Forum Replies Created

-

AuthorReplies

-

It would be nice to put on an audiobook and go for a walk at the end of the day!

That’s how I first “read” Chiang’s second collection of short stories, Exhalation. It is not quite as good as his first. But it is still extremely excellent.

I also like audiobooks for more narrative history. It was a good way to “read” Tooze’s The Deluge.

I’m re-reading Gabriel Garcia Marquez’ Love in the Time of Cholera. I’ve long said it is one of my favourite books of all time, but recently realized that I didn’t actually remember the story that well. It has definitely been worth the re-read. As with most writing from Latin American authors, power and political economy stalk the pages and the characters.

I recently finished NK Jemisin’s amazing Broken Earth trilogy. Like a lot of sci-fi / fantasy it takes some work to get into the language—just as it does with much philosophy—but once you do, it is seriously page-turning.

Blair, I wonder how you’d feel about the short stories of Ted Chiang. They are works of fiction, but you can tell how deeply researched they are. He brilliantly extrapolates from reality to tell a compelling story, while also offering important insights for our actual present and potential futures.

His short story ‘The Story of Your Life’ was the basis of the movie Arrival, which is one of the best things Hollywood has produced in years. And the story and movie are different enough that each has its own merits. The story ‘The Truth of Fact, The Truth of Feeling‘ is a phenomenal exploration of the difference between truth and record-keeping. These too often get conflated. ‘The Great Silence‘ contrasts our obsession with finding evidence of extraterrestrial life with our wilful blindness to the incredibly alien lifeforms that share our planet.

I’m finally taking on web scraping. I’m still making the climb up Mt. R, so I’m trying to do it with that. Actually, I’m not even learning R generally. I’m focusing on the tidyverse.

The package rvest—which is part of the tidyverse—has many good introductions online and is quite intuitive. However, now I’m trying to iterate. Based on your post, James, I suspect this is simpler with Python. But I worry about trying to jump back-and-forth between R and Python. I’m going through the ‘Program’ section of R for Data Science because I’m long overdue to start employing functions, which will also make iterating with rvest simpler and more repeatable.

Sidenote: I’m continually blown away by the amount of knowledge that people give away online. You cannot tell me that Elon Musk, Mark Zuckerberg, or Jeff Bezos has done more good for the world than Hadley Wickham. I suspect that if there is any problem humans need solved there is someone who wants to solve it for the pleasure of the challenge and the esteem. And how many potential Hadley Wickhams are there who’d love to give away knowledge for free, but they have to exhaust themselves struggling just to make ends meed?

Thank you, Joseph, for your very thoughtful response to my initial post. It feels like I posted that a million years ago. It is hard to believe it was only a year and a half.

A proper reply will require more time. But I wanted to acknowledge the post. I hope it represents a fruitful rejuvenation of dialogue. I will offer a quick rejoinder [NB: I’ve come back to acknowledge that it is becoming more than a ‘quick’ rejoinder].

More and more, I’m compelled to argue for a political economy. And my contention is that this is an inescapably moral matter: who gets what? Why?

One of the grand defences of capitalism is connected to the issue you raise at the very end: the relationship among capital, capitalization, and creation. Disruption. Creative destruction. Entrepreneurship. Innovation. All of these get pointed to as the basis of accumulation and the justification for capitalism. And it works because, as you note, there is an undeniably creative component. However, the equilibrium economists want us to accept that markets will properly filter this creative output by responding to consumer desires. On the one hand, as N&B have persuasively argued, this obfuscates the role of power. On the other hand, this tries to eliminate any moral concern. It is not, we are told, our place to judge the autonomous consumption decisions of sovereign individuals. That means there can be no moral judgement of the creativity that gets encouraged, supported, and proliferated by profit-seekers.

I suspect those who hold and defend this position includes both those convinced that we can, and should, have an economy free from moral consideration—except as a matter of personal consumption choice—and those who know the argument merely diverts attention from the morals at work.

Those of us who hope for a more just economy should grab onto the need for moral consideration with both hands. This basically takes us back to pre-Smithian/Physiocrat political economy, which was heavily focused on “just price”.

