Regan Boychuk British, American, and Russian elites planned global domination through one great war a century ago, but it did not quite work out. Instead, today we approach a third world war to avoid democracy and the rational conservation of resources on a finite planet. It appears imperial monarchs were colluding in 1914 to vanquish […]

Continue ReadingKim, ‘Monetary Expansionism, Global Commodity Prices, and Global Inequality’

Abstract An early analysis of the imperialist implications of the surge of global commodity prices was conducted in 2014 by Jonathan Nitzan and Shimshon Bichler. However, their analysis did not consider how the US monetary and fiscal expansionist policies have contributed to the rise of global commodity prices. This article fills this gap. Arguably, under […]

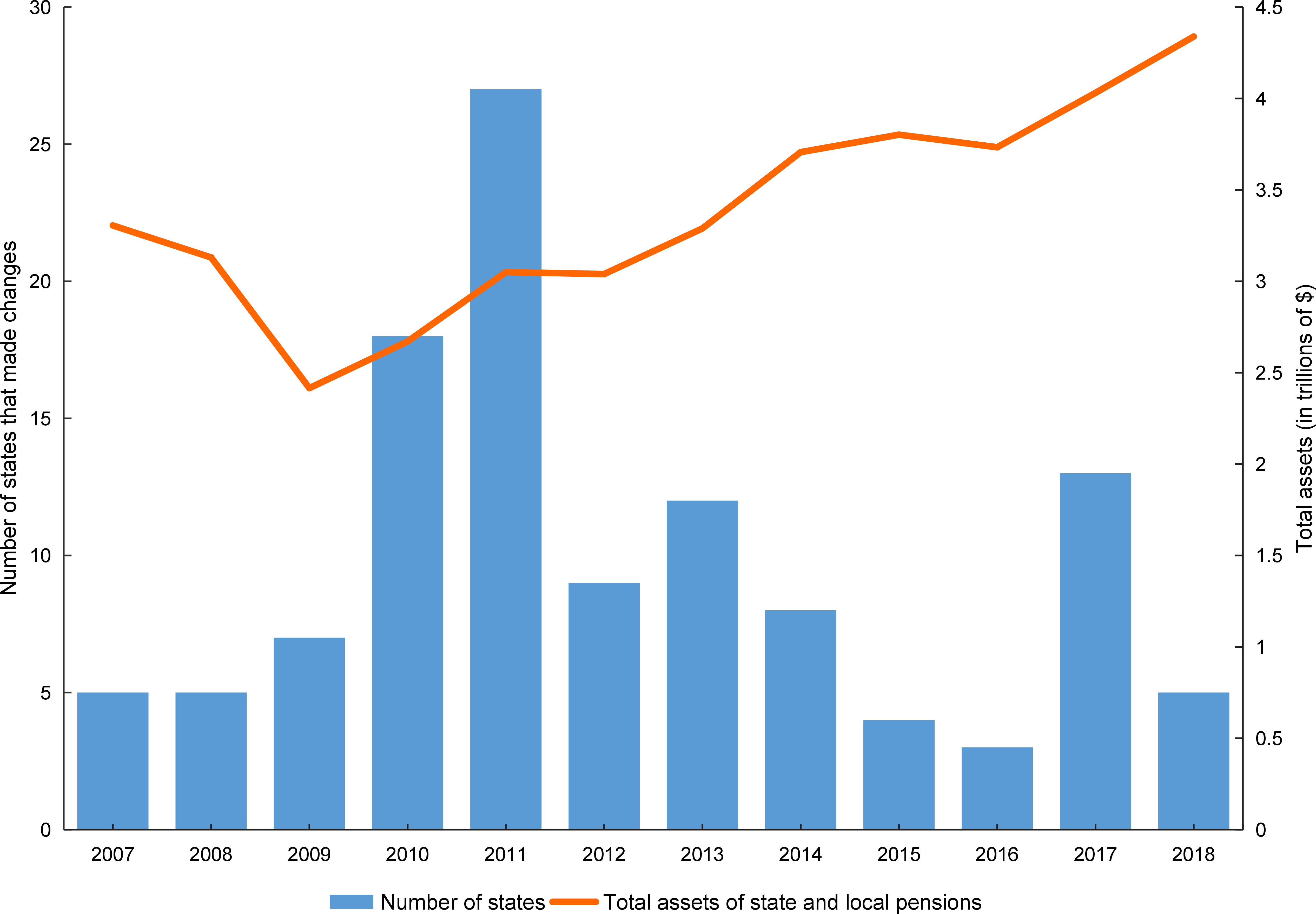

Continue ReadingKolasi, ‘Pensions and Power: The Political and Market Dynamics of Public Pension Plans’

