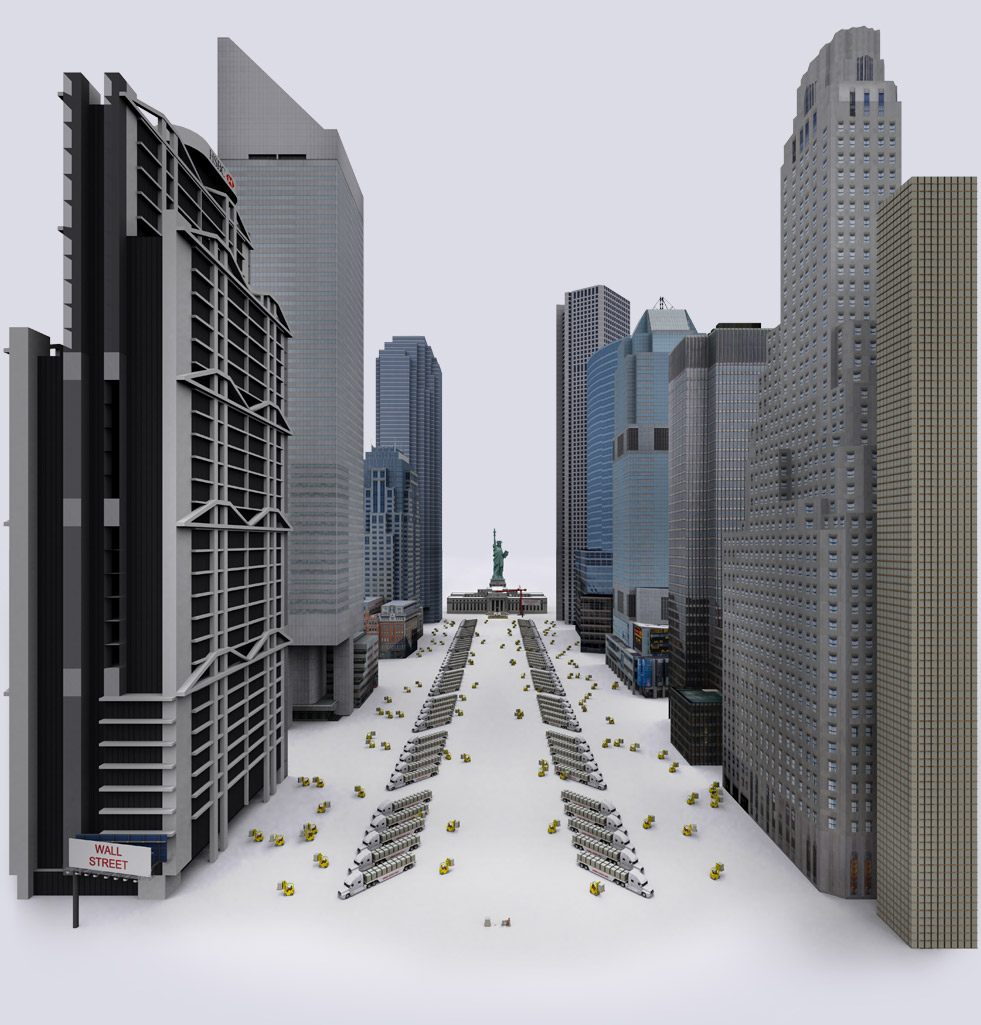

Abstract Our recent article on ‘The Road to Gaza’ examined the history of the three supreme-God churches and the growing role of their militias in armed conflicts and wars around the world. The present paper situates these militia wars in the broader vista of the capitalist mode of power. Focusing specifically on the Middle East, […]

Continue ReadingBichler & Nitzan, ‘The Road to Gaza’

Abstract The war that started in 2023 between Hamas and Israel is driven by various long-lasting processes, but it also brings to the fore a new cause that hitherto seemed marginal: the armed militias of the Rabbinate and Islamic churches. The Rabbinate militias, embodied in Jewish settler organizations, have taken over not only Palestinian lands, […]