I suspect we all agree that there is not, and cannot be, a determined or mechanical relationship between productivity and income, especially when we try to aggregate across outputs, or reduce to a single input. So there is no means to distinguish between productive and unproductive income, earned and unearned income. But as you note, many people want some sort of reward for socially beneficial invention, including for greater efficiency. The classical economists thought that is what profit was. And they thought it was just, but also economically determined. Rent, however, was seen as a reward to control, and largely rooted in archaic, unjust institutions.

From our vantage point, where there is popular support for rewards to beneficial entrepreneurial endeavour, and widespread recognition that much of the current income and wealth distribution is unjust, rent offers a useful term. Can we identify the earned, productive income? No. Can we identify the returns to ownership? To a large degree, yes. If anything, it strikes me that profit is the less useful term for our purposes, since it has always been connected to the productivity of capital.

We cannot look to systems of production to tell us how much of the social product entrepreneurs ought to claim. So, let’s have the difficult discussion to decide. From a moral perspective, what should the reward for socially beneficial creativity be? It is earned not because the economy dictated but because the community decided. And the rest that is captured by anyone in excess of their contribution, by virtue of their control, is rent.

May 21, 2021 at 2:02 pm in reply to: Is the economics/politics duality Capitalism’s Noble Lie? #245677None of this makes those dualities true.

Dominant capital remains thoroughly political. My quippy definition of politics is “the art of living life in common.” Markets are supposed to do away with politics because the utopian market ideal is that exchange among individuals renders unnecessary negotiation among groups. Of course, they never do so. Braudel notes that in 14th century Italian markets, there was a saying that one should remember we make friends, as well as money, in the market. They understood that the market was not a substitute for the messy business of living together.

My little experience within corporations shows them to remain thoroughly political. There are all kinds of intra-corporate groups, both formal and informal. And there is all kinds of negotiation that has to happen among them. Of course the bottom line is always the bottom line. But because there is no given, simple, or determined path to profit maximization, and there are no rational utility maximizers continually action as though they were engaged in exchange, all kinds of negotiations among groups have to take place.

Also, the quantitative ‘real’ does not exist, except as a problematic statistical construct. That construct is meaningful and affective because of the way it is deployed. But it is not a representation of output or well-being, distorted or otherwise. As for what that measure supposedly relates to ‘actual production’, that remains incredibly important. I agree that nominal concerns dictate. But production has a lot to say. An area of CasP research that needs more work is the relationship of production with the structures of ownership. CasP undermines productivism–the perspective on accumulation that considers production determinant–and, as such, research has tended to look away from production to other social forces that are relevant for accumulatory outcomes. But it does not deny the importance of production.

Thanks for the prompts to thinking of these things, even if I disagree with your suppositions!

It does not seem strange to cite legal scholarship at all!

Corporations are ultimately legal entities. Law is likely the most effective means of confronting and reducing corporate power.

Thanks for the reference. I’ll add Gangs of America as a book about the history of the corporation that cites the ruling.

I just recently confirmed that corporations are also considered legal persons in Canada. I’m not sure how the concept came across the border. I believe US case law does get cited in Canadian courts, but I’m not certain about the rules pertaining to that. Nonetheless, corporations also enjoy rights as persons here as well.

How does time pass so quickly?

I never would have guessed that I first posted about this over half a year ago.

Anyway, thank you for your comments, Steve. Thinking about fixed-price vs. variable-price assets is useful for clarifying the matter.

1. ‘Bridges’ do not seem like the most fruitful methodological metaphor for understanding potential relationships between analytical/theoretical frameworks.