Pensions and Power The Political and Market Dynamics of Public Pension Plans ERALD KOLASI June 2022 Abstract This paper uses the theory of ‘capital as power’ to analyze the struggle over public pensions in the United States. While mainstream commentators claim that public pensions must be ‘reformed’ because they are ‘under funded’, I argue that […]

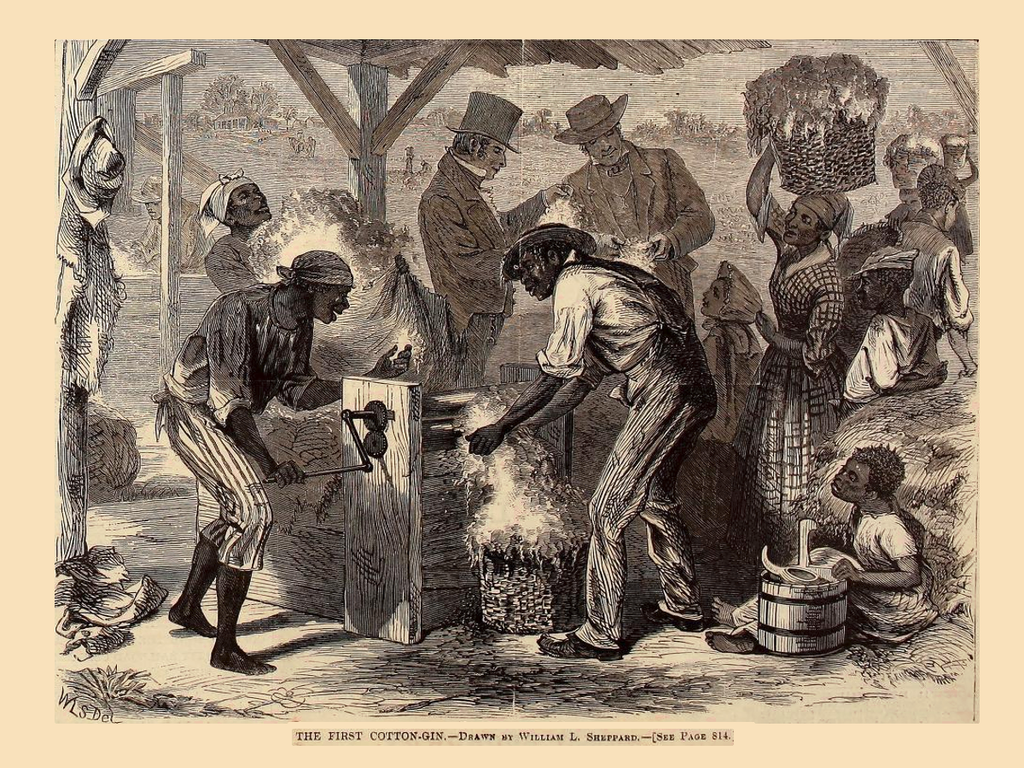

Continue ReadingSlavery, the Development of the United States, and the Case for Reparations

Originally published at joefrancis.info Joe Francis In a new working paper I outline how slavery contributed to the development of the United States before the Civil War. The paper is called ‘King Cotton, the Munificent’ because I argue that slavery benefitted the free society of the North. In a nutshell, I argue that slaves were […]

Continue ReadingCotton and Slavery in Antebellum America

Originally published at joefrancis.info Joe Francis The dominant view among economic historians is that American slavery was an unnecessary evil: nothing good came of it for the development of the United States after independence. Even if some reluctantly accept that the boom in cotton production may have had some benefits for Antebellum America, they argue […]

Continue ReadingMcMahon, ‘Selling Hollywood to China’

Abstract From the 1980s to the present, Hollywood’s major distributors have been able to redistribute U.S. theatrical attendance to the advantage of their biggest blockbusters and franchises. At the global scale and during the same period, Hollywood has been leveraging U.S. foreign power to break ground in countries that have historically protected and supported their […]

Continue ReadingBaines & Hager, ‘The Great Debt Divergence and its Implications for the Covid-19 Crisis: Mapping Corporate Leverage as Power’

Abstract The COVID-19 pandemic has amplified longstanding concerns about mounting levels of corporate debt in the United States. This article places the current conjuncture in its historical context, analysing corporate indebtedness against the backdrop of increasing corporate concentration. Theorising leverage as a form of power, we find that the leverage of large non-financial firms increased […]

