Forum Replies Created

-

AuthorReplies

-

February 8, 2022 at 5:47 pm in reply to: Correlation between capacity utilization and markup #247755

Thanks Scot,

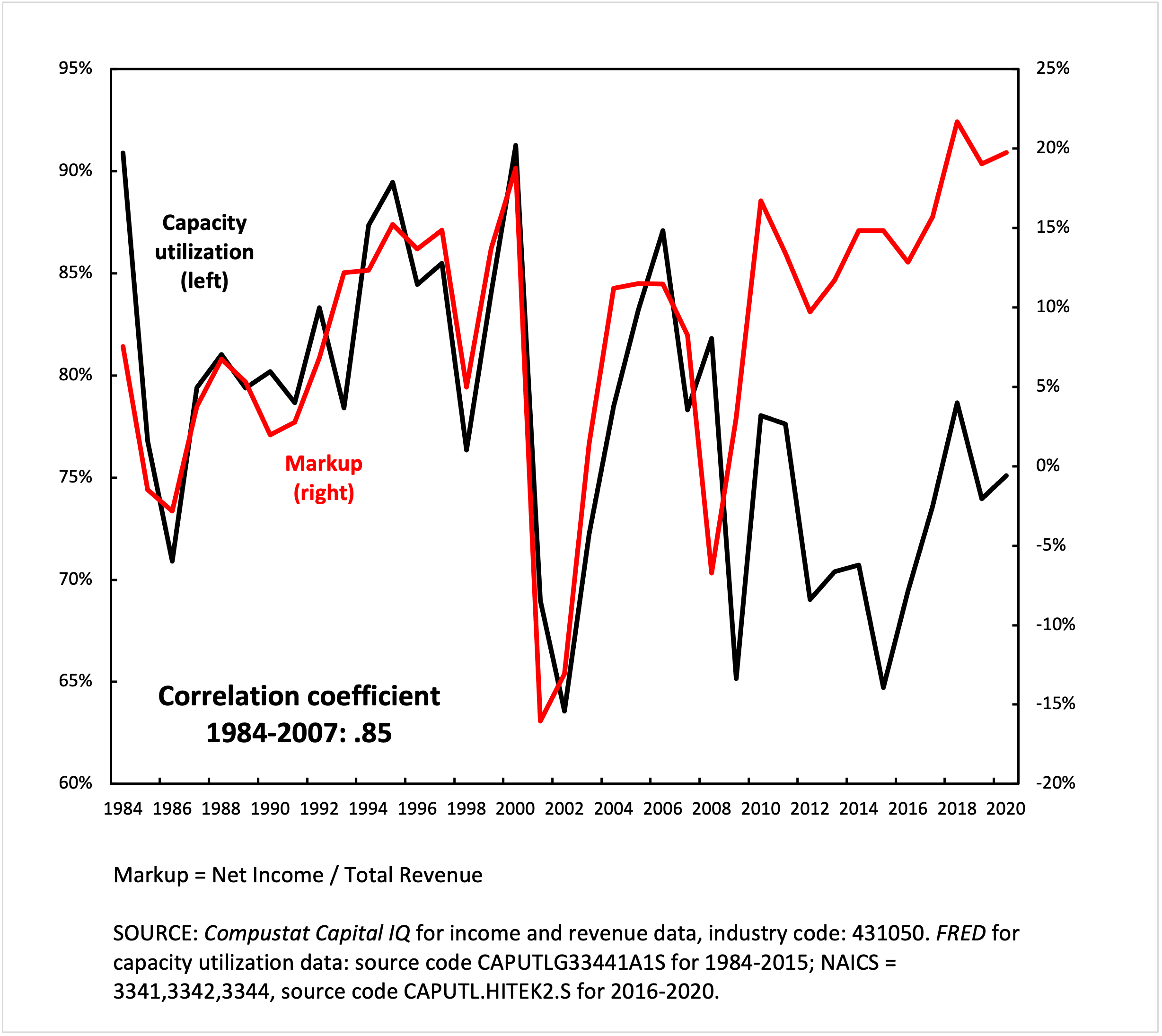

You articulated much more clearly one of my guesses, namely that high fixed costs of fabs eat into operating margins when production is slow. But there are still at least two puzzles for me. First, why such a tight correlation? I’ve looked at a few other sectors and so far I haven’t found much if any correlation between these two variables. Second, if its just an accounting issue, what happened after 2007?

February 7, 2022 at 9:12 pm in reply to: Correlation between capacity utilization and markup #247753Thanks!

