- This topic has 2 replies, 3 voices, and was last updated March 27, 2023 at 7:14 am by .

-

Topic

-

I forgot/didn’t see this section in the forums and posted it in the Political Economy section. For the original, the link is here: https://capitalaspower.com/casp-forum/topic/balance-of-trade-non-us-power-indexes-the-amalgamation-stagflation-cycle/

—————————————

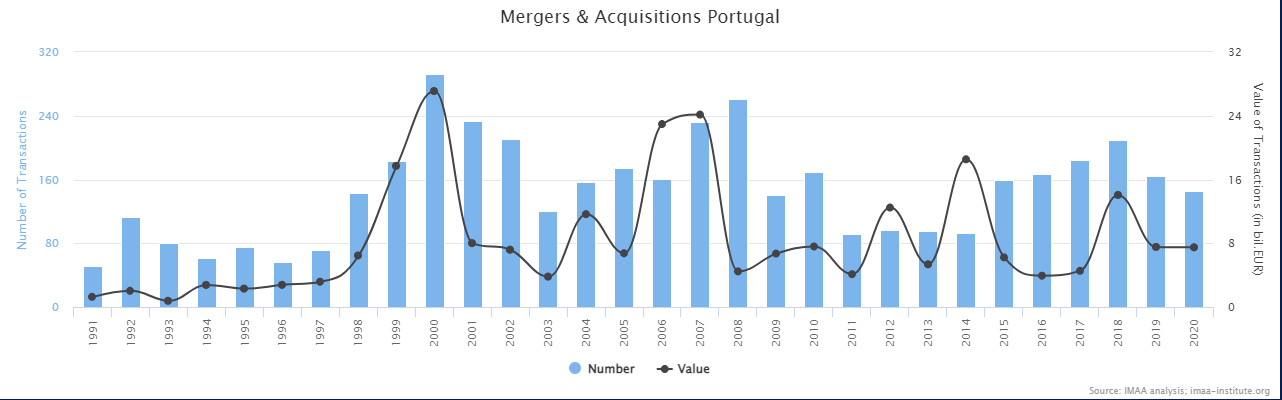

The following post is a way of explaining a discovery I made very recently: that a nation’s adherence to the amalgamation-stagflation cycle seems to be predicated on how much of their economy is controlled by foreign dominant capital. ———————————- While investigating into how well Nitzan & Bichler’s findings on the relationship between amalgamation and stagflation translates to countries outside the US, I came across something rather curious that I need help building up. The example in question is Portugal, and to test the relationship, I used M&A statistics from the Institute for Mergers, Acquisitions, & Alliances. For inflation, I used Trading Economic’s work (ending in 2020 to match the M&A stats). source: tradingeconomics.com I thought something was off with the sharp deceleration of the inflation rate approaching 1998 despite Portugal’s amalgamation rate being relatively level and low in the same time frame. I was also bewildered at how Portugal’s inflation rise during the turn of the new millennia was so lackluster considering M&As were record-breaking at the time. So I thought that perhaps there’s a link between the power index and how well a country adheres to the Amalgamation-Stagflation cycle. Using the historical yearly averages of the PSI-20 as a Portuguese stand-in for the S&P 500 and the OECD’s statistics on average wages, I made a Portuguese power index.