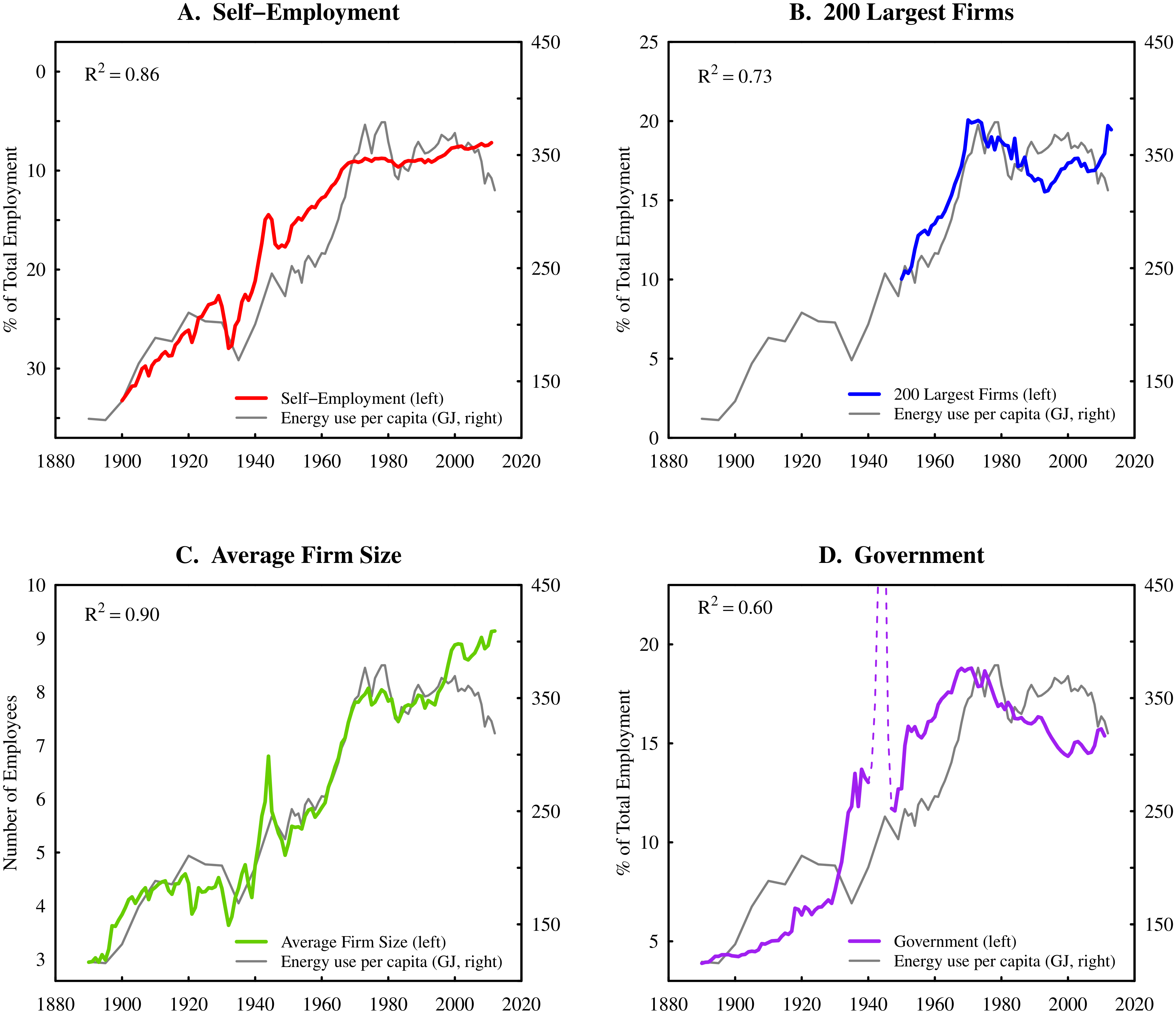

Continue ReadingFix, ‘Energy and Institution Size’

Abstract Why do institutions grow? Despite nearly a century of scientific effort, there remains little consensus on this topic. This paper offers a new approach that focuses on energy consumption. A systematic relation exists between institution size and energy consumption per capita: as energy consumption increases, institutions become larger. I hypothesize that this relation results […]