Your comment made me realize I cited the wrong source for this particular chart. The capacity utilization data is from a discontinued series from the FRED website, and the NAICS codes cited are for computers, communications equipment and semiconductors. The semiconductors series was discontinued after 2015, and I was using the latter combination as a proxy for 2015-2020 (not shown in this chart).

This is very good to know as I will be working more with NAICS in the future, and had no idea how the codes worked. I will definitely get in touch if I have a question!

Your chart is interesting because markup is going up as capacity utilization drops, possibly indicating a depth strategy of accumulation at work. Here’s what the rest of the time-series for semiconductors looks like:

As you can see, after 2008/09 something similar happens.

Paging James McMahon…

This looks like another case of differential accumulation through the reduction of differential risk. There’s a whole new cottage industry in acquiring music rights springing up that is connected with this process. Companies are buying song rights and then contracting other (often young and internet-hyped) musicians to record covers to juice their royalties earnings.

The Baffler covered it last year:

Thanks for posting!

January 24, 2022 at 6:49 pm in reply to: Military Spending and Economic Growth in the United States #247616Hi Jonathan,

I have a technical question. Is the correlation you mention the correlation of the 10-year trailing averages, or do you take the correlation of the year-over-year data?

I’ll have to rewatch Matewan, I watched it a long time ago. It is merged in my memory with The Molly Maguires.

It’s great to know Sayles has written about his process – he definitely has a special talent.

It could be just that bananas are ‘loss leaders’ in Canadian grocery stores – items sold just above or below cost to entice people into store and to psychologically ‘nudge’ the shopper toward the idea that the grocery store prices are in general ‘a good deal’. This is plausible to me because bananas are a great product to choose for a loss leader: they are very cheap, relative to other products (so selling under margin isn’t that costly) and they go off really quickly (so the store wants to sell them more quickly than the average product).

The global price of bananas tells a different story (compare to oranges below): steady, almost systematic price inflation of 300% since 2003.

- This reply was modified 3 years, 11 months ago by CM.

January 3, 2022 at 11:27 am in reply to: Costly Efficiencies Working Paper – Critical feedback #247463Hi Jonathan,

Thank you for pointing this out!

January 3, 2022 at 11:26 am in reply to: Costly Efficiencies Working Paper – Critical feedback #247462Thank you for your comments Scot, you raise many good issues, esp. with the US. I agree with you that it looks like the large not-for-profit healthcare institutions in the US are being run like for-profit companies, but I haven’t done much research into it. The US was so far outside of the normal distribution of study (both in costs and deaths) that it skewed the results (albeit in favour of my argument). Within the US, it would be interesting to see if the same pattern shows up between states. I haven’t looked into whether there are data on the public/private mix of institutions at that level. Though I was unable to figure out how to segregate private for-profit from private not-for-profit organizations, it appeared that private insurance made up a significant portion of private funding of healthcare. If this is the case everywhere, I belive my approximation should hold.

Regarding your initial question, I don’t think health care systems have been entirely unable to treat covid-19. Even at a basic level (as in, excluding expensive technological solutions like ventilators and vaccines), healthcare systems which had enough hospital beds and nurses to monitor and properly quarantine patients, proper PPE, an honest and communicative medical community, etc. have gone a long way to reducing the spread and severity of the pandemic, especially in the initial months of the outbreak. In the long term, I suppose its possible that everyone will eventually contract the virus and the efficacy of healthcare systems will have been insignificant.

Thanks Jonathan, Shimshon, and James for the lists. Lots of films I have not heard of. In terms of good films about power, I recently watched Lone Star, a John Sayles film. I thought it was a brilliant depiction of the complexity of small town power relations, and touched on a wide variety of issues (race, class, US imperialism, the politics of prison-building) while remaining at its heart, an incredibly sympathetic study of the human condition.