I came to CasP seeking to understand the corporation as an obviously powerful institution. Through my undergrad and master’s degrees, I’d majored in economics, and devoted a lot of time to social justice activism. Through the latter, I learned a lot about corporate power, and picked up a few, scattered analytical skills. Through my degrees, corporate power was almost entirely absent, although I gained a few other skills. CasP was more empirically grounded than the other economic theories I had learned, and more systematic than the activist-motivated research. However, it is not a fully self-contained theory, at least for my needs. In other words, it is not an island. It offered a) important tools for quantifying corporate power, b) a theoretical explanation for understanding differential financial values as an expression of relative power; and c) a solid argument for understanding that power as ‘confidence in obedience’ of society, which includes, but exceeds, production. One criticism of CasP by Bob Jessop was that it is unclear if power is the explanans or the explanandum. Basically, is power the explanation or is power what needs to be explained? I have come down firmly with the latter: we need to explain power. CasP offers tools for identifying the shifting distribution of capitalist power as understood by the capitalists. But what are the contents of that power? What are the specific institutions, laws, cultural habits, etc. that affect the rise and fall of a corporations relative power? How do they increase confidence and/or obedience?

For these latter questions, I turned to actor-network theory. It is a commitment to deeply empirical research, and the treatment of everything as potentially affective. To me, this resonated with CasP, which is similarly empirical, and it also forecloses reflexively invoking ‘class’ or ‘production’ or some other standard bearer category of political economy. For my dissertation, CasP analysis showed that the De Beers diamond cartel had undergone a long decline in its social power that it reversed into a protracted period of increased power with an inflection point in 1940. Informed by ANT, I treated the Oppenheimer family, U.S. marriage habits, diamonds, and different governments, as affective components of a global diamond assemblage that De Beers controlled. The company had to managed these entities, and the relationships among them, in order to increase its power.

My concerns are largely practical. I want to understand corporate power in order to confront it, challenge it, diminish it, and eliminate it. So, I will pick up whatever concepts are useful to help. That’s why I think ‘tools’ and ‘toolkits’ are better metaphors for understanding the potential relationships between CasP and other theories.

2. For both strategic and intellectual reasons, it seems best to claim aspects of work by other thinkers that resonates with CasP, even when other aspects clash.

We don’t need to get into “what Marx/Polanyi/Robinson/etc. actually meant” debates/dead-ends. Nor do we need to claim other thinkers were doing proto-CasP. We can identify parts of their thought that resonate or connect with features of CasP. Strategically, this makes CasP richer and gives it tendrils into other arenas of political economic debate. Intellectually, it provides fodder for generating new insights. It seems more fruitful to identify ways these thinkers, and their analysis, do connect rather than ways they do not.

3. At the very least, Polanyi and Braudel are rich empirical sources.

Braudel’s work is an especially rich empirical source. There is certainly a CasP reading that could be done of Capitalism and Civilization. They are very descriptive of the temporal and spatial expansion of capitalist practices. It is more explicitly materialist than CasP, but it is not slavishly devoted to a certain form of production as the sine qua non of capitalism. It is rich with descriptions of the emergence and development of financial instruments that would become capital. While he used the term ‘anti-market’ to describe capitalism, that comes out of his bottom-up analysis. He saw markets expand and develop from local to regional to national to transnational. From that emerged financial trade instruments as practical mechanisms of exchange that then came to dominate the markets. He is not focused on the intra-capitalist struggle in the same way a CasP analysis would be, but he is offering rich details for how capitalists, pursuing their own accumulatory ends, were limiting and transforming markets.

4. While there is no ‘economy’ out there, there is ‘The Economy’ within popular, political, academic, and bureaucratic discourse.

That object does not represent or express some objectively given thing. Rather, it is incredibly affective. It changes the way governments and corporations behave. It is a powerful tool of the ‘state of capital,’ in part because it naturalizes certain types of relationships, particularly hierarchy and competition. It requires some nuance to talk about ‘economic’ matters in ways that don’t naturalize the economy. The work of Timothy Mitchell, and others, on the history of ‘the economy’ as an intellectual, theoretical, and empirical object is useful for trying to disentangle how the notion of an economy was invented and then mobilized intellectually, ideologically, and most importantly, within policy.

None to my knowledge, but that was long my dream. I did extensive archival research for my dissertation and wished I could speak to both the corporate insiders and the traders.

I conjoined CasP to a actor-network-theory as an empirical, constructivist qualitative method. Obviously lots of development of ANT was through ethnographic work. I think they make an ideal pairing (although not everyone agrees!).

While standard fare macroeconomics tries to answer what is happening in the economy just from analysis of aggregates, my interpretation of CasP is that it offers a mapping of power that must then be explained, and that explanation requires nitty-gritty empirical work, of which ethnography would be a powerful tool for insight.