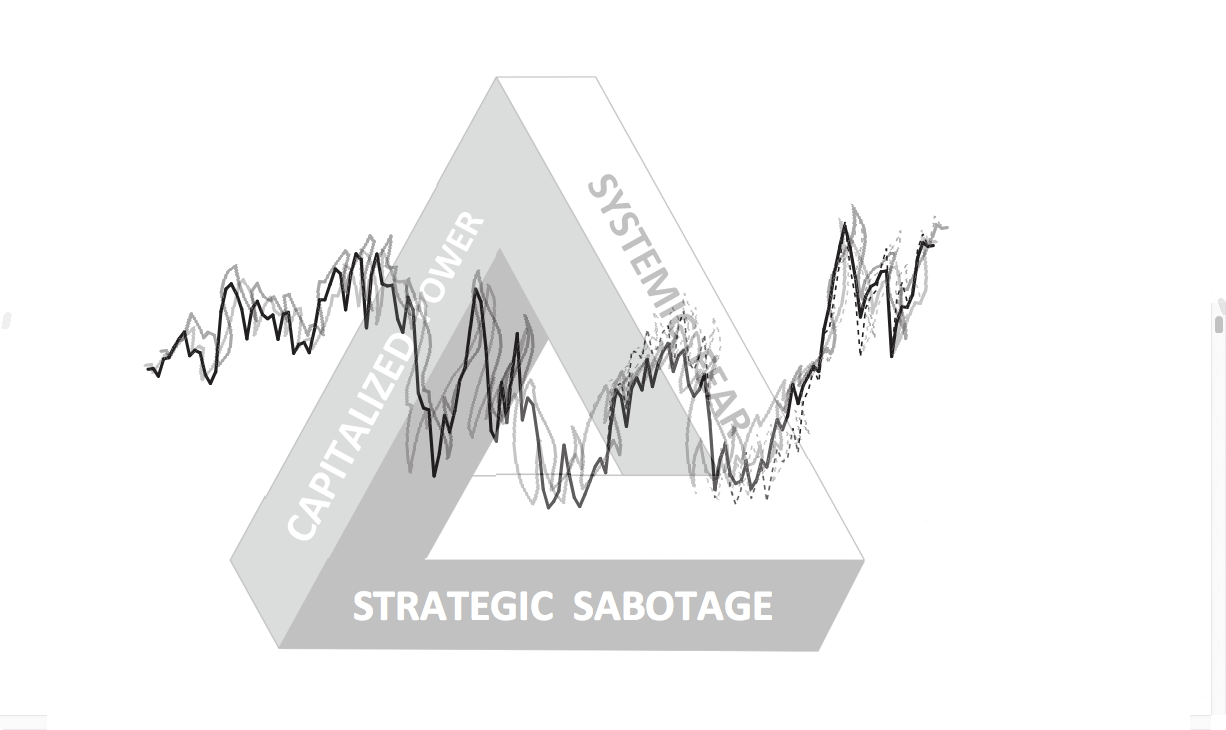

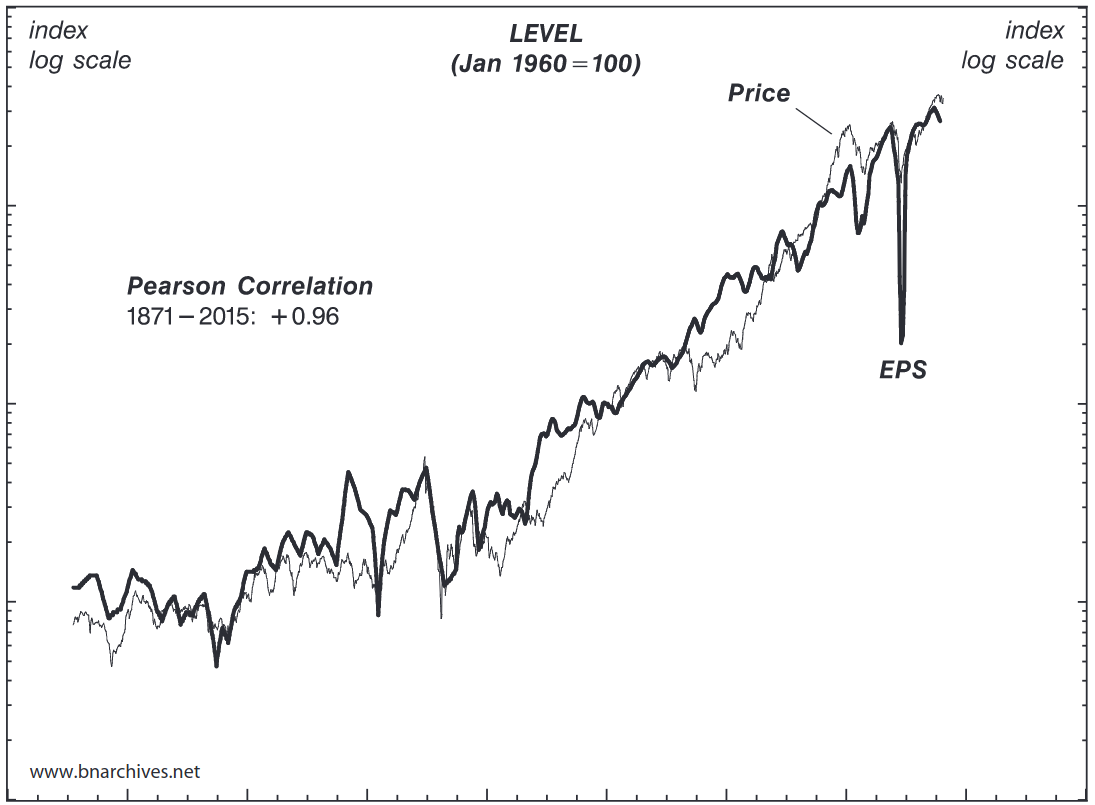

Continue ReadingBichler & Nitzan, ‘A CasP Model of the Stock Market’

Abstract Most explanations of stock market booms and busts are based on contrasting the underlying ‘fundamental’ logic of the economy with the exogenous, non-economic factors that presumably distort it. Our paper offers a radically different model, examining the stock market not from the mechanical viewpoint of a distorted economy, but from the dialectical perspective of […]