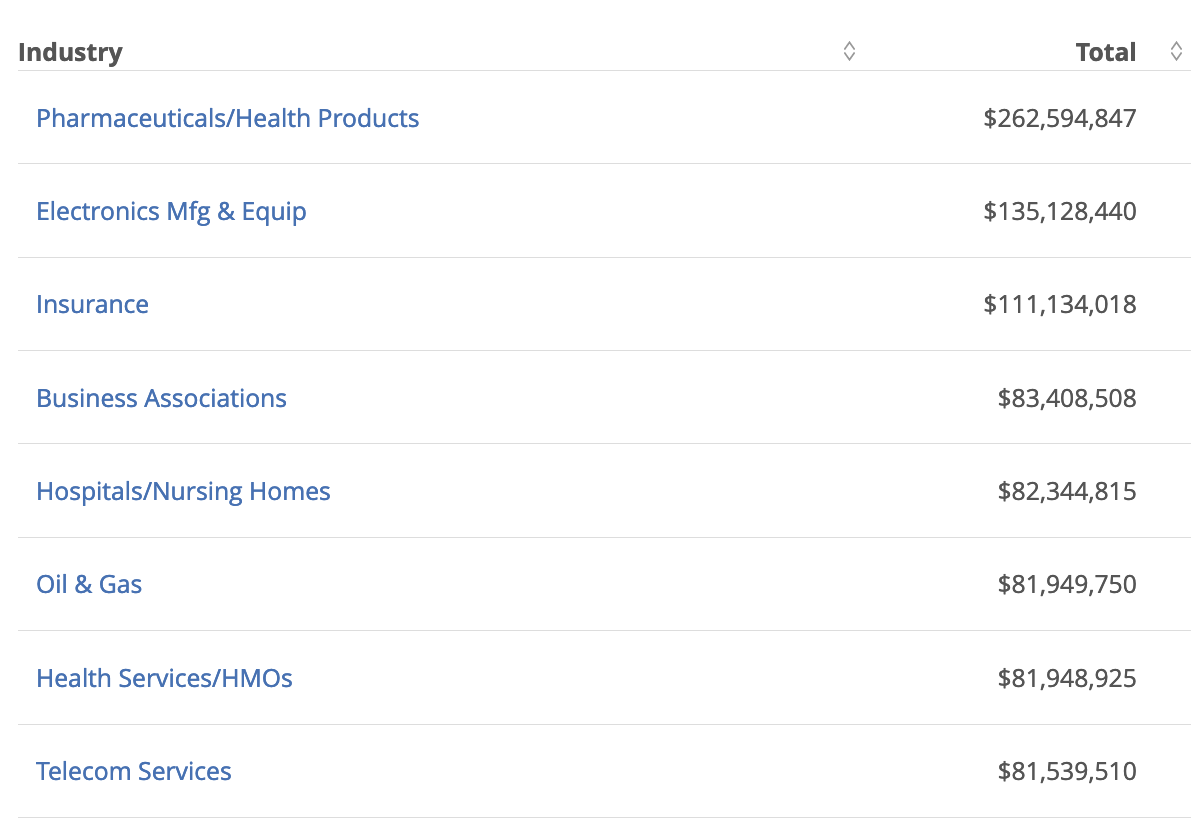

US Lobbying numbers for 2021 (Jan-Sept). Pharmaceuticals industry spends twice the second highest industry (Electronics).

https://www.opensecrets.org/federal-lobbying/industries

Attachments:

You must be logged in to view attached files.November 2, 2021 at 4:45 pm in reply to: Cleaning US trademark data to analyse trends in ownership #247084This is really awesome James, thanks for sharing! In glancing through it, it is funny/interesting to see some firms so high up on the list (like WWE??).

It also seems there are separate entries for Apple inc and Apple Computer inc., leading to a much lower rank for that company.

I don’t know if you have read K Birch, D Cochrane, and C Ward’s article “Data as Asset?”, but I was fascinated by their finding that the big tech firms seem to hold significantly lower than average intangible assets, and at least for Google and Facebook, slightly higher than average tangible assets. Just goes to show the diversity in how intellectual property/intangible assets are capitalized/capitalized upon, and how little we actually know about the so-called new knowledge economy.

Article:

Birch K, Cochrane D, Ward C. Data as asset? The measurement, governance, and valuation of digital personal data by Big Tech. Big Data & Society. January 2021. doi:10.1177/20539517211017308

Thanks James! This is a great find. Do you happen to know if ‘patents gained’ refers to patents that were acquired through purchase, patents granted that were filed by the company itself, or simply patents gained by any means?

August 26, 2021 at 5:30 pm in reply to: Questions on the schism betwen monetary consumption and material consumption #245955I don’t have an answer to either question, but I did have thought regarding de-growth, though not entirely in the sense used by its advocates.

From a CasP perspective, de-growth seems to be compatible in some sense with capitalism. The reason is, and please correct me if I’m wrong: if power is measured relative to society at-large, as long as overall de-growth is faster than that of dominant capital, there will still be differential accumulation. There would presumably be serious societal devastation and unrest, and the integration of dominant firms and government police power might reach extreme heights, but theoretically it is a possibility. National governments would also likely have to become more integrated than they are now, though a crisis makes good cause for unity.

To my mind, corporation-driven climate initiatives like carbon offsets seem designed for the possibility, if not eventuality, of differential ‘de-growth’: as the shrinking natural world gets increasingly capitalized into carbon offsets/assets, rising global carbon tax and regulation regimes will be provided with a “natural” market-mechanism to redistribute the right to pollute away from the rest of society in financially complex (as in fraudulent), technocratic fashion.

-

AuthorReplies