Forum Replies Created

-

AuthorReplies

-

Actually, I’m not even learning R generally. I’m focusing on the tidyverse.

That’s a good point, Troy. Programming languages are just platforms to share code using a common language. So coding in R or python or C++ can mean many different things, depending on the libraries you are using. That’s something I appreciate more and more.

When analyzing data in R, I spend most of my time using data.table. And of course, like you, I’m grateful that Hadley Wickham has contributed so much to the R ecosystem.

When I code in C++, I’ve found the Armadillo library to be extremely helpful.

Funny that you mention the Tech billionaires. Armadillo is a heavy-duty linear algebra library, and I’m told that big tech uses it extensively. But it was written for free by … academics.

Blair, I wonder how you’d feel about the short stories of Ted Chiang.

I’m not familiar with his work. I’ll check it out.

On another note, my daughter has recently become obsessed with audiobooks, so I am getting my fiction fill through her (admittedly, not the books I’d read myself). We’re working our way through the Roahl Dahl corpus. It’s funny how insane many of his ideas are.

I’m actually thinking that if I do get back into fiction, it will be through audiobooks. I spend all day reading and writing. It would be nice to put on an audiobook and go for a walk at the end of the day!

March 21, 2022 at 1:35 pm in reply to: Did Capitalism Change the Nature of Power, or Just Its Expression? #247874Thanks for the response, Scot. I agree with much of what you said. But one thing caught my attention. What is the ‘intrinsic value of money’? Does this not require some absolute standard for judging value?

Since this is about Colin’s thesis, perhaps he has more to add.

March 11, 2022 at 12:16 pm in reply to: Did Capitalism Change the Nature of Power, or Just Its Expression? #247868I take your point, Colin. Yes, gold is an extremely important status symbol. And that has to do, in part, with its properties. But the same goes for anything that is desired. It is partially due to the properties of the thing … but it also has to do with cultural values.

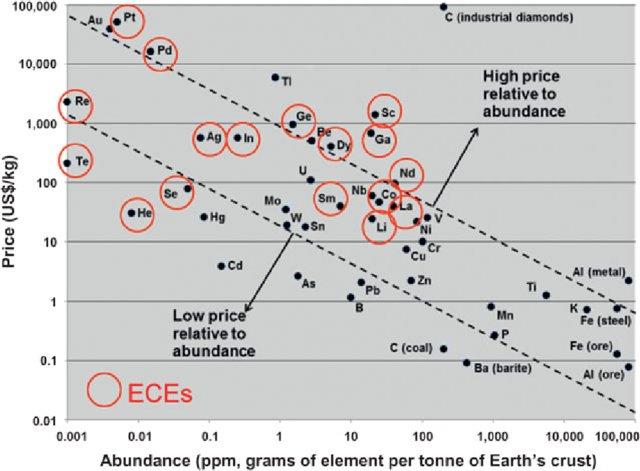

There is an strong connection between rarity and price, as the graphic below show. Does this connection say something about the ‘inherent’ value of a commodity? Or does it say that, all things being equal, things that are more difficult to find will cost more?

I am not familiar with the ‘abstraction thesis’, but am interested to learn more. Would you say that in ‘Debt’, David Graeber voices this thesis, as he proposes that abstract credit was the first form of money?

Attachments:

You must be logged in to view attached files.March 4, 2022 at 6:39 pm in reply to: Did Capitalism Change the Nature of Power, or Just Its Expression? #247857Interesting questions and ideas, Scot. I haven’t read Drumm’s dissertation, so I can’t comment on his ideas. But I do have some questions for you.

First, if we’re going to talk about the ‘nature of power’, how do you define power?

Second, what is the ‘nature of money’?

My own take is that focusing on money itself is a bit of a distraction. My view is that money is nothing but a quantification of property rights. Part of the development of capitalism involved making the unit of quantification progressively more abstract. But really, the abstraction has been there all along. There is nothing in gold that makes it valuable. But it is convenient (for the human mind) to give a unit a physical dimension.

The more interesting element of money, at least for me, is the progressive expansion of property rights — the ability to own and therefore quantify anything.

To get back to the question of power, I agree that power is essentially the same everywhere, in that it is simply the ability to influence others. But what is not constant is the ideology that motivates the followers.

My issue with this argument is that we have to pretend, in Soddy’s thought experiment, that cows have no ability to generate cash flows.

Like many natural scientists, Soddy thought mostly about commodities, not investments and the property rights that come with them. Obviously, if you have property rights that ‘generate’ an exponentially growing income stream, then paying off interest is not a problem. But I agree that Soddy’s arguments have limited use.

Strike density is inversely correlated with Nitzan and Bichler’s power index — the ratio of stock prices to wages. In other words, stocks tend be higher relative to wages when strike density is low.

Here’s my analysis: https://economicsfromthetopdown.com/2020/10/05/how-the-history-of-class-struggle-is-written-on-the-stock-market/

That’s impressive growth! I’m glad these ideas are circulating.

Interesting thoughts, Pieter.

When it comes to policy, capital-as-power research is in a very different place than most economics research. Since CasP research focuses explicitly on analyzing power, it is most practical for bottom up activists who are critical of power. Using CasP research to implement policy (i.e. wield power) would be odd … kind of like an anarchist becoming a CEO. When you’re critical of power, you are self selected from becoming powerful.

That said, I do hope that CasP research becomes influential among the non-powerful. If it ever became widely recognized, it would be a sign that capitalism is in trouble.

Thanks for this research, Pieter. You’ve uncovered some important landmarks for how the practice of discounting evolved.

There is no better training for doing research than simple doing it. Sure, you’ll make mistakes (visible in hindsight). But that’s science. I hope you share more research in the future.

I typically take a multi-pronged approach, which is to release a working paper in many places. I like to host the preprint on the Open Science Framework, where I also post the supplementary material. I then release the same paper as CASP working paper (which will also be hosted on the bnarchives.) Finally, I also post it to my blog.

This is the advantage of publishing things in the creative commons. Your work can be in multiple locations to suite the habits of your readers.

Regarding the SSRN, I avoid it because it is owned by the monopolist publisher Elsevier. The Open Science Framework, in contrast, is a non profit, as are other preprint services like the arXiv.

November 22, 2021 at 5:57 pm in reply to: Inflation is always and everywhere a redistributional phenomenon #247211Much appreciated!

November 22, 2021 at 10:05 am in reply to: Inflation is always and everywhere a redistributional phenomenon #247203Also, a question about methods. Could you clarify how you calculate the markup of the Compustat 500? Do you sum all profits (across companies) and divide by the sum of all sales? Or do you calculate the markup for each company, and then calculate the mean across companies?

November 22, 2021 at 9:37 am in reply to: Inflation is always and everywhere a redistributional phenomenon #247202Thanks for updating this research, Jonathan. I wonder if you would be able to share the underlying data. Particularly the IRS historical data seems to be difficult to get, and I vaguely recall that you and Shimshon compiled it manually from old documents. It would be nice for researchers to have that data available in one place.

November 9, 2021 at 5:54 pm in reply to: Cleaning US trademark data to analyse trends in ownership #247151On a technical note, when I’m dealing with a dataset that’s too big for my computer’s memory, I use the Unix split command, which divides the file into more manageable chunks: https://kb.iu.edu/d/afar

-

AuthorReplies