I’m going to echo Blair about the usefulness of the linear scale for showing the extreme spikes. In relative (to itself) terms they were not large changes, which is why the log scale compressed them. But if I imagine myself watching these markets at the time, I wouldn’t be thinking, “Well, sure the price is spiking relative to the S&P 500, but relative to their current baseline, it isn’t that much of an increase.” But, as Blair pointed out, the log scale makes clearer how much they’ve continued to decline since 2019, while it looks a little flat in the linear scaled graph.

One tip on formatting, if you format the horizontal axis, you can change the “number.” This looks like it is using an automatic date formatting that’s a bit overly busy. You don’t really need the days. You can create your own date formatting. I found it pretty intuitive, but I’m also speaking from years of Excel experience and perhaps forgetting what it was like to first start formatting graphs.

Adam,

That sounds great. When, and if, you are ready to share any of your visualizations and interpretations, please do. I’m interested to see what you have found.

“its given me a much clearer picture of how dependent their accumulation strategy was on UK govt policy support.”

This sounds very encouraging.

January 26, 2021 at 10:10 am in reply to: Control over skill realization: A response to Fix in RWER (2019) #245229What this thread made me think about was the concept of “skill.”

A point I often hammer at is that innovation is not inherently good. I take this from Castoriadis, who argued the same about creativity. He observed somewhat that both Auschwitz and Beethoven’s 5th are creative outputs. We should not celebrate something simply for being creative. Since innovation is a subset of creation, the same applies.

We should also be thinking this way about “skill.” Think about the skills that appear to be useful in climbing a corporate hierarchy. Yes, there are technical skills, skills associated with command of knowledge, especially domain specific knowledge. But there are also skills of navigating the personalities in the workplace. This is thoroughly entangled with one’s cultural background and the backgrounds of those that occupy the higher rungs of the hierarchy. People coming from backgrounds different from those of the people that typically occupy higher rungs often cite a feeling that the “culture” of the workplace felt alien. Different types of behaviour will be interpreted in different ways. Women talk about seeing aggressiveness in men be rewarded, while aggressiveness in women would often be punished. Those from outsider backgrounds often have to conform in order to succeed. I recall being told of a study of students entering and exiting med school regarding their perspectives on different topics. The men and women entering med school differed in some significant ways, such as on the importance of gender. On leaving med school, those differences were much more compressed. However, the compression was almost entirely about the women’s perspectives converging on the men’s. I suspect similar dynamics are at work in corporate hierarchies. For a woman, a person of colour, a queer person, to climb the ladder, they have to modify much of their behaviour to converge on what is considered “normal” by the gatekeepers who have also been trained and acquired this skill..

But this can also be very workplace specific, which is an important part of the luck factor. An aggressive woman who lucks into a workplace where the bosses appreciate her aggressivenes may be able to breakthrough the gender glass ceiling there, while if she’d started at a different workplace, she would have failed.

As BF has very capably demonstrated, the reasoning of the higher skill = higher placement in the hierarchy = higher income is entirely circular, since the evidence of being higher skilled is being higher in the hierarchy. But we could also dig into what is claimed to constitute “skill.”

Hi Adam,

First, at points in this thread, empirical has been used as a synonym for quantitative, although JN has clarified that empirical includes qualitative. It is important to keep that front-and-centre.

Second, I somewhat disagree with BF on the possibility of including quantitative analysis in your work given the short time frame. The one caveat I will put on that is the intended objects of your quantitative analysis should be a publicly-traded corporation. They have the most readily available, comparable data available. Ideally, it would also be a U.S. corporation, or at least U.S.-listed corporation.