Continue ReadingNo. 2016/07: Bichler & Nitzan, ‘A CasP Model of the Stock Market’

Abstract Most explanations of stock market booms and busts are based on contrasting the underlying ‘fundamental’ logic of the economy with the exogenous, non-economic factors that presumably distort it. Our paper offers a radically different model, examining the stock market not from the mechanical viewpoint of a distorted economy, but from the dialectical perspective of […]

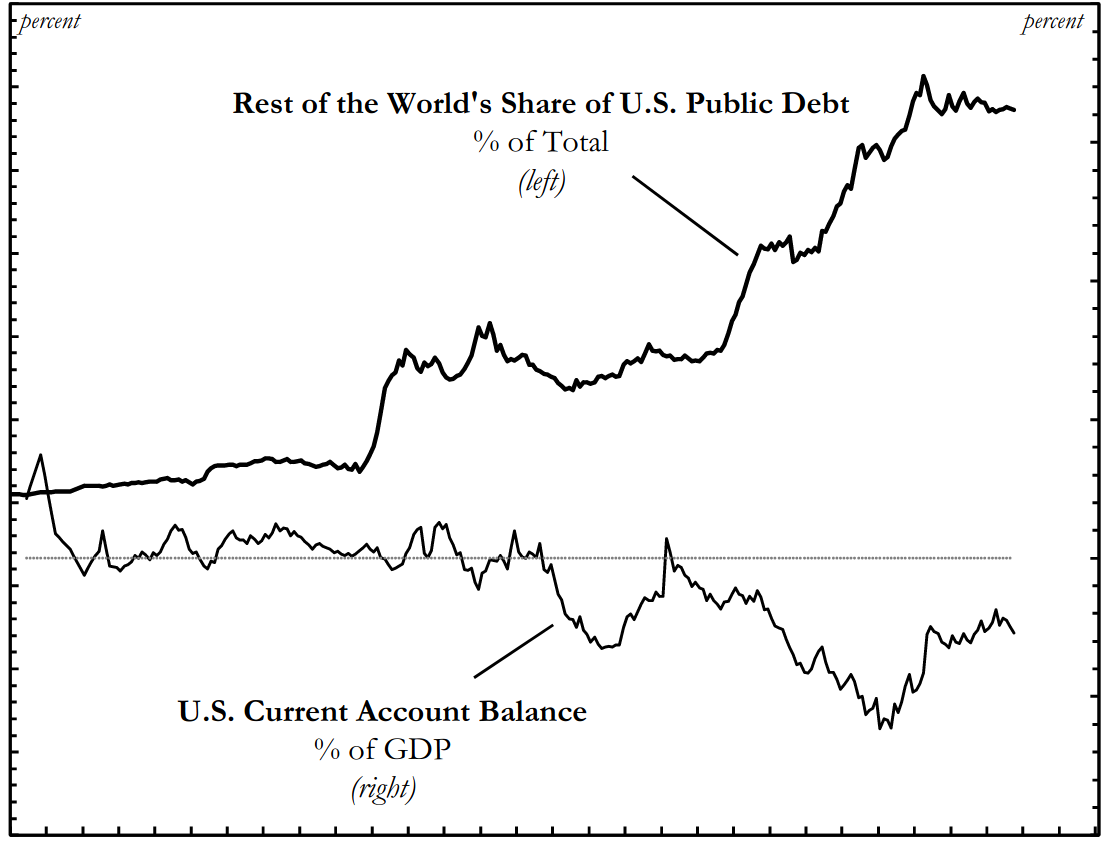

Continue ReadingHager, ‘A Global Bond: Explaining the Safe Haven Status of U.S. Treasury Securities’