Continue ReadingBichler & Nitzan, ‘Regime Change and Dominant Capital: Lessons from Israel’

Abstract Israel’s ongoing crisis – or ‘judicial coup’ in popular parlance – has elicited two opposite responses. The first comes from global rating agencies, economists and investment strategists who see Israel’s country risk rising. The opposite reaction, by Prime Minister Netanyahu and his acolytes, insists that the ‘coup’ is much ado about nothing, and that […]

Continue ReadingBichler & Nitzan, ‘Regime Change and Dominant Capital: Lessons from Israel’

Abstract Israel’s ongoing crisis – or ‘judicial coup’ in popular parlance – has elicited two opposite responses. The first comes from global rating agencies, economists and investment strategists who see Israel’s country risk rising. The opposite reaction, by Prime Minister Netanyahu and his acolytes, insists that the ‘coup’ is much ado about nothing, and that […]

Continue ReadingKolasi, ‘Pensions and Power: The Political and Market Dynamics of Public Pension Plans’

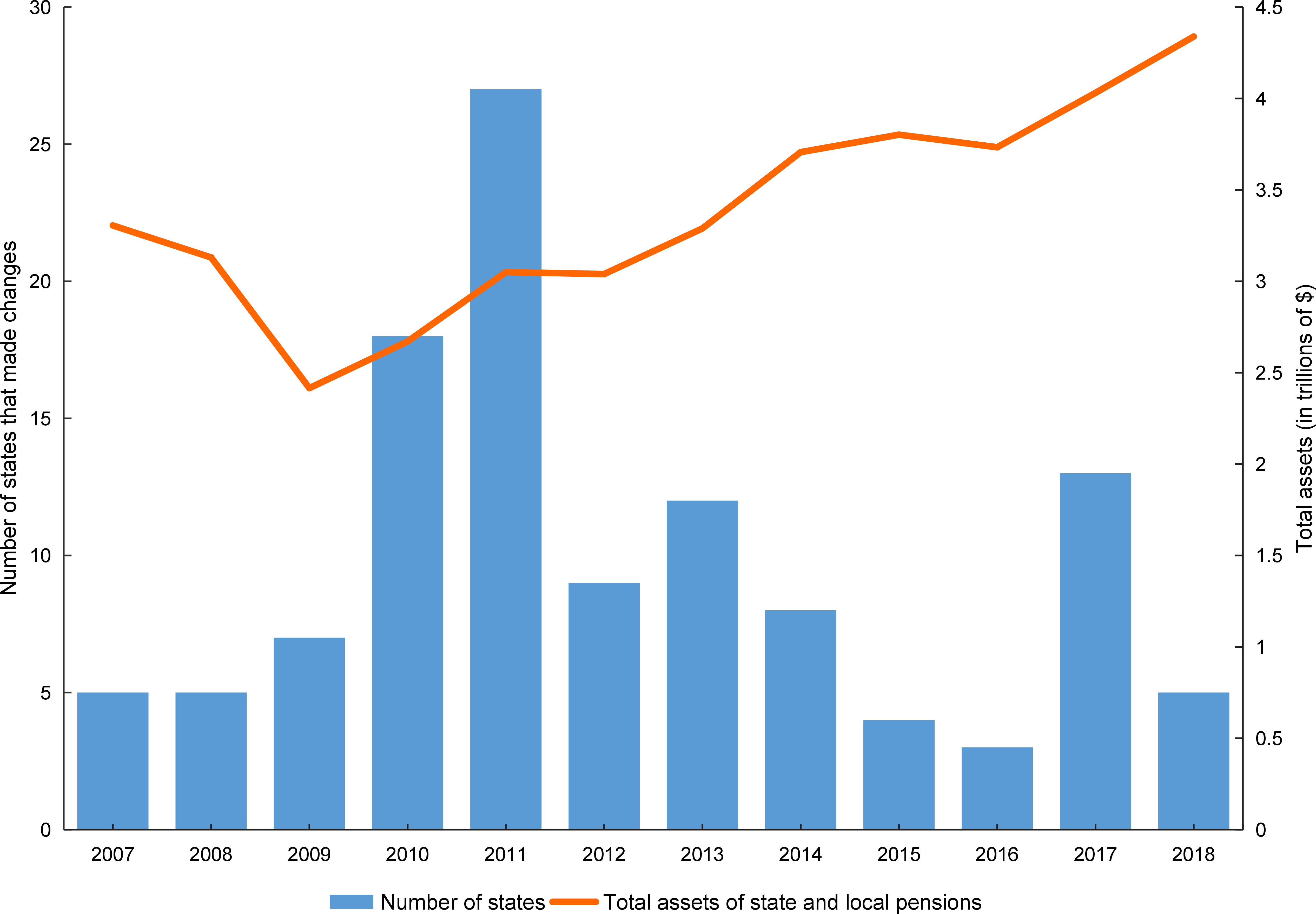

Pensions and Power The Political and Market Dynamics of Public Pension Plans ERALD KOLASI June 2022 Abstract This paper uses the theory of ‘capital as power’ to analyze the struggle over public pensions in the United States. While mainstream commentators claim that public pensions must be ‘reformed’ because they are ‘under funded’, I argue that […]

Continue ReadingHager & Baines, ‘The Tax Advantage of Big Business’

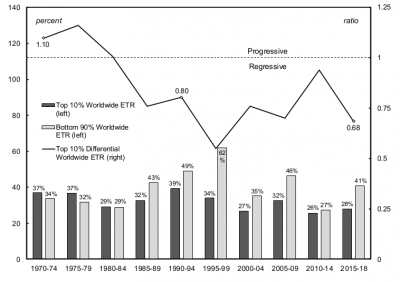

Abstract Corporate concentration in the United States has been on the rise in recent years, sparking a heated debate about its causes, consequences, and potential remedies. In this study, we examine a facet of public policy that has been largely neglected in current debates about concentration: corporate taxation. As part of our analysis we develop […]