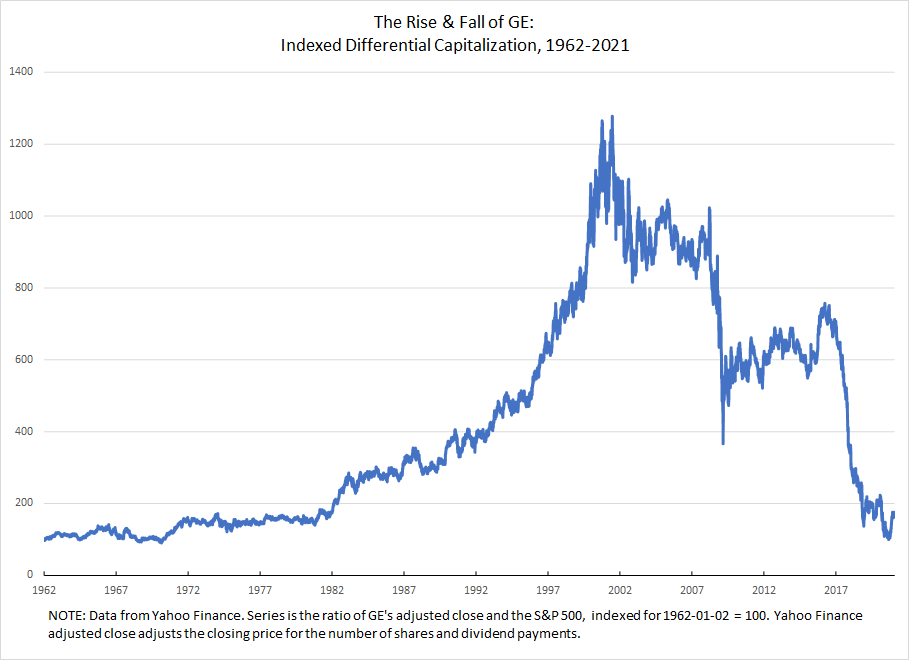

The basic tool of CasP is differential capitalization. The mechanics of it are remarkably simple. It’s just a ratio. The most common number for the denominator is the S&P 500 index, which serves as a proxy for dominant capital. Then, you can put the market capitalization in the numerator. Yahoo Finance provides publicly available comparable figures. JM is right to caution about just directly comparing share prices. However, Yahoo provides an “adjusted close” that factors in changes to the number of shares and dividend payments. It can serve as a suitable proxy for equity valuation.

A bare ratio between the S&P 500 index and the “adjusted close” of a random corporation does not say anything meaningful. But if you compare that ratio over time, it is a pretty good measure of the changing relative power of the corporation in the numerator.

The above is the indexed ratio of GE’s adjusted closing price to the S&P 500. I downloaded both series from Yahoo Finance. You can select the date range to download as well as the frequency. Learning to do all that should take you less than an hour depending on your general web skills.

I opened both series in Excel. I had already downloaded the same date range, so I could directly compare the series as downloaded. But I first converted both to an index, using the first day of available data for GE as the base. This calculation just involves dividing each value by the base value. Common practice is to then multiple by 100.

Once you have both indexed series, you divide GE by the S&P 500. I again multiplied that by 100, so the value for the very first day is 100.

Performing all the steps in Excel could be very quick if you’re familiar with Excel or have good intuition with it. It could also be an exercise in extreme tedium. The indexing does not have to be performed day by day by day, thank the gods! The above has almost 15,000 data points. Calculating the indexed value point by point would have taken a very long time. Maybe worth it if my dissertation was on it, but thankfully I was able to perform the calculation is less than a second with Excel. If you are not familiar with Excel, you could do an on-line course and get the basics in a couple of weeks of less than an hour a day. If you have a friend that is very good with Excel, they could show you what you need in an hour.

The above graph is 90% the Excel default. Learning how to use Excel graphs can be equal parts hair-pulling frustration and fun. But you can probably get the basics in a few days.

Maybe this description of the process may have served to dissuade rather than persuade you. But if that is that case at least you know that the quantitative aspect of CasP is more than you can take on at the moment. I still think there is valuable qualitative work to be done using CasP, although it would be limited in terms of claims about changes in power as understood by the owners of capital.