Abstract This article offers new theoretical and empirical insights to explain the resilience of U.S. Treasury securities as the world’s premier safe or “risk free” asset. The standard explanation of resilience emphasizes the relative safety of U.S. Treasuries due to a shortage of safe assets in the global political economy. The analysis here goes beyond […]

Continue ReadingHager, ‘Public Debt, Inequality, and Power: The Making of a Modern Debt State’

Abstract Who are the dominant owners of US public debt? Is it widely held, or concentrated in the hands of a few? Does ownership of public debt give these bondholders power over our government? What do we make of the fact that foreign-owned debt has ballooned to nearly 50 percent today? Until now, we have […]

Continue ReadingOstojić, ‘Differential Taxation: The Case of American Banking’

Abstract This paper maps an empirical history of corporate profit and taxation in the United States, with a special focus on the differential profit and taxation of banks relative to other corporations. An examination of these trends reveals a striking anomaly within the American banking sector: from the early 1980s until the financial crisis of […]

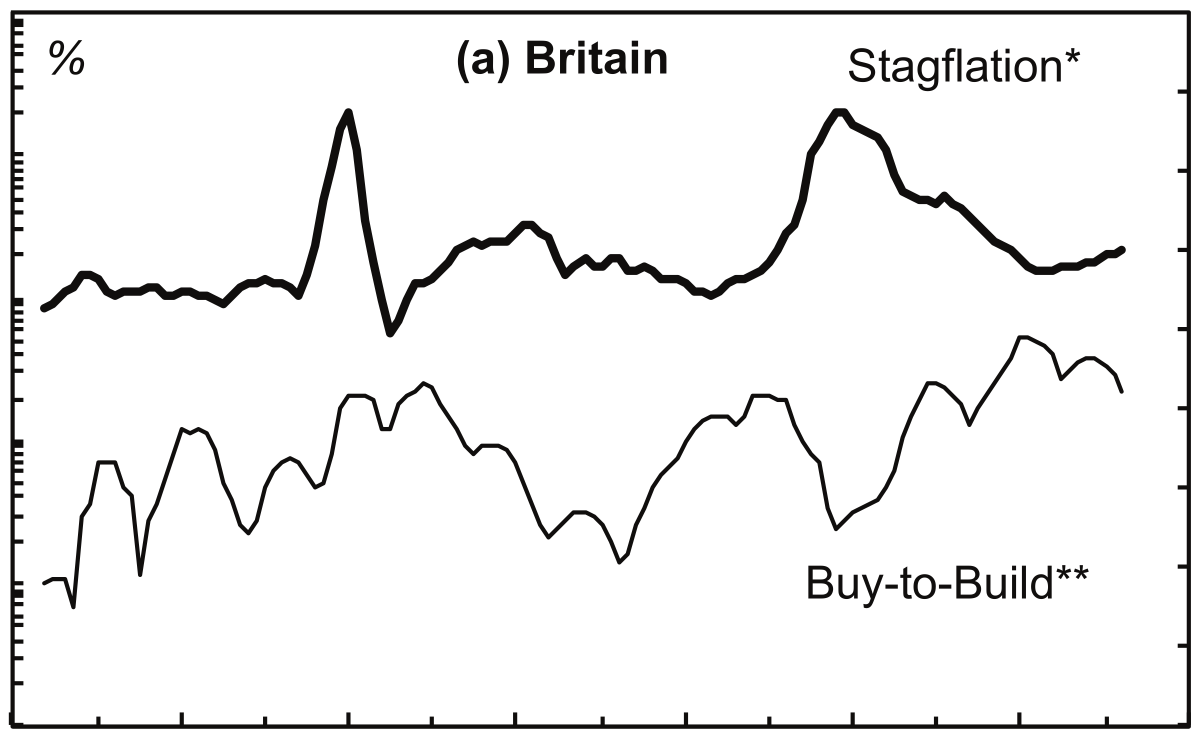

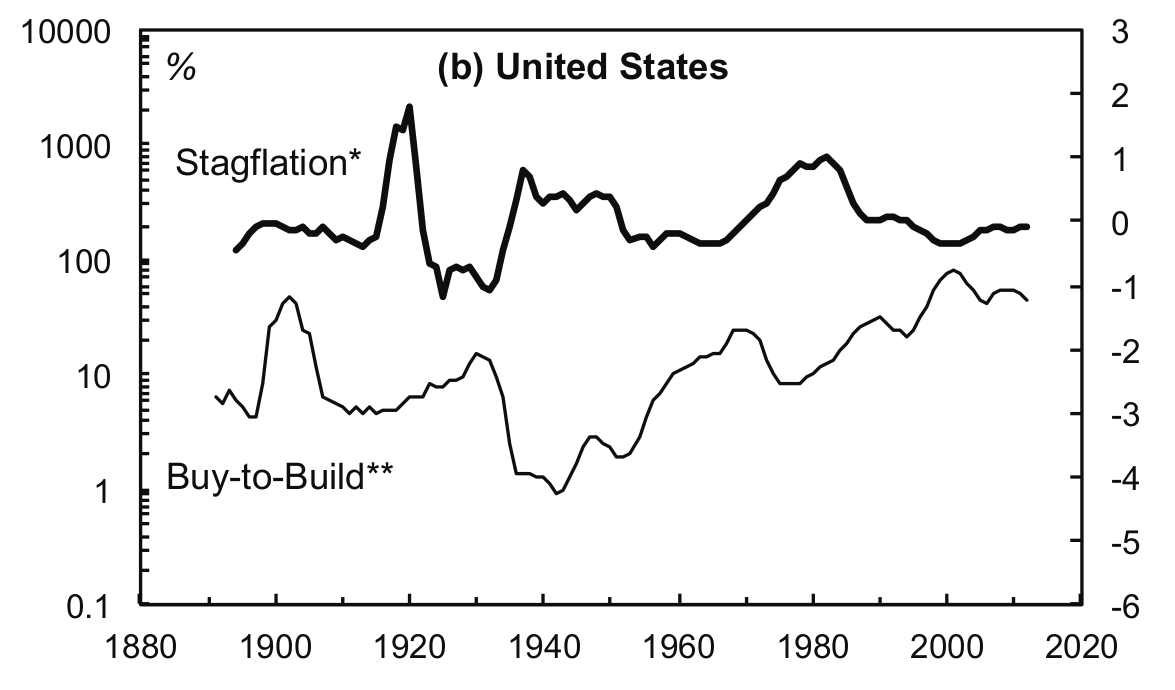

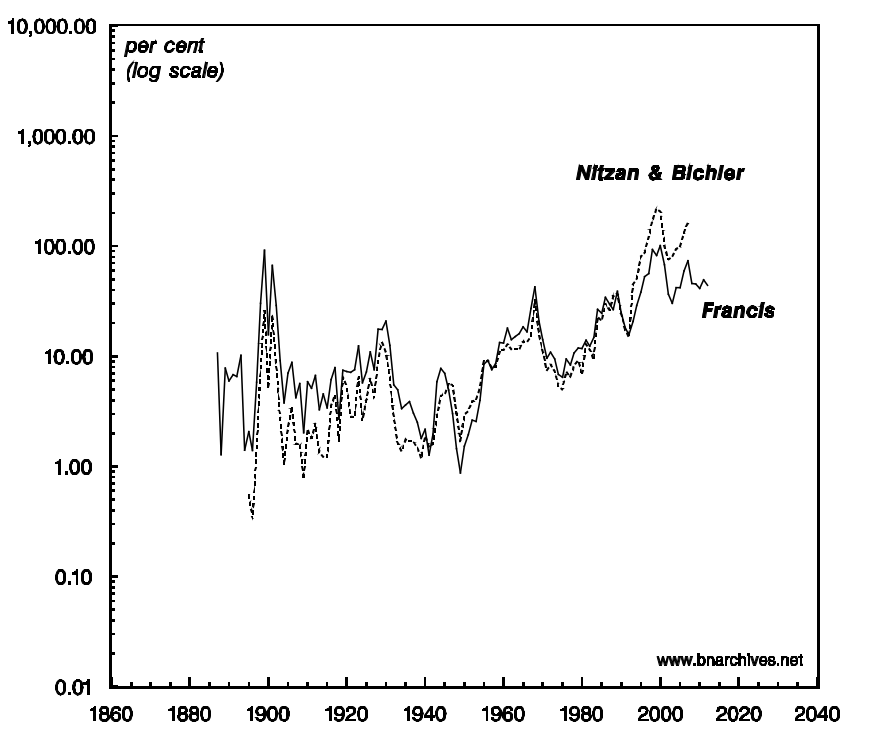

Continue ReadingFrancis, Bichler & Nitzan, ‘The Buy-to-Build Indicator: An Exchange’

Abstract The first part of the exchange is a short article by Joe Francis. The article provides new long-term estimates and an assessment of the buy-to-build indicator for the United States and Britain, going back to the end of the 19th century. The second part offers commentary by Shimshon Bichler and Jonathan Nitzan. Citation The […]

Continue ReadingBichler & Nitzan, ‘No Way Out: Crime, Punishment and the Capitalization of Power’