Continue ReadingThe CasP Project Past, Present, Future

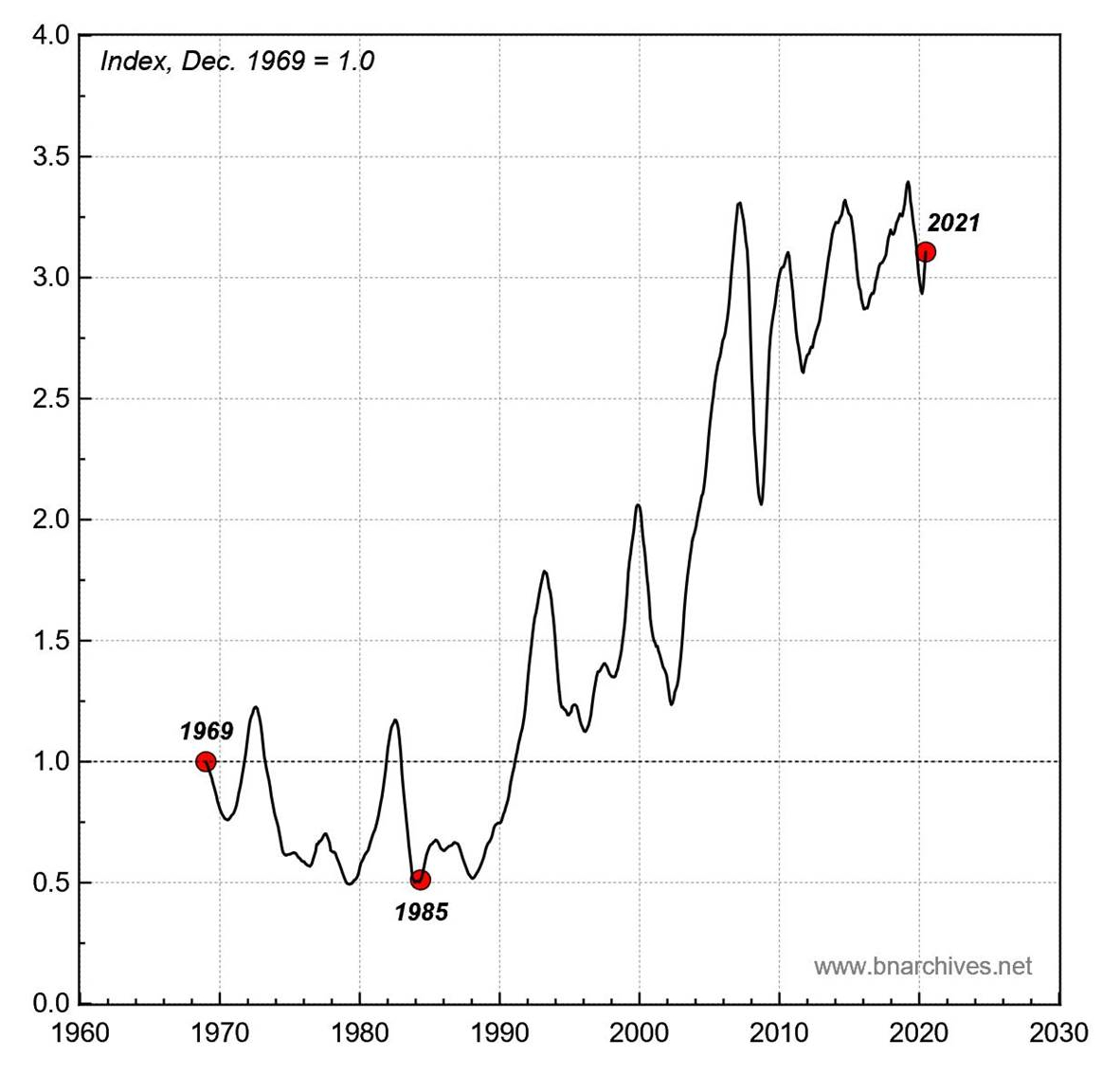

The CasP Project Past, Present and Future SHIMSHON BICHLER and JONATHAN NITZAN April 2018 Abstract The study of capital as power (CasP) began when we were students in the 1980s and has since expanded into a broader project involving a growing number of researchers and new areas of inquiry. This paper provides a bird’s-eye view […]

Continue ReadingBichler & Nitzan, ‘The Scientist and the Church’