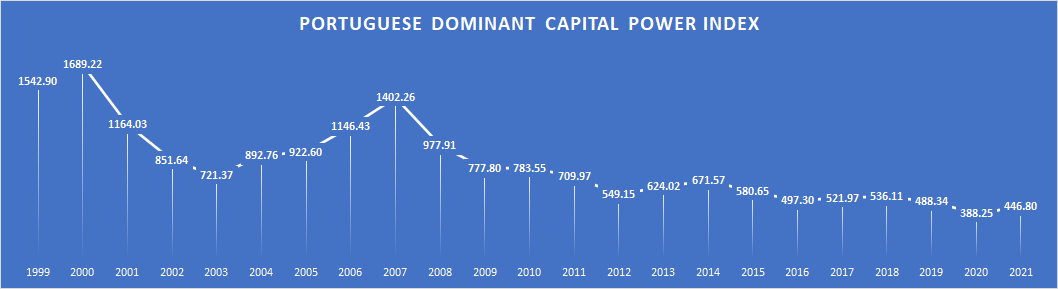

For inflation, I used Trading Economic’s work (ending in 2020 to match the M&A stats). source: tradingeconomics.com I thought something was off with the sharp deceleration of the inflation rate approaching 1998 despite Portugal’s amalgamation rate being relatively level and low in the same time frame. I was also bewildered at how Portugal’s inflation rise during the turn of the new millennia was so lackluster considering M&As were record-breaking at the time. So I thought that perhaps there’s a link between the power index and how well a country adheres to the Amalgamation-Stagflation cycle. Using the historical yearly averages of the PSI-20 as a Portuguese stand-in for the S&P 500 and the OECD’s statistics on average wages, I made a Portuguese power index.  Unfortunately, due to issues with currency conversion between the old Portuguese Escudo and the Euro, 1999 has to be the starting point. If the power index is right, then the late 90’s to 2000 should’ve seen a massive drop in the inflation rate similar to that of 2009. ***PLEASE CORRECT ME IF I’M MISTAKEN***, but from what I remember, the higher the power index, the greater dominant capital’s ability to institute measures like stagflation & control prices (and thus adhere to the cycle). Comparing the three, it seems to me like there might be another aspect involved in a country’s adherence to the cycle. Portugal, like many others, started skyrocketing in inflation rate at the start of 2022. Although M&A statistics for Portugal specifically are difficult to come by, some of what is available seems to indicate that Portugal experienced either lackluster growth or even declines in M&As. So if amalgamation in that nation declined, what then is the cause? Looking at various economic statistics on the World Bank, I came across the stats for imports as a percentage of GDP. Looking at this chart, sparks started to fly as I read the most recent statistic: 45% as imports! And it’s been growing even more for 2022! Also, we can see that when imports reach its lowest point within the range of 30.6%, Portugal starts to adhere to the cycle more with the inflation rate rising as M&As decline, only to detach itself from the cycle once more as its import rate increases. With this, I now have the idea for what I believe to be a very important factor in a country’s adherence to the amalgamation-stagflation cycle and possibly translating other CasP metrics and ideas to other countries. Ultimately, it seems like there is an inverse relationship between a country’s adherence to the cycle and the domination of their economy by other, more economically dominant nations. When I checked the major trade partners of Portugal (Spain, Germany, China, Italy, and the US), it seems like the more that nation’s economy is controlled by said nation’s dominant capital, the more it adheres to its own national amalgamation-stagflation cycle and vice versa. In the case of Portugal, due to its reliance on foreign dominant capital, it’s now adhering to the cycles of those nations rather than its own. Additionally, its own power index becomes skewed, with the power of Portugal’s dominant capital being supplanted by that of other nations’ dominant capital. I’m also starting to see a threshold that separates adherence and detachment to the cycle, that threshold being somewhere in the low 30% range. It can also explain the dissonance between Germany’s abysmal amalgamation stats in 2021 and its delayed high inflation in 2022 (Germany also has a very high import % now). Now here comes the issue: how to make a mathematical metric or means of incorporating & truly measuring this phenomenon in a more scientific way. I’m not good with math & statistics, at least not as good as many of the more accomplished academics in this forum. I want this to serve as inspiration for developing better metrics, ideas, and concepts, but I myself don’t have the skills and knowledge to develop them independently. Perhaps there can be an adjustment to the Power Index calculation method, or some other index entirely. Maybe what I’ve found and the ideas put forth can help create a “amalgamation-stagflation cycle adherence” metric or something else that I can’t even think of right now. —————— If there’s any issues, critiques, or corrections you wish to make, PLEASE DO SO! I welcome, encourage, and actively desire it. Thank you

Unfortunately, due to issues with currency conversion between the old Portuguese Escudo and the Euro, 1999 has to be the starting point. If the power index is right, then the late 90’s to 2000 should’ve seen a massive drop in the inflation rate similar to that of 2009. ***PLEASE CORRECT ME IF I’M MISTAKEN***, but from what I remember, the higher the power index, the greater dominant capital’s ability to institute measures like stagflation & control prices (and thus adhere to the cycle). Comparing the three, it seems to me like there might be another aspect involved in a country’s adherence to the cycle. Portugal, like many others, started skyrocketing in inflation rate at the start of 2022. Although M&A statistics for Portugal specifically are difficult to come by, some of what is available seems to indicate that Portugal experienced either lackluster growth or even declines in M&As. So if amalgamation in that nation declined, what then is the cause? Looking at various economic statistics on the World Bank, I came across the stats for imports as a percentage of GDP. Looking at this chart, sparks started to fly as I read the most recent statistic: 45% as imports! And it’s been growing even more for 2022! Also, we can see that when imports reach its lowest point within the range of 30.6%, Portugal starts to adhere to the cycle more with the inflation rate rising as M&As decline, only to detach itself from the cycle once more as its import rate increases. With this, I now have the idea for what I believe to be a very important factor in a country’s adherence to the amalgamation-stagflation cycle and possibly translating other CasP metrics and ideas to other countries. Ultimately, it seems like there is an inverse relationship between a country’s adherence to the cycle and the domination of their economy by other, more economically dominant nations. When I checked the major trade partners of Portugal (Spain, Germany, China, Italy, and the US), it seems like the more that nation’s economy is controlled by said nation’s dominant capital, the more it adheres to its own national amalgamation-stagflation cycle and vice versa. In the case of Portugal, due to its reliance on foreign dominant capital, it’s now adhering to the cycles of those nations rather than its own. Additionally, its own power index becomes skewed, with the power of Portugal’s dominant capital being supplanted by that of other nations’ dominant capital. I’m also starting to see a threshold that separates adherence and detachment to the cycle, that threshold being somewhere in the low 30% range. It can also explain the dissonance between Germany’s abysmal amalgamation stats in 2021 and its delayed high inflation in 2022 (Germany also has a very high import % now). Now here comes the issue: how to make a mathematical metric or means of incorporating & truly measuring this phenomenon in a more scientific way. I’m not good with math & statistics, at least not as good as many of the more accomplished academics in this forum. I want this to serve as inspiration for developing better metrics, ideas, and concepts, but I myself don’t have the skills and knowledge to develop them independently. Perhaps there can be an adjustment to the Power Index calculation method, or some other index entirely. Maybe what I’ve found and the ideas put forth can help create a “amalgamation-stagflation cycle adherence” metric or something else that I can’t even think of right now. —————— If there’s any issues, critiques, or corrections you wish to make, PLEASE DO SO! I welcome, encourage, and actively desire it. Thank you——————————————————————-

9/16/22 Note: While it seems like FDI & FPI can also contribute to a “foreign domination” or “foreign influence” metric in addition to imports, I’m struggling to find or figure out what other metrics could be used to measure the power of foreign firms within a domestic market. Being able to accurately measure that would help not only create a more comprehensive and accurate power index, but might also lend insight and help me hone in on a country’s “threshold of chaos” when it comes to inflation & price control (the point where foreign dominant capital has such an enormous grip on a domestic economy that price control and inflation control measures turn into a matter of foreign policy rather than domestic).

- You must be logged in to reply to this topic.