Abstract The United States is often hailed as the world’s largest ‘free market’. But this ‘free market’ is also the world’s largest penal colony. It holds over seven million adults – roughly five per cent of the labour force – in jail, in prison, on parole and on probation. Is this an anomaly, or does […]

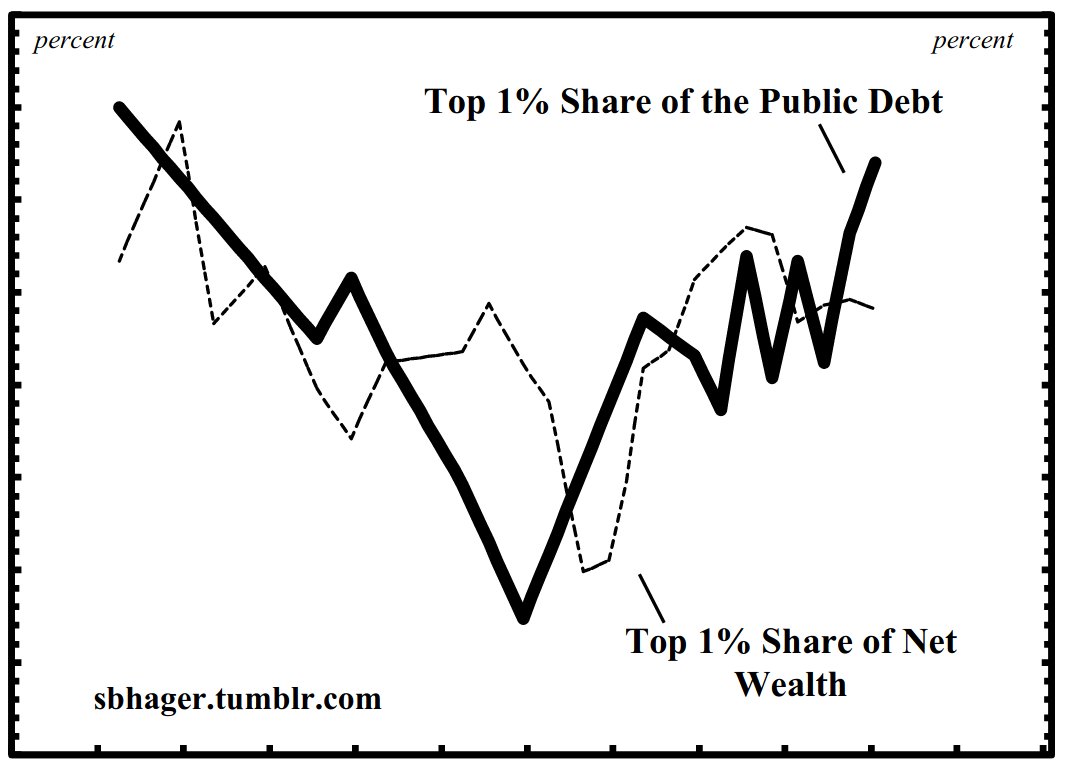

Continue ReadingHager, ‘Public Debt, Ownership and Power: The Political Economy of Distribution and Redistribution’

Abstract This dissertation offers the first comprehensive historical examination of the political economy of US public debt ownership. Specifically, the study addresses the following questions: Who owns the US public debt? Is the distribution of federal government bonds concentrated in the hands of a specific group or is it widely held? And what if the […]

Continue ReadingHager, ‘What Happened to the Bondholding Class? Public Debt, Power and the Top One Per Cent’

Abstract In 1887 Henry Carter Adams produced a study demonstrating that the ownership of government bonds was heavily concentrated in the hands of a ‘bondholding class’ that lent to and, in Adams’s view, controlled the government like dominant shareholders control a corporation. The interests of this bondholding class clashed with the interests of the masses, […]

Continue ReadingThe Buy-to-Build Indicator: New Estimates for Britain and the United States

The Buy-to-Build Indicator New Estimates for Britain and the United States JOSEPH A. FRANCIS October 2013 Abstract This note presents new long-term estimates of what Jonathan Nitzan and Shimshon Bichler have named the ‘buy-to-build indicator’, which is calculated as the value of mergers and acquisitions as a percentage of gross capital formation. Keywords Britain, buy-to-build […]

Continue ReadingFrancis’ Buy-to-Build Estimates for Britain and the United States: A Comment

Francis’ Buy-to-Build Estimates for Britain and the United States A Comment SHIMSHON BICHLER and JONATHAN NITZAN October 2013 Abstract Comments on Francis’ new estimates of the buy-to-build indicator for the United States and Britain. These estimates offer a welcome correction, modifications and additions to the U.S. numbers that we first presented in 1999 and later […]

Continue Reading