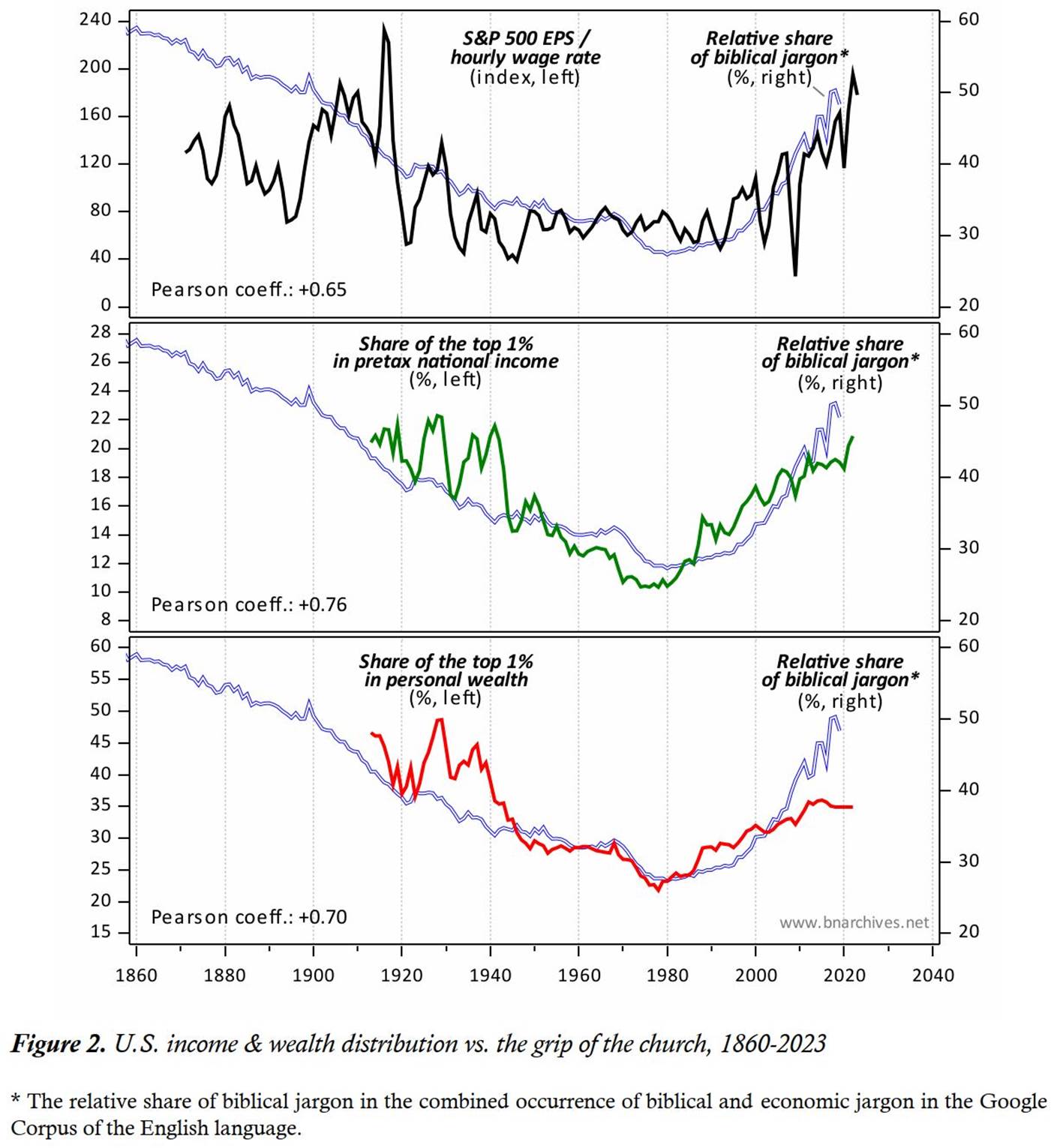

Abstract The Scientist and the Church is a wide-ranging biography of research, showcasing Bichler and Nitzan’s attempts to break through the stifling dogmas of the academic church and chart a new scientific cosmology of capitalism. Central to the authors’ work is the notion that capital is not a productive economic category but capitalized power, and […]

Continue ReadingBrennan, ‘Ascent of Giants: NAFTA, Corporate Power and the Growing Income Gap’

Abstract There is growing awareness in Canada of how unequal society is becoming. It is probably most obvious in the gap between the compensation of Canada’s highest paid corporate executives and the average worker. The political pressure to do something to close this gap, for example by increasing taxes at the top of the income […]

Continue ReadingNo. 2015/01: Hager, ‘Public Debt as Corporate Power’

Abstract In various writings Karl Marx made references to an ‘aristocracy of finance’ in Western Europe and the United States that dominated ownership of the public debt. Drawing on original research, this paper offers the first comprehensive analysis of the pattern of public debt ownership within the US corporate sector. The research shows that over […]