The way I read a graph like the above is as a map to the changing relative power of GE as understood by “the market.” One thing that I think many critics of CasP misunderstand is that CasP is not claiming relative capitalization is an objective measure of objectively given power relations. Rather, capitalization is a measure of how the powerful understand and evaluate their own power. That means the above graph shows the rise and fall of GE’s power, relative to dominant capital, as interpreted by the powerful themselves. Through the 90s, they saw GE growing more powerful. Come the dot-com bust, GE slumps, but remains highly powerful. Then, with the GFC it plummets. It limps back upward for the next few years, but fails to achieve its previous heights. Then, beginning in 2016, it starts to tear itself apart. Now, it is a shadow of its former self.

Rarely can you one-to-one a given event and significant, sustained market movement, although I analyzed such an event in the case of the Deepwater Horizon with my paper in Valuation Studies. Instead, there are numerous events and processes occurring that are leading the vested interests to see GE’s relative power growing and falling. It might be a commanding CEO with lots of political connections getting favourable laws passed. It might be their luck at offering a particular product suited to a cultural moment and then properly exploiting that moment with sophisticated marketing. It might be a research breakthrough on a new drug for which they will have a multi-decade patent and there is little potential competition on the horizon.

Constructing convincing narratives about why power has waxed and waned for a given capitalized entity is extremely important and one reason why we need more people doing qualitative research into corporate power.

JN cautioned that quantitative research can be scary not just because of the techniques but because of the risk it poses to our expectations. You might have a narrative in your head about the power of the companies has shifted during the period of activism you’re analyzing. And you might have some sense of the causal relationship between the activism and the corporation’s power. However, if the movement is relatively small and the company is relatively large, then any effect will disappear into all the events that bear on a massive global corporation. That does not mean there is no power story to be told and no insights to be gleaned from CasP. But it does mean you might not get the image you’re imagining. That said, if the movement is large and/or relatively effective and the company is relatively small, you absolutely might see the effects of their activism. In a chapter I wrote with Jeffrey Monaghan, which has just be uploaded to the bnarchives, we looked at several activist campaigns, including SHAC: Stop Huntingdon Animal Cruelty, which was an anti-vivesection campaign. Our research showed how the criminalization of SHAC was absolutely read by the market as increasing the power of Huntingdon.

I strongly encourage you to dig around, see what you can find quantitatively. Maybe you won’t end up doing an analysis of differential capitalization. But you’ll definitely learn some things about the targets of the anti-fracking movements.

Hi Jonathan,

The analysis I’m doing is trying to identify where the revenue that flows through a corporation ends up. I’m not focused on what is happening with the recipients. Part of the revenue is used to buyback shares and that money flows to the asset owners, while the company gains back a portion of its outstanding shares. In theory this has a neutral effect on the value of the company and on the value of the assets of the owners, although in practice the exchange will likely cause a market revaluation.

As for retained earnings, I think that it matters who or what is controlling the monies. For some purposes it makes analytical sense to sink corporate assets into the assets of the ownership class — as Zucman & Saez do in their measures of wealth. For other analytical purposes, I think it makes sense to keep them separate. The systematic shift between the monies flowing to owners and the monies remaining with corporations suggests to me that owners view the distinction as relevant. The standard productivist conception would identify retained earnings as useful for investment in productive assets. A business/industry based analysis would draw other conclusions. I haven’t thought explicitly about the owner-corporation distinction from a CasP perspective. But I do think identifying how monies flow through the corporation is a good empirical starting point, and identifying the monies that flow to owners as ‘rent’ is a means to connect the analysis to the history of political economic thought.

Hi Jonathan,

I figured this would pique your interest!

