fall2009.pdf

Pew Research. 2019. ‘Legal Protections for State and Pension and Retiree Health Benefits.’ Washington, DC: Pew Charitable Trusts. https://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2021/09/the-state-pension-funding-gap-plans-have-stabilized-in-wake-of-pandemic

Pew Research. 2021. ‘The State Pension Funding Gap: Plans Have Stabilized in Wake of Pandemic.’ Washington, DC: Pew Charitable Trusts. https://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2019/05/legal-protections-for-state-pension-and-retiree-health-benefits

Reinhart, Carmen and Kenneth Rogoff. 2013. ‘Financial and Sovereign Debt Crises: Some Lessons Learned and Those Forgotten.’ IMF Working Papers 13/266, International Monetary Fund, p. 14. https://www.imf.org/external/pubs/ft/wp/2013/wp13266.pdf

Rhee, Nari and William Fornia. 2017. ‘How do California Teachers Fare under CalSTRS? Applying Workforce Tenure Analysis and Counterfactual Benefit Modeling to Retirement Benefit Evaluation.’ The Journal of Retirement 5 (2). https://jor.pm-research.com/content/5/2/42.short

Samuelson, Paul. 1958. ‘An Exact Consumption-Loan Model of Interest with or without the Social Contrivance of Money.’ Journal of Political Economy 66(6): 467-82. http://public.econ.duke.edu/~hf14/teaching/socialinsurance/readings/Samuelson58(6.3).pdf

Siddiqi, Faisal and Gavin Benjamin. 2018. ‘Setting the Accounting Discount Rate Assumption for Pension and Post-employment Benefit Plans.’ Canadian Institute of Actuaries. https://www.cia-ica.ca/docs/default-source/2018/218086e.pdf

Sielman, Rebecca. 2019. ‘2018 Public Pension Funding Study.’ Milliman. http://www.milliman.com/uploadedFiles/insight/Periodicals/ppfs/2018-public-pension-funding-index.pdf

Spiotto, James. 2018. ‘When Needed Public Pensions Reforms Fail or Appear to be Legally Impossible, What Then?’ The Hutchins Center on Fiscal and Monetary Policy, Brookings Institution. https://www.brookings.edu/wp-content/uploads/2018/04/Spiotto-J.-v8.pdf

Taibbi, Matt. 2013. ‘Looting the Pension Funds,’ Rolling Stone. https://www.rollingstone.com/politics/politics-news/looting-the-pension-funds-172774/

Tompor, Susan. ‘Even 5 years later, retirees feel the effect of Detroit’s bankruptcy.’ Detroit Free Press. July 18, 2018. https://www.freep.com/story/money/personal-finance/susan-tompor/2018/07/18/detroit-bankruptcy-retirees-pension/759446002/

Topoleski, John and Elizabeth Myers. ‘Worker Participation in Employer-Sponsored Pensions: Data in Brief’ Washington, DC: Congressional Research Service. https://sgp.fas.org/crs/misc/R43439.pdf

Warshawsky, Mark and Ross Marchand. 2016. ‘The Extent and Nature of State and Local Government Pension Problems and a Solution.’ Mercatus Research Center, George Mason University. https://www.mercatus.org/system/files/Warshawsky-Govt-Pension-Problems.pdf

Webber, David. 2010. ‘Is “Pay to Play” Driving Public Pension Fund Activism in Securities Class Actions?’ Boston University Law Review 2031. https://scholarship.law.bu.edu/cgi/viewcontent.cgi?article=1504&context=faculty_scholarship

Webber, David. 2014. ‘The Use and Abuse of Labor’s Capital’ New York University Law Review 2106. https://scholarship.law.bu.edu/cgi/viewcontent.cgi?article=1033&context=faculty_scholarship

Webber, David. 2018. ‘The Real Reason the Investor Class Hates Pensions’ New York Times. https://scholarship.law.bu.edu/cgi/viewcontent.cgi?article=1123&context=shorter_works

Wessel, David. 2014. Central Banking after the Great Recession: Lessons Learned, Challenges Ahead. Washington, DC: Brookings Institution Press, p. 34.

Williamson, Christine. ‘Texas Teachers drops return rate 75 basis points to 7.25%.’ Pensions and Investment, July 27, 2018. https://www.pionline.com/article/20180727/ONLINE/180729853/texas-teachers-drops-return-rate-75-basis-points-to-725