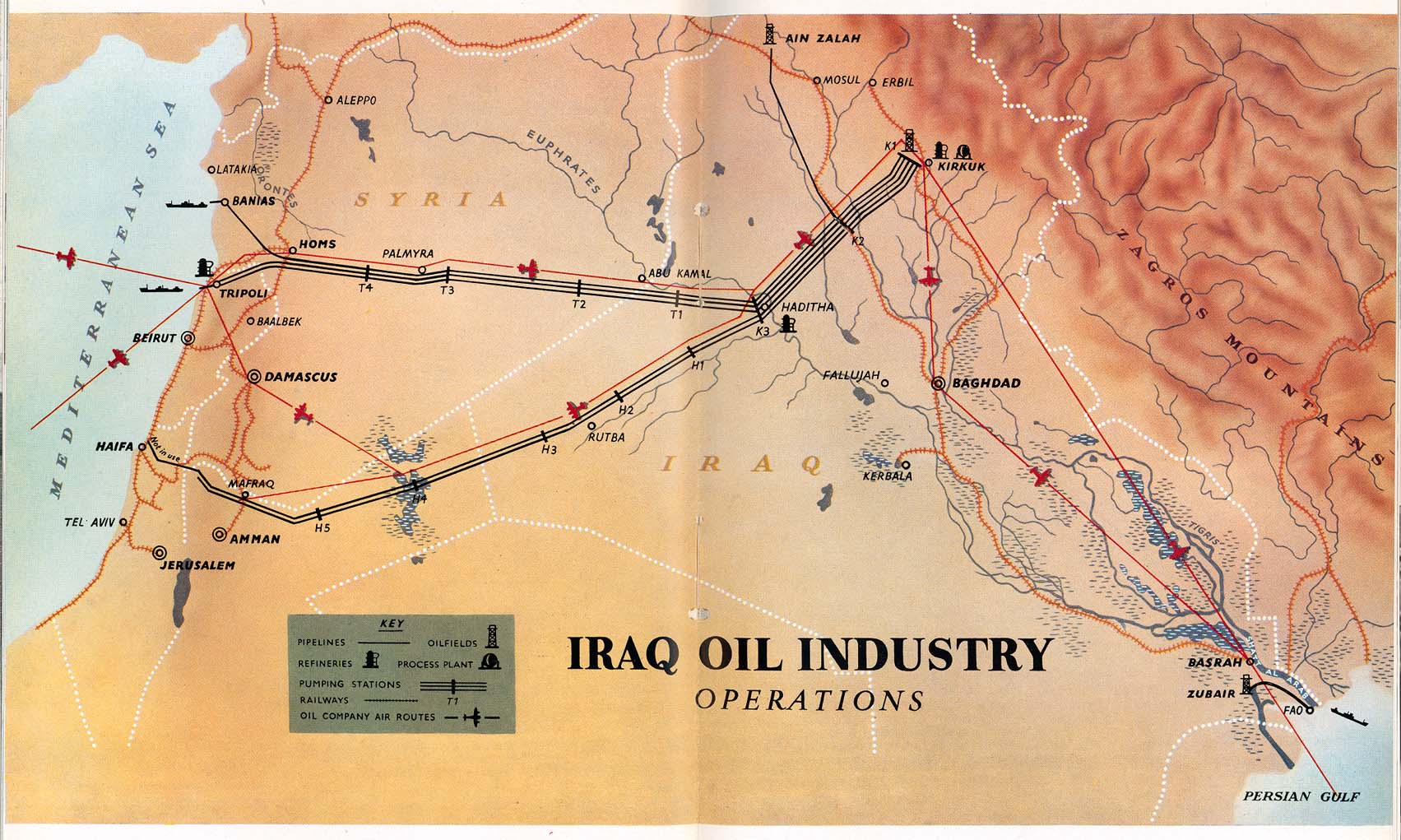

Continue ReadingNo. 2014/04: Bichler & Nitzan, ‘Still About Oil?’