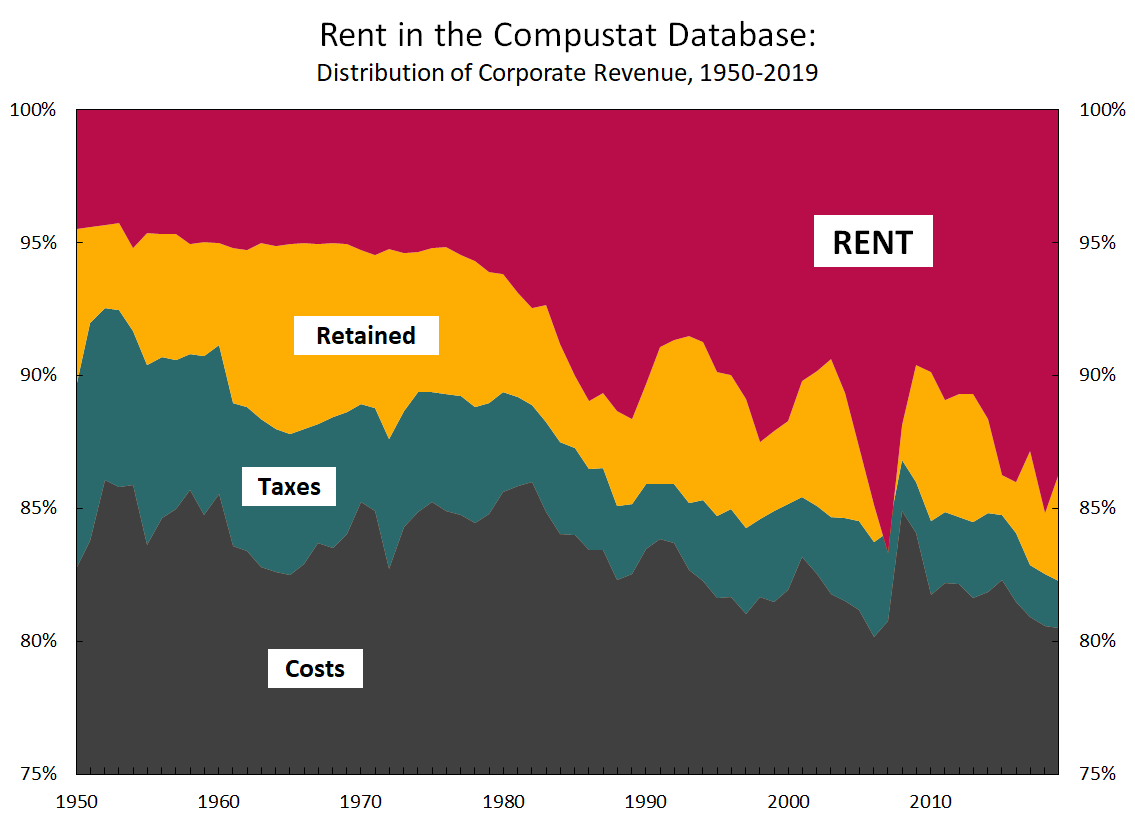

Rent is considered returns to ownership. I tried to identify every flow from corporate revenue in the Compustat universe going to owners. I identified dividends, interest, share buybacks and acquisitions as monies that flowed to ownership. That does not mean the other flows are going to production. It makes no judgement on the productivity of any particular flow. Instead, it maps where corporate revenues are going.

As seen in this image, I created an identity for corporate revenue.

Revenue = Costs + Retained Earnings + Taxes + Rent.

Then, I mapped the distribution to these four channels.

This mapping shows that the share of corporate revenue that flows to owners has been growing, though fitfully, since the early 1980s. The other three categories have been the outlet for a falling share of revenue. It is possible for retained earnings to be negative, as you can see in 2007.

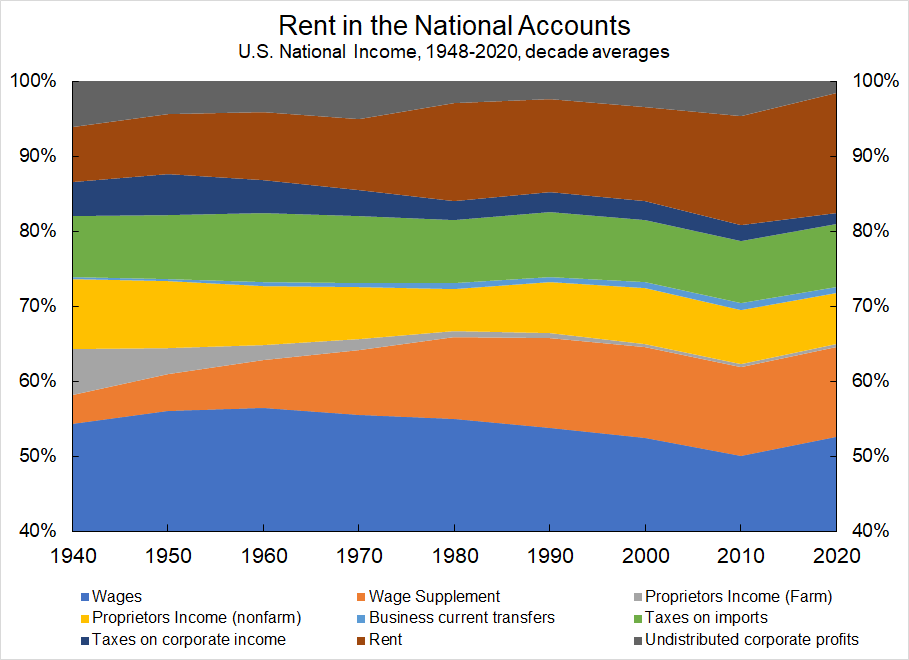

I came at rent through the national accounts as well. The categories are different, and the base is not corporate revenue, but national income. I identified three categories that flow to owners: net interest, net dividends and rental income. (NOTE: net dividends is without capital consumption or inventory valuation adjustment; rental income is without capital consumption adjustment. The end result does not change substantially if those are included or excluded).

This figure shows decade averages for rent plus the other categories that comprise national income.

The story here is similar to that for the Compustat universe: the share of US NI going to owners, i.e. rent, has been growing.

Again, this makes no judgement that the other forms of income are returns to productivity. It just identifies where monies are flowing. And a growing share is flowing to owners.

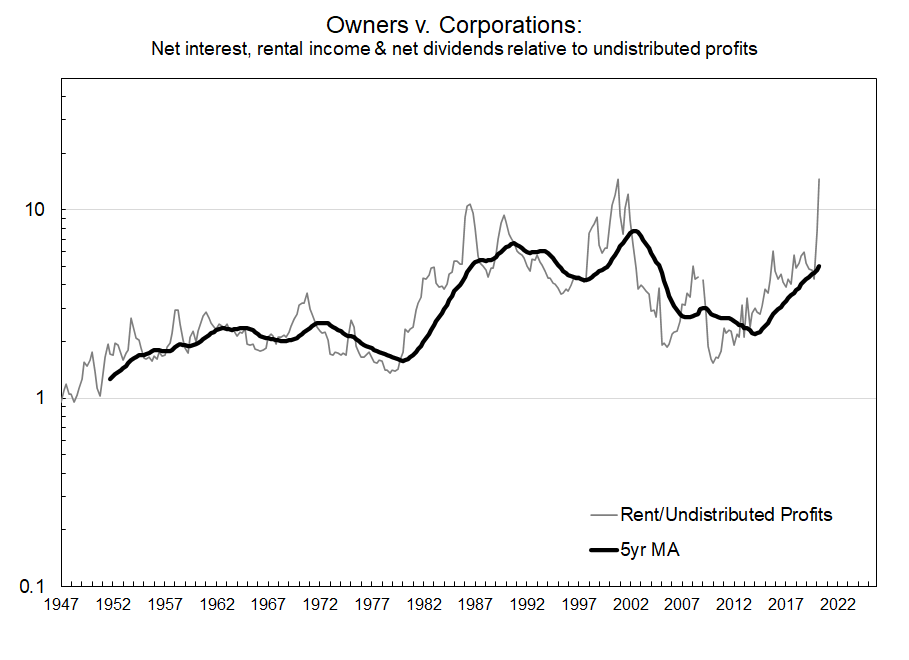

In your Twitter post, Jonathan, you include a figure that showed the ratio between net interest and retained earnings. I questioned why you offered this as a proxy for ‘rent.’ I actually constructed a similar figure, but substituting my measure, which combines net income, net dividends and rental income. I also restricted mine to the post-war era.

This would confirm your challenge of the facile equation between neoliberalism and rent-seeking. The ratio between rent and retained earnings grew with neoliberalism, peaking with the so-called dot-com bubble. It then hit a new low since the 1970s right after the GFC. But it has been rising rapidly since then. And it appears that the pandemic has created an unprecedented redistribution away from corporation and toward owners.

-

AuthorReplies