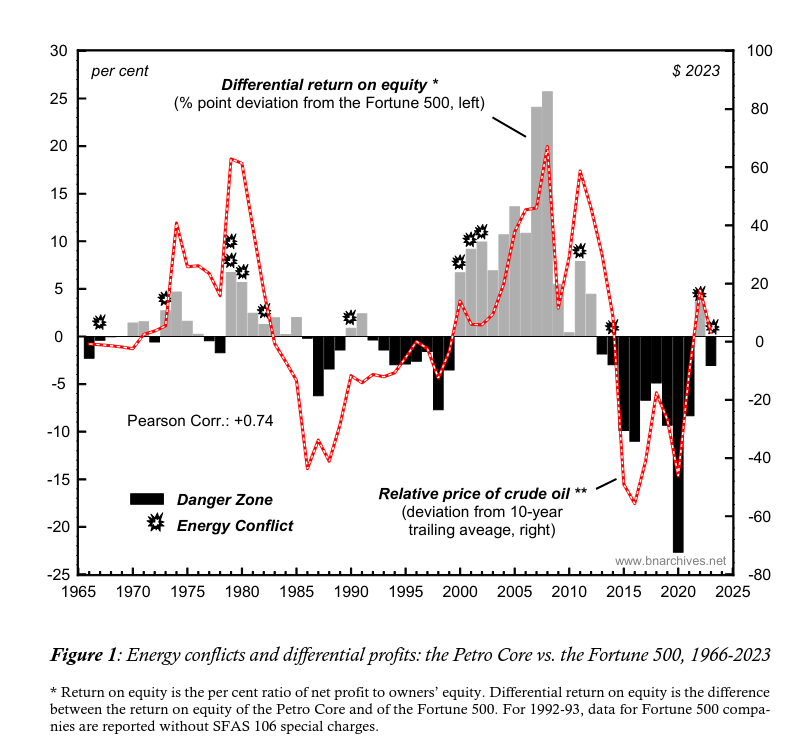

Abstract During the late 1980s and early 1990s, we identified a new Middle East phenomenon that we called ‘energy conflicts’ and argued that these conflicts were intimately linked with the global processes of capital accumulation. This paper outlines the theoretical framework we have developed over the years and brings our empirical research up to date. […]

Continue ReadingCan Capitalists Afford Recovery?

Can Capitalists Afford Recovery? Three Views on Economic Policy in Times of Crisis JONATHAN NITZAN and SHIMSHON BICHLER October 2014 Abstract Economic, financial and social commentators from all directions and of various persuasions are obsessed with the prospect of recovery. The world remains mired in a deep, prolonged crisis, and the key question seems to […]

Continue ReadingNitzan, ‘Inflation As Restructuring. A Theoretical and Empirical Account of the U.S. Experience’

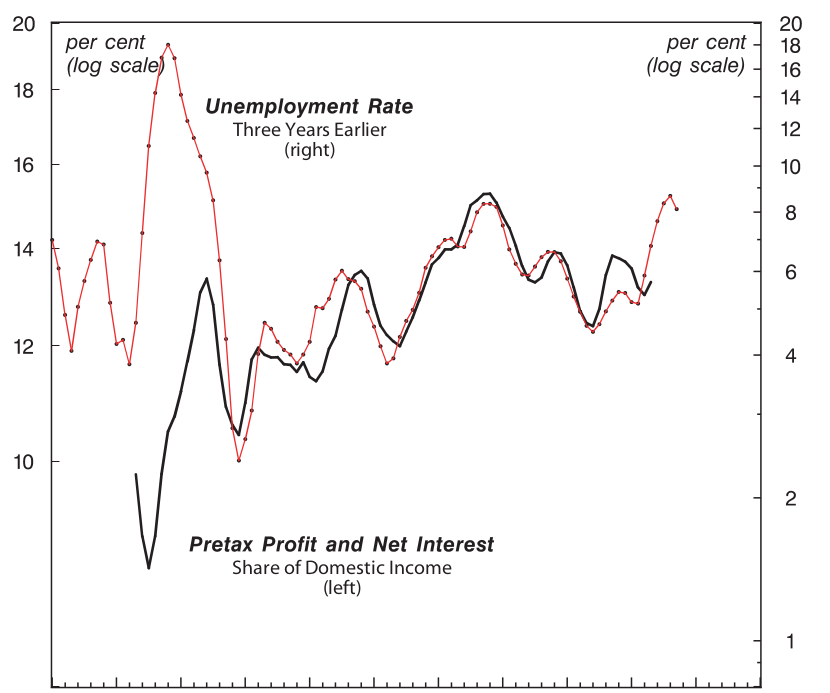

Abstract The thesis offers a new framework for inflation as a process of restructuring. Contrary to existing theories of inflation, which tend to take structure and institutions as given for the purpose of analysis, we argue that inflation could be understood only in terms of ongoing structural and institutional change. In the modern context of […]

Continue Reading